Geopolitical risks have spiked again.

Ukraine's cross-border attack in early August followed by Russia's largest air assault escalated the conflict. Meanwhile, the assassination of Hamas and Hezbollah’s political leaders and subsequent retaliatory actions have sharply increased geopolitical tensions in the Middle East. Waves of explosions in Lebanon and Israel’s declaration of “a new phase of war” have also raised fresh geopolitical concerns in the region.

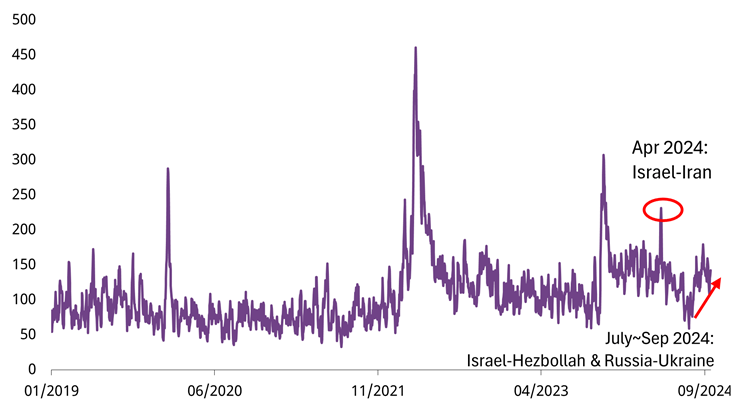

Chart 1: A period of heightened risks

Five-day moving averages of the Geopolitical Risk Index (GPR), as of 20 September 2024.

Source: matteoiacoviello.com, Bloomberg, World Gold Council

The Geopolitical Risk Index (GPR) indicates increasingly frequent periods when geopolitical risk is elevated – periods that have been particularly challenging for investors over the past three years. So far in 2024 the GPR Index has recorded 15 spikes – days when the Index surged by more than 100% – on the back of tensions in the Russia-Ukraine war and developments in the Middle East. This follows 31 spikes in 2023, 20 spikes in 2022 and 41 spikes in 2021.

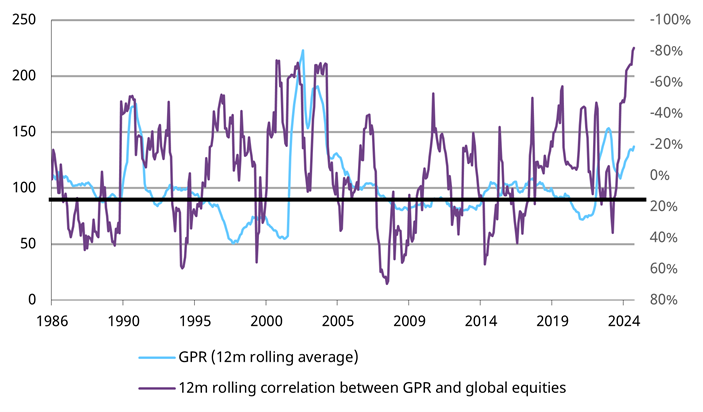

Historical data tells us that when geopolitical risks stay elevated (typically above 100), global equities suffer – evidenced by the negative correlation between the GPR Index and global equity returns (chart 2). Currently, the correlation between GPR and VIX is marching towards a record high.

Chart 2: Rising geopolitical risk leads to equity market selloffs

Rolling average GPR index and correlation with the VIX*, as of August 2024.

*Based on 12m rolling average of the GPR index and correlation between average monthly changes in the GPR Index and the MSCI World Index.

Source: matteoiacoviello.com, Bloomberg, World Gold Council

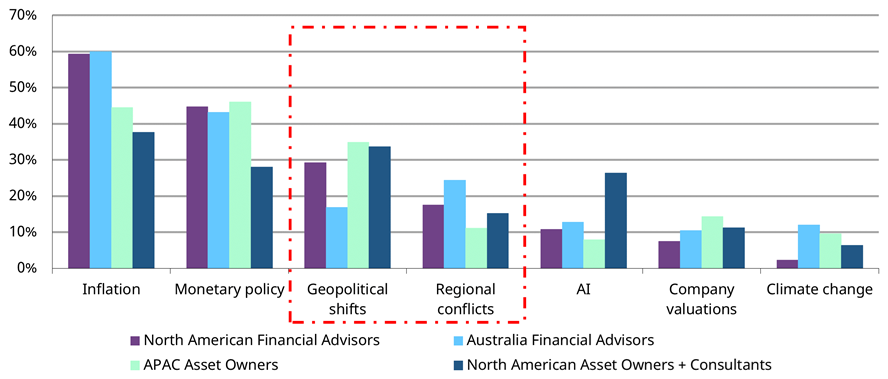

In fact, geopolitical risks have been front of mind for institutional investors for some time.

