In a recent article, I compiled a list of 16 ASX stocks that you could buy and hold forever. The idea for the article came from Warren Buffett’s shareholder letter this year, where he identified Occidental Petroleum and five large Japanese conglomerates - Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo – as companies that he expects Berkshire Hathaway will own indefinitely.

In the letter, Buffett wrote: “When you find a truly wonderful business, stick with it … Patience pays, and one wonderful business can offset the many mediocre decisions that are inevitable.”

Given that more of our readers are looking to invest overseas, I thought it would be worth a follow-up article on US stocks that you could potentially buy and own forever.

The criteria

The US market in massive. The ASX has around 2,200 listed companies, which is similar to the New York Stock Exchange (NYSE). Yet, there are also almost 4,000 companies listed on the NASDAQ, albeit there are stocks listed on both the NSYE and NASDAQ.

The larger number of companies listed in the US presents both opportunities and challenges. The opportunities are that there are so many stocks to choose from, and they often operate in large, attractive markets, not only in the US, but often internationally. The challenges involve filtering through the stocks to try to identify the best ones to own forever.

The filtering process isn’t straightforward. First, you need to be supremely confident that a company can last a long time, if not indefinitely. That’s no easy task given the average company listed on the S&P 500 has a lifespan of close to 20 years. Second, you not only want companies that can stand the test of time but that will deliver returns at least in line or better than the indices. If they can’t achieve that, then there’s not much point in owning them.

Here's the criteria that I’ve come with to find the top US stocks to buy and hold forever:

1. In the S&P 500. Ideally, you want to own well-established firms that have some history of success. Funnily enough, there are 503 stocks currently in the S&P 500, as several companies have two share classes. The company with the smallest weight in the index is one of our own, News Corporation Class B shares, with a market capitalization of US$14.2 billion. That type of market cap is large in Australia, though less so in the US.

2. Long runway of growth opportunities. This is critical. It means excluding many companies that operate in mature industries and/or restricted geographies. It also cuts out businesses with short-lived assets. Think of materials and energy companies with mines and oilfields that have finite lives. Or pharmaceutical companies that rely on a limited number of drugs with patent or exclusivity expirations. This criterion favours companies with global operations and large, untapped opportunities.

3. Economic moats. Moats are sustainable competitive advantages. They help companies defy the laws of capitalism which suggest that businesses with high returns of capital will have these returns competed away. Competitive edges can come from many things including network effects, intangible assets, cost advantages, switching costs, or efficient scale. You can find out more about moats here.

4. Good returns on capital. High returns on capital usually denote a quality company. In simple terms, return on capital is the profit that a company generates from the equity and debt that’s put into the business.

5. Solid balance sheets. Excessive debt makes companies fragile. You want to own companies that don’t rely on too much debt to generate returns.

6. Don’t need exceptional managers. Having good managers certainly helps. But if you’re going to own a stock for a long time, it can’t be reliant on one or two managers to succeed. The business needs to be so good that it doesn’t need an exceptional CEO. Or, put another way, the business needs to be so good that a bad manager will have a hard time messing things up.

7. Disruption resistant. This overlaps with other criteria 2 and 3, but it’s worth adding. When you buy a company for the long term, you are essentially betting on things that won’t change. This is especially important with the rise of AI or other technology.

The buy and hold forever list

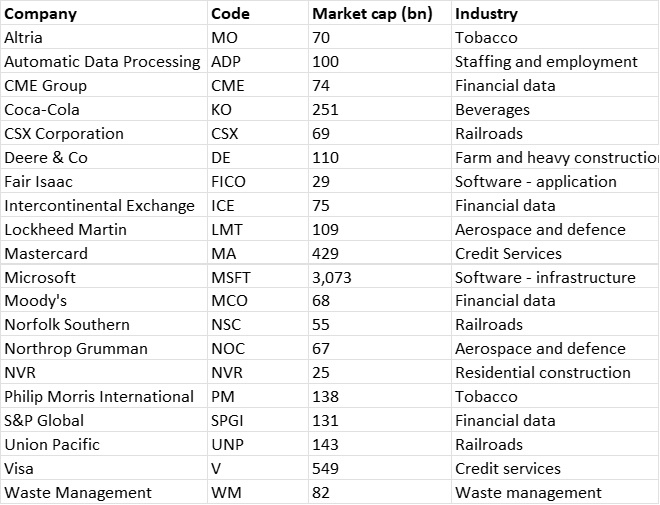

Here is the list of US stocks.

