Australia is in the midst of a $5.4 trillion intergenerational wealth transfer, the largest in its history. Fuelled by decades of rising property prices and investment gains, this unprecedented shift is prompting many Australians to rethink the question of legacy: What do I truly want to leave behind?

As James Gruber explored in his 12 March editorial, this transfer has the potential to entrench inequality, concentrate privilege, and distort economic incentives – what he termed a “generational tragedy.” But the impact isn't only economic. When wealth arrives without context or purpose, it can disorient the next generation, dulling ambition, blurring identity, and eroding a sense of value. Warren Buffett’s widely quoted maxim captures a growing sentiment: “I want to give my kids just enough so that they feel they can do anything, but not so much that they feel they can do nothing.”

In response, Australians are turning to philanthropy. Not only to share wealth but to pass on values, engage their families meaningfully, and ensure their legacy enriches more than just their descendants. Structured giving vehicles offer a rare combination of emotional resonance and strategic advantage, enabling donors to model generosity across generations while accessing tax benefits, both during life and through their estate.

The new face of inheritance

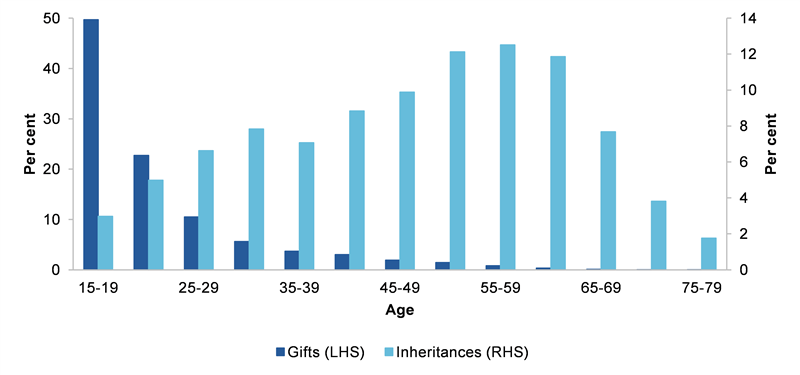

Unlike previous generations, modern heirs are more likely to receive wealth at a time when they are less likely to need it. The average recipient is in their 50s, typically at or near peak earning years, and is often already established in regards to their career and property ownership. While the median inheritance across the population remains modest, the figures grow significantly in affluent households.

At the same time, financial dynamics within families have shifted. Adult children are increasingly supported earlier in life through home deposits, school fees for grandchildren, or gifts during their lifetime from the ‘Bank of Mum and Dad’. By the time a formal inheritance arrives, many recipients are already financially independent.

Figure 1: Gift recipients are younger than inheritance recipients

Source: The Productivity Commission’s Wealth Transfers and their Economic Effects report, December 2021.

If the kids are alright, what kind of legacy matters now?

A practical response: Giving structures

For families who want to pass on more than just money, philanthropy is a meaningful alternative. Structured giving through sub-funds (also known as giving funds) in Public Ancillary Funds or Private Ancillary Funds is gaining popularity as a way to model generosity, reduce tax, and involve future generations in purposeful giving.

Donations into these structures are fully tax-deductible in the year they are made or can be spread over up to five years. This has made them a popular tool for managing large tax events during life – such as business exits, asset sales, or bonuses – allowing donors to receive a larger tax deduction when they need it most, while retaining flexibility to thoughtfully distribute the funds to charities over time.

Chris Cuffe, Portfolio Manager and trustee Director of the Australian Philanthropic Services Foundation, notes that structured giving is increasingly common among pre-retirees looking to front-load their giving during their income earning years.

“Just as many people pre-fund their retirement through superannuation, structured giving allows you to pre-fund your giving, claim the tax deduction while you're earning, then support the causes you care about over time during your retirement alongside your children and grandchildren.”

Once established, the capital is irrevocably committed to the community. A minimum of 4% (for public ancillary funds) or 5% (for private ancillary funds) must be distributed to charity each year, while the remaining balance is invested for long-term growth. Investment returns are tax-free, enabling the fund’s giving capacity to grow and compound over time.

Structured giving can also play a strategic role in estate planning. Where an ancillary fund is already in existence at the time of death, assets bequeathed to it are eligible for capital gains tax rollover relief. This allows families to direct assets with significant unrealised gains into philanthropy, which maximises the impact of the gift while enabling a more tax-effective distribution of the estate.

More than money: A tool for connection

One of the most powerful aspects of structured giving is its ability to unify families around shared values. This alignment between purpose and planning is what makes philanthropy such a compelling legacy tool.

Parents are increasingly involving the next generations in conversations about charitable priorities, community needs, and family values.

For Simon and Susan Power, establishing a giving fund in the APS Foundation following a liquidity event opened a meaningful conversation with their children about wealth, responsibility, and impact. “It’s helped our kids understand the privilege we have and the responsibility that comes with it,” Simon says. “Giving has become part of our family’s story.”

From the outset, the fund was designed to be collaborative. “The key reason we set it up was to involve the kids in giving,” he explains. “They decide together who we support each year.” In the first year, their children chose a grassroots charity helping kids play local sport – something close to their hearts. “We went to a presentation where supported kids spoke. It was incredibly powerful,” Susan recalls.

Rather than a transactional handover of assets, philanthropy provides a platform for families to reflect on what they stand for. It is increasingly common to see a founder establish a giving fund during their lifetime, involve their children in decision-making, and use the fund as a long-term vessel for charitable capital – one that can continue well beyond their own lifetime.

“It’s become something we do together as a family,” Simon adds. “We talk about what matters to us, and decide where to give. It’s one of the most meaningful conversations we have.”

For some, this is about reimagining what they see as an outdated model of inheritance. For others, it’s about anchoring their wealth in purpose and passing on a legacy of generosity.

A quiet shift is underway

Australians are generous – more than 80% give in some form – but what is changing is the structure, scale, and sophistication of that giving. There are now more than 3,000 ancillary funds in Australia, managing billions in capital committed to the community. "Contributions to these vehicles in the last financial year (FY24) are anticipated to have reached a record high, building on the exponential growth in contributions over the past decade.

Structured philanthropy is moving from the margins to the mainstream of wealth and estate planning. It’s being embraced not only by ultra-high-net-worth individuals, but also by retirees with appreciated assets and professionals seeking to create lasting impact. While once considered the domain of the very wealthy, structured giving is now far more accessible, with meaningful benefits beginning to accrue from donations of around $40,000.

A legacy that lasts

The traditional model of inheritance is changing. For a growing number of Australians, legacy is no longer defined solely by the transfer of wealth but by the opportunity to pass on values, purpose, and a vision for the future. As we navigate the largest intergenerational wealth transfer in history, philanthropy is emerging not just as a way to give back, but as a way to look forward.

Rachael Rofe is Head of the APS Foundation, a Public Ancillary Fund offered by Australian Philanthropic Services.