Labor has announced a $2.3 billion Cheaper Home Batteries Program, aimed at slashing the cost of home batteries by around one-third. Open to all households, small businesses and community groups, the scheme aims to turbocharge battery uptake nationwide.

The rebate is based on a battery’s usable storage capacity and excludes installation costs. It offers roughly $370 per kilowatt-hour (kWh), equating to about 30% off the battery’s base price. For example, a 13.5 kWh Tesla Powerwall 2, priced at around $11,900 (plus installation), would attract a rebate of nearly $5,000.

The rebate is not means-tested but is limited to one battery per household. Installation must be carried out by accredited providers, and further details on eligibility, start dates and application processes will be released state-by-state, pending jurisdictional agreements.

Is it good policy?

The proposal might be good in theory, but it’s a different thing in practice.

When COVID struck, we found ourselves with a cash surplus thanks to refunds from cancelled trips and decided to install a Tesla Powerwall. It’s been a trouble-free appliance and can even think for itself. Recently, when a cyclone was approaching, it sent me a text advising it was charging from the grid so it would be full in case of a blackout. The days before the cyclone were cloudy, so no electricity was coming from solar.

It’s impressive technology — but that doesn’t mean it adds up.

Consider a typical day in a household with solar panels and a battery. The day usually starts with the battery down to its minimum and no solar power being generated. At this stage, all electricity is coming into the house from the grid. As the sun—if it appears—rises, solar begins to offset grid use. If conditions are favourable, solar output eventually exceeds household consumption, and the battery begins to charge. But as the afternoon wears on, solar generation drops. The moment it can’t meet demand, the house draws from both the battery and the grid. It’s common to end the day with a near empty battery — especially in winter when the sun sets early.

All a battery can do is store excess energy when your solar system is producing more than you’re using. Once the battery is full, the surplus goes to the grid — and as we all know, there’s not much money in that.

Let’s pretend it’s been a perfect day to see how the numbers work. The sun is shining brightly, and by sunset your battery is full — charged entirely from your own solar panels at zero cost. Keep in mind this is also the time most people return from work, just as power generation fades and demand surges. We’re currently paying around 30 cents per kilowatt-hour, which means a fully charged battery holds just $3.60 worth of electricity. It’s great to be using free power from your battery, but in reality, that full battery is only saving $3.60.

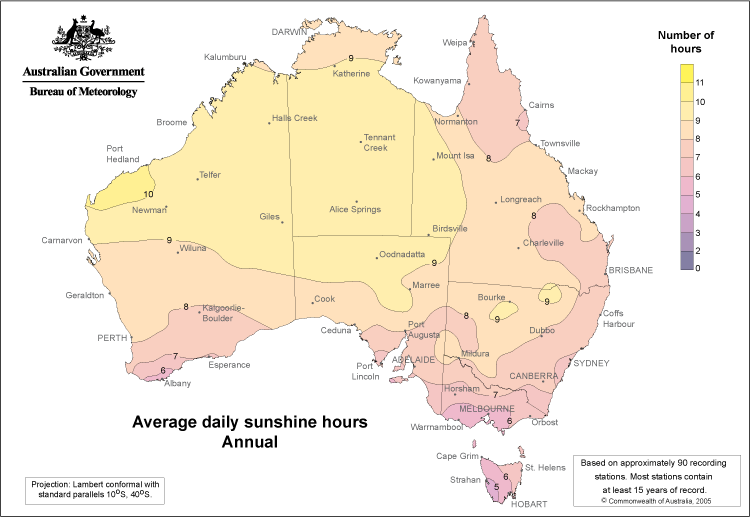

And solar generation varies greatly depending on where you live, how many panels you have, and even the direction of your roof. Still, let’s assume you manage to fully charge and use your battery on 200 days of the year. That means the total annual saving amounts to just $720 — not nothing, but hardly the game-changer it’s claimed to be.

Given Labor’s proposal offers a $5,000 discount on a battery like a Tesla Powerwall, the homeowner is still left with the balance — around $12,000 — once installation is included and the total cost climbs to about $17,000. At annual savings of just $720, it would take 16 years to recover the cost — which, by coincidence, is also the estimated lifespan of the Tesla Powerwall battery. In other words, just as you’ve broken even, the battery may be ready for replacement.

Another major drawback is its basic unfairness. The people most likely to be cash-strapped are renters, and they cannot install solar and batteries on a rental property because they’ll never get their money back. There’s an argument that savvy landlords might install the wiring, solar panels and battery to increase rents, but we’re heading for an unholy alliance of Labor and the Greens. It is Greens policy to freeze all rents — so what landlord would go to the expense of installing a solar system when there’s every chance their rents would be frozen?

The nonsensical part

Here’s a real head-scratcher from the latest battery rebate announcement: if you install a battery before July 1, you qualify for the subsidy — but you’re not allowed to switch it on until that date. Seriously?

You can pay for it, install it, wire it up, and connect it to the grid — but then it must sit idle for months. That’s not just bureaucratic nonsense — it’s policy gone mad.

The whole point of the scheme is to ease pressure on the grid and help households save money. Forcing people to wait defeats the purpose. It’s process over purpose — and a reminder that common sense is too often missing in Canberra.

Noel Whittaker is the author of Making Money Made Simple and numerous other books on personal finance. His advice is general in nature and readers should seek their own professional advice before making any financial decisions. Email: [email protected].