Last week's poll question asked:

Do you believe the family home should be included in the age pension assets test?

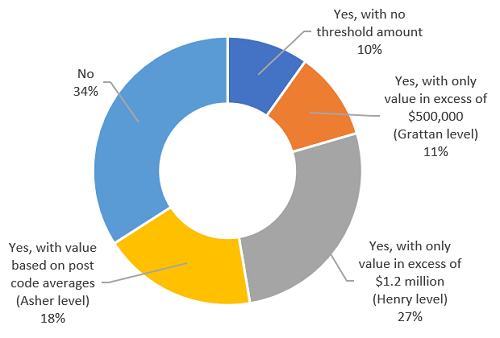

From 700 participants, two-thirds or 65.4% believe the value of the family home should be included in some way. The most favoured threshold above which the value should be measured was that proposed by Ken Henry in his 2009 Tax Review, then at $1.2 million (which if indexed since 2009 would now be worth about $1.45 million).

This leaves 34.2% believing the assets test should continue to exclude the value of the family home.

There were also many additional comments, with a selection below.

|

Answer choices

|

Responses

|

|

Yes, with no threshold amount

|

9.8%

|

|

Yes, with only value in excess of $500,000 (Grattan level)

|

11.2%

|

|

Yes, with only value in excess of $1.2 million (Henry level)

|

26.1%

|

|

Yes, with value based on post code averages (Asher level)

|

18.3%

|

|

No

|

34.2%

|

Comments received

Yes it should be included but only with a Fed Gov operated reverse mortgage loan at the RBA cash rate.

It's not fair to non-homeowners and those who received an Inheritance. I HATE Centrelink, nice to people who have $1m property and not nice to those who don't. Just unfair.

Post Code averages would be totally useless. I am reminded that a person with one foot in a bucket of ice and the other in a bucket of boiling water is comfortable ON AVERAGE.

All assets should be counted. Current system encourages over investment in Capital Gains and Pension Test exempt assets

The home should be considered as an investment at retirement age, and therefore included in the overall assets test

It's unfair for the people who has paid the home with After Tax income. Why punish them? Announce a date or grandfather from certain date, so the people can plan for next 20 years - don't punish the people who didn't know 20 years before, who sacrificed many luxuries of life to pay with after tax income for dream home.

Any move to do this should have a 30-year transition - ie. the same period as required to accumulate retirement assets and the same period over which a person might pay off a home. People like to live where their children and relatives love and where they enjoy the natural beauty of their local area. The pact that house prices rise due to excessive migration should not affect their financial expectations in retirement.

All Age pension applicants should forfeit sole ownership of their residential property, by offering it as security for continuous future pension payments. When their circumstances change, the home would be sold and the aggregate pensions paid to date returned to the government. Any surplus would be added to the estate of the pensioner. The pensioner would benefit from the free accommodation and the public would benefit from the return of the pensions paid, or a (significant) proportion thereof. Any excess funds (if any) would be returned to the pensioner’s estate for distribution to their beneficiaries. Currently, a significant proportion of pension $’s end up in the bank accounts of pensioner beneficiaries. These $’s should be returned to fund improvements in aged care and other worthwhile causes.

Threshold does not solve issue of sufficient income. Need a compulsory reverse mortgage or a repayment/age pension tax on death from the estate.

Standard age pension for everyone after say 15 years fulltime residency and cut back on tax free benefit of super fund pensions

Who is going to work out the values, unless you use the land values for rating, and how often with market fluctuations.

Non home owners need to better understand the sacrifices made to purchase a home.

It is a clean, reasonable figure that would enable a good argument. It would eliminate unintended consequence as could happen with the postcode argument..

I don't believe that people should be penalised for living in a postcode with higher average valuation. If there was no threshold, those people would be forced to sell and move to a new lower average valuation area where they have no friends or support in order to access the pension.

I do have reservations, as the methodology is not perfect and does not take account of wide disparities within postcodes.However it does not seem fair for people with highly valued homes to still receive a pension when others may not because their financial assets are too high. State governments do not assist, due to the punitive levels of stamp duty they charge. This discourages downsizing. Personally I am a self funded retiree and hope never to be eligible for a government pension.

