(Editor’s note: Guy Debelle, RBA Assistant Governor, made an important speech on benchmarks at a Bloomberg conference this week. He cast doubts over the accuracy of BBSW, the benchmark against which billions of dollars of transactions are priced, including hybrids. There is a substantial amount of funding done at directly negotiated rates, with no reference to BBSW, and low turnover in the interbank market means banks are less willing to use BBSW. A consultation period is underway between the RBA and industry to explore other benchmarks).

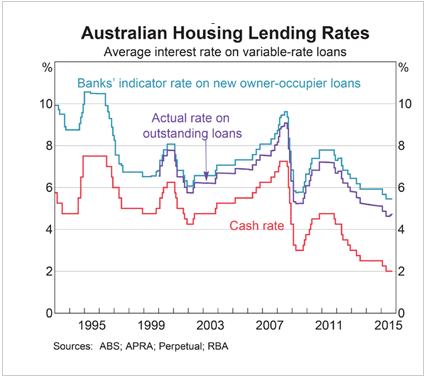

Mortgage broker websites, newspapers and television screens are awash with competitive offers on variable rate mortgage products from a wide array of smaller financial institutions. Names like Mortgage House at 3.79%, ING at 3.99% and Gateway Credit Union’s variable rate special of 4.09% are examples raising the volume of conversation about loan refinancing and new loan competition.

In July 2014, the Reserve Bank Governor, Glenn Stevens, when asked about how the increased cost of capital for the banks would be passed on, stated:

“… I imagine it will be passed on in some mortgage rates from the major banks. It is supposed to, that is the point …”

“It is for the banks to decide what they do, but if they made that adjustment nobody should find that surprising or controversial. The whole point of [the FSI recommendation] was to change the competitive landscape between the majors and the others … you can’t do that unless some process adjusts …”

The majors are not the only players now

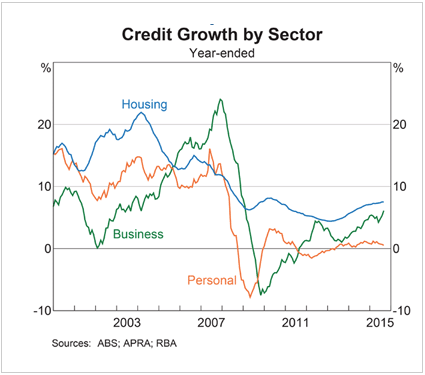

Traditionally, 80% of domestic mortgages were written by the big four banks. If APRA’s macro prudential regulations and capital ratio improvements are designed to promote healthy competition, then it seems to be succeeding.

As a result of the out of cycle rate rises by the four major banks in mid-October, sourcing the cheapest deal in Australia will be an emerging psyche in borrowers’ minds. A clear price differential is now in place for this be a mainstream pursuit. Nightly news bulletins have recently drawn attention to the great deals on offer through smaller lenders. I expect this to gather momentum until each individual lender achieves their growth targets.

In the last few weeks, more than half a dozen institutions ranging from large regionals, to mutual banks and smaller credit unions, have told me the momentum under mortgage lending for them is intensifying.

To fund this growth, their holdings of surplus liquid assets will be run off in the initial phase as banks see this as the lowest cost funding source. Then they will increase rates on at call and term deposits in the second phase of funding.

Recently, within a few days, one bank redeemed all its excess liquid holdings to meet its expected loan drawdowns. It has run a successful solar panel related lending campaign which has brought a new borrower demographic. It has now engaged its clients on ‘ReFi’ (refinance) opportunities and is having considerable successes. Conversely, some of the major banks’ treasury departments are winding back rates due to a clear void in demand in the early stages of their new financial year.

Put simply the regulatory intentions are having an effect. Possibly the variables are in place and the time is right for demand at smaller banks to exceed all expectations.

In the last four years, I have not witnessed a period where smaller banking institutions have been overly challenged to fund asset growth. I think the next three months will be more difficult for their funding. I foresee ‘ReFi’ taking off as a crusade by customers who refuse to pay for a stronger big four bank system. I will be surprised if customers are truly willing to pay the differential of 50-80 basis points on their loan to a big four bank.

The key question is, will borrowers have both the desire and the time over the Christmas holiday period to ‘make the switch’? There is a clear opportunity for a valet service business to emerge and assist all existing mortgagees who will not make the switch because it appears all too hard!

Funding the loans is the challenge

The real challenge for smaller banking institutions will be successfully funding the demand. Liquidity holdings will crimp to minimal buffers by those who market their price differential most aggressively, or incentivise the mortgage brokers to place them front and centre in the ‘ReFi’ battle or new lending campaigns. Mortgage brokers currently arrange about 50% of household mortgages. Their influence in marketing the price advantage of the smaller more aggressive banking institutions will be a key factor in this competitive opportunity.

But this opportunity may be limited to the strict growth targets approved by each banking institution’s board. If a campaign achieves the percentage growth target expeditiously then the ‘special’ may be withdrawn. Marketing of the next best offer will be critical to the longevity of this ‘ReFi’ phenomenon. But even small percentage improvements in market share will increase real profitability and viability of the smaller banking institutions who have endured years of tough economic competition in the fight for survival.

Term deposit rates are rising as a result

If organic funding by the smaller banks proves challenging through normal channels, then middle market and institutional funding opportunities will arise. Middle market councils, federal and state agencies and religious organisations will be the first source of non-client deposits. I have already found banking institutions’ Negotiable Certificates of Deposit (NCD) levels have pushed out from +0.30% to +0.50% this month for 90 days, and more than likely will push out further. The market is questioning what the prime bank BBSW rate set really means when so much activity is done away from the majors at substantially higher rates. Indeed, very little major bank paper is traded on many days.

This funding demand from smaller banks will potentially resume the dynamics of a positively sloped yield curve on all tenors out to one year and beyond rather than the inversion currently evident between six months and two years.

Overhaul of short term pricing dynamics

The pursuit of dependable ‘sticky’ funds and the challenge of loyalty at rollover may be the new game in town if smaller banking institutions tap real ongoing demand through competitive price dynamics. Substantial change is happening in the way short term deposits and BBSW are priced, with potential implications for millions of investors and borrowers who use these benchmarks.

Peter Sheahan is Director, Interest Rate Markets at Curve Securities Australia. This article is for general information purposes.