As 2022 has proven, the direction of financial markets is determined by the continuous colliding of two highly reactive elements: expectations and realities.

Fixed income, often taking a back seat to the allure of equity markets, has this year been the focal point for financial pundits around the world. And with this excitement comes real opportunity for investors who can identify market sectors providing compelling relative value.

Expectation versus reality

Expectation: The Reserve Bank of Australia would continue to aggressively raise interest rates. Reality: A more measured 25 basis point increase in the cash rate for both October and November. The result was a rebound in asset prices through October and November and a renewed sense of optimism in the state of the economy.

However, while it may have helped to reverse some of the Australian share market’s[1] September slide, the fifth-worst single month of market performance over the last decade, it did little to alleviate the overall pain investors have felt since the start of the year.

A balanced 60/40 portfolio of shares and bonds is down 8.56%, calendar year to date[2]. This has been driven by a fall in equity valuations, as well as the downward repricing of interest rate sensitive assets. Nonetheless, with future interest rate rises expected and the possibilities of a global recession looming, the composition of investors’ fixed income allocations has never been more important.

The periodic table of bonds

For professional money managers and individual investors alike, the question remains the same: which fixed income securities offer the best risk and return potential on a forward-looking basis?

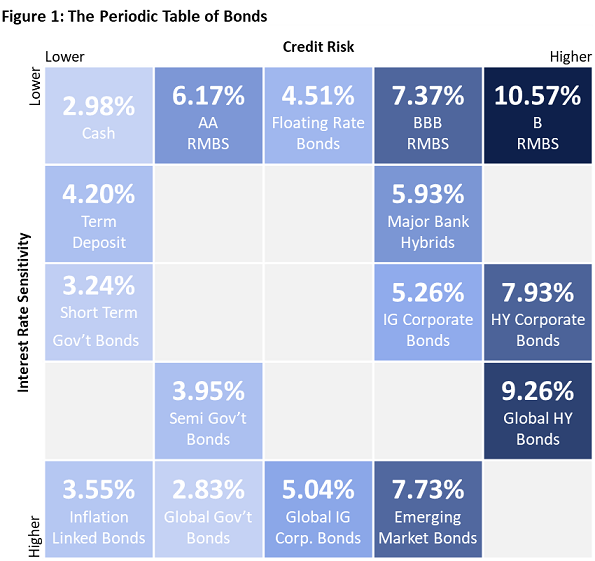

Below is the periodic table of bonds; a range of bond market sectors, mapped by credit quality and interest rate sensitivity. The location of each bond sector represents its relative risk exposures, while the number is what the sector is currently yielding. It’s a novel way to provide a reading on the current climate of the fixed income market.

Source: Bloomberg, Aquasia. Interest rate sensitivity measure is modified duration and CPI is assumed to remain unchanged. Credit risk measure is the credit quality of the index or underlying securities. Bloomberg AusBond Bank Bill Index (Cash), published 12 month term deposit of major bank (Term Deposit), Bloomberg AusBond Treasury 0-5 Yr Index (Short Term Gov’t Bonds), Bloomberg AusBond Treasury 5+ Yr Index (Long Term Gov’t Bonds), Bloomberg AusBond Infl 0+ Yr Index (Inflation Linked Bonds), Bloomberg AusBond Semi Govt 0+ Yr Index (Semi Gov’t Bonds), Bloomberg Global Agg Treasuries Index (Global Gov’t Bonds), Bloomberg AusBond Credit FRN 0+ Yr Index (Floating Rate Bonds), Bloomberg Global Agg Corporate Index (Global IG Corp. Bonds), S&P Australia Investment Grade Corporate Bond Index (IG Corporate Bonds), Bloomberg EM Aggregate Index (Emerging Market Bonds), S&P Australia High Yield Corporate Bond Index (HY Corporate Bonds), Bloomberg Global High Yield Index (Global HY Bonds). All Hybrid and RMBS data is based on recent primary issuance. All data as at 25 November, 2022.

Cash has the backing of the Australian government, in the form of the Financial Claims Scheme, for deposits of up to $250,000. The mark to market value of cash is also relatively immune to changes in interest rates - that’s to say it has extremely low duration. The combination of these two things means cash is located at the top left-hand corner of the table. Using the Australian AusBond Bank Bill Index as a proxy for cash, we can calculate that the yield on cash is currently 2.98%.