The asset allowance of about $220,000 for non home owners is unfair, also the current exemption encourages people to do stupid things to get the pension. Unsure about the method that should be used.

We will never qualify for any age pension, and it grates that others can manipulate their assets to qualify, with the ridiculous situation of people of intentionally wasting money on cruises and renovations to keep themselves under an assets limbo stick.

The Asher level and only above a threshold with threshold indexed to CPI? or market values? - preferably the second

Cant trust politicians to keep it at the same levels indefinitely. Cant trust poloiticians to not rip it off

Such matters don't affect politicians as they MAKE the rules to suit themselves and in my view all people should be subject to the same laws/undertakings. Passing on wealth to family should be viewed positively as they will require less pension, will they not?

The late Labor Finance Minister Peter Walsh was right, the exclusion of the family home (principal residence) would lead to an unhealthy skewing of investment in Australia.

Until all retirees who have a nominated number of years in the Australian workforce (eg 20 years, need not be continuous) are able to receive a part pension irrespective of wealth then I say NO. Should a system be implemented where everyone gets a base and the remainder is asset tested then I am unlikely to change my mind.

My home is my castle. I worked hard to pay it off. It is part of my assets to allow a comfortable retirement without paying rent. Why should my home be "taxed". The next idea will be to tax your car because it is an "asset". At $1.2M (Henry Level) almost half of Sydney would miss out given the median is a touch over $1M. Thus a great proportion of Sydney dwellers who may need some pension funds to remain in their family homes which they lived and grew as a family, would be penalised. Similarly with Asher level. The postcode average may be $300K and the owner has a $400K value, thus excluded as being too wealthy in a low income suburb.

This is not a fair example, as it assumes that everyone would be happy to move to a regional area. Changing the goal post with regards to the home is extremely unfair. It may also lead to the government using that as an excuse to look at taxing the family home, eg. CGT

Those who decide to rent, at any time in their life, especially after down-sizing, need a measure of equity. The home must be tested.

If you are say enough to save and finally own your own home at retirement you should not be penalised for this accomplishment.

Only if the above were combined with a restructure of other tests. My mum is 63, Dad is 68. She works in Aged care receiving 43k p.a, they have about 100k in Super and a 350k house. he only receives $300 per fortnight because of her working (which she needs to do to help support the cashflow). He is an ex-miner and doesn't really have the option to work. This is a bad system

Not sure that a specific dollar value is the correct threshold to apply, but the pension system massively favours home owners anddiscriminates against renters. I believe that home ownership is likely the biggest single determinant to a reasonable lifestyle in retirement so perhaps the ability to 'll k super savings to home (Or investment property ownership) should be considered.

Basing the threshold against the houses in a specific postcode will be detrimental to pensioners in lower socioeconomic and/or rural and regional areas. It will also encourage people to move to more expensive areas to “it wealth. A flat level threshold would be fairer.

Don't tie it to a house value - increase the assets test threshold adequately and then index (e.g. to CPI or others)

Total net assets should be the amount considered with tiering thresholds. Public will never trust the government on this issue as it continually changes the rules to capture a greater share of an individuals long term savings plan.

I have ticked No because none of the other options correctly address the problem. If the value of the home is such that it prevents an income-poor person from pension eligibility and, then forces that person to sell their home, then that is unjust. Also, many older people consider that if they must go into institutionalised aged care, the home value will fund for a better standard of aged care. The majority of older people want to stay in their own home. Why should they be forced to sell if their income is inadequate. In this current low interest environment, the elderly are being shafted --Big Time! It is disgraceful.

Pay a universal pension, taxed at lowest tax rate.

Why should some assets be exempt, this is extremely unfair on those who must rent for one reason or another.

It is simply cruel to force people out of the home they may have lived in for years, because that's what any of the above proposals will do to a greater or lesser extent.

Has to be included but a fixed threshold too likely to force people to sell and relocate for no reason other than luck (good or bad).

