This is a copy of the ASA's submission to Treasury's post-implementation review of the banning of stamping fees, in response to this request:

Treasury is seeking feedback from consumers and industry stakeholders on the 2020 change which extended the ban on conflicted remuneration to ‘stamping fees’ paid by Listed Investment Companies (LICs) and Listed Investment Trusts (LITs).

Treasury is seeking feedback on

- the policy’s regulatory impacts on advisers and stockbrokers

- changes to consumers' investment choices

- competition settings for managed funds, and

- any other unintended consequences in the market.

Stamping fees are an upfront one-off commission paid to Australian financial services licensees for their role in capital raisings associated with the initial public offerings of shares.

***

The Australian Shareholders’ Association (ASA) represents its members to promote and safeguard their interests in the Australian equity capital markets. The ASA is an independent not-for-profit organisation funded by and operating in the interests of its members, primarily individual and retail investors, SMSF trustees and investors generally seeking ASA’s representation and support. ASA also represents those investors and shareholders who are not members, but follow the ASA through various means, as our relevance extends to the broader investor community.

Consultation process on stamping fees

Thank you for the opportunity to submit comments to the post-implementation review on the removal of the stamping fee exemption.

We will briefly address 4 of the 5 questions posed, grouping 1 and 3:

1.What impact has the policy change had upon retail investors?

3.How have consumers’ investment choices been affected?

4.Has the policy beneficially changed competition settings in the managed funds sector? and

5.Have there been unintended consequences resulting from the policy changes?

1 and 3. What impact has the policy change had upon retail investors and how have consumers’ investment choices been affected?

We maintain the policy stance enunciated in our submission in 2020 on the merits of the current stamping fee exemption in relation to listed investment entities, that there be no carve out of a subset of listed entities from the overarching exemption. We remain concerned that access to initial public offers (IPOs) is denied to many retail shareholders, denying them the ability to access risk- and price-appropriate assets.

We consider the removal of the stamping fee exemption has reduced the number of listed investment companies (LICs) and listed investment trusts (LITs) coming to market and hampered the creation of new and innovative listed entities designed to meet perceived investor need.

Since the policy change in May 2020, there have been few IPOs of LICs and LITs, with fewer being made available as general offers. The Magellan Global Fund (MGF) listed in November 2020 and was a compliance listing merger of two pre-existing funds; Salter Brothers Emerging Companies Limited (SB2) listed in June 2021; WAM Strategic Value Limited (WAR) listed in June 2021; Touch Ventures Limited (TVL) listed in September 2021 (and had no general offer); and Cadence Opportunity Fund Limited (CDO) listed in November 2021 after commencing as an unlisted fund in January 2019.

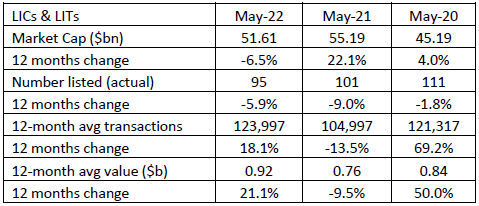

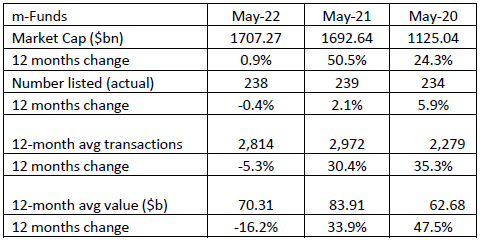

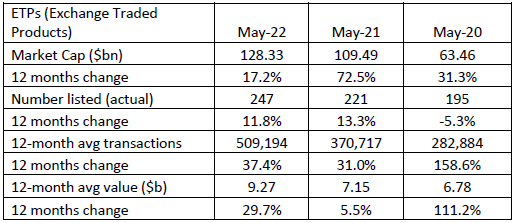

The overall statistics in the three tables below, show a reduction of the number of listings of LICs and LITs, and modest growth of $0.08b in the 12-month average transaction value from 2020 to 2022. This compares to an increase in number and lift in the 12-month average transaction value of $7.63b for selected unlisted managed funds available via the ASX (m-Funds) and $2.49b for exchange traded products (ETPs).

Source: ASA and ASX Investment Products reports May 2022 and May 2020

4.Has the policy beneficially changed competition settings in the managed funds sector?

There has been an increase in the number and the market capitalisation of m-Funds as shown in the table below and for unlisted funds. ICI Global, in its Worldwide Public Tables for the end of 2021, stated the total assets in Australian unlisted managed funds were valued at about $3.5 trillion, or in US$2.6 trillion and increase from US$2.5 trillion.

Source: ASA and ASX Investment Products reports May 2022 and May 2020

5.Have there been unintended consequences resulting from the policy changes?

It is our understanding from reading the initial consultation paper that the intention of the removal of the stamping fee exemption was intended to relatively advantage managed funds compared to LICs and LITs. It also appears to have advantaged exchange traded products.

Source: ASA and ASX Investment Products reports May 2022 and May 2020

In summary, ASA considers the removal of the stamping fee exemption should end, and retail investors be allowed to choose appropriate investments.

We also flag the short eight working day consultation period, with the notification email received at 5pm Tuesday, 28 June and comments required by Sunday, 10 July. We believe short notice periods act to limit the consultation, reducing the number and depth of submissions. We request that longer consultation be considered for future stakeholder engagement on important matters to retail investors.

Rachel Waterhouse is Chief Executive Officer of the Australian Shareholders’ Association.