What will the investment management industry look like in 2030? Nobody can predict the future with certainty, but it will be very different to today. Specifically, what the investors of the future will look like, how their needs, requirements and behaviours will evolve and what this could mean for investment managers. As you read this paper, we ask you to consider which trends will impact you most.

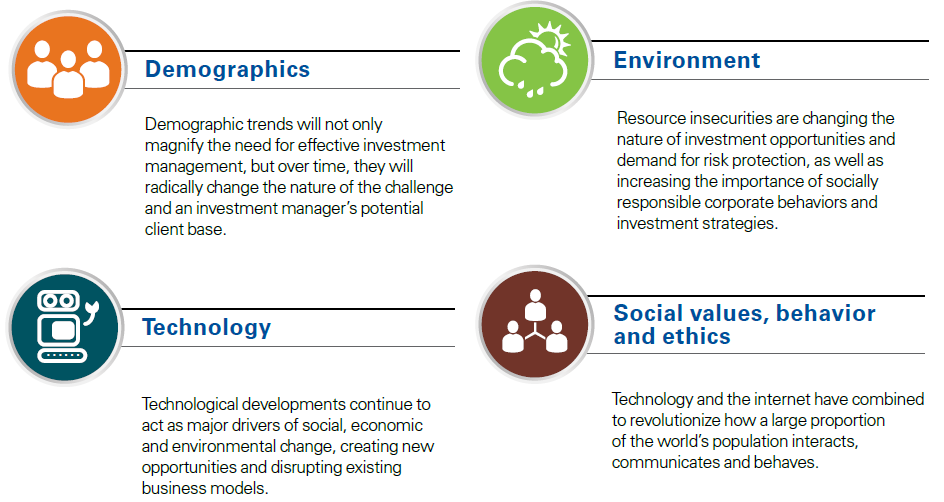

The world is changing rapidly, driven by a number of deep-rooted forces we call megatrends. We have been tracking these trends and considering the potential implications for the industry.

Seismic shifts in demographics, technology, the environment, social values and behaviours are set to re-draw the corporate landscape. Investment management will not escape this overhaul.

There is a significant prize up for grabs. Not only is the industry likely to be considerably larger in 15 years’ time, but it will have a more important role to play in clients’ lives and society in general.

Clients will be more diverse

The clients of tomorrow are likely to be different from the clients of today. The demographic drivers are clear. There will be more older people living for longer. By 2030, 13% of the global population will be over 65, compared to 8% today. But other trends such as the changing role of women, growth of the middle class, increasing mobility and growing economic influence of the developing world will help to make gender, culture and religion more important drivers of change.

Individuals will need to take greater responsibility for their retirement planning. No one else will do it for them given the decline of state provision in many counties and continued pressure on the traditional annuity models. An increasing number of people will simply run out of money in retirement. This presents an opportunity for the industry to capture clients earlier and build a cradle-to-grave relationship, rather than only focus on attracting clients when they have assets to invest. The net result is likely to be a much broader, younger, more diverse, multi-generational and multi-cultural client base.

However, each client segment will have different requirements, needs and expectations. Herein lies the challenge for an industry which to date has largely served a relatively narrow demographic.

Expectations will be different

We believe future generations will be more engaged in managing their savings and planning their retirements. Investors will seek greater certainty and personalised solutions which can transition across life-stages. The growing relevance of online communities and social networks is creating a new ‘trust paradigm’, with people increasingly looking to ‘people like me’ rather than professionals for advice.

Being able to provide timely, relevant, engaging and personalised information and education about the choices available to an investor will become as important – if not more so – than the underlying product.

The increasing capability of personal technologies will drive demand and expectations for all this to be delivered seamlessly through a multiplicity of devices at any given point in time. The incredibly rapid rate at which new technology is adopted is a feature of the modern age and the pace of development will only increase. Some 75% of the world now has access to a mobile phone and by 2030, 50% of the world will have access to the internet. This will drive huge change in behaviours.

Institutional investors will be calling for greater information, education, flexibility, solutions and certainty. We are already seeing an increase in institutional demand for tailored and multi-faceted delivery and reporting.

What does this mean for industry?

We believe that a new investment management value chain will emerge. The days of the ‘product-push’ model and being able to attract flows solely on the premise of delivering a decent return are in our view numbered. Traditional products will increasingly become components of more flexible solutions. We will see a greater demand for outcome certainty, and investment niches will become more mainstream.

We also believe that investment managers can play a much broader, deeper role in clients’ lives and the industry value chain. This will mean understanding clients far better than today and creating a new value proposition based around education, outcomes (not just returns), flexibility and personalised solutions. Investment return will continue to be important but we believe that the pendulum will swing from manufacturing to distribution.