Or death tax on wealth but that is difficult to execute appropriately with all the scammers

Another huge issue is the 10 year residency to access the pension. It should be 40 as in Canada

The Asher level is not fair. I live in Sydney, sell my 2 million dollar house, then move to a small rural town and buy a 400,000 dollar house. I do this after age 67. I now have 1.6 million excess funds that can no longer be invested in super as I am already at the upper limit. super

It makes sense to have the family home included in the assets test, because it is an asset. Having a threshold amount that allows for the excess value of your home, relative to where you live also makes sense because it represents the excess value pensioners hold by living in a family home alone, as opposed to downsizing. I would look to change the postcode average, and do it by region or whole city area average, that way making the policy more equitable.

By remaining in the family home, less stress is placed on an already strained aged care system in which many are poorly cared for.

the plight of increasing numbers of low income single women, as well as the traditional marginalised handicapped and unemployed will swell as the boomers age and the pension age increases (to 67) flow through.Rent assistance , more that increasing the basic pension should be a priority to shore up the quality of our society

Any change must examine the "unintended consequences". For example, by increasing the depreciation of the pension to 3$ per 1000$ of assets, cash spent on improvements to the asset free home effectively returns 7.8% on that money spent as increased pension. Fantastic in a sub 2% world.

Some people are living in homes worth 3 to 4 million dollars and struggling on the pension.The whole retirement system needs a complete overhaul. At the moment it's a bureaucratic nightmare.

too many pensioners living in multi million dollar houses!

You cannot derive a retirement income from this asset without deminishing its value. Some will still have a mortgage. You need an income stream to survive in retirement

All you be shame,may all of you get fat salaries and not care for the pensioners how to living.The most of countries of world not have income and assets test.Any Australia government should be asked the Pensioners how they living before making decision.

Postcodes may be too granular but some form of allowance for the wide disparity in house prices needs to be addressed. The bigger issue which I am astonished that has not been accepted yet is that no person entering the workforce today earning around the average wage should have any expectation of getting an aged pension. Once this proposition is accepted then changes such as including the family home in the assets test flow logically and fairly.

Pensions should be a loan paid back from a person's estate. SG should increase to 15% so fewer people require pension.

Some homes have been handed down generation to generation doesn't necessarily mean the person or persons living there have much money and old people need to live closer to the city due often to medical needs accessibility. I would hate to have to move from my home because unfair taxes made it to expensive for me to live here I have no family in Australia my brother married a Norwegian and moved over there, in Norway if you work for 10 years you are not means tested and at 65 you retire at the income level you earned while working no means test there bu if you didn't work for 10 years you don't get a pension which adds incentive to make sure you spend 10 years in the workforce at least, so no generation after generation of dole bludgers there.

Intention of super is to provide a replacement income in retirement. There needs to be a limit on what gets subsidised and the 1.6 mill per person indexed is reasonable as provides around 80 k per year before any capital draw down More needs to be done to grow balances over time. A STAGGERING anonomloy is where a couple have say accumulated 1.2 mill between them (about 60 K per year before capital draw down are actually worse off than a couole who have accumaulted a touch under the 800 K betwen them the transition needs to be addressed to given incemtive to have dollars in super to reduce demand on govt socail security

It is savings accumulated from earnings that had already been taxed at the highest marginal tax rates as savings come from additional earnings above what is necessary for living expenses. Family home is needed for aged care bond; if "taxed" again via imputed rent and therefore a reduction in aged pension based on income test, there is severe progressivity of tax on this form of savings. People would choose to rent for life and go on full aged pension and then get subsidised aged care without needing to pay aged care bond. It's just too hard to do the right thing and save for a fully paid house and then see your lifestyle no better than someone who didn't bother ,,,

Why ? As we have been working and saving the whole life to own a house and to not live in rental home so we should deserve it

Grandchildren can hardly afford a house even on a reasonable income whilst their grandparents receive full pension and live on a $1.2m house in South Perth.

No - as a matter of principle. I paid for my home when the mortgage interest rate was around 15 - 17%. I am not eligible for a pension but would greatly resent having my sacrifices in earlier life to counted against me in retirement. 2. If any amount were to be included, that portion will be inevitably increased over time to exclude any entitlement to a pension and to force retired homeowners to sell their homes.

