When an Australian couple becomes eligible for the full age pension, it's almost equivalent to the government handing them $1 million, plus other benefits. While top of the list of worries for many retirees is that they will ‘run out of money’, what many really mean is they will not have enough money for the lifestyle they want. A homeowner receiving a full pension and access to home equity should not literally ‘run out of money’.

The fear leads to underspending in retirement with most people dying with a substantial amount of their wealth intact. The Retirement Income Review Final Report in July 2020 reported (page 432):

"Data provided by a large superannuation fund found members who died left 90% of the balance they had at retirement. Another study found a similar result: at death, age pensioners leave around 90% of the assessable assets they had at the point of retirement."

A study by Allianz Retire+ claimed 61% of people fear running out of money more than they fear death. However, the age pension system, concessions on services, access to free or low-cost health care and home equity release schemes provide a significant backstop for retiree homeowners. These are not factored in sufficiently when they fear their own money dwindling.

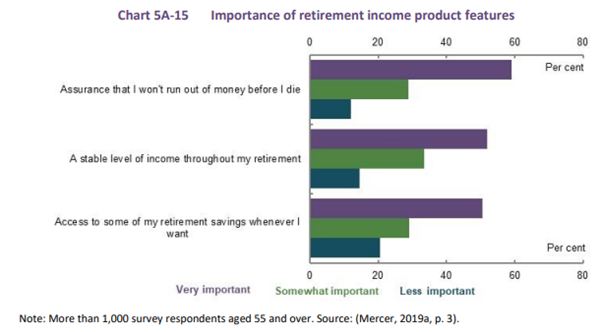

But it remains a common concern. The Retirement Income Review included a survey of over 1,000 people over the age of 55, who identify “Assurance that I won’t run out of money before I die” as the main reason they may consider retirement income products.

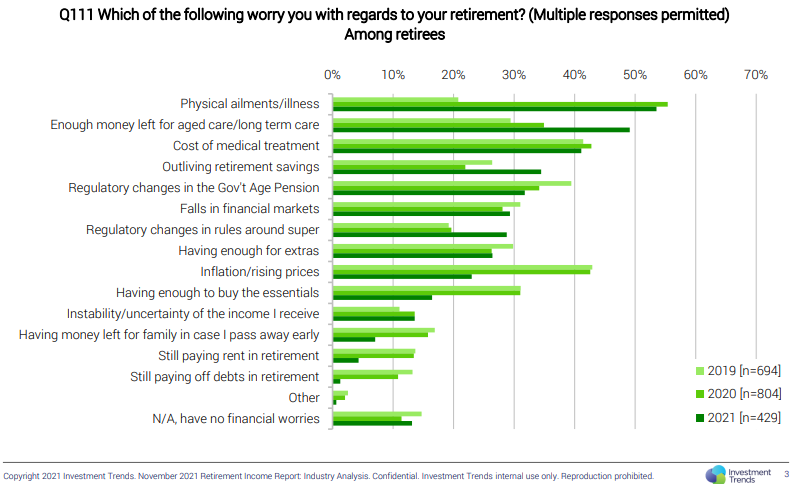

In research by Investment Trends, ‘outliving retirement savings’ ranked fourth among retirement worries, nominated by about 35% of respondents in 2021, after medical issues and aged care.

The retirement income system

Australia has a complex retirement income system but it is commonly recognised as comprising three components:

- Age pension, means tested and funded by the Federal Government

- Superannuation, privately managed with mandated savings

- Voluntary savings

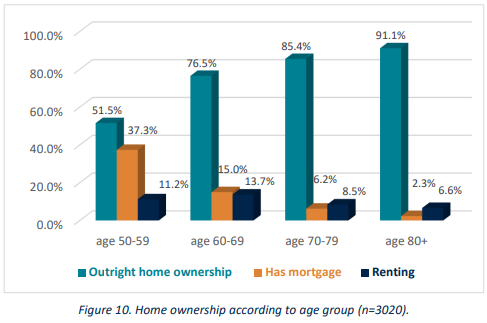

Given that well over 80% of people over the age of 65 own their home outright, access to the equity should be part of a retirement income discussion.

