Sir Michael Hintze is an Australian success story (well, we'll claim him, anyway). Born in China, he emigrated to Australia as a young boy. He earned degrees in Physics and Engineering in Sydney before joining the Australian Army, and then finding work in bond trading.

Hintze moved to Britain in the 1980s and set up his own credit-focused hedge fund, CQS, in 1999. It was wildly successful and Hintze, like a number of hedge fund managers, became an investment rock star in the lead-up to 2008.

The rock star status faded in the 2010s as serene markets made outperformance tougher. Still, Hintze grew his business until stumbles during the pandemic saw funds under management fall 25% to A$20 billion.

It was during this recent period that Hintze pivoted away from his hedge fund roots, growing his long-only business with lower fees.

Since 2022, as market volatility has returned, hedge funds have found favour with investors again. And that's perhaps proved the tipping point for Hintze to step away from his firm, announcing the sale of CQS to Canadian giant, Manulife, for an undisclosed sum. A well-time sale, though you'd expect nothing less.

In 2018, Firstlinks' Graham Hand interviewed Sir Michael about his firm and what gave it an investing edge.

GH: You’ve made the point that to have an investment edge, knowledge is not enough, you need imagination. How important is it when you hire staff that they have backgrounds and interests outside of finance?

MH: Over the years, I’ve hired staff with broad backgrounds, but let me say, they do need to be numerate as well, good with numbers. I’ve hired people who are historians or work in English literature, for example, many different backgrounds.

Knowledge has become a commodity, and true alpha lies in insight and imagination. You construct an investment, trade it and then risk manage it. You get paid for the imagination.

GH: When you interview someone, how do you find out if they have imagination?

MH: It’s difficult, that’s why you need to have a conversation. We have a process to see whether they can absorb some facts and how they think about them in a creative way. We might ask if they’ve seen something in the news today, what they think of it and have a conversation around it. It’s hard but you can pick up if someone is not aware.

GH: You also write about the need for context and deep analysis in investing. Do you find you need to encourage staff to switch off their first reaction to something (what Daniel Kahneman calls ‘System 1 thinking’) and delve deeper into a problem?

MH: That’s why you have processes. You want analysts who pull apart a problem, you want them to understand the fundamental issues around it with issues viewed through the lens of our models.

GH: Is that what you mean when you write, “Models are a great way to begin but a terrible place to end.”?

MH: We have models which simulate various scenarios, but the really interesting thing for me is thinking about the problem and using imagination and judgement. We like to look at what can go wrong. For example, looking at the sub-prime market meltdown, you need imagination to say whether it will matter or not, to try to think about the fatter tails, the opportunities.

GH: In 2008, despite delivering excellent performance in the previous few years, your funds under management fell corresponding with a negative performance. And then 2009 and 2010 performance was again good. The same in 2015, there was a negative followed by a really strong year in 2016, but funds flowed out in 2015. Is that frustrating for you, that some investors take such a short-term perspective and exit at the wrong time?

MH: Operationally, we’re always watching liquidity, we’re watching what’s happening, and perhaps that makes us an ATM. Many of our investors who were getting cash calls in 2008 needed to take money out.

GH: I can understand why you felt like an ATM around the GFC, but what about 2015?

MH: I think what happened in 2015 was a general view that the credit cycle was going to turn and the strategies I manage had substantial exposure to that. It’s structured credit, and to some extent, still is. But we need to make sure our messages are put together in a more effective way.

GH: Your long-term track record is outstanding with only three small negative years since 2005. Do you look back on those years and ask what did we do then that was different?

MH: We always study where we make and lose our money, we pull it apart, I make sure we have liquidity and excess margin, we manage operational risk, and we take a longer-term view. The types of investments we make where the market falls often allows the next year to be much better.

In 2015 for example, there were a number of dislocations such as the end of QE, the end of the year concerns over China growth and systemic risk, a sharply-declining oil price, and that affected the high-yield bond market. That dislocation provided an opportunity to set up for a good 2016.

GH: It does look like many investors are exiting at the wrong time.

MH: I think they might but that’s the nature of the business. I’m just managing strategies for long-term opportunities and not worrying about if it falls a bit.

GH: You’ve had an office in Sydney since 2010, and CQS funds are not available to retail investors although they are available to sophisticated investors through some private advisers. We have a shortage of the types of funds you manage for retail investors. Are there better opportunities to open access to retail investors in Australia, perhaps with a listed vehicle?

MH: We’re uncomfortable with the potential volatility not only from the assets, but in a listed entity, the discount or premium relative to net asset value. It doubles up on the NAV volatility.

