This year’s Federal Budget is expected to return to a small surplus of $4 billion for 2022-2023, the first time that the Budget has been in the black for 15 years. But the Budget is forecast to return to deficit in 2023-2024.

Key spending measures, many announced prior to Tuesday night, include:

- $14.6 billion in cost-of-living support over four years including:

i) $3.5 billion for Medicare over five years to improve access to bulk billing by tripling the incentive payment to GPs.

ii) $3 billion in one-off energy bill relief (split 50:50 with the states) for five million low-to-middle income households and one million small businesses. Households will receive $500 rebates, while small businesses will get $650 rebates.

iii) $1.9 billion to help single parents. They’ll receive increased welfare support until their children turn 14 as well as increased payments.

iv) $4.9 billion over five years for increased Jobseeker payments. The higher Jobseeker rate of $745.20 a fortnight, previously only available to those 60 and over, will be extended to include people 55 and over.

v) Renters will get an additional $2.7 billion via a rise in the maximum payment rates of Commonwealth Rent Assistance of 15%.

- More support for the aged care sector, principally through a 15% pay rise for workers that will cost $14.1 billion over four years.

- Measures to help housing affordability, such as broader access to the Home Guarantee Schemes and tax changes to boost build-to-rent housing.

- $2 billion for the hydrogen industry and incentives for developers to build more environmentally friendly homes.

Budget saving initiatives include:

- $9.1 billion over the next five years by cracking down on those avoiding GST and personal income tax.

- Changes to the Petroleum Resource Rent Tax to raise $2.4 billion over four years.

- A 5% hike to the tobacco excise, bringing in an additional $3.3 billion.

- Increasing the payment frequency of super.

- Slowing NDIS growth from 13.8% per annum to 8%.

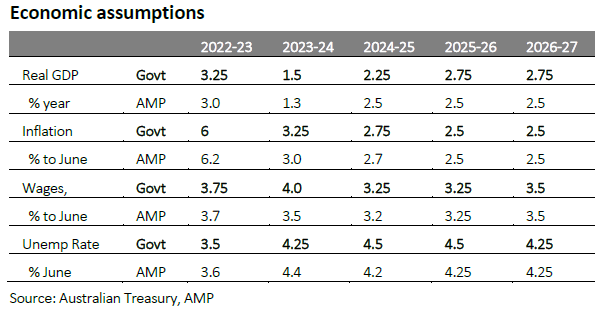

Below, AMP's Shane Oliver compares the Government's economic assumptions to his own forecasts.

On superannuation, there are two important highlights:

- It came as no surprise that the Government confirmed it would increase the tax on earnings for superannuation balances exceeding $3 billion. Yet as Firstlinks’ contributor Meg Heffron notes, the Budget indicates that the Government won’t be changing how it calculates the tax:

“… we had hoped the Government might adjust the method used to calculate the tax (to avoid a current criticism that the proposed method effectively taxes unrealized gains), might index the $3 million threshold or might allow those who exceed it to withdraw some of their super even if they hadn’t reached the age where this would normally be allowed. It seems that won’t be happening.”

- The Government provided an update on proposed amendments to the non-arm’s length expenditure (NALE) rules. It will limit the income of SMSFs and small super funds that are taxable as NALI to 2x the general expense. Fund income taxable as NALI will also exclude contributions. The changes could result in higher tax bills for SMSFs and SMSF trustees. For further details, go here:

For more on the Budget, please see updates from two of our sponsors below.

nabtrade

nabtrade's Gemma Dale breaks down the Budget and what it means for you, with a focus on:

- Taxation

- Superannuation

- Families

- Cost of living measures

Click here to watch the video or read the full commentary.

Heffron

The 2023 Federal Budget was about cost of living pressures, health and housing, so not surprisingly, superannuation didn’t rate much of a mention. Meg's summary is here.

James Gruber is an Assistant Editor at Firstlinks and Morningstar.com.au