The 2022 Budget contains a healthy dose of sugar pills, but amid all the statistics, one number is most critical for thousands of Australian borrowers. Treasury is accepting that inflation will rise to 4.25% this financial year, and no doubt the Reserve Bank will need to respond with higher cash rates. But here's the potential lifesaver - the inflation forecast for next financial year is 3%. Transitory is back! And Treasury is expecting wages to rise 3.25% next year, making it a rise in real wages for the first time in years.

Treasury has a long history of inaccurate forecasts, and the latest Budget shows the Department was wildly pessimistic on the size of the deficit as recently as MYEFO only a few months ago. But the inflation rate is one number borrowers hope is close to accurate.

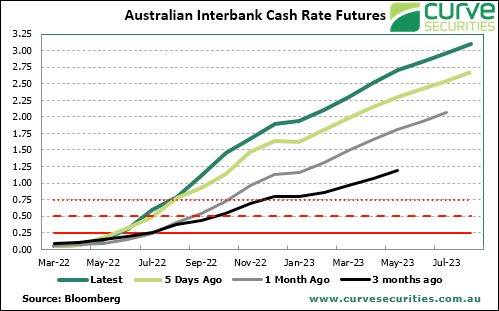

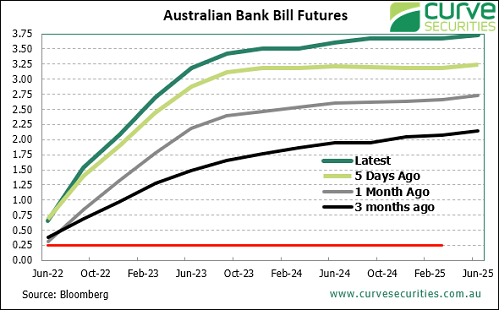

Futures market predicting a meltdown

The interest rate and inflation story continues to evolve almost by the day, and the outlook is becoming more acute. The chart below shows the upward revision in expectations as recent months have rolled by, with the market now forecasting the cash rate will rise from the current 0.1% to over 3% by July 2023. That’s an amazing 12 0.25% increases. If the Reserve Bank announces a new rate rise almost every time it meets for the next year, followed by a rise in mortgage repayments, borrowers will become increasingly worried and stop spending. If variable rate housing rates head to 6%, thousands will default and property prices will fall.

Source: Curve Securities and Bloomberg, as at 29 March 2022

The rate expectations are driven by the need to control inflation, and widespread expectation that ‘transitory’ is an illusion. The Reserve Bank is trying to be patient, especially watching wages growth, and Governor Philip Lowe wants to wait until inflationary expectations are firmly entrenched. If Treasury is correct, inflation at 3% will not worry him, but companies are already passing on price increases to each other, and their clients.

Let’s consider three influential factors.

1. Price increases passed through the value chain

In an 11 March speech, Philip Lowe recognised the important of expectations:

“One issue that we're paying close attention to here is the inflation psychology. For many years, firms were reluctant to put up their prices and because they didn't want to put up their prices, they didn't want to put up wages. It's quite possible that a period of protracted headline inflation will see this psychology shift and firms will decide that they have to put up their prices, and if their prices are rising, then they can afford to pay higher wages. So we're watching very carefully for any shift in the inflation psychology. If that shift were to occur, inflation would be higher and it would be more persistent and we would need to respond to that in time.”

Companies have reached the stage where it has become acceptable to pass on price increases at both the wholesale and retail levels, and this is likely to feed into wage demands.

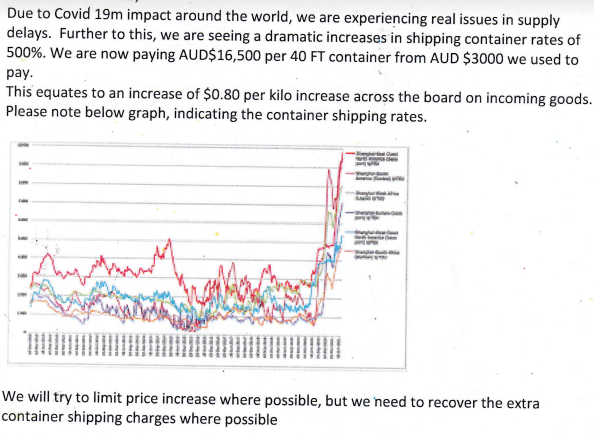

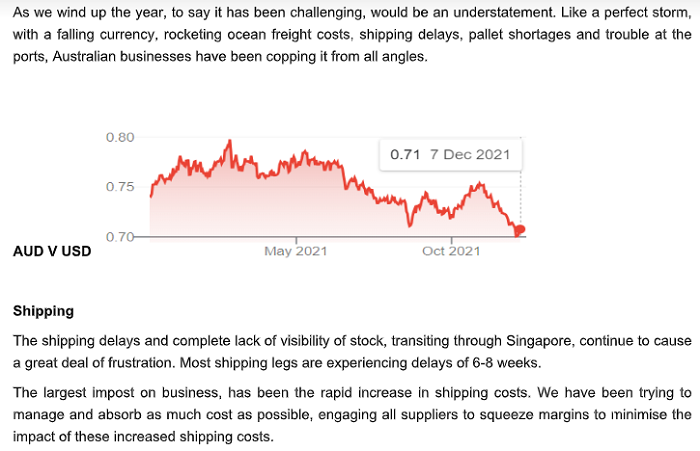

Here are extracts from a couple of letters received recently by a small family company that was holding off passing on increased prices to its retail customers, but finally gave in.