- Accessing equity in a family home.

A common mistake in thinking about the age pension is the belief that its purpose is to provide a minimum standard for Australians with limited financial resources. In fact, it is increasingly a supplement in retirement for middle-income earners, with most pension recipients expected to receive a part-pension rather than full pension in future. Furthermore, the majority of Australians will still receive an age pension by 2060 despite the growth of the superannuation system.

What are the age pension limits and payments?

Full details of pension rates are on the Department of Social Security website.

Following the latest indexation of pensions in September 2022, the maximum rate rose to $1,026.50 a fortnight for singles and $1,547.60 for a pensioner couple, including pension and energy supplements. A couple receives an annual pension of over $40,000 a year.

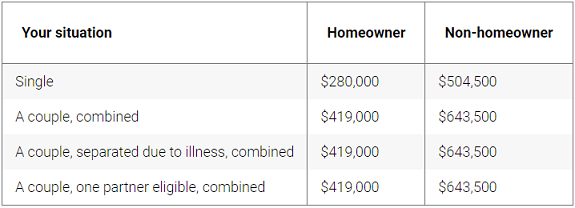

Most people enter retirement as a couple, and provided the value of their combined assets excluding their own home (see Services Australia for full definitions) is less than $419,000, they will be eligible for a full pension.

Allowances are even more generous on some assets. For example, generally only 60% of the purchase price of a lifetime income stream (such as a lifetime annuity) counts as an asset until age 84, and then only 30% is assessable.

Asset levels for full age pension eligibility

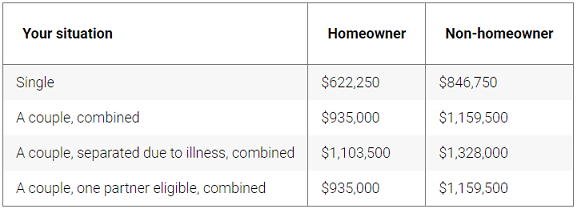

To receive a part pension, their assets (excluding the family home) cannot exceed the levels shown below.

Asset levels cut offs for part age pension eligibility

Therefore, a retired couple meeting other age (between 65.5 and 67 years old depending on birth date) and income tests can hold up to $935,000 in assets in addition to their family home and still qualify for the age pension.

While it's not a formula for regular business class travel, a new car every couple of years and fine dining each week, owning a home of unlimited value and nearly a million of other assets and still receiving some pension and related benefits seems a decent deal from our social security system.

What is a full age pension worth?

The age pension is a fortnightly payment from the Federal Government, indexed to inflation for life:

"Indexation occurs in line with increases in the Consumer Price Index (CPI), either yearly or twice yearly. The Pensioner and Beneficiary Living Cost Index (PBLCI) is used to adjust maximum basic rates of pension where movement in the PBLCI is greater than movement in the CPI for an indexation period."

The calculation of its value is potentially complex and I asked leading actuary, David Knox of Mercer, for a 'back of the envelope' estimate. David replied:

"Let’s keep it simple. The full age pension for a single person is now $26,781. As you know, the age pension will be payable from age 67 from 1 July next year. So for most people who are not yet 67, this is the relevant eligibility age. According to the latest UN data published this year, the current life expectancy for an Australian aged 67 is 20.1 years. It will continue to increase in future years.

The age pension is currently indexed to wages or prices so it keeps increasing and we also need a discount rate. Although we can debate the appropriate discount rate, a simple approach is to let the future increases cancel out the discount rate, so that in real terms the pension stays as its current value.

Therefore the current value of the future age pension for a single person now aged 67 is $26,781 times 20.1 which is $538,291; or to express in more general terms, the value of the full age pension for a single person is in the order of $540,000.”

Using the same logic, the pension for a couple of $40,237 is worth about $808,000, or over 30 years about $1.2 million. David's argument of not requiring a discount rate because the payment is indexed is a simple and elegant way to make the calculation.

Therefore, in financial terms, the age pension for a couple is akin to being handed about $1 million on eligibility date, plus other benefits.

