The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Welcome back to Firstlinks and the start of a new year. I hope you had a refreshing and safe festive season.

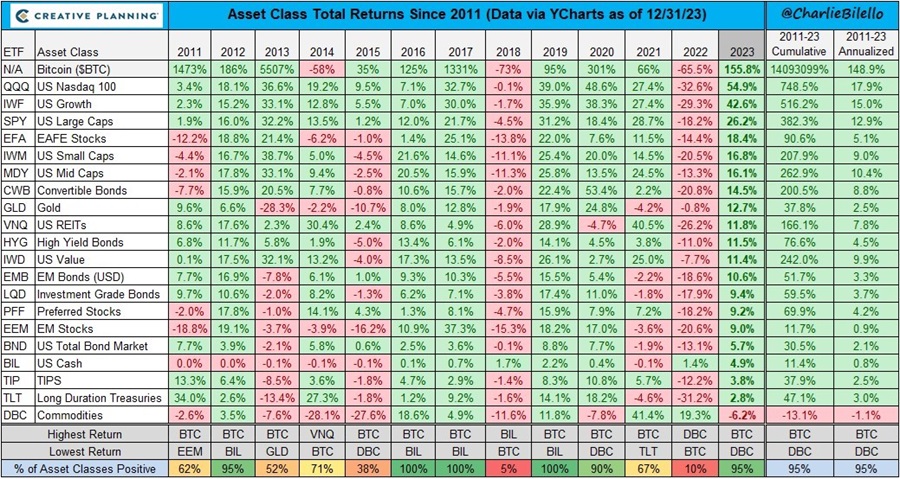

Last year was a good one for almost every major asset. Bitcoin led the pack, rising 156%, while commodities were the only asset with negative returns.

After 2022 where only 10% of assets had positive returns, 2023 flipped the script with 95% of assets in positive territory.

The Nasdaq 100 had an extraordinary bounce back, leaping 55% higher last year, led by the ‘Magnificent Seven’ tech stocks. That resulted in US growth and large caps also outperforming. The Nasdaq left the S&P 500 in the dust though the latter still had a strong 26% return for 2023. Mid and small caps again trailed the indices both in the US and Australia. Meanwhile, REITs were surprisingly strong despite headwinds from rising interest rates and trends such as work-from-home. Emerging markets were a notable laggard, dragged down by poor performance from China. And commodities were lower for the year as oil prices plummeted from their highs in 2022.

The ASX 200 was up 7.8% for 2023 in Australian dollar terms (though similar in USD). That’s a decent return though looks meek compared to the world ex-US return of 18.6%. The ASX performance shouldn’t surprise given the index is dominated by slow-growing banks and commodity stocks, which were hit by those falling commodity prices.

From the chart above, it’s notable that asset returns for 2023 largely continued trends that have been happening for most of the past decade. Defying the naysayers, Bitcoin has returned 149% per annum (p.a.) since 2011. The Nasdaq is up 18% p.a. over the same period. Meanwhile small caps, value stocks, and emerging markets have all lagged badly.

Market predictions and the ‘I don’t know’ club

What do the results of 2023 mean for this year? Your email inbox has no doubt been inundated with predictions about where the market and various assets are heading in 2024. These predictions generally fall into two categories: extrapolating last year’s returns into the future or forecasting a reversion to the mean for returns.

Let’s call the first bucket of forecasters, the market extrapolators. They say you should stick with the strong. The markets, sectors, and companies that have recently performed well will continue to do so. That means the US, tech, and large caps should continue to beat the rest, riding trends such as AI, robotics, and the cloud/data. Investors in this bucket primarily fall into the ‘growth’ and/or ‘momentum’ category.

The second bucket of forecasters can be called the mean-reverters. They say extrapolating from recent market performance is dangerous and falls into the trap of a psychological bias known as recency bias. They believe returns revert to the mean in the long-term. Investors here generally fall into the ‘value’ category and favour value stocks, emerging markets, and commodities going forward. Famed investors in the mean reversion camp include GMO’s Jeremy Grantham and Research Affiliates’ Rob Arnott.

Critics of mean-reverters suggest they ignore that some assets are better than others and are unlikely to mean revert. For example, tech has been riding a 30-year wave of innovation and that’s unlikely to end any time soon. On the flip side, commodities are perennial long-term underperformers and that is unlikely to change in future.

What both categories of market predictors have in common is that they think they can predict the future. That though the future is uncertain, there are patterns which can be identified and forecast.

