The transition to retirement can be challenging, as retirees adjust to major changes in their lifestyle and finances. Entering retirement means the end of employer-sponsored pay cheques and a reliance on personal financial capital, plus any age pension entitlement, to maintain a desired lifestyle. In economic terms, the human capital has expired and the financial capital must take up the heavy lifting. This can be quite a mental and emotional hurdle for many retirees to overcome.

To make sure retirees' financial capital (superannuation and other wealth) is able to meet their needs, it is important to understand the major investment risks facing those in retirement: Longevity, Sequencing and Inflation risks.

Three investment risks: longevity

Living longer than expected may not seem like a bad thing and, all else being equal, it’s not. Longevity risk is the risk of outliving your capital rather than living too long, per se.

We have a reasonably good understanding of life expectancies. According to ABS Life Tables, for the average 65-year-old man, it is around 84.5 (or, looked at another way, another 19 years after retiring) and 87.3 for woman (or another 22 years). However, these are average figures and therefore around 50% of people will live longer, for another 6 or 7 years. An easy way to adjust for this, and therefore provide a reasonable chance of not outliving savings, is to plan for financial capital to last an extra five to 10 years longer than initial life expectancy.

Life expectancies are increasing over time as health standards improve. A cure for cancer, for example, or any similar advancement in medical research, will have the potential to increase our life expectancies substantially in a short period. While this would be a welcome development, it would also make longevity risk a bigger investment risk for retirees.

The age pension offers protection against longevity risk by providing for our base minimal income requirements, although emphasis should be placed on minimal (with no certainty of future levels). Other financial products offer hedges against longevity risk, such as lifetime annuities, but these tend to have relatively high implicit costs associated with providing a lifetime guarantee and offer relatively low returns. Investors should therefore consider these options cautiously, in our view.

Sequencing risk is the risk of an adverse market event, such as a GFC, occurring at a time when the dollar value of an investor’s portfolio is largest. For retirees, this is usually during the early stage of retirement. A 20% fall in portfolio value would hurt more in dollar terms at this time than it would early in their working lives or much later, when their account balances are generally much smaller. It is also harder to recover from an adverse market event (or sequencing risk event) in retirement because the investor is drawing down on capital at this time, meaning there is a smaller capital base from which to recover after such a loss.

When considering its impact, we tend to overstate the impact of a sequencing risk due to our inherent behavioural biases. We have a tendency to measure our losses against the previous peak of our portfolio wealth, typically at the top of an economic or share market cycle where valuations of assets are at their highest and often overvalued.

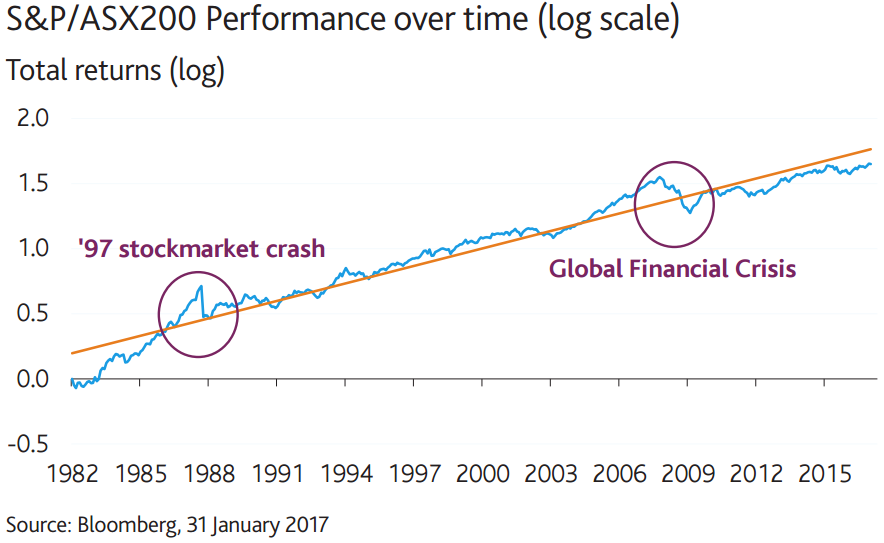

The example in the following chart shows the accumulated value of the S&P/ASX200 Accumulation Index over time (in log scale), including the average return (straight line). Prior to both the 1987 share market fall and the GFC, where equity markets fell by approximately 50% each time, returns had been well above the average in the preceding period. In the case of 1987, the share market had roughly doubled in value in the preceding 12 months before falling by half, or in other words, returning to where it started. The same occurred during the GFC, although the rise and fall happened over longer timeframes.

To manage sequencing risk, the portfolio should be properly diversified and match the retiree’s risk tolerance. Investors should realise, at least retrospectively, that account balances at the top of a bull market are probably too high and losses from previous peaks will probably be overstated.

Inflation is possibly the most underestimated of the three investment risks.

The impact of inflation in any given year, say 2-3%, compared to the impact of a 50% sequencing risk event, seems small. However, if inflation occurs year in, year out, its compounding impact over a long-term retirement can be substantial. Inflation of 2-3% per year over 20 to 30 years can reduce purchasing power by 50% or more. While this roughly equates to the impact of a 50% sequencing risk event, the two differ in their probability. The risk of inflation causing a 50% reduction in purchasing power in retirement is highly likely over a 20-plus year period, whereas a 50% sequencing risk event like 1987 or the GFC might occur only once on average during that time. What’s more, a retiree would need to be at or near the point of retirement to feel the full force of the sequencing risk event.

The lesson therefore is to be aware of and manage the incremental, yet compounding and therefore significant, impact of inflation on investment portfolios in retirement.

This can be achieved by:

- Ensuring sufficient growth asset exposure in the portfolio. Overweight exposure to nominal return assets such as cash and term deposits can mean that your retirement income is not inflation hedged.

- Aligning your investment objective to outperforming inflation, such as using a ‘CPI+’ approach as a benchmark or objective makes more sense for the average retiree compared with managing against more traditional market benchmarks.

Moving into retirement can be a challenging time, with financial stability a real concern. Retirees need an understanding of the major investment risks and have appropriate strategies in place to manage them in order to enjoy a more financially-secure retirement.

Josh Hall is an Investment Specialist at Aberdeen Standard Investments (formerly Aberdeen Asset Management). This article is for general information only and does not consider the circumstances of any individual.