I have work hard all my live so it can be from me is would me no the street

Re : the Asher level, what has the post code got to do with pensions?

The age pension should be paid in full to all residents with no income or asset test .the cost of this would be saved by more than halving the centre link employer numbers. New Zealand does this and its simple.

Because the home produces no income for a retiree. Selling the home involves significant expenses; relocation costs and loss of familiar surroundings and faces, which really matter to older people, like me. This is why staying in your own home matters to most of us. We worked hard to get our home and should not be forced out of it for financial reasons.

Yes, but only 50% of asset value.

By this stage in Life we have paid enough Taxes, and a lot of us do not wish to SELL or move and wood like to Die in our family Home if possable.

Aust pension is already bad due to assett test UK and others Re automatic at the retirement age

Family home concept needs to be a phased-in, graduated application only for workers who started working when super first came in. Many older people NEVER had super so they should be exempt.

Every other investment asset held is included at full value, not including the most valuable asset most people hold leads and has led to arbitraging the system and is dishonest to people who do not wish to tie up capital in a non income producing asset

Another rule change when people have made financial decision based on the rules

I live in a rural comunity and have a few acres of land around our house, the value of land in excessof 5 Ha. is included in my assets test. But if i lived in Toorak or the North Shore, as long as the block was less than 2 Ha. (I think) and worth Millions I'm not effected! Fair?

The Centrelink system seems to reward those who blow their disposable income on lifestyle things whilst punishing those who scrimp and save to fund their retirement in order to not be a burden on fellow taxpayers. I have recently seen several cases of people who have saved all their working life and are made unemployed a few years out from retirement. Centrelink's response is "sell your house and live off the proceeds", whereas had they not tried to be independent Centrelink would help them out. On the other hand I know of people arranging their affairs by buying the best house they can afford that leaves their assets in the range that "entitles" them to a aged pension.

There is no (economic) reason to prolong the distortions introduced by the very favourable and therefore inequitable treatment of one particular asset category.

Full value of home, adjust the index. Anyone who wants a pension but has too high a value home can get one under a help style loan, paid backwhen the house is sold or the owner moves out. Better than a reverse mortgage. Also, l don't think this will be such a problem in the future, with compulsory superannuation. A bigger problem will be the lack of retirees that own their own home. Maybe governments will have to start building public housing again.

We need to do away with all asset testing and provide a minimum age pension to all which could be taxed as appropriate at normal levels.

If introduced, the scheme would need to have some grading effect otherwise it would be tantamount to throwing people out of their homes in old age.

If the family home applied to the age pension a new tax source would then open to the Government to tax the home for other purposes which would then be said to be based on perceived equity vis a vis the age pension. e.g. super or land tax.

Post Codes can be scewed from within by considerable amounts. My immediate area,part of Coffs Harbour on the NSW North Coast has three distinct suburbs with land component values with similar houses on them varying by a factor of 3 to 4 times as you move closer to the Pacific Ocean. No one in quite simple homes in my precinct near to the sea would qualify for the pension if a post code wide average was used.

under no circumstances could any future politicians/ Government/treasurer/ be in any way entrusted to this change. look what they have done with super etc let alone give them financial control over family homes.

If the assets test was in place with a fixed amount, you could have the situation where old people have to move away from family and friends because of the value of their house they may have lived in for many years

It's only fair that some part of the family home be included in the pension assets test. But if that's not workable, how about a portion of the inheritance that kids receive from parents who were asset rich and cash poor, and went on a pension... be returned to govt. in other words, the pension is like a loan.

All the houses in this country are all way above the true value all over priced it wouldn't work

Every asset should be taxed

When the pensioners die, their home would regards as deceased asset and would subject to tax.

Yet another example of middle-class welfare and privilege which really should be abolished, freeing up more funds to help those who truly need help.

Include UCV of land that you own in Asset Test. This is set every 3 years by the Valuer General in Canberra regardlesss of what is constructed on the block.

At the conservative rateable value, with abrupt changes smoothed out.

Difficult to set a level given the huge disparity in house prices across the country. Also, many pension recipients have lived in the same property for many years. It's not their fault that property prices have gone up and it's unfair to force them to move.

