The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Several Government reviews have highlighted how retirees tend to be more frugal than they need to be.

In 2020, Treasury’s Retirement Income Review said that around 90% of retirees drew the minimum amount required and died with much of their super balances untouched. The review revealed that retirees lack the confidence and support to spend their savings, resulting in a poorer quality of life in retirement.

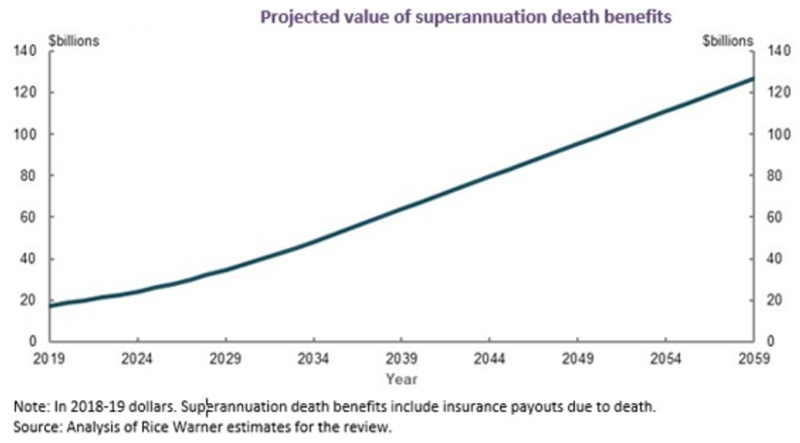

It suggested that the problem would become more pronounced going forward as people retire with larger superannuation balances. It also included projections that outstanding superannuation death benefits could increase from around $17 billion in 2019 to just under $130 billion in 2059, assuming there’s no change in how retirees draw down their superannuation balances.

The Intergenerational Report 2023 found that outliving one’s savings is a key concern for retirees in deciding how to draw down their superannuation, and that’s why many retirees draw down at the legislated minimum drawdown rates.

How retiree spending changes as we age

In an article in Firstlinks last year, actuary Ruvinda Nanayakkara outlined how spending in retirement varies for different age bands.

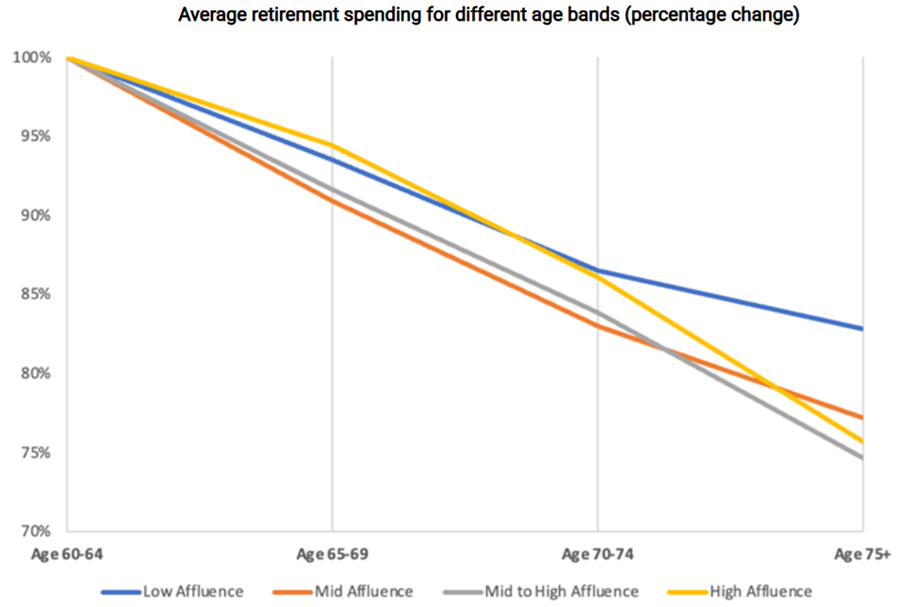

Using bank spending data, he looked at the percentage change in retirement spending, using the age 60-64 age band as the base year, and considering the relative decrease in retirement spending for older age bands.

He found that for all affluence levels, there is a consistent reduction in spending across the age bands. In the ‘low affluence’ group, individuals aged 75+ spent approximately 15% less than those aged 60-64. This reduction is even more pronounced for the higher affluent levels, with spending at age 75+ band reducing 20-25% of the spending levels observed at age 60-64.

