Whether the Government should be increasing the superannuation guarantee (SG) from 9.5% to 12% has become a topic of hot debate. Our research finds that whether a higher SG would benefit most people is far from straightforward for two reasons.

First, the appropriate SG varies greatly across individuals. We think this supports an argument for more flexibility rather than imposing a higher SG on everyone.

Second, the case for increasing the SG depends on what superannuation policy is trying to achieve. A clear case emerges if the aim is to replace the age pension, but not necessarily otherwise.

Super pushes money from pre-retirement to post-retirement

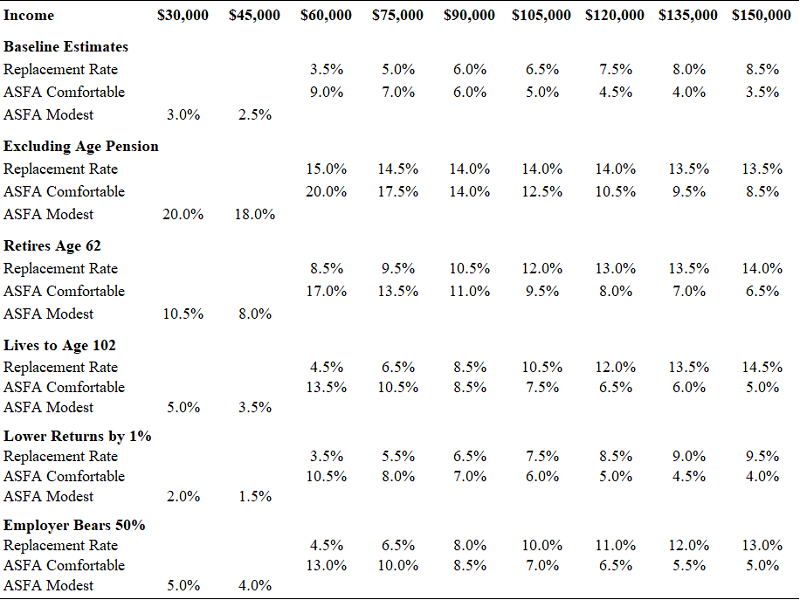

In a recent study (link below), we identify what might determine the ‘right’ level for the SG, and how it varies depending on the individual and assumptions. The analysis is conducted across nine income levels ranging from $30,000 to $150,000 and differing target spending levels. We apply existing rules that govern tax, superannuation and the pension. The table below presents selected estimates for the ‘optimal’ SG, although this is only a subset.

Our model focuses on the trade-off involved in saving via superannuation, which reduces money available pre-retirement but creates a benefit in terms of post-retirement income. Evaluating super as a trade-off is important. Focusing only on ‘how much super is needed’ to generate adequate income in retirement overlooks the possibility that some people might have better uses for the money.

For example, forcing lower income earners or women to place money in super need not make them better off if they are struggling to make ends meet or could use the funds to help buy a house during their working life.

‘Optimal’ SG estimates per income level and objectives

No single SG suits all

The table illustrates the wide range of SG estimates that emerges depending on income and other assumptions – anywhere between about 2% up to 20%. The lower SGs are associated with the ASFA modest income target which is 85%-90% covered by the pension plus supplements. The higher SGs exclude the pension.

Further, there are dimensions we don’t investigate that add to the potential differences across individuals, including household status, gender, assets outside of superannuation and homeownership. In particular, those who own a home obviously need a lot less income during retirement than those who have to pay rent.

The key point is that there is no ‘one-size-fits-all’ SG. Further, there is an asymmetry around the SG itself. Individuals can currently do nothing about an SG that is set too high but can contribute more if it is set too low. We think this adds up to a case for not forcing everyone to save more regardless but rather adding in some flexibility.

The SG might be better positioned as a default rather than a hard compulsion, while enhancing scope to vary contributions subject to limits that guard against people opting out too far.

Two conditions justify a higher SG for all

Our modelling also identifies two conditions under which increasing the SG would benefit the vast majority of Australians. Both relate to what the SG is trying to achieve, suggesting that the Government should settle the policy objectives before deciding whether to increase the SG to 12%.

The first condition would be using superannuation to replace the age pension. This implies getting as many people as possible to become self-funded retirees, with the pension acting purely as a safety net. Excluding the pension from our analysis indicates what savings are required without the pension, in which case an SG of 12% may not even be enough. The alternative is counting the pension as an income stream that is broadly available to all. In this event, the need to save for retirement is much lower because the pension supplies substantial income support, especially for lower income earners. Policy makers might be clear on whether the purpose of superannuation is either to substitute or to supplement the pension.

The second condition would be to ensure that people save enough to support themselves through retirement if things don’t pan out as expected, i.e. using superannuation as a self-insurance mechanism. There are three key risks that may lead to savings turning out to be insufficient:

- Living to a very old age so that the money runs out, also known as longevity risk.

- Retiring earlier than expected, such that contributions stop before the pension becomes available, thus creating a need to fund spending by running down savings. (Career breaks have similar effects, but there is the chance to catch up on super contributions later, and other income sources may be available such as unemployment benefits or paid maternity leave.)

- Low investment returns that impair the funds accumulated. The table reports results where we assume living to age 102, retiring at age 62 and lower returns by -1%.

We are not convinced that imposing a higher SG is the best way of addressing these risks. The problem is that requiring everyone to save more ‘just in case’ can result in over-saving if the feared risks do not eventuate. If the additional savings are not needed, then an individual’s pre-retirement standard of living would have been sacrificed without getting commensurate benefit, along with larger bequests for the children.

Other mechanisms to deal with these risks include social security and risk sharing amongst individuals. The latter are known as ‘pooling’ solutions and include annuities and various forms of member collectives. We would prefer to see policy makers explore these mechanisms.

The ‘who pays’ issue

A higher SG could be beneficial for some individuals if is paid for by employers rather than coming out of their take-home pay via some form of wage offset. However, this issue is far from straightforward. Evidence is mixed on whether the SG has been offset by lower wages in the past. And even if the employer pays in the first instance, where the burden ultimately falls is unclear. Profits taking a hit is one possibility, but others include the cost getting slated back to individuals if businesses increase prices or cut employment.

Conclusion

It makes more sense to add more flexibility to vary contributions rather than increase the SG. Further, the case for an across the board increase in the SG depends on what superannuation policy is trying to achieve. We see a clear argument if the aim is to replace the age pension, but otherwise the value of an increase is debatable.

Geoff Warren is Associate Professor at The Australian National University. This article draws on research undertaken in conjunction with Dr Gaurav Khemka and Yifu Tang. The full paper can be found here.