Investment managers can play a more important role in the value chain. This could be through a greater role in asset allocation, development of a broader range of solutions, helping intermediaries better understand and educate end-investors or taking a lead in aggregating an investor’s total financial position.

The technology platform and supporting infrastructure must also provide the ability to capture, harvest and leverage data. The industry has struggled to take advantage of the client information available to it, to deliver and use its insights into its clients.

The new business models will demand people have new skill sets while technology could continue to replace many traditional roles. The industry will need to adjust to acquire talent from different pools and employ a more diverse multi-generational staff.

The potential for more disruption

There are emerging models leveraging a combination of technology, data and social networks to bring fresh propositions to market which play to the evolving megatrends. One of the key challenges many new entrants have is creating a brand and building an appropriate profile and distribution footprint. A trusted brand which resonates and appeals to a more diverse client demographic and a new generation of investors with widely different values and behaviours will be increasingly crucial to build scale. This provides opportunities for non-traditional new entrants.

It may seem a little clichéd but could the likes of Amazon, Google and Apple be the next powerhouses in investment management? Instinctively they have the attributes and capabilities: brand ubiquity which is increasingly trusted by younger generations; propositions that engage and are relevant; business models which put them at the centre of extensive networks designed to understand needs, anticipate requirements, aggregate information, make clients lives easier, solve problems and change behaviours; enviable distribution footprints and huge client bases spread across all demographic groupings.

This is combined with an ability to capture and leverage data to really understand clients and an infrastructure which can deliver personalised and tailored services.

We can also see an opportunity for even more radical propositions to shake up the industry, particularly in response to challenges such as the pension time-bomb. With investors likely to increasingly value outcomes and certainty over returns and look for opportunities to lock-down value earlier, the focus could shift to products and services rather than cash savings.

Retirement planning should be about securing lifestyle expectations rather than simply cash accumulation. On that basis, options to secure holidays, cars and healthcare during retirement may be as attractive as putting aside cash. We believe such a paradigm shift could be feasible.

Conclusion

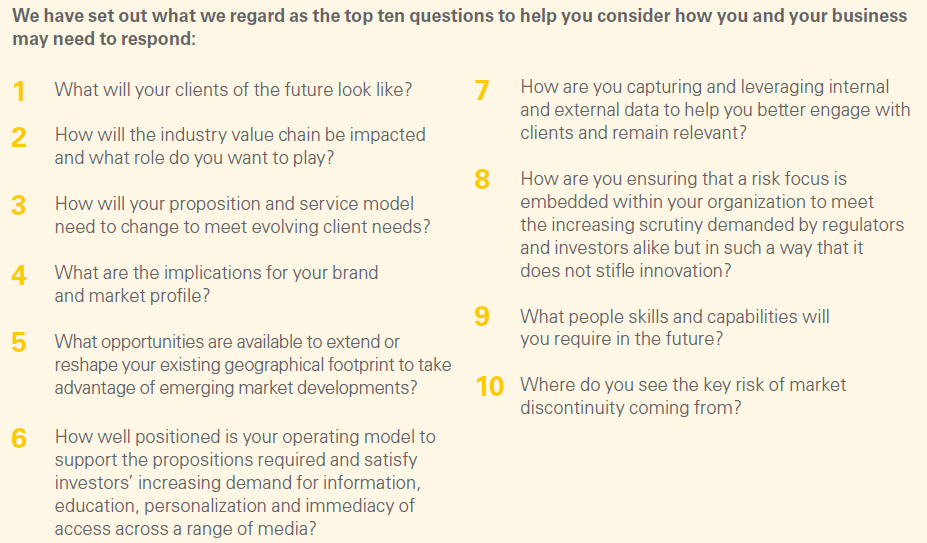

We are not attempting to predict the future. We are simply looking to better understand how megatrends could impact the industry. The spectrum of outcomes is broad and there is certainly no ‘one-size-fits-all’ response.

Some firms may decide that remaining true to models that have served them well for decades is actually the right strategy. Maybe they’ll be right – but this has to be a conscious decision, not the result of inactivity or apathy.

However, we firmly believe that the megatrends will drive fundamental changes in what investors of the future need, want and expect. In our view, simply appreciating that this shift is taking place and pursuing a strategy of incremental change will for many not be sufficient.

Jacinta Munro is Partner, Wealth Advisory and John Teer is National Leader, Wealth Management at KPMG.

This is a summarised version of the original KPMG International Report. For both the Full Report and the Executive Summary, see kpmg.com/investinginthefuture.