This reporting season has demonstrated the earnings resilience of corporate Australia. It started strong, with several retailers reporting solid earnings results early. Then, in the final weeks, aggregate ASX 200 EPS downgrades were approximately 0.5%. That compares to a normal level of close to 0.7% of downgrades during a reporting season.

These numbers are a solid outcome for corporate Australia. Throughout the reporting season, the key theme was revenue was strong as the demand from consumers and corporates remained relatively high.

Even the trading updates for the first four to six weeks of the 2023 year from some of the retailers highlighted how resilient the Australian consumer is.

On the downside, the biggest factor for downgrades was costs being much higher than expected. Many companies also pointed to high labour costs as an issue behind lower earnings. Higher commodity costs, which were an issue some months ago, have fallen back but higher labour costs are expected to be ongoing.

But, despite a sluggish backdrop, most of the company guidance pointed to good dividends. And many pointed to higher capital expenditure as well.

This reflects the strength in demand that many companies are currently observing. However, it does pose some concerns about what might happen if demand falls quite quickly, especially when higher interest rates start impacting consumers and their balance sheets.

The retail sector

The most surprising outperformance during earnings season was the retail sector which has performed well so far in 2023. The market has been surprised by how well consumers are holding up, despite excessive spending during the past three years courtesy of the government’s COVID support. Consumers continued to deliver a very strong Christmas for retailers, and their trading updates were strong.

Consumer resilience drove much of the upgrade for 2023, though many pointed to uncertainty into 2024 as the expected slowdown hits home.

Retailers have also demonstrated expanding margins for H2 2022. But most companies in the sector flagged that margin compression is likely within the next six months or so, as demand eases.

Banks and financials

The banks’ results were in line with high expectations – and these are some of the best results in recent years from the sector. Earnings grew more than 20% on the back of rising interest rate margins.

Looking forward, the sector is facing many headwinds in the next six to twelve months including rising labour costs and heightened mortgage competition. The Commonwealth Bank was the first of the majors to report and it highlighted the challenges ahead despite higher interest rate expectations.

We expect banking margins (NIM) to compress as economic activity slows and competition across mortgages increases.

Resources

Results in the resource sector were also in line with expectations. Along with reporting earnings, companies in the sector also all pointed to high capital expenditure. This is unsurprising given the high cost of inflation, higher labour costs and the labour shortage.

This more cautious outlook means some of the majors have been forced to cut dividends. For instance, BHP cut its interim dividend by 40% and Fortescue Metals cut its interim dividend to 75c (from 86c for the same time last year).

M&A activity

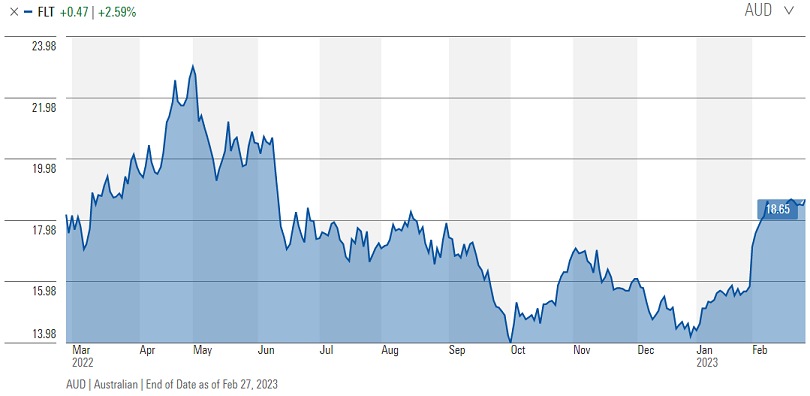

Also of interest during the most recent earnings season were two recapitalisations and acquisitions - Flight Centre and Star.

Flight Centre bought a business at the beginning of reporting season and then raised funds to shore up the balance sheet ahead of a potential slowdown.

Source: Morningstar

Star is going through several issues – a weak balance sheet, potential fines around money laundering and increased tax – and the recapitalisation will help boost its balance sheet as it awaits the decision by the government regarding tax.

Source: Morningstar

We expect these recapitalisations will pick up as corporates strengthen their balance sheets before any slowdown. While some companies continue to pay out special dividends or conduct share buybacks, they also want to keep that strong balance sheet (or war chest) ready as the economy inevitably slows in the next 12 months.

Both of these recapitalisations have done incredibly well, and we expect there will be a lot more of these coming through in the next few months and they will be well supported.

Earnings rebasing required

Given the volatility expected over the next three to six months, earnings downgrades are expected to be widespread and dramatic. Right now, the consensus is still expecting a high single digit earnings growth for Australia for the next four months. Our view is that this is just too high. And the earnings downgrades of 0.5% mentioned above are just too low.

We need earnings to be much more realistic in the next six months. And once that takes place, then the share market can begin to recover. We see a fair bit of earnings risk around the May update, particularly in consumer names. We do think that by the time we get to May, activity will have slowed down substantially for quite a lot of them.

Long-term outlook is good

After investors become more realistic in terms of earnings over the next three months and earnings are rebased, the outlook for the share market is expected to be positive heading into the second half of this year.

Companies are not expensive, and in the next six to eight months we will start cycling through weaker numbers from the second half of last year. Earnings will be picking up into 2024 as inflation comes under control, and interest rate expectations have already been built into the market.

All in all, that represents a solid environment for the share market in the long term. A sell off over the next few months puts equities in a much stronger position for the second half. We may well have a bull market by the second half of this year.

Take opportunities where you can

Investors need to be mindful that when markets experience volatile periods, instead of taking money off the table and sitting on the sidelines, they should use the opportunity to invest in good quality companies at low prices.

Stocks such as Ramsay Healthcare and CSL are countercyclical and should be able to maintain, or even grow, earnings into economic slowdowns. These companies’ earnings are expected to grow over the next few years underpinned by a recovery in demand post COVID – as well as from structural growth drivers.

Stocks with the ability to pass on cost increases or where demand is inelastic such as Goodman Group and Lottery Corporation should be able to protect their margins in a slowdown.

And finally, some stocks are exposed to structural growth tailwinds strong enough to offset short term cyclical headwinds such as A2 Milk Company and Treasury Wine Estates.

Jun Bei Liu is Lead Portfolio Manager, Alpha Plus Fund at Tribeca Investment Partners, a specialist investment manager partner of GSFM Funds Management, a sponsor of Firstlinks. The information in this article is provided for informational purposes only. Any opinions expressed in this material reflect, as at the date of publication, the views of Tribeca and should not be relied upon as the basis of your investment decisions.

For more articles and papers from GSFM and partners, click here.