Maximising income in retirement

The Retirement Income Review, page 133, stresses the need to consider not only the age pension but:

"Retirees receive a broad range of non-monetary supports, including social transfers in kind, that reduce the level of income required to achieve a particular living standard. When assessing retiree poverty, these supports should be taken into account, including whether retirees are using their assets to fund their retirement. Otherwise, asset-rich households may be counted as ‘living in poverty’."

As Noel Whittaker advises in his tips on earning a pension, while the home is not assessable, furniture, fittings and vehicles are. However, many pensioners make the mistake of valuing them at cost or replacement value, when a ‘garage sale’ value is fine. As such sales achieve poor results, furniture might be worth only $5,000, nowhere near their cost.

Since every $10,000 of excess assets above the minimum above reduces the pension by $780 a year, the cost of reporting higher asset values than necessary can be significant.

In addition, age pensioners may receive other payments, such as:

- Commonwealth Rent Assistance

- Carer Allowance and Carer Supplement

- Mobility Allowance

- Pensioner Education Supplement

- Family Tax Benefit, if they have dependent children in their care.

With a Pensioner Concession Card comes a range of other entitlements, including:

- Gas rebate

- Electricity rebate

- Water rebate

- Council rate discount

- Drivers licence and registration concession

Free or subsidised health and aged care services support Australian retirees. Brendan Ryan of Later Life Advice writes an annual checklist in Firstlinks which documents the many benefits from holding a Pensioner Concession card or Commonwealth Seniors Health Card.

Outliving retirement savings

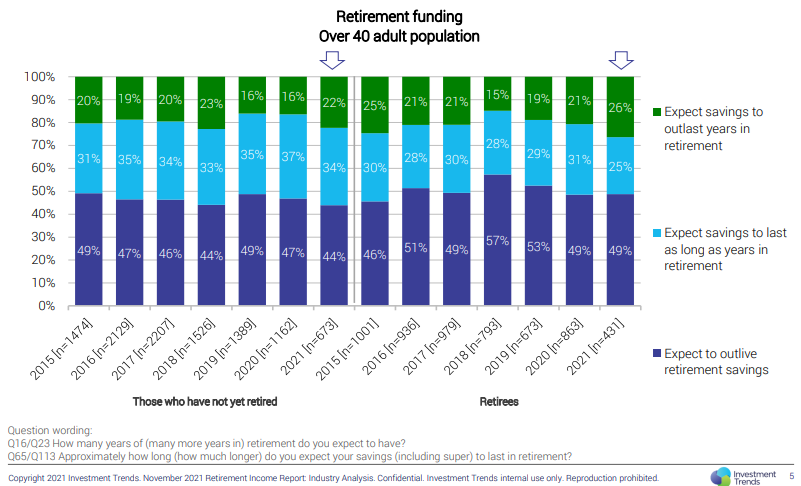

In further research by Investment Trends, about 50% of retirees expect to outlive their retirement savings, and the majority of those expect to become dependent on the age pension. While this is not something to aspire to, the social security system protects them.

Income from home equity access schemes

According to research by National Seniors and Challenger, 85% of retirees outright own their own home, while an additional 7% own a home with a mortgage. Ownership rises with age, as this chart from the report shows:

The home is usually the most valuable asset of the retiree and it needs to be considered in any discussion of retirement income.

The two major benefits of owning a home in retirement are avoiding:

- eviction at the end of short leases, and

- rental payments which can rise on landlord demands.

In addition, the equity in a home can be accessed as tax-free retirement income through reverse mortgage schemes, such as offered by the Federal Government in the Home Equity Access Scheme (HEAS). A feature of these schemes is that a lump sum or income stream can be arranged with payment of the loan deferred and paid from the estate after death of the retiree. HEAS is administered by the Department of Human Services through Centrelink.

Deborah Ralston, a member of the Retirement Income Review, wrote a detailed article in Firstlinks on accessing equity in the family home. We will not repeat her points here, but in addition to the Government scheme, private providers such as Household Capital and Heartland Finance offer access with different features such as higher limits on borrowing amounts.