Source: Spirit Super

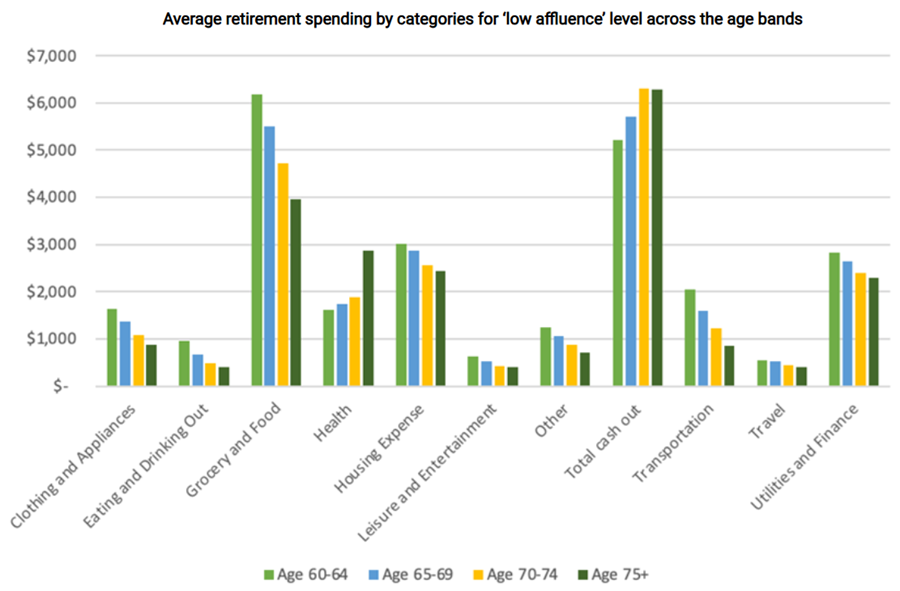

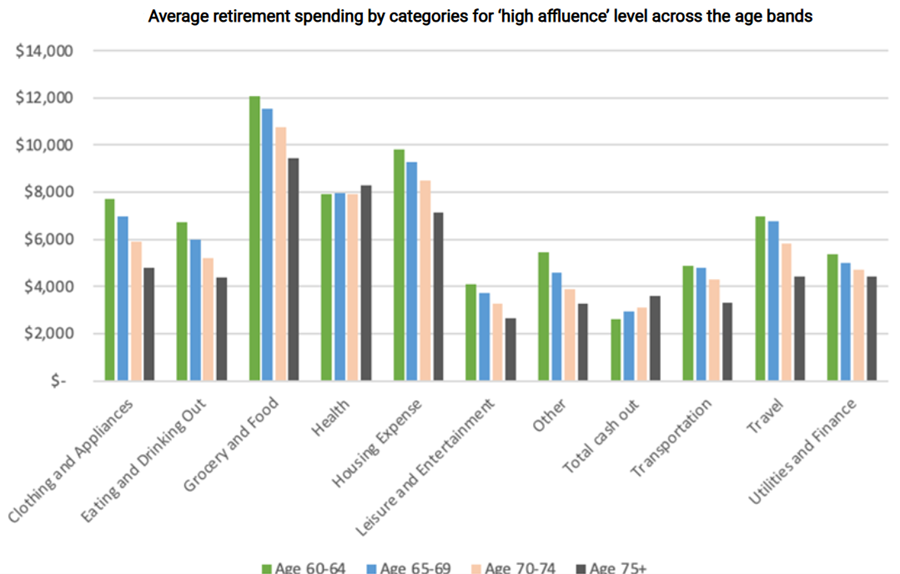

For both ‘high affluence’ and ‘low affluence’ groups, spending across most categories gradually decreases across the age bands, except for health-related expenses and cash withdrawals.

Source: Spirit Super

Explanations for frugality

Why aren’t retirees spending more? It seems much of it stems from uncertainty about the future. That uncertainty includes longevity risk, rising healthcare costs, financial market returns, inflation, interest rates, and sequencing risk.

Another growing risk less mentioned is Government risk, with potential threats to Aged Pension funding, and further tightening of superannuation rules.

There’s also the desire to leave wealth to children, especially given the cost-of-living crisis disproportionately impacting younger generations.

Other explanations

I’ve always thought that there may be deeper, psychological reasons for retirees underspending and recent research lends some support to this.

