The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

We live in a time when the ‘Magnificent Seven’ stocks dominate the direction of markets and are more powerful than most Governments. Investors are rightly fascinated by them and the endless growth they seem to offer.

Yet, pared back to the simplest terms, the main objective of these companies isn’t growth. It isn’t technology. It isn’t having a share price go to the moon, though that doesn’t hurt.

Instead, it’s survival. The ability to fend off competitors, to endure, and to thrive.

Maybe it’s why I’ve always been intrigued by companies which have managed to last through generations, and what their successes may teach us as investors.

Last year, I wrote of the 'Lindy effect'. It’s a theory that suggests how long an idea or technology may last is correlated with how long it has already lasted. In other words, old things have better odds of getting older still than newer things.

Nassim Taleb popularized the Lindy effect is his book, Antifragile, describing it thus:

“If a book has been in print for forty years, I can expect it to be in print for another forty years. But, and that is the main difference, if it survives another decade, then it will be expected to be in print another fifty years. This, simply, as a rule, tells you why things that have been around for a long time are not "aging" like persons, but "aging" in reverse. Every year that passes without extinction doubles the additional life expectancy. This is an indicator of some robustness. The robustness of an item is proportional to its life!”

The Lindy effect in action

Recently, I came across a book that describes the Lindy effect in action. It’s called Lessons from Century Club Companies by Vicki TenHaken. The book focuses on companies that have been around for at least 100 years.

TenHaken was drawn to the topic after going to a presentation by an economist who studied long-lived Japanese companies. Japan has some of the oldest continuously run companies in the world, with seven founded more than 1,000 years ago.

TenHaken studied how the US compared to Japan. She found that the average lifespan of a company there is 12-15 years. And that there are more than 1,000 companies in America which have survived over 100 years, yet that represents only 0.5% of all businesses operating today.

Looking elsewhere, the author also discovered an exclusive club of long-run, family-owned businesses, called the Henokiens. It’s an association of companies that have been continuously operating, and remain family-owned, for 200 years or more. The association’s objective is to promote long-term decision-making (how apt). Starting with four members in France, its numbers have risen to 54.

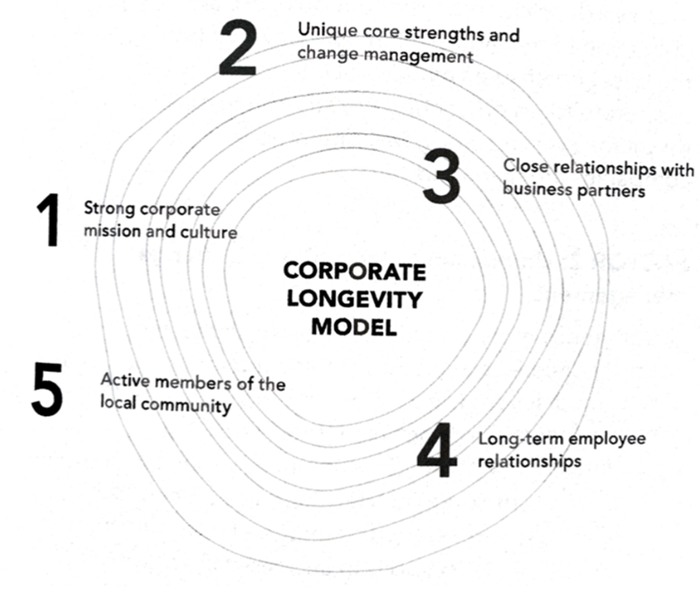

Through her 10 years of research, TenHaken found five key characteristics of companies that endured through generations:

Strong corporate mission and culture

I’ve worked at enough firms across my career to know that missions and cultures can be fuzzy concepts. Yet, they often provide the intangibles that ensure success.

So it goes with the oldest companies. They live their mission statements. The statements emphasise the technology or skills that make the company unique and its relationship with business partners.

The companies also tend to have specific values that guide management in their decisions and create a broad culture across the firm. The values are shared with employees, customers and suppliers. They’re a way for people to buy in to the company, and to filter out those who don’t fit.

That doesn’t mean tangibles like finances are forgotten. But the oldest companies often have a different view of them versus newer businesses.

Generally, the older companies take a financially conservative approach. They prefer minimal debt, and profitability over growth.

For them, profits are the fuel that drives long-term survival. The goal is to accomplish the mission, and if that happens, profits will follow.

Max De Pree from US-based furniture company, Herman Miller, is quoted saying, “profit is the result of doing well what they do as a company, not their goal.”