Briefly on the HEAS scheme:

- Borrowers must be of age pension age and own real estate in Australia

- Borrowers can either be receiving a qualifying pension, or meet the age pension rules but not receive a pension due to assets or income over the threshold. In other words, a borrower does not need to be receiving the age pension

- The combined loan and pension payment each fortnight cannot exceed 1.5 times the maximum pension rate

- Lump sums can be drawn in advance

- The current rate is 3.95%

- Debt is recovered through the estate when the last borrower dies.

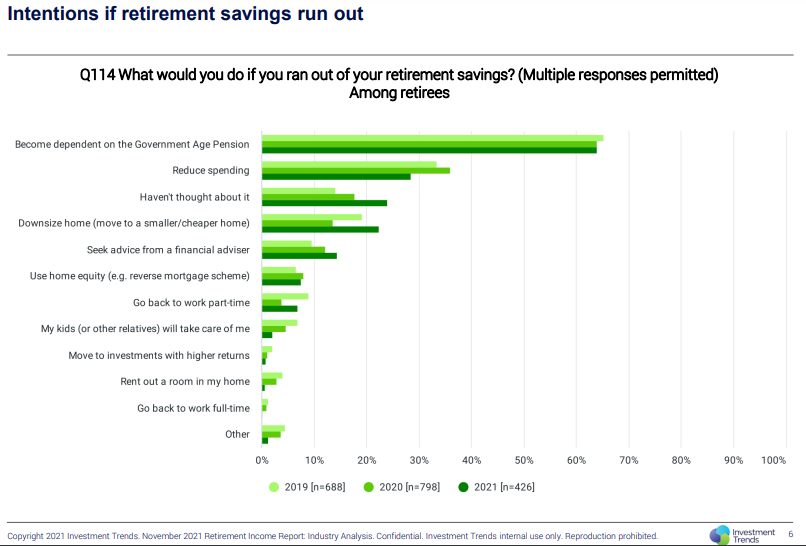

Terms from commercial lenders will differ. Investment Trends research suggests home equity access is low on the list for retirees looking for income if savings run out, nominated by only about 7% of retirees. If savings run out, more popular sources include accessing the age pension, reducing spending and downsizing their home. Home equity is on par with going back to work.

So 'running out of money' means 'running out of retirement savings', it does not allow for accessing the age pension and a regular annual income of $40,000.

How much income is needed in retirement?

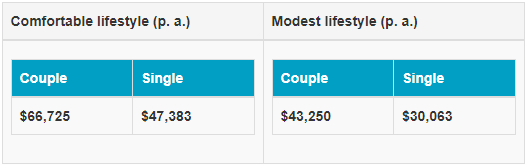

While not everyone aspires to an extravagant lifestyle in retirement, nobody wants to be poor, especially in old age. The most frequently-used standard for retirement income comes from ASFA, which estimates a modest lifestyle for a homeowner couple at $43,250 or comfortable at $66,725. On this basis, a homeowner couple on a full age pension with no other assets almost achieves a modest lifestyle on the age pension alone, which can be supplemented by accessing home equity.

This number has recently been challenged as too high by Super Consumers Australia (SCA), as reported in Firstlinks. Whereas ASFA sets a 'comfortable' level of assets required for a couple at $640,000 to give an annual income of $66,725, SCA says only $352,000 is required for its medium spenders requiring $56,000 a year. SCA has an income number of $42,000 as its lower bound for “you’d like to spend this much in retirement”.

Either way, for a homeowner with modest living needs, the age pension will go a long way to meeting their needs.

On 2 September 2022, the Government announced an increase to $11,800 in the amount a pensioner can earn before their pension is reduced:

“Age and Veterans Pensioners will be able to earn an additional $4,000 over this financial year without losing any of their pension due to the Albanese Labor Government providing a one-off income credit designed to give older Australians the option to work and keep more of their money.

Following the successful Jobs and Skills Summit in Canberra, an immediate $4,000 income credit will be added to the income banks of Age Pensioners from December to be used this financial year.