Scott Rick, an associate professor at the University of Michigan, suggests that there are three types of people when it comes to money: tightwads, spendthrifts, and those in between. He says tightwads and spendthrifts make up a disproportionate percentage of the population:

““Tightwads” experience too much pain when considering spending and therefore spend less than they would ideally like to spend. By contrast, “spendthrifts” experience too little pain and therefore spend more than they would ideally like to spend. Neither are happy with how they handle money.”

Rick’s research reveals that tightwads tend to be older than spendthrifts and that men are more likely to be tightwads. Tightwads are more highly educated and numbers oriented than spendthrifts.

Rick says that being a tightwad isn’t the same as being frugal as “the highly frugal love to save, and tightwads hate to spend.” And, “the highly frugal are generally much more at peace in their relationship with money than are tightwads.”

Tightwads have far more in savings than spendthrifts and think in terms of opportunity costs when considering spending money. The high savings offer “no guarantee that tightwads feel financially comfortable. Subjective feelings of financial well-being are only loosely related to objective aspects of financial well-being.”

On the other hand, spendthrifts are more impatient than tightwads and report a high susceptibility to shopping momentum ie. going to buy one thing and then getting carried away. And though spendthrifts have lower financial literacy on average, it isn’t markedly different from the rest of the population.

One of the most fascinating findings is that as younger children, we tend to be more tightwads, this changes somewhat as we enter adulthood, but by the time that we become adults, we commonly revert to what our parents are on the tightwad-spendthrift spectrum. Put simply, our attitudes and emotions toward money as adults seem to follow those of our parents, whether we like it or not!

Possible solutions

The Federal Government is intent on getting retirees to spend more money. It wants those billions or trillions of dollars flowing in the economy, spurring GDP growth.

The Government recognizes that financial advice is one area that could help reduce the fear for retirees of running out of money. Hence, why it’s trying to reduce the cost of advice and pressuring superannuation funds to do more for its members in retirement.

The Government moves are supported by recent research from Vanguard which found that having high retirement confidence isn’t dependent on age or income, but rather on having a plan, and financial advice has a large role to play in that.

Low cost advice has obvious merit, though Scott Rick’s findings highlight how difficult it will be to change retiree spending habits. Let’s hope the Government doesn’t go overboard with any future ‘nudges’, or legislative solutions.

----

In my article this week, I look at the performance of major asset classes in 2024 and over longer timeframes, and the lessons that can be drawn for building an investment portfolio for the next decade.

James Gruber

Also in this week's edition...

Schroders' Duncan Lamont details the cases for and against continuing US stock market outperformance. We also have renowned market strategist, Gerard Minack, on the risks to the US outlook.

Negative gearing is often referred to as a tax concession. Paul Tilley investigates whether that's fair, and what changes Australia could make to ensure its tax system is more equitable.

Danielle Hart and Jane Koelmeyer explore the issue of untangling assets after a broken relationship. They detail the steps that people should take to protect themselves.

Australia hasn't had a bond market rebellion in a long time, but Joshua Rout from Franklin Templeton warns that upcoming state and territory bond issuance to fund record levels of Government spending could test the market in the near future.

Retirement village contracts can be complicated beasts. Brendan Ryan offers a primer on what to look out for before signing on the dotted line.

Two extra articles from Morningstar this weekend. Roy van Keulen asks whether investors are missing the boat on a future ASX leader, Siteminder, while Esther Holloway suggests investors should vote in favour of Amcor's proposed merger.

Lastly, in this week's whitepaper, Fidelity International outlines the financial needs of younger generations and what advisers and investment groups can do to cater to their preferences.

****

Weekend market update

All three major indexes in the US advanced Friday, with each of the Magnificent Seven tech stocks logging gains. Big banks continued their rally following bumper earnings reports earlier this week. The Dow increased 0.8%, the he S&P 500 was up 1% and the Nasdaq rose 1.5%. The 10-year U.S. Treasury yield wavered, settling at 4.61%. Oil prices rose for a fourth-straight week while investors gauged the incoming Trump administration’s plan to ramp up sanctions. Benchmark U.S. futures closed Friday at US$77.88 a barrel.

From AAP netdesk:

The local share market on Friday slipped slightly but still managed to eke out a small gain for the week. The benchmark S&P/ASX200 index on Friday finished 16.6 points lower at 8,310.4, while the broader All Ordinaries dropped 0.14% to 8,557.4.

Eight of the ASX's 11 sectors finished higher on Friday, with financials, telecommunications and property ending lower.