Yet, most forecasters are deluding themselves. They can’t predict the future. For some, the delusion is forced on them through working for institutions whose investors expect predictions, and forecasts are a form of marketing for these institutions to increase their funds under management.

But investors are to blame too. Most people hate uncertainty and predictions provide a degree of comfort about the future.

I’d like to propose an alternative. Let’s call it the ‘I don’t know’ club. The mission statement of the club could read something like this:

“We don’t have a clue about what 2024 and beyond will bring. The future is uncertain. We see no need to predict an imaginary future to reduce this uncertainty. Instead, we’ll focus on those things that we can control, rather than those we can’t.”

Focusing on what matters

What should investors focus on, then? There are three drivers for future returns from markets and stocks: the starting dividend yield, earnings growth, and change in price to earnings multiple. Or in formula terms:

Starting net yield + earnings growth rate + % change in earnings multiple = future return p.a.

Investors don’t have any control over the multiple that the market will attach to an index or stock. The biggest driver of future returns is likely to come from the earnings growth rate. If you can buy quality businesses with competitive advantages and pricing power that will earn much more in 5-10 years’ time than they do now, the returns from these stocks should reflect this in the long-term. And this business growth will in turn drive market returns.

Earnings are what matter, and that’s where investors should focus their attention. Market commentary outside of that is largely a distraction.

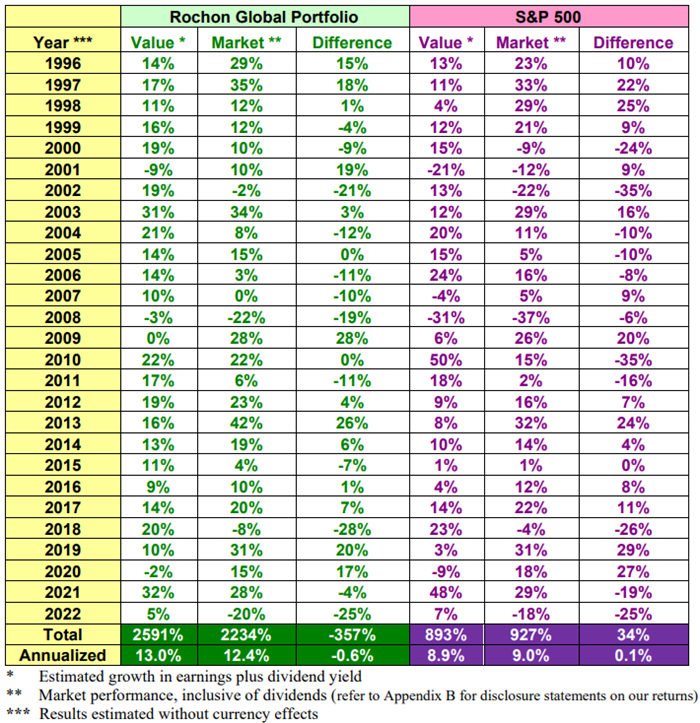

The next two charts illustrate this point. The first comes from one of the best global fund managers, Canada-based Francis Rochon. Each year, Rochon compares the annual earnings growth and yield from his portfolio of companies against the market value ascribed to these companies.

In 2022 for instance, Rochon’s portfolio had earnings growth plus a dividend yield of 5%, yet the market value of his portfolio went down by 25%. Similarly, the S&P 500 yield and earnings growth increased by 7% in 2022 but the market value of the index fell 18%.

However, in the long term, the earnings growth and yield largely mirrors the resulting market value. Rochon’s portfolio delivered a dividend yield and earnings growth of 13% annually over the 25 years to 2022, and the market value of his portfolio went up by 12.4% p.a.. Likewise for the S&P 500, EPS growth plus the dividend yield increased 8.9% p.a. over the same period, and the market value for the index rose by a similar amount.

In other words, markets are volatile and may not reflect the underlying earnings of businesses in the short-term. Yet market returns tend to converge with underlying business earnings growth and yields in the long-term.