The Grattan and Asher proposals are totally rediclious... will cause a massive added adminstrive nightmare... constantly monitoring... inflation... changing values and house transactions/altrerations.

We do NOT get a Govt Pension. However our earnings from working full-time were less than average,we went without and saved for our home and retirement rather than spending our money on Overseas trips and other extravagances. Why should only people that spend their money on a Home be penalized?

We work all our life to own a home just as we are about to retire. Leave it out of all pension calculations otherwise you are penalising those of us that have been thrifty all through our working life. Any changes should not affect those on a pension now. Grandfathering must apply otherwise it is a matter of changing the goal posts after we have planned for our retirement. We can't make any changes to our financial plans once we have retired so changes must have a lead in time so people can plan retirement based on the new rules. Leave pensioners alone and go after social security rorts if you are serious about funding pensions in the future.

My wife and worked very hard to pay our mortgage.

Normalising by postcode isn't that feasible. Some postcodes in Australia cover massive areas. I also don't think it's fair that an elderly couple, who never had the opportunity to save super, but have a house in what was once a working class suburb but is now a sought after location, should be forced to sell the house they may have lived in for a long time in order to access the age pension (which they never had the opportunity to avoid through superannuation in the first place). You can't just change the goal posts for people who retired long ago with a completely different set of goal posts. If any changes are to be made to this, then phase them in aka the current pension age extensions.

Don't keep changung the rules! Maybe for future retirees only!

There should be no assets test, only income test on financial assets. Pay for it by taxing pension mode super at 15%

For any aged pension entitlement you are talking peanuts

Your principal residence should be excluded if it provides no income to the owner/s.

raising the qualifying age and the frequent changes to income and assets tests [to exclude more people from qualifying for the pension) has devastated the retirement planning of many who planned their retirement under the old rules (and those who forced to retire due to poor health, accidents or retrenchment/offshoring). No more changes.

Many older people in their retirement depend quite a lot on the support group of local friends that they have established during their lifetime. Most did not initially choose to live and remain in a location because the value of their house would increases beyond their wildest dreams as has happened to some. If they have significant health problems as do my wife and I and have had a protracted period where neither of us had a driver's licence for a some months, our life in a small country town 3 hours drive from our capital city and 30 minutes from any substantial shopping centre, our existence would have been significantly difficult had it not been for the generosity of our many long time friends. Why should we be forced to downsize into a cheaper town or suburb where we would have few, if any, immediate friends that we could rely on, if need be. One cannot earn any income from an asset such as one's home to offset any part of a pension lost because they live in a house that has grown substantially in value through no fault of theirs.

I am 78, my family and I worked and saved all our lives. My family home is my castle and my SMSF and franking credits are my only income now. Why do you want to stifle initiative to work hard for a better future? Better education is the solution.

Definitely don't like the median by post code idea. Depending on house value someone could be popping in and out of age pension eligibility year by year - a nightmare to manage and budget. While I understand the equity arguments, remember that generally one's home does not generate income and it is no little thing to sell and leave a lifetime home, which has simply gone up in value without intention over years.

It would force some people to sell their core asset

Grattan level triggers a reduction in pension with sliding linear scale gradually reducing the pension to zero if home value is $2M or higher.

I think a portion of the family home (up to say 25% of its value) could be paid back to the government on the passing of an age pension recipient. Alternatively, the government could have a claim on an estate of say say 25% of age pension benefits paid out over the pensioners lifetime (from age pension age). For example, someone receiving $15,000 per annum over 20 years would receive $300K benefit. The government to have the right to claim $75K back from the estate secured by a RAD, PR or any gifts over 30K in the prior 5 years before death.

Why should someone in a ten million dollar mansion receive the Centrelink pension??

with an appropriate increase in the assets test threshold so an average home does not decrease the pension received

Income Test ONLY. Not Family Home. Old person living at home, that owns there own home outright, that lives in there local community should NOT be forced to move house because their house passes the value from below the threshold to above the threshold and hence the person goes from receiving (possibly therer only form of income, the age pension, to no income) due to a rise in the asset value of their home. This would most affect those people that are in their latter years of life as their home increases in value, and their savings are depleted. I also beleive that the administration, and disagreeemnts between the 'values' of houses would be horific. The true value of a house is never realized until sold. Until then it's a guess. Even if every house was valued, it would be an 'estimate' and would be in disagreement.

