For investors whose liabilities or spending objectives are linked to inflation, the decision to link investment objectives to inflation is a natural one. Not only does it crystallise the link between the inflation-linked components of an investor’s liabilities and its investment strategy, it can also provide a simple, transparent method of measuring performance. Additionally it allows an investment policy to be set and reviewed without having to continually revisit the liabilities.

An investor who would benefit from an inflation plus objective is a retiree who uses their defined contribution savings in order to provide for old-age income. This spending objective is specified as a percentage of the nominal sum at retirement, but indexed with inflation over time so that real spending is maintained. Another example would be an endowment that has a spending goal expressed as a percentage of the available funds with preservation of real capital being crucial to ensure perpetuity in its operations.

Inflation as an objective vs. inflation hedging

An important aspect to note is that in building a portfolio that has an ‘Inflation Plus’ target, you are not seeking to hedge inflation, rather to add returns over and above inflation (whilst keeping the latter in mind). This is an important distinction, because if hedging were the sole purpose, the portfolio selection and risk criteria would be different.

Inflation obviously fluctuates over time, but typically varies slowly within a consistent epoch. Discontinuities arise due to shocks, such as rapid currency movements, sales tax changes, spikes or troughs in commodity prices and demand and supply shortfalls. At the time of writing, central banks globally are embarking upon a gradual exit from quantitative easing, against a backdrop of low inflation rates. The countries where quantitative easing had not taken hold, such as Australia and New Zealand, find themselves in a different position but nonetheless in a climate of contained inflation. Building a strategy with an objective of outperforming inflation has to include the climate as a key ingredient whilst also trying to be responsive to any shocks that might occur.

Identifying the appropriate asset classes for inclusion

In identifying which asset classes are most suited to a real return portfolio, a large range of potential liquid candidates was analysed, including Australian dollar cash, nominal bonds, inflation-linked bonds, domestic and international equities, commodities, listed real estate and even volatility itself as an asset class. The focus was on identifying liquid assets which could provide potential inflation-hedging possibilities as well as return-enhancing ones.

Our findings for Australian inflation show significantly negative correlations of inflation with the overall Australian stock market, and on a sector level only two positively significant correlations in the Basic Materials and Oil and Gas sectors.

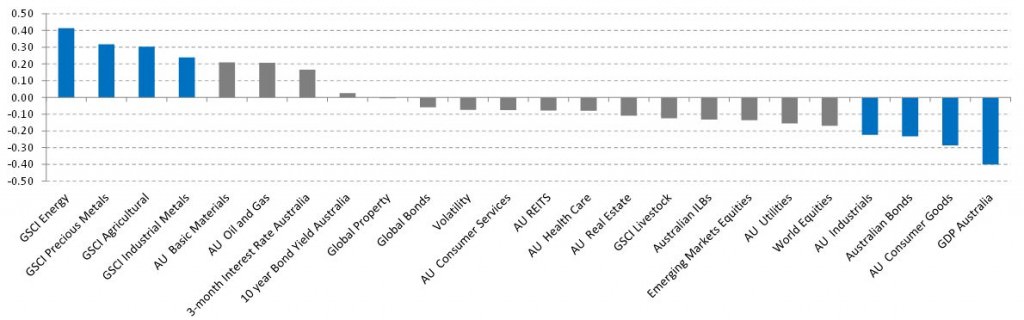

Figure 1 shows the correlation with inflation, sorted by highest to lowest correlation, by asset category; with statistically significant correlations shown in blue.

Figure 1: Correlations with Australian CPI

All data used in this analysis is based on quarterly observations, spanning the period from the quarter ending 30 June 1991 to 31 March 2012 for a total of 84 observations, with all data in AUD.

Nominal bonds showed a significant negative correlation with inflation, as might be expected. After all, interest rates and bond yields are expected to increase with rising inflation, hence depressing total returns. More surprising however might be the fact the Australian inflation-linked bonds showed a statistically insignificant negative correlation with inflation. The reason for this is the mark-to-market noise introduced into the total returns by movements in both real and nominal yields. If bonds were held to maturity, the real yield over inflation would be realised, but other factors impinging on the inflation-linked bond market make it a poor inflation hedge if one has to mark one’s portfolios to market. As we are considering liquid mark-to-market portfolios here, we do not explore the hold-to-maturity strategy in detail, but instead focus on inflation-linked bonds as a liquid investment.

Commodities do seem to possess inflation-hedging characteristics, with significant correlations for the Energy, Precious Metals, Agricultural and Industrials sub-indices of the S&P GSCI commodities index series. The highest correlation at 0.41 is recorded by the Energy sub-index, which is mildly remarkable as the Australian CPI basket does not contain an explicit energy component. Nonetheless the indirect impact of energy prices seems to be sufficiently large to result in a relatively high correlation. The inflation-hedging properties of commodities have also been well documented in previous studies.

Listed property securities turn out not to have any great inflation-hedging characteristics, which is consistent with the literature. We also included volatility as an asset class as a possible hedge against tail risk as described in (Baars, Kocourek and van der Lende 2012).

While these inflation correlations results are consistent with previous studies, it is surprising that it is not more explicitly considered in the construction of multi-asset portfolios. A reason may be that until recent times the majority of diversified offerings in Australia have been designed in fund of fund structures, thus limiting the ability to implement a more bespoke allocation that can accommodate these findings. Nevertheless, we believe it is worth taking the time to challenge the relevance of the ingredients we choose to achieve your objective, before attempting to blend them together.

Blending the right mix of asset classes

After establishing a range of potential asset classes to invest in, the next step is finding the combination of assets that best meets the objectives within reasonable risk limits. This can be done in a number of ways, from naïve application of modern portfolio theory to using risk-weighted baskets, minimum variance portfolios, principal components-weighted portfolios, copula-based approaches and others. Furthermore, the optimisation and portfolio selection process can take place in a real asset space, rather than in the more traditional space of nominal return and volatility. If the long-term objectives are stated in terms of real assets and spending, this evaluation space makes more sense.

We do not lose sight of the fact that we are not seeking to hedge inflation but to create a return stream that outperforms inflation with a certain amount. So while the inflation-relative characteristics are important, the real expected returns of the assets need to be taken into account.

Further information on this research, details of the literature referenced and a worked example of how to blend these allocations are linked here.

Jan Baars, Petr Kocourek and Epco van de Lende are in the Multi Asset Solution team at Colonial First State Global Asset Management.