Nonetheless, TenHaken says older firms are very profitable. In Japan, they are 2x more profitable than peers. In other countries, the gap is less but still significant.

Unique core strengths and change management

“Century Club companies are not dinosaurs. They would not have survived world wars, economic depressions, globalization, changing social and cultural mores, and quantum leaps in technology that created whole new industries (and obsoleted others) without innovation and change.”

TenHaken gives many examples of how business survival depends on the ability to innovate and adapt. For instance, the now 126-year-old US-based Jelly Bean Candy Company, founded by the Goelitz family, has a history of making new products. The second generation made candy corn and buttercreams. The third and fourth generation made tangerine slices and spice drops. They experimented by injecting different flavors in mini jellybeans in 1965. And in 1973, they introduced chocolate dutch mints.

Close relationships with business partners

The oldest companies view suppliers as partners and collaborators rather than enemies. That means they often have long-term relationships with suppliers.

TenHaken gives many examples of these relationships. Morse Lumber, established in 1853, has been doing business with Mascot Construction for 60 years. Alden Shoe has been getting its leather from Horween Leather Company since 1930. Flooring products company, Armstrong, has been doing business with Derr Flooring since 1918.

Long-term employee relationships

“Building relationships with employees so they stay with the firm for a long time is consistently described as a key longevity success factor by 100-year-old companies.”

TenHaken says century club companies have long-term employees. She cites General Mills, where of about 16,000 employees, more than half has been on the job for more than 10 years. Almost 3,500 for more than 20 years.

Being a good workplace that retains employees isn’t just positive for these long-run firms, though. TenHaken cites data showing that the 100 best US companies to work for have outperformed the S&P 500 by 2-to-1 since 1998.

Active members of the local community

The oldest companies tend to have deep roots in their communities. These companies see their community support as being socially responsible. Plus, it’s mutually beneficial.

They invest in local projects, step up in times of crisis, and pay employees for local volunteer efforts.

Again, TenHaken provides examples. When an oil spill created a crisis in Michigan, Schuler’s Restaurant fed over 2,500 clean-up crew members 24/7 for months on end.

Interestingly, the century club companies were also found to be environmentally conscious. TenHaken says the data backs it up: of the ‘Global 100 Most Sustainable Corporations in the World’, about half are more than 90 years old.

Lessons for investors

Here are the key takeaways for investors:

- Companies should focus on processes over results. It’s nice to have goals, but they should be loosely held. That’s because there are 1,000 things which go into achieving a goal, and it’s those things that matter most.

- Experimentation is critical to success. Companies that aren’t trying new things aren’t adapting and are likely to fall behind competitors.

- Supplier relationships are critical and often overlooked by businesses and investors. Of the companies that you invest in, which ones have long-term supplier relationships?

- Employee turnover provides an important clue to the culture of a firm. Good companies retain good employees and prefer to hire from within than without.

- Do the businesses you invest in give back to their communities and help out in crises? Or are they constantly fighting to get their way? Successful companies are generally highly community conscious.

----

Last year, I wrote a piece titled, 'Australian stocks will crush housing over the next decade'. It got a lot of feedback at the time. One year on, my article this week looks at how the forecast is going, and what's changed for both shares and housing since.

James Gruber

Also in this week's edition...

Last week's article on the gender super gap from Pascale Helyar-Moray provoked a lot of debate. This week, Noel Whittaker pitches in with his own take on the issue. He says the problems have festered for a long time, for many reasons. He proposes some solutions though acknowledges they won't be easy to implement.

Meg Heffron is back. Like many of us, she's been glued to coverage of Cbus' problems, and it got her thinking about the risks in super versus those in SMSFs. She says SMSFs are often portrayed as the riskier option for the community, but that may not tell the full story.

Mercer's Dr. David Knox is a world-renowned pension expert, and he's planning his own retirement next year. He's been generous enough to pen a peice looking back at the pension index he helped create in 2009, what's changed since, and the reasons why Australia isn't currently rated an A-grade system.

Magellan's Head of Global Equities, Arvid Streimann, sat down with Firstlinks to outline his views on what's ahead for markets. He thinks global markets won't go gangbusters like this year though there should still be positive returns. He favours cyclical stocks in sectors such as resources and financials.

Recently, Australia recorded its seventh consecutive quarter of negative GDP per capita growth. How does this compare to history, and are there clues from the past about what may happen next? Andrew Wilkinson investigates.

