Given the current macroeconomic backdrop of rising inflation and interest rates that is putting pressure on consumers, it is no surprise that household finances are central to debates on global growth. It's an important input for the manager of a global demographics fund.

Consumer demand moves between goods and services

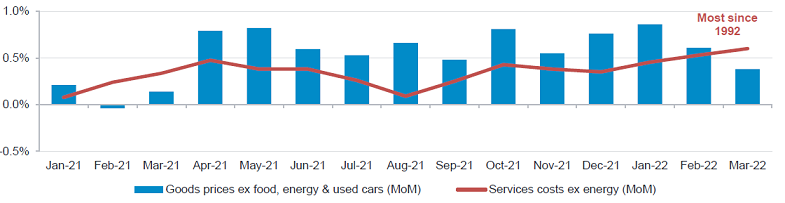

Inflation shifts from goods to services as consumer habits normalise. As we enter the second half of the year, global inflation readings remain well above target and stubbornly high (except for China). The drivers of inflation are also broadening and, while goods inflation shows some signs of easing, non-core inflation and services inflation rising (Figure 1).

This is not surprising. As mobility restrictions in response to the Covid-19 pandemic are eased, consumers are shifting their purchasing to areas that were most depressed during the lockdowns, for example travel and leisure.

Figure 1: Inflation transition - Core goods prices in the US show signs of cooling, while costs of services pick up

Source: Bureau of Labor Statistics, May 2022

A growing appetite for travel and leisure

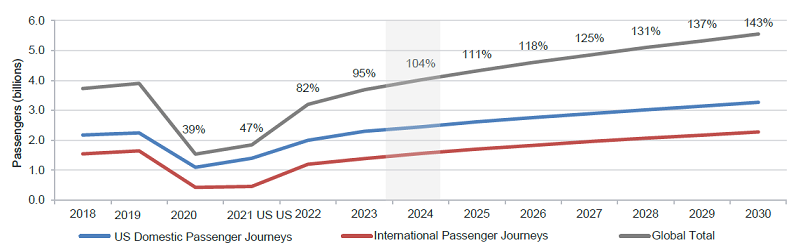

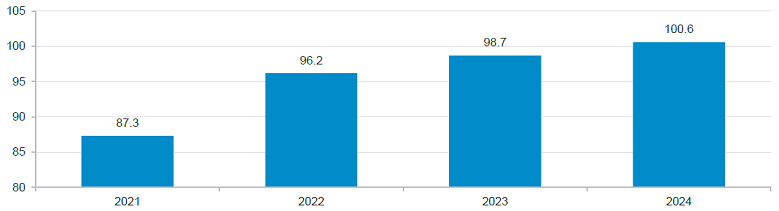

After two years of enforced constraints, the desire to resume normal life benefits the leisure and travel industries. This is reflecting in, for example, the rebound in air traffic and hotel occupancy rates (Figures 2 and 3). Bookings for both cross-border and air travel have started to recover and are now at 66% and 72% of 2019 levels in the US respectively.

While domestic air traffic recovered faster as mobility restrictions were aimed primarily at international travel, the gap between international and domestic bookings is narrowing. However, we observe some disparities across regions with Asia-Pacific lagging behind significantly due to lingering restrictions, particularly in China.

Figure 2: Long term US passenger forecast (billion passengers and % of 2019 level)

Source: IATA Economics/Tourism Economics - 20-year Passenger Forecast - May 2022

Figure 3: Hotel occupancy index (global indexed to 2019)

Source: Tourism Economics, May 2022

Across the portfolio, we hold several stocks that are well positioned to benefit from the uptick in consumer demand for 'experiences'. Airbnb and Booking Holdings - the leading vacation rental business and largest online travel agent respectively - are geared towards the rebound in demand. We also hold Ryanair, Europe’s largest low-cost carrier.

Consumers will make trade-offs across sub-sectors

The effect of normalisation will not be consistent across industries. Given the elevated and pervasive nature of inflation at this time, consumers may have to make trade-offs, particularly in their discretionary spending. Potential impacts vary and depend on sub-sectors as well as the consumer groups these companies appeal to.

For instance, thanks to their higher disposable incomes, luxury consumers may not feel the pinch from inflation as much as other groups, although they are not completely immune. Luxury group LVMH is a key holding across the portfolio and in the beauty space, we hold L’Oréal and Estee Lauder, which, given their higher exposure to luxury cosmetics compared to peers, should prove resilient. The broader consumer trend to buy higher quality goods that last may accelerate amid the current inflationary conditions, and this offers a further tailwind to these names.

Careful consideration of the broader structural growth drivers is important when assessing consumer behaviour. For example, the increasing focus on health and wellness spurred by the pandemic provides the sporting goods segment with some resilience to navigate through lower consumer budgets. However, selectivity should be key. We continue to prefer the highest quality players such as Nike, which has a demonstrated a track record of resilience in even tougher economic backdrops, for example in 2009 and 2010 when it posted flat revenue growth while many economies were still in contraction.

Company pricing power

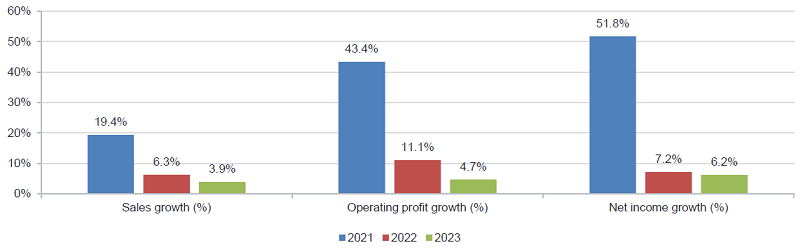

More generally, cost control and pricing power are potentially key in the current conditions. We expect consumer companies that can leverage their strong brands to maintain pricing power to emerge as winners. As costs rise with inflation, corporate profit margins are under threat and, as a result, investor returns could fall (Figure 4). Sustainable pricing power can protect margins by passing on higher costs to customers.

Figure 4: Fidelity Analyst Survey points to end in margin expansion

Source: Fidelity International, May 2022

Sustainability to remain in focus

Sustainability has become dramatically more influential in consumer decisions. This has led to companies guiding their brands to invest in and develop their identities through clever and dynamic sustainability strategies. This trend could persist despite the tougher market conditions. Recent survey data shows that most consumers will continue to consider sustainability in their purchasing decisions despite the rising cost of living1.

We maintain an explicit focus on sustainability credentials for the portfolio when assessing businesses, as reflected in the relatively high proportion of holdings rated BBB and above by MSCI ESG (85% for Fidelity Global Demographics Fund as of 31 May 2022).

High quality names could protect investors

The health of the consumer will remain in focus as we progress into the second half of the year. For investors, it is crucial to identify high quality names with business model resilience, balance sheet strength, and brand power. These are important factors that can translate into a superior ability to exert pricing power and protect investor returns in this high inflation, high-rate environment.

Aneta Wynimko is Co-Portfolio Manager, Fidelity Global Demographics Fund at Fidelity International, a sponsor of Firstlinks. This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity International. This document is intended as general information only. You should consider the relevant Product Disclosure Statement available on our website www.fidelity.com.au.

For more articles and papers from Fidelity, please click here.

© 2021 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited.