Last year, like many others, I had spare cash and decided to put some in term deposits, across various terms of up to 12 months, with rates ranging from 4.85% to 5.25%. Now, as more of these term deposits are about to end, I must decide about whether to roll these over or look for alternative uses for the cash.

Everybody's circumstances are different, and in my case, the initial move into term deposits was driven by a need to park money for the short-term, and yields were attractive enough to make this a decent option.

Was it a good decision? If you look at the performance of stock markets over the past 6-12 months, maybe not. The ASX 200 is up more than 10%, including dividends, over the past year, while the S&P 500 has soared by 21%. Year-to-date, the ASX has climbed 3%, and the S&P 500 has surged by 9%.

Stocks weren’t the only place that I could have put the money, though. I could have gone into bonds, and the performance of bonds has been anything but stellar. For instance, the yield on a ‘risk-free’ Australian 10-year government bond has increased from 3.39% to 4.42% over the past year. And when bond yields rise, prices fall.

Another option would have been to build a traditional 60/40 equities/bonds portfolio with the money. If I’d gone with ASX 200 equities and the Australian 10-year government bond, it would have marginally trailed my return from term deposits. Other variations on the portfolio, such as having international stock exposure, may have lifted these total returns.

Overall, the decision to put the cash in term deposits was a low-risk option that provided decent short-term income, though there was an opportunity cost as stocks shot up during that period.

The decision now is if it’s worth rolling over these term deposits or not.

Current term deposits on offer

Let’s first look at what current term deposits offer. The big 4 banks all offer similar term deposit rates over 12 months. CBA has a ‘special offer’ rate of 4.75% p.a. for 12 months, ANZ and NAB have 4.70% over same period, while Westpac offers 4.70% p.a. over 11 months.

Interestingly, Macquarie Bank is at 4.65% p.a. for a 12-month term deposit. Yet, it offers a higher 4.85% p.a. 3-month term deposit.

ING Bank has a 4.90% p.a. term deposit for 12 months, while Judo Bank is even better at 5.10% p.a.

The good news is that competition in the deposit space is healthy, especially with the rise of online banks like Judo. That’s led to a reduction in many of the terms and conditions attached to term deposits in prior years, though it’s still worth checking the fine print on these offers.

Bank savings and money market funds

What are about the alternatives to term deposits – how do they stack up?

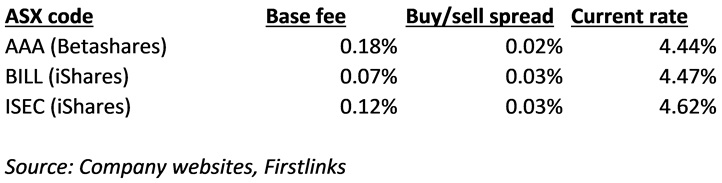

Unfortunately, the savings deposit rates at banks are not as competitive, and remain pitiful. A popular alternative is cash ETFs, where you can get good yields and liquidity.

Betashares AAA is the most popular cash ETF and currently offers 4.44% p.a. interest rate. ISEC has a higher yield as it can hold up to 20% in floating rate notes – these carry greater potential return with greater risks than cash.

Cash ETFs offer more attractive yields than bank saving deposits. However, they still trail term deposits, with the proviso that the latter locks up money for a period of time (and generally you need to give a month’s notice to not incur penalties).

Bonds

This time last year, investors poured money into bond funds and ETFs, and that bet hasn’t paid off so far. Bonds are now in their fourth year of a bear market.

Source: Trading Economics

The question is whether bonds offer value here. The yield on a risk-free 10-year government bond is 4.42%, not as high as that of major bank term deposits. And I remain cautious on bonds for a few reasons:

- Though bond yields have risen, they still aren’t high versus long-term history. Some investors jumped on bonds last year as yields were finally offering something compared to the near 1% during the pandemic. That turned out to be a classic case of recency bias – just because bond yields rose from all-time lows didn’t make them great value.

- History shows that bond markets move in long cycles of 30-40 years, and therefore this bear market may have some way to go. History doesn’t repeat, and circumstances are always different, but it’s certainly worth keeping in mind given the incredible bull market in bond markets from 1981-2020.

- Recent decades of negative correlation between nominal stock and bond returns have likely come to an end. This may have significant implications for the construction of investment portfolios. Investors had got used to the negative correlation, which meant that when bonds went up, stocks invariably came down, and vice versa. Yet as MFS’ Robert Almeida showed in a recent Firstlinks article, positive long-term correlation between stock and bond returns is the norm, and we seem to be reverting to that pattern. If right, it means that bonds can’t be relied upon to provide a ballast for portfolios when stocks go down.

That said, bonds should still perform well during certain economic environments including deflation and recession. Also, better yield can come from corporate bonds, private credit, and part-debt instruments like hybrids, albeit with higher risks attached.

Equities

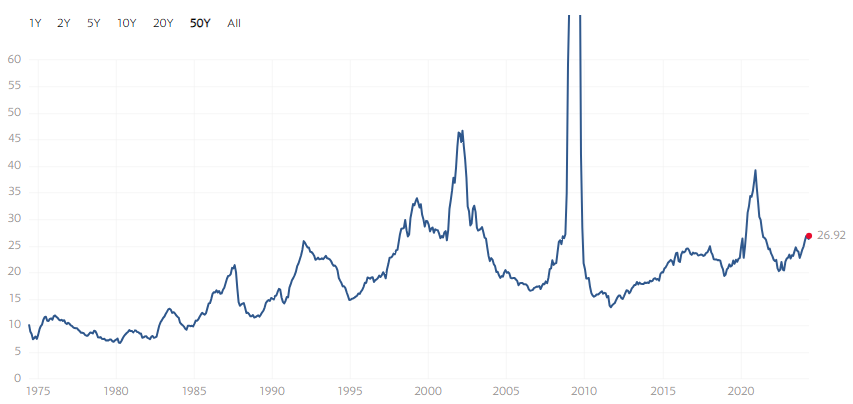

What about equities, then? After a great run of late, they don’t appear cheap. The ASX 100 is trading at 17.2x 2024 earnings, compared to a long-run average of 15.7x. Outside of financials and commodities, the ASX 100 trades closer to 21x. And stocks outside the top 100 are valued at 17.7x earnings.

Taking the 17.2x price-to-earnings ratio (PER) of the ASX 100, that equates to an earnings yield of 5.8%. That isn’t much of a premium to ~5% bank term deposit rates given the greater risks which come with equities.

Overseas, the picture isn’t much better. The S&P 500 trades at a trailing PER of almost 27x, which equates to a paltry earnings yield of 3.7%.

S&P 500 PE Ratio

Source: Robert Shiller

Emerging markets are the one area of global equities which offer more value, and better earnings yields, though that’s been the case for some time and is unlikely to change until China turns around. And emerging markets entail greater risk too.

In sum, while equities are great long-term vehicles, the short-term looks more balanced with valuations a little stretched both here and overseas. And cash including term deposits offer real competition to the likes of equities at this junction.

Term deposit attractiveness will depend on your circumstances

The answer for whether term deposits are attractive will depend on your personal circumstances. Whether you want income or capital gain. Whether you’re wanting to park money for a short period or invest long-term. Whether you are looking to take on more risk or not.

In my case, I’ve decided to roll over my term deposits in Judo Bank at a rate of 5.10% for durations of 6 to 12 months. I like how they offer competitive yields to other assets, with less risk involved. I also like that unlike a year ago, the term deposit rates are higher than inflation rates, which means I’m earning a real return.

The key risks with my decision are:

- We get a soft economic landing and risk assets such as stocks continue to climb at the expense of less risky assets such as cash.

- Inflation re-ignites, resulting in a negative real return on my cash.

- We unexpectedly enter recession, where cash trudges along, but bonds are the major beneficiary.

All up, the risk versus rewards for cash look decent going forward.

James Gruber is an assistant editor at Firstlinks and Morningstar.com.au.