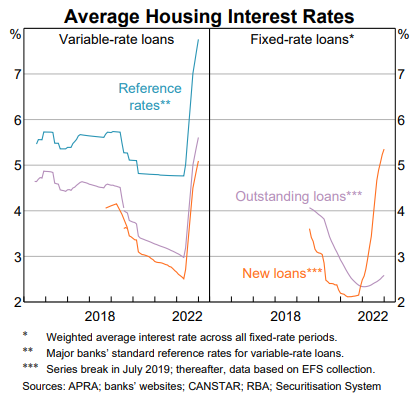

There’s more bad news for homeowners. Interest rates are up again, with promises of more to come as central banks around the world play follow the leader. The effect on inflation is anybody’s guess. Much of our inflation is entrenched - think the building industry - and many parts of household spending being non-discretionary. The rise in variable reference rates facing borrowers who come off low fixed rates is frightening.

The latest rise drew the predictable headlines, but once again, a major factor has been glossed over in the reporting. That is the way the big institutions have a feeding frenzy the moment people become vulnerable or get into trouble.

Think about a typical family who are doing their utmost to keep their finances in order. They are battling to cope with quickly rising prices on most things they need, along with multiple increases to their home loan repayments. Even with the best of intentions, they may easily fall behind in either or both their home loan repayments, and credit card repayments.

Even though banks spend a fortune on advertisements trumpeting that they wish to assist customers in financial trouble, the reality is entirely different.

Raising rates on overdue loan amounts

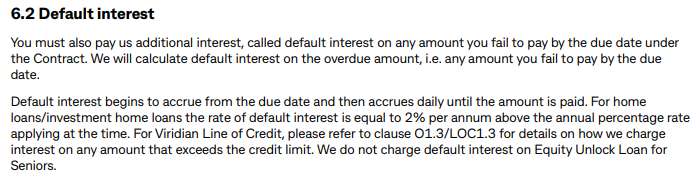

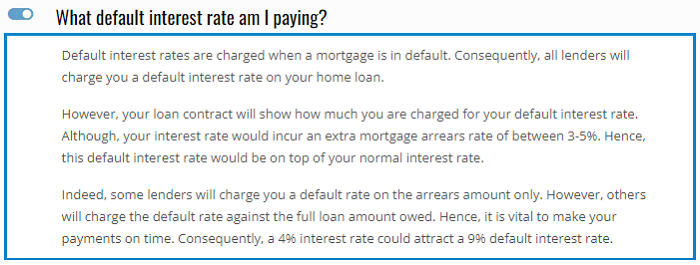

Many banks have a policy of moving home loans to a ‘default interest rate’ once borrowers are in arrears with payments. This means banks raise the interest on the overdue amount of a home loan purely because customers are having trouble making the payments.

But if they can’t make the payments at normal interest rates, how can they possibly make them when the interest rate has been raised? It’s not rocket science – this is kicking borrowers when they are down.

In fact, most banks outline their policies on raising rates on loan shortfalls (see below), and though these shortfalls may be small at first, they can quickly compound with variable rates of 7-8%.

Source: CBA's Consumer Mortgage Lending Products Terms and Conditions, effective 15 December 2022

Source: ANZ's Home Loan Terms and Conditions

Source: The Loan Saver Network

Credit card practices are unfair

Then there are credit cards. If the outstanding balance is not paid in full before the due date, the interest rate skyrockets to around 22%, backdated to when the goods were purchased. The interest-free period is removed. It gets worse, and relying on credit cards is a dangerous path. The borrower's credit rating will be shot, and it will become virtually impossible to switch a credit card to a cheaper provider. People will be stuck with an increasing debt at 22% and little chance of getting out of it.

This has been going on for years, and I’ve yet to meet any politicians who are willing to take on this predatory practice. Surely, it’s a matter of fairness.

The impact of rising rates and mortgage insurance

It’s not easy for people who are trying to protect their financial position. Think about a couple who shopped around for the lowest possible rate of interest on their home loan a year ago, before prices started to fall. If their deposit was less than 20%, they would have needed mortgage insurance – an expensive product with the sole purpose of protecting the lender, in the event of default by the borrower. That’s correct: the borrower insures the lender, for the privilege of borrowing money! A fundamental problem is that mortgage insurance is offered by only a few specialist companies and is not transferable.

A borrower who has a loan with Bank A, and decides to change banks, will discover that a new mortgage - with the same borrower, same mortgage insurer, over the same security - will require them to pay a second premium, to insure their new lender, Bank B. And the cost of that second premium would normally be enough to make the shift uneconomic. They are locked in.

But there’s more. This year, many homeowners will see their fixed loan rates expire and be faced with paying a much higher rate. Their deposit may have been sufficient to avoid mortgage insurance when they bought the house, but if the home’s value has fallen due to interest rate rises forcing prices down, they may find that their deposit is now under the 20%. They are now locked into the existing lender.

Mortgage brokers tell me their existing bank will probably renew the loan if the borrowers are prepared to cop whatever interest rate the bank offers them. However, if they wish to change banks to get a cheaper rate, there will be the expense of a valuation, and then mortgage insurance, if the loan is approved. Once again, their only viable option would be to stay with their existing bank and cop whatever terms that bank decides to put on them.

The combination of rising prices due to inflation, and rising interest rates – which may be well be a futile mechanism to reduce inflation – mean that many families will be under extreme pressure. It’s hard to think of any action more reprehensible than punishing them further with default loan rates and high credit card rates.

Noel Whittaker is the author of Retirement Made Simple and numerous other books on personal finance. Email: [email protected]