Based on results from a survey we commissioned last year, geopolitical shifts and regional conflicts are identified by global investors – including Australian financial advisors – as the third and fourth biggest trends affecting their investment decisions (chart 3).[1] Geopolitical instability is also one of the top concerns of global central banks when it comes to reserve management.

Chart 3: Geopolitical risks: one of the top concerns for global investors*

Q: Which of the following are the top two global trends affecting investments right now?

*Base: 75 North American Asset owners, 50 North American consultants, 400 North American Financial Advisors, 250 Australian Financial Advisors and 75 Asia Pacific Asset Owners.

Source: ZoomRX, World Gold Council

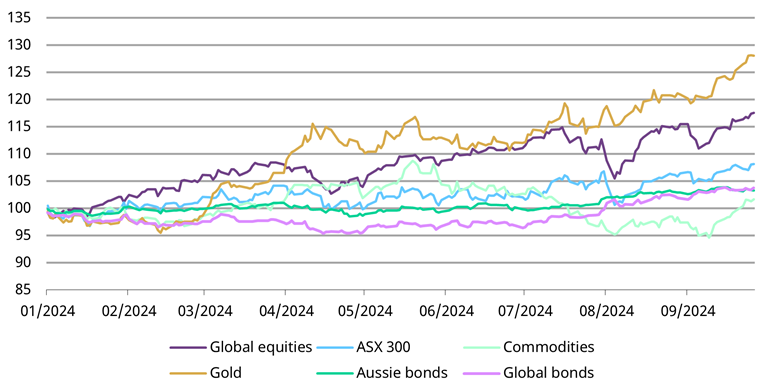

Asset allocation implications

How have major assets fared so far this year? Gold has outperformed to date, surging by 28% (chart 4). Global equities have delivered robust results too. While US stocks rocketed by 20%, the ASX 300 witnessed an 8% increase, mainly driven by factors such as the prospect of lower global interest rates ahead. But taking a closer look, when geopolitical risks spiked during April and August, equities fell back – impacted by multiple factors including surging geopolitical tensions – and gold rose higher.

Chart 4: Gold has held up during geopolitical risk spikes so far this year

Performance of indexed assets to date in 2024* as of 27 September 2024.

*Based on MSCI World Index, ASX 300 Index, Bloomberg Commodity Index, LBMA Gold Price PM, Bloomberg AusBond 0+ yrs Index and Bloomberg Barclay Global Agg Index. 1 January 2024 value = 100.

Source: Bloomberg, World Gold Council

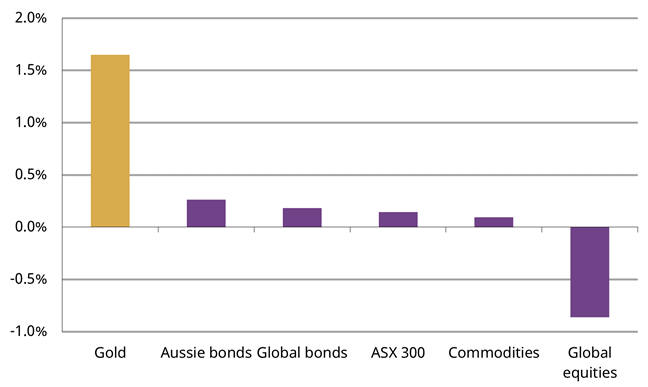

In almost every week during which the GPR index soared by over 100%, gold saw positive returns. Gold averaged a weekly return of 1.6% during these spikes while global equities declined, on average, by 0.8% (chart 5).

Chart 5: Gold, a consistent outperformer during geopolitical crises

Performance of various assets during geopolitical risk spikes*

*Based on average weekly performances between January 1999 and September 2024 due to limitation of certain indices. Figures show when the GPR index during the week soared by 100% or more.