As it is, it's not fair that mega-millionaires can still draw the pension. I am a self funded retiree.

More importantly, there needs to be an actuarial approach which enables people to continue with a pension whilst living in their more expensive home, but having some of their pension receipts being repaid on their deaths and sale of the property.

I think there are a number of reasons not to include the family home. For elderly Australians on low pension incomes, the family home can be considered as a form of insurance for the time they may need high level care in old age, the costs of which are often horrendous. This will offset the costs to government at that time of life rather than through a potentially reduced pension income which creates hardship. Also the family home is not an asset which is income producing to offset any pension payments. Many elderly Australian pensioners have seen significant growth in their homes over many years, but not as an active investment strategy; rather the result of market forces beyond their control. Why should they be punished for that?

I am a great believer in Means tested welfare. I do not get any pension

If the family home is included in the pension assets test and a person starts drawing drawing down on the equity in the house at age 67 at say 5%, if that person then needs to enter assisted care say 15 years later will there be enough equity left in the value of the family home to enable that person to fund the cost of entering assisted care?

If you worked to pay off a house then you should not be punished for being fiscally responsible.

enough with the changes unless they only affect new ,younger persons entering the workforce with 40 plus years ahead,so as they know what to expect when they retire and can plan accordingly

Those that forego consumption today to prepare for the future, continue to be penalised, whilst those that consume today, knowing that most of their future requirements will be met by others, continue to be rewarded. People willing to save and prepare for the future, via whichever legal mechanism and method, should be encouraged and incentivesed to do so.

And on top of that Govt needs to stop retirees blowing lump sums and lining up for pensions. Not a simple issue but will need some policy around it which will save the country going broke in the future.

The only logical way to set a not counted threshold is to use the median or average rates valuation depending on postcode. Simplistically, otherwise all the people in capital cities will get nothing and all the coutry people will geta full pension.

Somewhere between Henry and Asher but if Henry it would need to be indexed. Either would need to be phased in and/or include grandfathering to avoid cruelly disrupting the aged

We should all get a pension to stop the ducking and diving that goes on as people near retirement.

State governments need to give duty relief for downsizing

You can't eat property no matter how valuable it may be.

Yes, with the threshold matching that of Aged Care MTCF

Am just above the income threshhold and have a 99 yr lease in a retirement village. Result = no Centrelink pension.illage

Yes - the Asher level is most appropriate of the lot above - but I would just say anything that is more than 25% above the average for each state (perhaps with a regional/city split) should be included..So if you are in Sydney and average price is $1m - you get hit if house worth more than $1.25m

People can downsize and free up cash if they are asset rich and cash poor. Makes no sense for tax payers to fund them

I like the idea of linking the exemption amount to local home values, but I think median is too low. 60th or 75th percentile would be less likely to cause problems to those whose wealth is almost entirely in their home.

I agree with the idea that any savings be re-directed to supporting renters

It would potentially disadvantage residents of Sydney & Melbourne v rest of country as their home value is so much higher but at the end of the day a 3 bedroom house is a 3 bedroom house whatever the location

Something has to be sacred in our country, and surely the family home shoudl be it. People shouldnt be allowed to spend all their super on retirement living it up and then end up on the full pension because the squandered what was meant to sustain them!

Family homes worth in the millions, say $2M+ definitely should be included so as to 'even the playing field', the sale and downsize by such owners can fund substantial lifestyles, compared to, say, those with low value properties (think Hackham West in southern Adelaide). Many inherit high value properties, and not 'work for it all their lives', as a lower socio eco person might. Those luckier folk should be adjusted accordingly.

We should adopt the BC Canada approach as well and essentially allow older people with low incomes living in big expensive houses to defer council rates until property is sold

a home is the last refuge from aged care

It's an asset that shows your wealth, like everything else.

Should use reverse mortgage if need the cash.