Source: Morningstar, Firstlinks

Let’s go through the companies, one-by-one:

Altria (NYSE:MO)

Nothing like a controversial tobacco stock to begin the list. It will surprise many investors that the tobacco sector has been the best performing sector in the US over the past 100 years. How can this be, given the decline in the number of smokers and continued increase in taxes on tobacco companies? These taxes, along with bans on tobacco advertising, have created formidable barriers to entry for competitors. Combined with industry consolidation, it’s resulted in significant and enduring pricing power for the existing players. Altria is the leading tobacco company in the US.

Automatic Data Processing (NYSE:ADP)

Many of you would have encountered ADP via the payroll and human resource products that it provides to companies. These products are critical to their customers, and they become embedded in company operations. That customer ‘stickiness’ underpins ADP’s moat. Increasing regulatory complexity and the rise of hybrid work should help drive growth in the long-term.

CME Group (NYSE:CME)

Stock exchanges are wonderful businesses as they essentially act as venues to facilitate transactions and take a share of the action without the heavy capital investment, financial leverage, or operating risk that their customers take on. CME owns the dominant exchanges for interest rate futures and WTI oil futures. The low volatility of the past 15 years hasn’t favoured CME, though that’s starting to change and should provide a tailwind in the decade ahead.

Coca-Cola (NYSE:KO)

Coca-Cola has undergone a transformation over the past ten years or so, moving towards a fully franchised, capital light business that has widened its moat and offers the opportunity for renewed growth. They remain the global leader in soft drinks, and with consistent volume growth, pricing power, and reduced costs thanks to better management, the future looks bright.

CSX Corporation (NYSE:CSX)

Railroads in the US are brilliant businesses. For heavy grains, commodities, steel, and anything that requires a lot of capacity to be hauled over a long distance, rail is the only suitable transport option. That means companies such as CSX have a captive audience. Add in a highly consolidated industry, and railroad companies have little trouble raising prices and earning nice returns. Four companies control almost the entire industry in the US, and CSX is one of them.

Deere & Co (NYSE:DE)

Deere is the leader in agricultural machinery and one of the leaders in construction machinery. Farmers have relied on their tractors and other products for more than 150 years. While the agricultural industry is cyclical, suppliers to the industry have less cyclicality. The construction arm also has growth opportunities from the US$1.2 trillion infrastructure deal in the US.

Fair Isaac Corporation (NYSE:FICO)

Fair Isaac is the industry leader in credit scores. These scores are essential in the US as they are used as benchmarks for investors, lenders and the like. Their prevalence makes them almost impossible to displace. Fair Isaac only started raising prices in earnest about five years ago, and it should be able to continue with that for many years and deliver fantastic returns for shareholders.

Intercontinental Exchange (NYSE:ICE)

With CME, I described why stock exchanges are wonderful businesses. Intercontinental Exchange owns the grandad of exchanges, the New York Stock Exchange. It’s also the dominant futures exchange for global energy contracts. Lastly, the company has been building out a mortgage data business that also seems promising.

Lockheed Martin (NYSE:LMT)

History would suggest that it’s highly unlikely that the relative world peace of the past 30 years will continue for the next 30. And it would also suggest that the US will need to fend off competitors to maintain its global dominance. If right, the handful of trusted defence contractors that the US government uses are likely to be big winners. Lockheed Martin is one the largest of these contractors. The best thing is that even if peace ensues, the company should continue to deliver satisfactory returns.

Mastercard (NYSE:MA)

Mastercard and Visa dominate electronic payments. Amazingly, global digital payments only surpassed cash payments a few years ago, and the continued shift to digital should ensure continued growth for decades to come. Also, these businesses benefit from a so-called network effect, where the more consumers that are plugged into a payment network, the more attractive that payment network becomes for merchants, which, in turn, makes the network more convenient for consumers. That’s allowed Mastercard to report net profit margins of close to 45% and returns on equity of 169%!

Microsoft (NASDAQ:MSFT)

The largest company on the S&P 500 is also one of the best. Microsoft Office is a money-making machine that’s essential for corporates and individuals alike. The business also owns LinkedIn, the pre-eminent online recruitment site. Microsoft also has a rapidly growing cloud segment via Azure. And, finally, there’s its leadership in AI. Combined, the company has a suite of incredible, mission critical businesses that have long runways for growth.

Moody’s Corp (NYSE:MCO)

Moody’s is the market leader in credit ratings for bonds. These ratings are essential for capital market players, index providers, and regulators. Moody’s and S&P Global dominate the industry, and that’s led to pricing power which, combined with capital light businesses, have resulted in spectacular returns on capital over a long period of time. It’s difficult to see this changing any time soon.

Norfolk Southern (NYSE:NSC)

With CSX above, I outlined why US railroads are some of my favourite businesses. Norfolk Southern is one of the other four companies that collectively have 90% market share. Price increases and cost control should result in Norfolk Southern delivering high single digit earnings growth for the next 10-20 years.