The temporary income bank top up will increase the amount pensioners can earn from $7,800 to $11,800 this year, before their pension is reduced.”

Although health, disability or other factors may inhibit a retiree returning to work, there are currently more job vacancies than unemployed people, and with the record-low unemployment rate, the opportunities to supplement income with part-time work are far better than in the past.

Homeowners not renters

This article assumes home ownership rather than renting, and the difficulties of living in retirement without owning a home is a major but separate issue. Clearly, a renter may 'run out of money' in covering rent. The Retirement Income Review states:

"Almost one-quarter of retirees who rent privately are in financial stress. High housing costs are likely to be the primary driver of the financial stress experienced by this group. Renters face higher housing costs than home owners in retirement: an additional $6,900 per year for the median single, and $12,200 per year for the median couple."

Providing for aged care

Aged care is a specialist and complex area, so Rachel Lane from Aged Care Gurus provided this explanation of the cost of aged care.

"If you are moving into an aged care home you will be asked to complete a combined income and asset assessment. This assessment is used to work out how much funding the government will provide to the facility for your accommodation and care.

The residential aged care means test is a complicated formula that uses a combination of an asset test and income test (with the outcome of each test added together), to calculate your cost of care.

Income test

50c per dollar of income above

$30,204/year single

$29,632/year member of a couple

Asset test

17.5% of $55,000–$186,331

1% of $186,331–$448,994

2% of above $448,994

People with a calculated amount below $63/day are considered financially disadvantaged, or ‘low means’. They have some or all of their accommodation cost subsidised by the government.

Most people have a calculated amount above $63/day, meaning that they need to pay the market price for their accommodation. The amount above $63/day is their contribution to their care, which is known as the means-tested care fee.

There is an annual limit of $30,574 that applies to the Means Tested Care Fee

There is a lifetime limit on means tested fees across Home Care and Residential Aged Care of $73,378.

Special rules apply to the assessment of your former home. As general rule, your home will be included in your aged care assets up to the capped value of $186,331 unless a protected person lives there in which case it is exempt.

A protected person includes: your partner or dependent child, a carer who is eligible for an Australian Income Support Payment who has been living in the home for at least 2 years or a close relative is eligible for an Australian Income Support Payment who has been living in the home for at least 5 years.

If the value of your home is less than the $186,331 cap then the market value of the home will be used in the assessment. In most cases the market value will be far greater than the cap.

Under the pension assets test the full value of your home is exempt for 2 years from the date you or your partner leave the home (whichever is later). When the 2-year exemption ends the home is included in your assessable assets at the market value but your pension assessment changes from a homeowner to a non-homeowner giving you an asset test threshold and cut off that is $224,500 higher.

While the asset value of the home receives special treatment for both pension and aged care means testing it is important to know that if you receive rent from the home it is assessable income for both pension and aged care means tests."

Planning for retirement

For many homeowning couples, $40,000 a year plus other benefits paid to concession holders, supplemented by a home equity access scheme, will finance an acceptable standard of living. While it is not much to aspire to for anyone with the ability to save more, the present system suggests homeowners are placing too much fear on ‘running out of money’.

For those who plan to run down their savings to qualify for a full pension, such as by spending money on holidays, increasing living expenses or renovating the family home (but not giving money away as that falls foul of the gifting rules), here is a warning from Noel Whittaker:

“Think about it. If you spend $100,000 renovating your home, your pension may increase by just $7,800 a year, but it would take almost 13 years of the increased pension to get the $100,000 back. Of course, the benefit of money spent should be taken into account too – money on improving your house or travelling could have huge benefits for you. The main thing is not to spend money with the sole purpose of getting a bigger age pension.”

While there is some risk that future age pension payments will be less generous, a change seems unlikely while the cohort of retirees represents such a large voting block. As the franking credit debate proved in 2019, it's not only older people who vote against change, but their children want their entitlements protected.

Graham Hand is Editor-At-Large for Firstlinks. This article is general information and does not consider the circumstances of any person. Thanks to Rachel Lane, David Knox and Noel Whittaker for additional input.