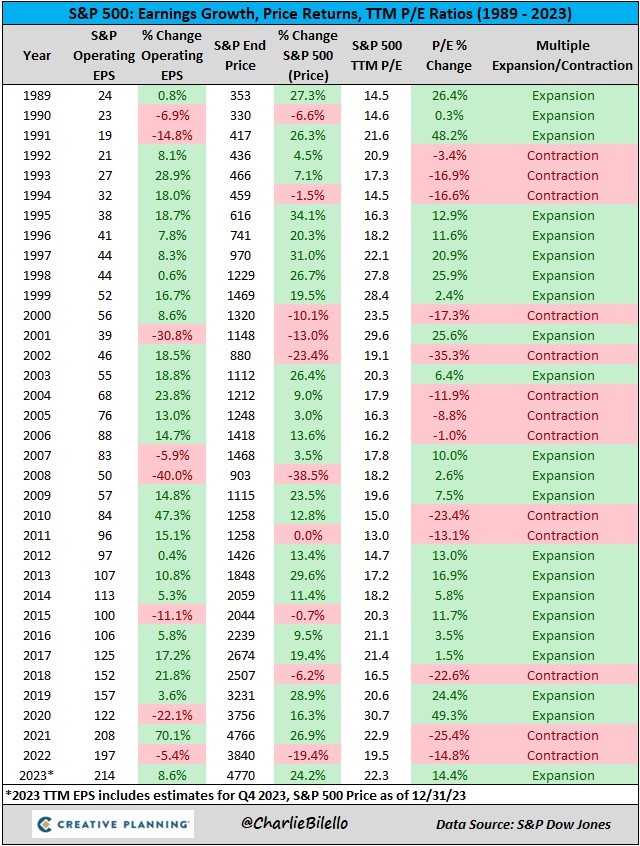

The second chart is a little different yet makes a similar point.

S&P 500 earnings for 2023 are likely to increase 8.6%, yet the market ex-dividend yield climbed 24%. The difference comes from the price-to-earnings (PER) multiple for the index rising from 19.5x in 2022 to 22.3x in 2023.

Historically, the PER multiple has fluctuated from as low as 13x in 2011 to as high as 29.6x in 1999. What’s remarkable though is how consistent earnings growth has been during the past 34 years. 2023 earnings are likely to be close to double those of 10 years ago (2013), which were roughly double those of the decade prior to that (2003), which were about double those of 10 years before that (1993). Using the rule of 72, doubling earnings over 10 years means earnings growth of about 7% p.a. It’s happened like clockwork over more than 30 years.

That earnings growth isn’t assured in future. What is more certain is that the starting yield and earnings growth of stocks and markets will continue to drive long-term returns.

James Gruber

Also In this week's edition...

As Firstlinks enters its 12th year of publication, Graham Hand goes back over the past 540 editions and finds some of our most popular and standout articles. Graham also provides a brief update on his health.

Two extra articles from Morningstar for the weekend. Shani Jayamanne reports on how Qantas' costs are rising and the implications for the carrier, while Susan Dziubinski looks at 33 undervalued US stocks for 2024.

In this week's whitepaper, Orbis writes of how it's preparing for a new investing environment over the next decade.

**

Weekend market update

On Friday in the US, the major indices all gained modestly after stronger than expected jobs data clouded the interest rate outlook. Payrolls increased by 216,000 and the unemployment rate held steady at 3.7%. The &P 500 finished up 0.2% while the Nasdaq rose 0.1%. US Treasury yields initially spiked higher, then pared their advance. The 10-year yield ended four basis points higher to 4.04%.

From AAP Netdesk:

The local share market on Friday finished slightly lower. The benchmark S&P/ASX200 index on Friday gave up its modest morning gains in the afternoon to close five points lower at 7,489.1, a dip of 0.07%. The broader All Ordinaries dropped 12.2 points, or 0.16%, to 7,718.4. The ASX200 dropped 1.3% for the holiday-shortened week, snapping its five-week winning streak that saw it gain 7.3%.

The ASX's 11 sectors closed mixed, with five up, five down and utilities basically flat.

Tech was the biggest mover, dropping 2.1%, as Xero fell 2.3% and Wisetech Global retreated 3.8%.

Core Lithium plunged 9.6% to a year-and-a-half low of 23c after confirming it would temporarily cease production at its Grants open-pit mine near Darwin, which opened to great fanfare just a year ago. The move was driven by the plunging price of lithium ore, whose price is down more than 85% in the past 12 months, including by 50% since the end of October.

Elsewhere in the mining sector, BHP fell 1.0% to $49.07, Fortescue dropped 2.6% to $28.19 and Rio Tinto retreated 1.6% to 4132.36.

Goldminers did well, however, as rising geopolitical tensions in the Middle East boosted the price of the yellow metal, with Northern Star gaining 1.3% and Newmont rising 1.1%.

Among the Big Four banks, CBA added 1.4% to $112.99, Westpac advanced 1% to $22.86 and ANZ and NAB had both gained 0.3%, to $25.62 and $30.56, respectively.

Latest updates

PDF version of Firstlinks Newsletter

LIC Monthly Report from Morningstar

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website