Northrop Grumman (NYSE:NOC)

I explained with Lockheed Martin above why defence companies in the US have a long, bright future. Northrop is another defence contractor, though it’s more focused on producing hardware for classified programs. The US Government relies on trusted partners like Northrop to deliver their military needs and that keeps any potential competition at bay.

NVR Inc (NYSE:NVR)

Including a homebuilder here may seem odd. After all, homebuilding is notoriously vulnerable to economic and housing downturns, and it normally requires heavy investment to boot. Yet, NVR revolutionized the industry with an investment light model that optioned land for development, and though competitors are trying to copy the company’s strategy, they haven’t quite caught up. NVR has delivered some of the best returns of any US stock over the past 30 years, and I think it will perform well going forward.

Philip Morris International (NYSE:PM)

I outlined the case for tobacco companies with Altria. Philip Morris is an international tobacco producer with leading brands such as Marlboro and Parliament. The company is diversifying away from tobacco to less harmful heatsticks, which are also highly profitable.

S&P Global (NYSE:SPGI)

S&P Global is the second largest player in bond credit ratings. I detailed why these ratings make for fine businesses in my summary of Moody’s. S&P Global also has other businesses including indices, such as the S&P 500, and market intelligence and insights with well-known companies such as Platts and IHS Markit. Most of these businesses provide recurring income with high margins.

Union Pacific (NYSE:UNP)

Union Pacific is one of the four railroad behemoths that control 90% of the industry in the US. Railroads are great businesses, as I detailed in my summary on Norfolk Southern. The primary risk for these businesses is from increased government regulation, should profits be deemed anti-competitive.

Visa (NYSE:V)

Visa is the global leader in electronic payments. It and Mastercard dominate the space and the growth from more cash payments turning digital, especially in emerging markets, seems assured. Visa has incredible net profit margins of 53% and its return on equity exceeds 46%. It’s a powerhouse.

Waste Management (NYSE:WM)

The waste management industry may seem boring though it’s anything but. Waste Management, the company, is number one in the US for waste collection and disposal. The beauty of its business is in its ownership of landfills. Constructing new landfills is extremely difficult given government regulations and the 'Not in My Backyard' (NIMBY) effect. It puts current owners of landfills in a powerful position, and that power means they can charge healthy prices.

What didn’t make the list

Often there’s more debate about what doesn’t make a list than what does. Let’s run through some of the companies that didn’t make the cut:

a) 6 of the Magnificent 7. Microsoft is the only member of the Magnificent 7 that made the list. Telsa didn’t because it’s facing increasing competition in EVs and has a limited moat to protect against itself against that competition. Apple’s sales have flatlined for some time now, indicative of a company that’s maturing. Nvidia will also face extensive competition in semiconductors and its sheer size will also make growth hard to come by in the long-term. Meta has Facebook, which is a dying app (ask anyone under 16 if they use it, and you’ll get strange looks) and is reliant on investments in AI and the Metaverse to deliver future growth. Alphabet’s search dominance is under threat from AI, and it hasn’t done enough with AI to starve off that threat. Finally, Amazon is primarily reliant on cloud services, as its retail business doesn’t make much money, and I can’t tell what the cloud industry will be like in five years, let alone 50+ years.

b) Banks. No banks made it onto the list. Investment banks have limited moats, are cyclical, and have historically delivered subpar returns. Retail banks in the US, unlike Australia, operate in a ferociously competitive environment, which makes decent returns hard to come by. I considered the largest retail bank, Bank of America, for the list but it didn’t stack up against other contenders.

c) Pharmaceutical companies. The likes of Eli Lilly and Novo Nordisk have been spectacular market performers of late, and many other pharmaceutical companies have also delivered fantastic long-term returns. Why didn’t any of them make the list, then? Branded drugs have limited exclusivity periods before generic competition can enter the fray. These companies are then reliant on investment in future drugs for revenue growth. The issue is that it’s difficult to pick which drugs will be the next big thing. And that makes it almost impossible to forecast the long-term earnings growth for the pharmaceutical companies.

d) Mining and energy companies. Mining and energy are cyclical and capital intensive, which invariable make for poor long-term returns.

e) Property. Real estate is capital intensive, cyclical, and often reliant on equity markets to fund growth. Infrastructure companies are more interesting, as they are less cyclical and have some serious tailwinds from the US Inflation Reduction Act, however there are few moats among stocks in this space.

A final word

It’s worth noting that the list isn’t a buy now and hold forever one. Instead, it’s meant to be a wishlist of stocks to own in the future when the price is right. In other words, I didn’t take valuations into account when compiling this list.

The list also doesn’t take into consideration your personal financial needs. As always, please seek financial advice if needed.

James Gruber is an assistant editor at Firstlinks and Morningstar.com.au.