Markets benefitted from peace for 40 years, but a military resurgence is now underway globally, fuelled by geopolitical tensions and technological advancements. Defence spending is soaring, and Franklin Templeton's Kim Catechis says that opens up compelling opportunities for investors.

Two extra articles from Morningstar this weekend. Simonelle Mody looks at ASX companies that could benefit from our ageing population, while Adrian Atkins highlights a high-yielding REIT that may have fallen too far.

Lastly in this week's whitepaper, Pinnacle's 17 fund manager affiliates offer 17 charts that encaspulate markets in 2024.

****

Weekend market update

U.S. stocks closed out the trading week near the unchanged mark in a subdued session on Friday. The S&P 500 and Dow posted weekly declines, while the Nasdaq secured its fourth consecutive week of gains. Broadcom quarterly revenue surpassed Wall Street expectations and predicted robust growth in demand for its custom AI chips over the next few years. The optimistic outlook propelled the company’s shares 24% higher, pushing its market capitalization past US$1 trillion for the first time. The Dow Jones Industrial Average finished 0.2% lower, the S&P 500 was flat, while the Nasdaq Composite gained 0.12%.

From AAP Netdesk:

The local share market on Friday fell to a four-week low after its fourth-straight session of losses. The benchmark S&P/AS200 index on Friday dropped 34.3 points, or 0.41%, to 8,296, while the broader All Ordinaries fell 36.6 points, or 0.43%, to 8,550.3. The ASX200 dropped 1.5% for the week, its second-straight losing week.

Nine of the ASX's 11 sectors finished lower on Friday, with energy and financials posting modest gains.

The mining sector was the biggest mover, dropping 1.8%. Fortescue retreated 3.7% to $19.48, BHP fell 1.5% to $41.17 and Rio Tinto subtracted 2.8% to $120.72 as the miner committed to spending $US2.5 billion ($A3.9 billion) to expand the scope of its new Rincon lithium mine in Argentina. Goldminers were also in the red, with Northern Star dropping 1.9% and Evolution falling 3.6%.

In the financial sector, Insignia Financial rose 6.2% to a two-and-a-half-year high of $3.61 after the wealth manager confirmed it had received a $2.7 billion tentative takeover offer from Bain Capital. The 178-year-old company formerly known as IOOF Holdings said it was considering whether it was worthwhile to engage with the US private equity firm over its $4-per-share offer.

The big four banks were mixed, with CBA up 0.4% to $158.21 and Westpac adding 0.7% to $32.17 as Australia's oldest bank held its annual general meeting, while ANZ was flat at $29.13 and NAB dipped 0.1% to $37.57.

IRESS was up 7.4% as the financial software company reaffirmed its 2023/24 guidance.

Premier Investments dropped 0.8% to $33.91 as chairman Solomon Lew told the retailer's annual general meeting Black Friday/Cyber Monday sales "while challenging, have not disappointed".

From Shane Oliver, AMP:

- Global shares were mixed over the last week with a backup in bond yields and a bit of profit taking after a strong run up weighing on US and Eurozone shares leading to small falls. For the week US shares fell 0.6%, Eurozone shares fell 0.2% but Japanese shares rose 1%. Chinese shares fell 1% on the continuing lack of concrete fiscal stimulus details. Australian shares fell 1.5% for the week with profit taking after a strong run up, the lack of fiscal stimulus details from China and concerns shares may have run ahead of the likely outlook for earnings next year all weighing. Bond yields generally rose, particularly in the US as investors moved to factor in less Fed easing next year. Oil prices also rose on prospects for tighter sanctions on Russia and Iran but remain in the same $US0.67 to $US0.72 range they have been in for the last two months. Metal and iron ore prices rose slightly but gold prices fell. The $A fell slightly and the $US rose.

- Shares remain torn between the negatives of rich valuations, higher bond yields, uncertainties as to how much central banks will cut rates or in Australia’s case when the RBA will cut, uncertainties around Trump’s trade policies and geopolitical risks on the one hand versus the positives of global central banks being in an easing cycle, goldilocks economic conditions particularly in the US, optimism that Trump will reinvigorate the US economy and prospects for stronger profits ahead in Australia. And we are now in a seasonally strong period of the year for shares. Our overall assessment remains that the trend is still up, including for Australian shares, but expect a more volatile and constrained ride over the year ahead.

- It’s worth noting that while December is normally a seasonally good month for shares, the first half of the month is often a bit soft before strength kicks in over the Christmas period. But of course, it’s not guaranteed.

Curated by James Gruber, Joseph Taylor, and Leisa Bell

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website