The ASX is one of the largest 15 stock markets in the world, with a market capitalisation of $1.5 trillion. What investors might not be aware of, however, is how top-heavy it is. The largest 20 stocks account for 60% of the S&P/ASX300 Index, while financial and mining companies comprise more than two-thirds of the top 20. Banks and miners dominate the local market.

These companies are facing challenging times. Banks are now required to retain more capital on their books, crimping credit growth and putting pressure on returns. At the same time, interest rates are on a downward trend, which has negative impact on their margins. Additionally, they will need to set aside more money in provisions for bad debts, which can only rise from historic lows. All this will cut into their profitability.

Meanwhile, mining companies are being hurt by the decline in commodity prices and a slowdown in the economic growth of China, Australia’s largest trading partner.

Greater investment options

This makes a strong case for investing in the mid- and small-cap companies that comprise the remaining 40% of the ASX and that derives its earnings from more varied sources. This diversity is important, because you don’t want all your stocks exposed to the same growth drivers, nor do you want your returns to be highly correlated.

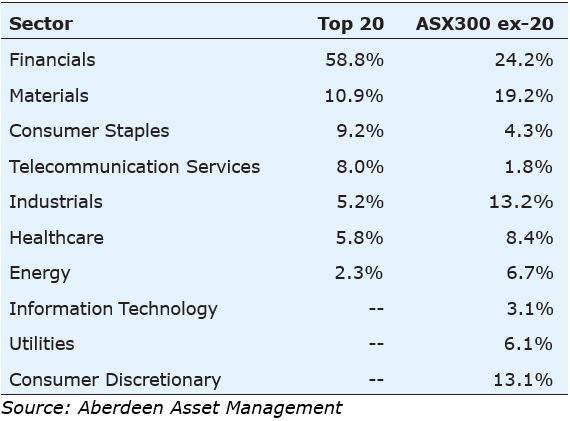

Once you exclude the top 20 stocks, as the table below demonstrates, the weighting of financial companies falls from 59% to 24%, making it far more balanced and diversified.

Sector breakdown for ASX300 ex-20

If we consider mid-caps alone, they generally have more developed governance and risk frameworks than small companies, their cash flows are more stable and replicable, and their share prices less volatile.

Still, defining what constitutes a mid-cap company is not an exact science. A good starting point is the S&P/ASX Midcap 50 Index, which comprises all stocks listed on the S&P/ASX 100 excluding the top 50 – in other words, numbers 51 to 100. But this is a narrow definition, and fund managers tend to have their own interpretations. At Aberdeen, we think of mid-caps more broadly as future leaders in their sectors with the right foundations to become the next blue chips: it’s more about potential than position in an index.

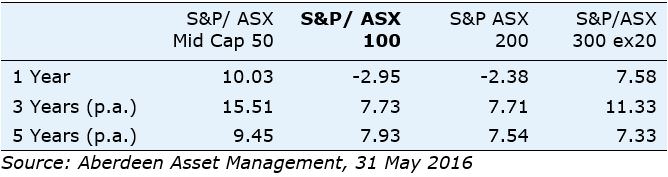

This potential is reflected in their returns. Over the past five years, the ASX Mid-Cap 50 Index has consistently outperformed the larger ASX100, 200 and 300 ex-20 indexes.

Performance of large cap vs mid cap

Reasons mid-caps may outperform

There are a number of reasons for this.

Firstly, mid-caps have more capacity to grow than blue chips, which are constrained by their size in the sectors they already dominate. Average growth in earnings per share for companies in the S&P/ASX300 ex-20 is forecast to be 14.9% over the next 12 months and 9.4% for the following year, versus 7.05% and 8.9% for the S&P/ASX200 Index, according to Bloomberg data.

Secondly, mid-caps have greater flexibility to disrupt the industries they operate in. For example, NIB Holdings, which offers low-cost health insurance products, is competing against market leaders Bupa and Medibank Private. Its comparative nimbleness and lack of bureaucracy allows it to make quick decisions, enabling it to deliver above-average growth consistently. NIB is also diversifying into new markets.

Thirdly, compared to small companies, mid-caps have greater access to capital to drive their expansion. It means they can gain more exposure to larger and/or faster-growing economies, reducing their dependence on domestic earnings. A good example of this is in the health-care sector. Cochlear, Ramsay Healthcare, ResMed and Fisher & Paykel Healthcare are all mid-caps that derive a strong proportion of their earnings outside Australia.

Cochlear makes implants for the hearing impaired. Initially it focused on infants domestically but has since broken into the market for adults and now sells products in more than 100 countries, becoming a global leader in its field.

Similarly, Fisher & Paykel Healthcare, which designs and manufactures products to treat sleep-disordered breathing conditions, has innovated constantly to extend its range of equipment. In a world of rising obesity levels, it now sells its systems in more than 120 countries.

Be wary of sector titles

As an active manager, the sector a company operates in is not a factor in our investment decision-making. We want to understand if a business can generate returns in excess of its cost of capital. Having said that, we are mindful of avoiding overlapping exposures in our portfolio and we prefer to invest in industries with strong tailwinds.

While we take a company-by-company approach, generally we see industrials as asset-intensive and carrying significant amounts of debt, so we are underweight. Aurizon and Asciano, for example, are leveraged to trading volumes driven by mining and agriculture, creating cash-flow uncertainty.

At the same time, some sector titles are misleading. Consumer discretionary firms, which provide non-essential goods and services such as entertainment and leisure, make up 13% of the ex-20 index. Because they deal in discretionary goods, demand tends to fluctuate. However, Invocare is a mid-cap in this sector that provides funeral services, and we don’t see them as discretionary at all. In a similar vein, wagering and lotteries operator Tatts Group has produced consistent cash flows across investment cycles.

It is this diversity that makes mid-caps such a fertile ground for active managers to find value. They have a wider dispersion of returns than blue chips and offer greater opportunities to uncover mispricing.

These companies don’t have the inherent bias that comes with large index weightings, or the volatility of the smaller end of the market. There’s a lot to like about them. They’re not too big and not too small, just right, as Goldilocks might say.

Michelle Lopez is a senior investment manager on the Australian equities team at Aberdeen Standard Investments (formerly Aberdeen Asset Management), including sharing responsibility for the Aberdeen Ex-20 Australian Equities Fund. This article is general information and does not consider the circumstances of any individual.