Moving down the table we find securities with greater levels of duration and therefore greater sensitivity to interest rate changes. An increase in interest rates will cause the value of a long-term government bond to fall by more than a short-term government bond, all else remaining equal. Importantly, they are both backed by the AAA credit rating of the Australian government, one of only a handful of countries currently awarded the highest possible rating.

Moving to the right represents an increase in the credit risk of the underlying securities. The Bloomberg Global Aggregate Treasuries Index, a representative index for global government bonds, will inherently have a lower credit rating than Australia, as it includes government bonds issued by countries that have a lower credit rating than AAA.

The relationship between risk and return is well understood by investors and the objective is to earn the highest return possible for the lowest level of risk. Therefore, increases in either interest rate sensitivity or credit risk, two key risk factors for fixed income assets, should be compensated by increases in return. Sectors in the top left corner are lower risk and lower return for investors, while those in the bottom right corner are higher risk and should provide higher returns.

Identifying relative value

In some good news for investors, fixed income securities are finally offering attractive yields, especially when compared to riskier asset classes. Only 10 months ago cash was yielding 0.05%, short-term government bonds were offering 1.03% and global government bonds were at 1.13%. Whether or not yields have found their ultimate resting place remains to be seen, but the increase will no doubt be welcomed by income seeking investors.

More importantly however, this table highlights pockets of relative value within the bond market that are worth exploring. There are currently opportunities where investors could reduce both the level of credit risk and interest rate risk and yet be rewarded with a higher yield. For example, BBB and B RMBS offer greater levels of yield with lower levels of interest rate sensitivity compared to corporate bonds of the same credit quality. They also trump major bank hybrids, whose market value has historically been more closely correlated to equities than traditional bonds. Unfortunately, a higher equity beta is not a desirable trait for a defensive asset.

Asset-backed securities, such as RMBS, are floating rate in nature, meaning that changes in interest rates flow through to the coupon payments, reducing the impact of these changes on the mark to market value of the assets. RMBS also benefit from the legal caveats unique to securitised assets, including full recourse loans, waterfall payment structures and excess spread. Much like other mark to market assets, the current yield on asset backed securities reflect all available information and risk, meaning the softening housing market and higher interest costs have created a new market implied margin from which all new deals must now be issued. As a result, these securities can deliver superior risk adjusted returns to the defensive part of an investor’s portfolio.

Positioning a portfolio

Investors have already had a challenging year, as expectations have met reality in chaotic fashion. The periodic table of bonds provides more than food for thought. It is actionable analysis that highlights sectors of the fixed income market that provide the greatest level of relative value.

The reality of future interest rate changes cannot be known, but the market expectation is for further rate increases. For investors that are looking to maximise returns from investment grade assets while also reducing their exposure to interest rate risk, asset backed securities and RMBS currently provide attractive opportunities. Regardless of where you see value, the periodic table framework can be used to ensure an investment portfolio is protected from both expectations and realities.

Tim Dowling is an investment specialist at Aquasia, a boutique investment management and corporate advisory firm that specialises in fixed income and credit markets. This commentary is provided by Aquasia Pty Ltd ABN 20 136 522 051, AFSL 337872 for general information purposes and is not financial or investment advice or an offer to buy or sell any financial product. It does not take into consideration any person’s objectives, financial situation or needs and should not be used as the basis for any investment or financial decision. Past performance is not a reliable indicator of future performance.

[1] Source: Bloomberg. S&P/ASX 200 Total Return Index.

[2] Source Bloomberg, Aquasia. 20% S&P/ASX300 Index, 14.5% MSCI World ex-Australia Index (with net dividends reinvested) in Australian dollars, 9% MSCI World ex-Australian Index (with net dividends reinvested) hedged into Australian dollars, 3.5% MSCI World ex-Australia Small Cap Index (with net dividends reinvested) in Australian dollars, 3% MSCI Emerging Markets Index (with net dividends reinvested) in Australian dollars, 15% Bloomberg Barclays AusBond Composite 0+ Yr Index, 35% Bloomberg Barclays Global Aggregate Float Adjusted and Scaled Index hedged into Australian dollars as at 25 November, 2022.