Australian shares are likely to outperform in 2023 helped by stronger economic growth than in other developed nations, and ultimately increased demand from China supporting commodity prices. Certain sectors could be set to sizzle while others may be left behind.

Resources

Australian resources stocks could continue their upward trajectory this year if China’s demand for Australian mining resources ticks higher as the country rapidly reopens.

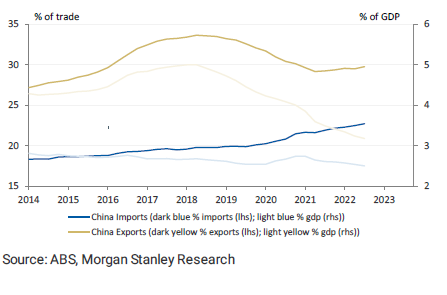

The reopening of a country with 1.4 billion residents offers investment opportunities, particularly within Australian sectors that have high revenue exposure to China. The country makes up around 30% of Australia’s total exports and 23% of total imports. China remains Australia’s largest trade partner by a significant margin, despite its exposure falling somewhat in the last few years.

Chart 1: China remains Australia’s largest trading partner

Australia is distinct globally in terms of economic links with China. Specifically, we see a tailwind to Australian resource sector earnings. Recent positive sentiment towards China has seen commodity prices move higher.

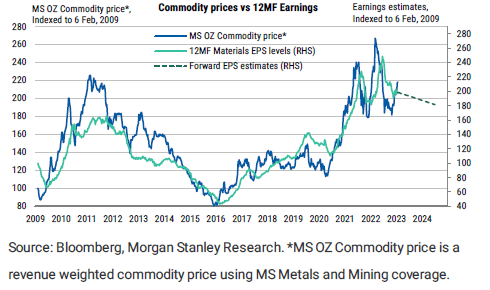

Chart 2: China reopening has supported prices for Australia’s key commodities

Despite geopolitical tensions, and Chinese sanctions on some major Australian exports, China remains reliant on Australian mining resources. 19% of Australian mining revenue is attributed to China, based on the constituent weighting of MVIS Australia Resources Index.

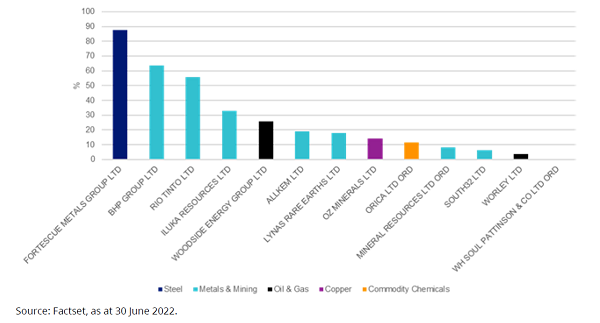

Chart 3: Australia resources revenue attributed to China

The lion’s share of Australia’s trade exposure to China remains in commodities, particularly iron ore, which is still worth more than all other merchandise exports put together.

Chart 4: Iron ore still represents the majority of Australian exports to China

Chinese President Xi Jinping has cited infrastructure spending as the government’s main lever to rescue economic growth, like it was during the global financial crisis. Australian resources sector could once again be a major beneficiary of this investment, as it was during the GFC.

Consumer discretionary (underweight)

Consumer discretionary was the third worst performing sector on the ASX in 2022, lagging the benchmark by over 19%. The challenging landscape is likely to extend into 2023 for discretionary stocks as household savings continue to diminish and the majority of fixed mortgages roll off later this year. A number of discretionary companies have flagged tougher times ahead in their half year earnings.

As the cumulative effects of lower savings, higher costs of living, negative wealth effect from falling property prices and increased interest rate payments start to hit consumers back pockets we anticipate a pullback in discretionary spending. Based on Corelogic Data, the aggregate housing value in five capital cities have contracted 7.3% yoy, resulting in a negative wealth effect among households.

The solid results from Wesfarmers this earnings season are unlikely to be repeated. Cracks in the confidence of consumers are starting to show, with shoppers shifting to value-orientated retailers like Wesfarmer’s Kmart chain. As rates go higher, we see sales of Wesfarmers retail brands declining as the company manages softer demand due to inflation and rate hikes. We expect discounting and competition between value orientated retailers will become fierce.

Consumer sentiment has tanked to recessionary lows. We think investors should be very wary of consumer discretionary stocks with widespread weakness on the not-so-distant horizon. The latest Westpac consumer sentiment survey shows weakness is broad based with conditions, family finances and time to buy a household item all close to historical lows.

Markets are generally optimistic, and prices reflect sentiment – a lot of the factors that support higher prices are factored in. Management outlooks and guidance should be a leading indicator for investors to assess if the current price reflects future earnings and hurdles. A number of discretionary retailers including JB Hi-Fi have signaled discounts are on the way as sales across the industry slow.