The financial sector was the biggest mover, dropping 1% as all four of the big retail banks lost ground. CBA fell 1.2% to $153.90, Westpac dropped 1.5% to $32.16, NAB retreated 1.7% to $37.78 and ANZ subtracted 1.8% to $29.45.

In the heavyweight materials sector, Rio Tinto dropped 0.7% to $118.74 after Bloomberg News reported that the mining giant had held early-stage merger talks with Glencore. A tie-up would create a $254 billion behemoth that would surpass BHP as the world's biggest miner.

Elsewhere in the sector, BHP grew 0.2% to $40.05, Fortescue expanded 1.8% to $19.22 and Mineral Resources climbed 2.9% to $37.05.

In the financial sector, Insignia Financial climbed 6.5% to $4.43 after CC Capital Partners raised its offer for the wealth management group to $3 billion, or $4.60 a share. The move came after Bain Capital had matched a lower, $4.30-per-share offer earlier offer from CC.

In health care, Telix rose 3.1% to an all-time high of $26.59 after European regulators approved the Melbourne-based radiopharmaceutical company's prostate cancer imaging agent, Illuccix.

From Shane Oliver, AMP:

- Shares mostly rose over the last week helped by lower-than-expected underlying inflation in the US which boosted confidence that the Fed was still on track to continue cutting interest rates this year. For the week US shares rose 2.9%, Eurozone shares gained 3.1% and Chinese rose 2.1%. Japanese fell 1.9% though reflecting the increasing likelihood that the Bank of Japan will raise rates in the week ahead. The positive global lead also helped boost the Australian share market which rose 0.2% for the week, with resources, property and utility shares leading the way. Bond yields also fell back after recent sharp rises as inflation concerns faded a bit. Oil prices rose further on the back of tighter US sanctions on Russian oil exports and metal, gold and iron ore prices also rose with Bitcoin making it back above $US100,000 with a pull back in the US dollar helping. The slight fall in the US dollar also helped the $A stage a small bounce.

- Shares have had a bit of a wobbly start to the year reflecting a messy combination of negative and positive drivers. The big negatives are rich valuations, higher bond yields, uncertainties as to how much the Fed will cut rates, uncertainties around Trump and various geopolitical risks. Against this the big positives are global central banks still being in an easing cycle, goldilocks economic conditions particularly in the US, optimism that Trump will reinvigorate the US economy and prospects for stronger profits ahead in Australia. The past week has been better and ultimately we see the positives dominating resulting in positive returns for shares this year, but we expect a far more volatile and constrained ride over the year ahead than we saw in 2024.

- Here we go again...the return of Trump as US President on Monday will be the big focus in the week ahead and could blow investment markets around. Trump’s return means increased economic, trade and geopolitical uncertainty given the more extreme nature of many of his policies and his own erratic approach to policy making often characterised by grand statements on social media that may or may not go anywhere. This is likely to contribute to a volatile ride for investors. Trump’s policy agenda is somewhat schizophrenic for investment markets in that it includes some very pro-market aspects – with tax cuts and deregulation – but some negative aspects – notably around tariffs and immigration - and the market impact will ultimately depend on what dominates. Trump’s desire to see shares go up, political pressure to bring down the cost of living (whereas big tariff hikes would do the opposite) and fiscally conservative House Republican’s will hopefully keep a lid on Trump’s populist inflation boosting tendencies (including the tariffs) but this may not be clear for a while. In the meantime, expect a flurry of Day One pronouncements in the week ahead on: immigration restrictions; energy deregulation; financial de-regulation; crypto; the federal workforce; and tariffs. Tariffs are likely to be ultimately less than the 10-20% general tariff, 25% on Canada and Mexico and 60% on China as flagged in the campaign and immediately after. Some reports suggest that they may be phased in but this may only make them more inflationary and is contrary to Trump’s go in hard up front negotiating style. Treasury Secretary nominee Scott Bessent’s confirmation hearing comments suggest that tariffs on China are likely to be more aggressive but those on the rest of the world will be for negotiation purposes. With the US having a trade surplus with Australia its likely we will ultimately avoid US tariffs and only 4% of our exports go to the US anyway, but we are vulnerable to tariffs on China as 35% of our goods exports go there.

- With bond yields and the US dollar having already seen a big increase since last September and shares having wobbles since early December there is some chance that uncertainty around Trump has already been factored in which could see bond yields and the $US initially pull back a notch and shares rally providing Trump is no more disruptive than expected. But I don’t really have a strong view on this.

Curated by James Gruber and Leisa Bell

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website