It is doubtful that this company will now reference the AUD rising to US$0.74 as a reason to give some price discount.

2. Philip Lowe’s interpretation of the numbers

Followers of interest rates hang on every word from the RBA Governor, but it’s clear that he does not have any great insight into what inflation is likely to do for the rest of the year. In fact, he wants to downplay what the market expects of him. This is from his Press Club Q&A session on 2 February 2022:

“I didn't expect us to be in this situation. We don't have a crystal ball, there's a lot of uncertainty. But what we have done is respond to the changed circumstances we find ourselves in, and I understand that in some people's eyes that damages our credibility. We don't have a crystal ball. Things happen that we don't expect. But what I hope you expect of us is that we respond to that and try and explain why. The result of that might be damaged credibility for the central bank, but I hope people can see the fact that the economy evolves in an unexpected way, and we respond to it.”

While we have all moved on from his expectation of no rate rises until 2024, he still believes the market is wrong. At the Press Club talk:

“So the market is pricing in the same increase in interest rates in Australia and United States by the end of this calendar year. Yet our inflation rate is half that in the US, and labour cost growth is half that in the US. So, that's a thing that I'm kind of still surprised about. We keep looking at the markets and trying to understand what they're telling us, but I still struggle with how the same interest rate reaction is priced in for Australia and the US.”

Here are a few points the market is underplaying in reading Lowe's intentions and why rates are unlikely to rise as much as currently priced in.

a) He expects inflationary forces to ease

Again, at the Press Club:

“Cast forward six months, what's likely to happen? I suspect we won't be buying as many electronics, we'll be going to cafes and travelling and the supply side problems in the chip market are now being resolved and the price of chips are coming down. I suspect on that category we'll go back to more normal rates of increase. The same with cars.”

b) He sees a moment in history to deliver full employment

“I think we have a unique opportunity here to get people into jobs and get their incomes growing more quickly and we can do that without running an unacceptable risk of inflation. The Board has made the judgement that's an appropriate trade off – managing the risk of inflation being too high, we've got to be conscious of that – but there's great benefit in getting unemployment down and we can do that I think safely.”

Even repeating the point later in the same presentation:

“And we're also on the cusp of this historic milestone of getting unemployment down, and I think we can test how far we can get the unemployment rate down without having an inflation problem in the country, and that's worth doing.”

c) He believes households are resilient

More than any other country, Australian borrowers are vulnerable to rate rises. Lowe knows a rate rise will have a material impact on borrowers, but he also talks about the high level of household savings:

“The resilience is also evident in household balance sheets. Households have built up a lot of extra savings during the pandemic. Most of us couldn't spend as we used to spend, and the government gave people money to compensate for their loss of income. So people had their income maintained and they couldn't spend, savings went up. So there's almost $250 billion of additional savings over the past couple of years. That's a huge amount of money. The median borrower now is two years ahead of their mortgage payments. Four or five years ago, the median borrower was one year ahead of their mortgage payments.”

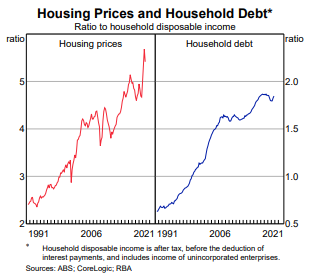

Household debt is around 170% of disposable household income versus around 60% in 1990. What does that mean? If a two-income household has income of $200,000, its average debt is $340,000 now versus $120,000 30 years ago. That makes the impact of a rate increase at least three times more powerful.

3. Commodity prices surge

Russia invading Ukraine has made Lowe’s ‘historic opportunity’ even more difficult to achieve. These two countries were major exporters of energy and food. Wheat and oil prices have surged and Europe is struggling to find alternative suppliers. Food costs generally will rise as transport cost is a major input factor, and the dynamics of global trading across a wide range of commodities have fundamentally changed. If it continues for long, questions will arise on how countries will feed their people and keep them warm.

In fact, with US inflation hitting 7.9% in February 2022, mainly due to rising costs of fuel, food and housing, inflation was well-established long before Russia invaded Ukraine. This increases the fear of inflationary expectations as it has been building for longer than the war.

Where does that leave us?

Philip Lowe admits he is adjusting his view day-by-day. If he doesn’t know, the rest of us are also guessing.

But if mortgage rates go towards 6% on the back of cash rates at 3%, whatever legacy Lowe hoped to leave will be hit as households struggle. The economy faces recession as central banks attempt to control inflation, and while Lowe will be ‘patient’ and hold back, global factors may force his hand.

My expectation is that rates will rise significantly less than current market expectations, and the RBA is happy to lag. CBA's Gareth Aird expects increases to 1.25% by early 2023 before the RBA pauses, and this seems more likely. For the sake of the borrowers who stretched to buy a home, the market better not be right.

Graham Hand is Editorial Director at Morningstar. This article is general information and does not consider the circumstances of any person.