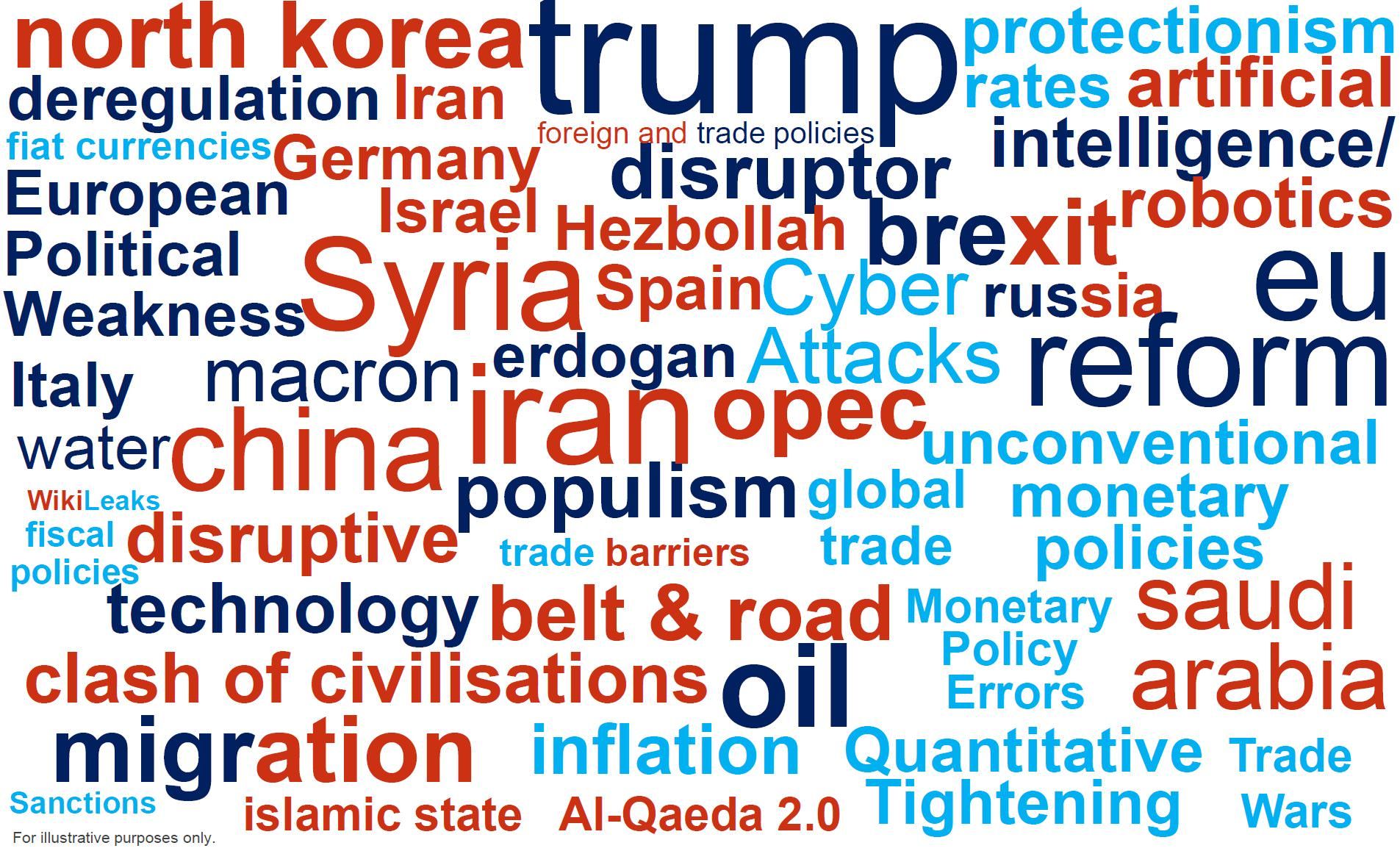

GH: In some of your presentations, the amount of detail on geopolitical issues is mind-boggling. How do you stay on top of it and lead to an investment decision?

MH: Again, we have a process, we have staff who do it and it’s been my passion in my thinking, it’s always been there. The market will also give a view, provided we’ve already done the background work. You start with noise, such as prices, news and events. You have to structure that noise into data sets to be able to create information and do more work on it to create knowledge. The problem is that because of education and data services, many can get to that knowledge, and there are lots of financial qualifications such as CFAs, CAIAs and MBAs.

Plus we’re very well plugged in, we access think tanks. The key is to understand the transmission mechanism, not every interesting event will have a market impact. If you’re in the Department of Defence or the Home Office or Foreign Affairs or wherever, you’ll have a different take on it. Consider, say, the ebola virus versus SARS. Different cost and effect on GDP.

GH: Can you elaborate on your comments that social media undermines the battle for ideas?

MH: If somebody says something that is mildly controversial, the trolling can get quite aggressive. It doesn’t even need to be controversial if you put your head above the parapet. It’s not just the individual, it’s their family. An example is my view on the environment. I care deeply about our planet and our environment is complex and fragile. For the record, I do think there is anthropogenic climate change and the whole global warming issue is important, but the almost-exclusive focus on CO2 is too simplistic. When I write that, I’ve had most horrific hate mail. The point I make is it’s all very well to get the Government to focus on CO2, but what about deforestation, use of antibiotics, what about plastic pollution and poisoning the oceans, biodiversity, what about all those critical issues. Some people think all we should legislate about is CO2 and we’ll be fine. We need a holistic view and strong global leadership to tackle the environmental challenges our planet faces. It’s like the sugar debate … people should know not to eat too much and exercise more, why should the government legislate against sugar?

GH: Do you mean it’s a personal responsibility, not the government’s?

MH: Any market needs to have rules and guidelines but governments cannot simply legislate things away. We are living through a time of unprecedented challenge and change and the old world order is under threat. The institutions and governments and economic models we’ve grown up with are struggling and less effective. Politically-inspired regulation can be stifling. But given proper rules, markets, which are a voting system, can solve problems.

GH: Last question, it’s important to mention your charity work, worsening income inequality, the plight of refugees, you say it’s our job to protect the most fragile in society.

MH: Society cannot rely solely on the public purse. Prior to the 20th Century, it seldom did. I believe private philanthropy is better placed to motivate and partner with charities. We must take individual responsibility to look after others, it’s our obligation to give back.

I often quote from the bible. It says, ‘To those to whom much has been given, much is expected.’ Charity is important. There are three principles that shape my philanthropy and career. The first is protection for the most fragile in society; the second is fostering aspiration; and the third is respect for institutions.

Graham Hand is Editor At Large at Firstlinks and this exclusive interview with Sir Michael Hintze, AM took place on 8 March 2018.