The big banks (neutral)

The four big banks were some of the best performing stocks in 2022 as rapid increases in mortgage rates and delayed marginal increases in deposit rates helped expand net interest margins. But this year we see storm clouds gathering over the banks. CBA in their half yearly results announcement specifically addressed concerns around the looming fixed rate cliff, deposit rates and cyber security risk.

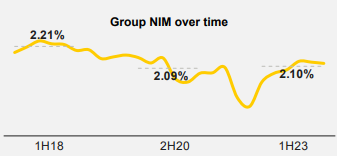

The chart below suggests CBA’s NIM peaked in October 2022 and trended down toward the end of the reporting period.

Chart 5: CBA’s net interest margin (NIM)

All the good news has already been priced in. We can’t see NIMs expanding any further as rates continue to rise and the majority of fixed rates roll off later this year.

The bank is increasing its capital buffer, a sign of caution as headwinds for the economy increase. Meanwhile, CBA’s loan impairment expense of $511 million for the six months leapt higher with the bank saying it reflected ongoing inflationary pressures, supply chain disruptions, rising rates, and declines in house prices.

As evidenced by CBA’s share price slump post results, investors are concerned that if NIMs have peaked it could lead to downgrades of profit forecasts. And with the economic outlook weak, at best, the bank has headwinds of slowing growth and higher bad debts.

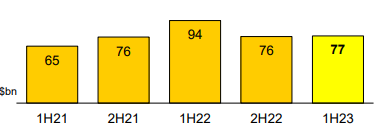

For years Australian banks have been able to grow their mortgage books as new home buyers looked to take advantage of record low rates. You can already see in the chart below, CBA experienced a significant slowdown of new loans during the 2nd half of 2022. The concern for investors is how has the slowdown impacted the other banks.

Chart 6: CBA’s Home lending new funding

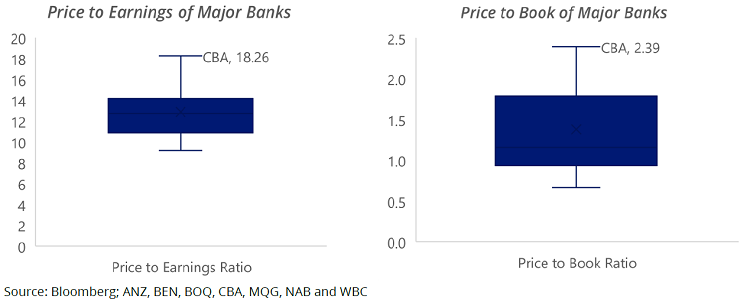

CBA in particular looks unattractive from a valuation perspective. It is the most expensive bank in Australia and one of the most expensive globally based on price to earnings and price to book ratios.

Chart 7: Price to book value of CBA

Consumer staples (overweight)

Consumer staples stocks returned -4.7% in 2022, lagging the benchmark by over 3.6%. While the performance in the past year was underwhelming, we think the sector will offer some defensive benefits this year as inflation remains elevated. Generally, the demand for staples are price inelastic – volume holds up well even with price increases.

Woolworths is well positioned as we move into the new year. The company is Australia’s largest supermarket chain and has a sticky consumer base with the ability to pass through any cost inflation to protect its margins. Additionally, the steady increase in food retailing bodes well for the company’s growth into 2023 and offers defensive characteristics. The company also continues to sharpen its e-commerce capabilities via personalised shopping trends and targeted discounts, which may prove to be a competitive advantage among its rivals.

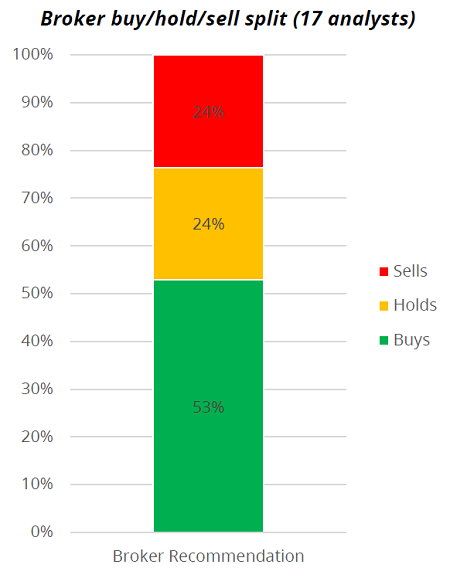

Chart 8: Woolworths buy-hold-sell

Source: Bloomberg as at 16 February 2023

Australia on balance, is much better positioned than most countries to manage economic challenges in 2023. This year we expect Australian equities to continue to outperform international equities. We favour resources and consumer staples, are neutral on banks and underweight consumer discretionary.

Cameron McCormack is a Portfolio Manager at VanEck Investments Limited, a sponsor of Firstlinks. This is general information only and does not take into account any person’s financial objectives, situation or needs. Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

For more articles and papers from VanEck, click here.