Source: Bloomberg, World Gold Council

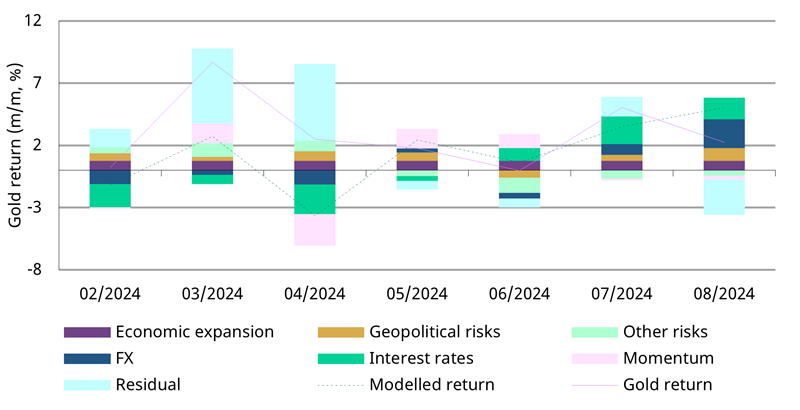

As our previous analysis demonstrates, geopolitical risks are a statistically significant variable that drives gold’s performance (chart 6). Our monthly Gold Return Attribution Model (GRAM) shows that geopolitical risks have contributed 4.3% of gold’s return to date this year. Furthermore, our research shows that every 100-unit increase in the GPR Index corresponds to a 2.5% rise in the gold price.

Chart 6: Geopolitical risks have been a consistent contributor to gold’s return in 2024

Monthly GRAM results* to 31 August 2024.

*For more information, see: Gold Return Attribution Model | World Gold Council. Results shown here are based on analysis covering an estimation period from June 2019 to August 2024. We have reduced the estimated window to five years to better reflect current conditions.

Sources: Bloomberg, World Gold Council

Gold as an effective geopolitical risk hedge

Creating a resilient portfolio is a topic constantly explored by investors. We believe one of the keys to building this resilience is to prepare for “unknown unknowns”. While scenarios such as global economic growth can be deduced from economic data clues, geopolitical risks tend to be sudden and unpredictable. And these geopolitical tensions often lead to financial market turmoil, damaging investor portfolios.

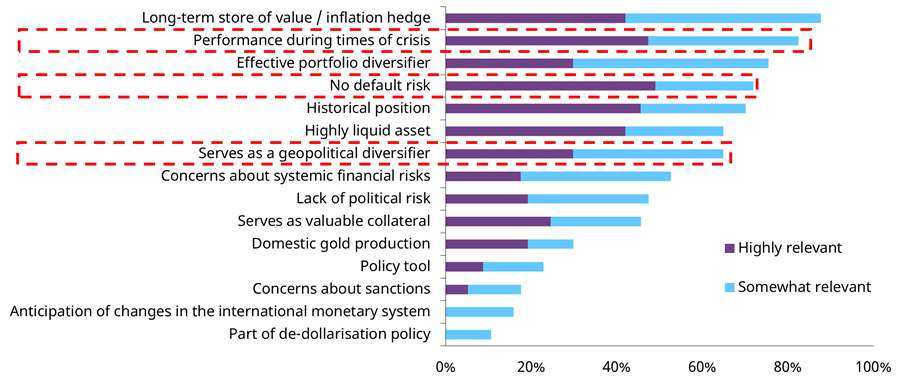

When we examine how various assets respond to sudden geopolitical risk spikes, gold’s robust performance during such events becomes clear. We conclude that gold is an ideal hedge against unpredictable geopolitical shocks. This is further evidenced in our 2024 Central Bank Gold Survey, which revealed that geopolitical risk was a key driver that spurred on central banks in their recent record-breaking gold purchases (chart 7).

Chart 7: Geopolitical risk-related concerns are driving the gold purchase decisions of global central banks*

*Base: All central banks that hold gold (57); Advanced economy (18); EMDE (39). Ranked by “highly relevant” plus “somewhat relevant”.

Source: World Gold Council

We believe that gold's key attributes – its safe-haven nature, its ability to generate long-term returns (especially now that a global easing cycle has begun), and its low correlation with risk assets – will continue to represent immense value to investors who seek to build a resilient portfolio in today’s world.

Ray Jia is a Senior Research Analyst at World Gold Council, a sponsor of Firstlinks. This article is for general informational and educational purposes only and does not amount to direct or indirect investment advice or assistance. You should consult with your professional advisers regarding any such product or service, take into account your individual financial needs and circumstances and carefully consider the risks associated with any investment decision.

For more articles and papers from World Gold Council, please click here.

[1] The World Gold Council and State Street Global Advisors commissioned ZoomRX (formerly Vivisum) to survey 75 North American Asset owners, 50 North American consultants, 400 North American Financial Advisors, 250 Australian Financial Advisors and 75 Asia Pacific Asset Owners. Fieldwork was conducted between 20 October and 18 December 2023.