Electric vehicles (EVs) are vehicles that are powered by electric motors and batteries instead of traditional internal combustion engines (ICEs). They are seen as a key technology for reducing emissions. Following a period of exponential growth, the outlook for EV manufacturers has recently become more challenging.

Electric vehicle sentiment turns sour

Slowing demand and profit warnings from the EV manufacturers has seen analysts revise down their EV penetration forecasts. EV sentiment has continued to worsen in 2024, with major EV automaker shares down 20-55% year-to-date.

We are big supporters of decarbonisation efforts, but these efforts cannot occur unless businesses are sustainably profitable. Decarbonisation projects must make economic sense.

Figure 1: Share price performance of EV manufacturers in 2024 YTD

It looks like EVs may have hit a natural saturation point. EV demand has been regionally concentrated and over-indexed to high income earners where demand might be exhausted for now. Some EVs are too expensive for their segment size (e.g. pickup trucks) and do not have great distribution channels.

There has also been a reality check on the rising cost of capital. Underpinning EV growth is a technology that is more efficient than fossil fuel but every bit as capital intensive. A major repricing of the cost of capital globally has had a clear impact on the payback periods of such projects.

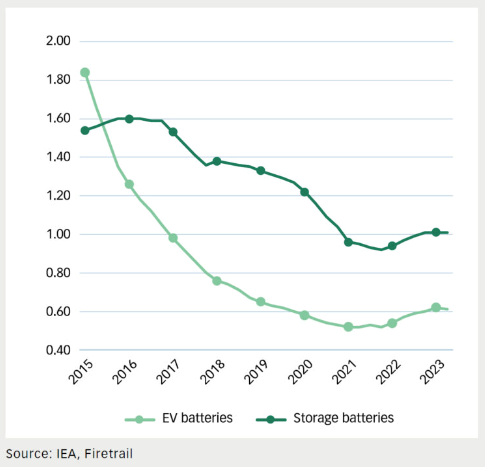

Figure 2: Average producer price for EV and storage batteries

It appears that investors are rewarding certain auto manufacturers for ‘dialling back’ their EV strategies. The relatively strong total shareholder returns by players like Toyota and Stellantis stand out given these names have spent far more frugally on the EV side.

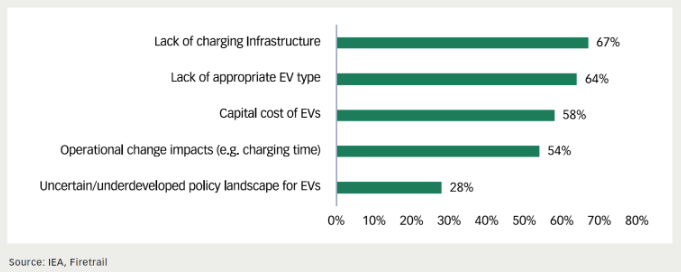

There are also EV adoption challenges. These include enhancing EV charging infrastructure (both availability and charge time), addressing maintenance issues, and concerns over range. While EVs are the future, it’s the traditional internal combustion engine (ICE) product that generates the profits and funds the dividends and buybacks for shareholders. The ICE product has an additional advantage – it is relatively insulated from Tesla and Chinese EV disruption.

Figure 3: Top 5 barriers to EV adoption reported by EV1001 companies

On top of this, the current U.S political environment may discourage new competition or lead to automakers deferring investment decisions.

Where are the opportunities?

Cutting through all this noise, and given the de-rating in the EV sector, where do the opportunities lie? We believe that caution is warranted and are taking a prudent approach by maintaining a highly selective approach.

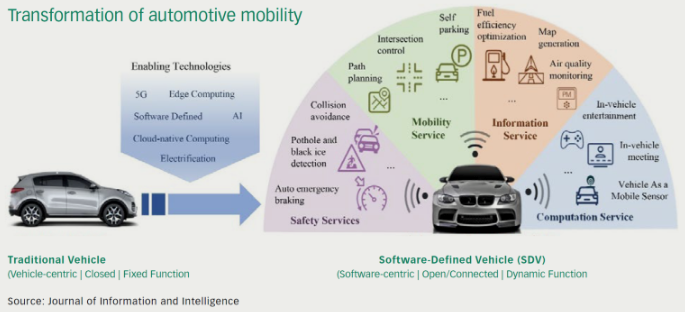

Our preferred exposure today to the EV thematic is Aptiv (NYSE:APTV), a US-listed company that designs, develops, and manufactures software and hardware solutions for both EV and ICE vehicles. To use a human body metaphor, Aptiv supply both the ‘brain’ (software and computing systems) and the ‘nervous system’ of vehicles. Aptiv’s clients include GM, Stellantis, Ford, Volkswagen, and Tesla. They supply electrical content for 1 out of 3 low voltage vehicles, and 1 out of 2 high voltage vehicles globally. EV bearishness is most focused in the US, whereas Aptiv’s high voltage business is around 80% European and Chinese auto manufacturers.

What we really like about Aptiv is that the outlook for the company’s earnings isn’t solely reliant on successful EV penetration outcomes. However, any upside to EV sentiment from current depressed levels is likely to drive incremental upside to an already compelling fundamental story. New products, an expansion of charging infrastructure, and improvements in affordability would see sentiment shift swiftly around the EV manufacturers.

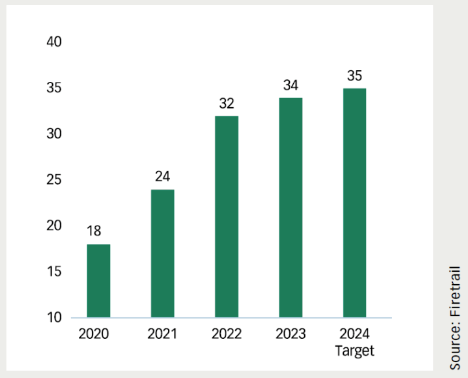

Figure 4: Aptiv order bookings (USD billions)

Figure 5: Transformation of automotive mobility

Focus on what matters

Aptiv is well placed to capitalise on the secular trends of automation and EV penetration. Investors have been wrong to focus on the near-term headwinds to EV adoption, rather than Aptiv’s long-term trajectory. Aptiv have always been more conservative than the market around EV penetration, and we view the company as the best positioned content supplier to benefit from the EV and ‘Car of the Future’ thematics.

As a business built around these megatrends it has a sustainable business model. As the only full-system provider of smart vehicle architecture and with over 90% sales visibility through to 2025, it has the potential to deliver sustainable earnings, which are supported by the company’s strong new business pipeline. The company is a future leader in the EV industry and is placed in two of Firetrail’s Sustainable Positive Change themes: Climate Impact, and Innovation & Equality.

We expect significant growth and margin expansion to continue to reinforce the quality of Aptiv to investors. Rather than getting caught up in noise, we are looking beyond the present to uncover and capitalise on opportunities.

1 The Climate Group’s EV100 Initiative brings together over 100 companies in 80 markets committed to making electric transport the new normal by 2030.

Firetrail Investments is affiliated with Pinnacle Investment Management, a sponsor of Firstlinks. This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance.

For more articles and papers in Firstlinks from Pinnacle and its affiliates, click here.