We received this request from one of our readers:

“Hi Guys.

Enjoy reading your publication.

I have an interest in investing in infrastructure (5 in's in a row ... must be a record!!). Could you think about providing an article on infrastructure investing in listed and unlisted funds, and also examine the effects of rising interest rates on these funds. Thanks.”

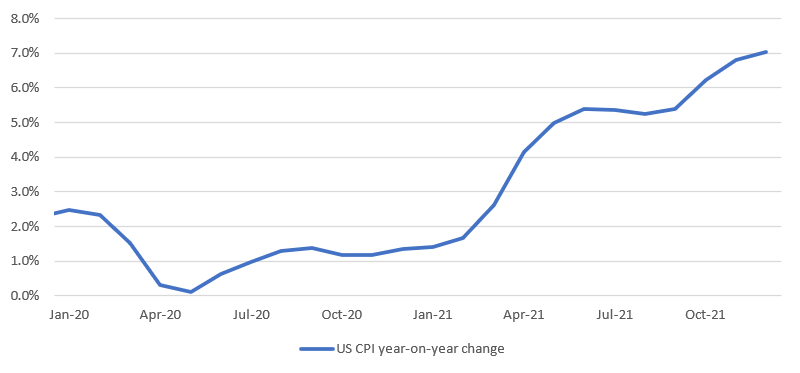

Global share prices dived in January as US stocks suffered their worst month since the pandemic began in March 2020. US shares sagged mainly because the Federal Reserve warned it would raise rates to counter US inflation, which reached a 40-year high of 7% in 2021. For the month, the S&P 500 Index shed 5.3% in US dollars (and 2.3% in Australian currency), its worst January since the GFC.

US Consumer Price Index (CPI) - January 2020 to December 2021

Source: Refinitiv

Inflation protection in infrastructure

As inflation accelerates worldwide, many investors are turning to stocks that are renowned for their inflation protection, especially infrastructure and utility stocks.

The discussion here assumes companies defined as infrastructure companies meet two criteria.

First, the company must own or operate assets that behave like monopolies.

Second, the services provided by the company must be essential for a community to function efficiently. Such companies have predictable cash flows that make them attractive defensive assets.

The key inflation protection for utilities stems from the fact they are regulated at the point of earnings. Their regulators set the price of the service supplied by the utility such that utilities earn a ‘fair’ return. When inflation boosts input and other costs, including the cost of capital, regulators allow utilities to raise their prices to ensure their returns compensate shareholders fairly over time for the capital invested to provide their services. If the regulatory process is working efficiently, then accelerations or decelerations in inflation and related changes in interest rates should have limited influence on the financial returns of regulated utilities.

The same goes for most infrastructure assets. The prices charged for services by infrastructure assets such as toll roads or airports are typically linked to inflation through either regulation or contract. The value of the business is thus somewhat protected from changes in inflation. Inflation can even boost the value of infrastructure assets over time because these assets typically enjoy higher patronage as populations and wealth grow.

Listed and unlisted infrastructure assets are inflation-proof to the same extent because the structure through which the assets are owned doesn’t change the economics of the assets. The economic model for the assets will reflect demand for the service the asset provides, the regulatory framework the asset faces and the underlying cost structure for the service provided.

Listed versus unlisted

Investors who can see the inflation-protection benefits of holding global infrastructure and utility assets face an early decision: choosing between listed and unlisted infrastructure assets. Many might tilt towards listed because it comes with some key benefits compared with unlisted.

1. An ability to invest quickly

While it can take investors many years to find available assets and invest their capital in unlisted infrastructure, hundreds of millions of dollars can be invested in a matter of days in the world’s best listed infrastructure companies.

2. Easy diversification

The global listed infrastructure and utility universe followed by Magellan contains more than 130 companies from 22 countries and 10 industry segment classifications (as defined by Magellan). This choice means that investors can build a well-diversified portfolio of listed infrastructure stocks on a regional and industry basis.

By comparison, it is not uncommon for unlisted infrastructure funds to hold a concentrated portfolio of 10 to 15 assets that is typically biased to a sector or region. Ultimately, portfolio composition for unlisted funds is heavily dependent on what assets are available at the time the fund is being invested.

3. Greater transparency

Listed securities are transparent, in contrast with private infrastructure funds that can often demand a ‘blind commitment’ to what may be a portfolio of low-quality assets.

4. No costly failed bids and related costs

Unlisted infrastructure funds generally start with a sum of money and then they bid to buy assets. These bids often fail and come with costs. Each bid can involve significant outlays for legal, tax, accounting and advisory services, which are ultimately borne by the investors whether the bid succeeds or fails. Even the most experienced infrastructure managers are not successful with every bid.

5. No forced sales

Listed infrastructure assets face no forced asset sales. The bulk of private infrastructure and unlisted funds are 'close ended' with fixed periods until termination. At the end of the term, assets need to be redeemed (unless there is a vote to extend the term) and this could result in the sale of assets in sub-optimal market conditions. The open-ended nature of listed assets means exposure can be held indefinitely.

6. An ability to tilt across regions and sectors

Once investors have built a well-diversified portfolio of global listed infrastructure stocks, they can readily adjust holdings across sectors and regions to take advantage of different market conditions. This ability can enhance the risk-return profiles of listed infrastructure portfolios. Unlisted infrastructure funds are restricted in their ability to make medium-term tilts across regions and sectors during the life of the fund by the illiquid nature of the unlisted infrastructure investment universe.

7. More liquidity and live pricing

The listed market is liquid enough for investors to easily gain and reduce exposures to global infrastructure companies. The live pricing allows the immediate valuation of portfolios, unlike the unlisted market where valuations are infrequent and opaque.

The management of illiquid assets within an overall asset allocation framework can make it hard to maintain proportionate weightings. Acquiring private market assets takes time and a significant public market rally or downturn can upset the balance in a portfolio and potentially exacerbate the cyclical nature of portfolio returns.

8. More mispricing opportunities

Analysis suggests that over the past decade, listed infrastructure investment opportunities have traded at a material discount to similar infrastructure assets in the unlisted market.

In theory, private market infrastructure assets should be priced at discounts to their publicly traded equivalents due to their illiquidity. This discount should present an opportunity for investors with typically longer investment horizons to trade off liquidity for superior long-term returns.

The opposite, however, has been the case in recent years.

Demand-and-supply dynamics for private market infrastructure have shifted such that many of these assets have consistently been acquired at valuation premiums to their publicly traded alternatives. Part of this reflects the intense competition for many assets in unlisted markets, driven by the sheer weight of capital in the sector. Data provider Prequin estimates that the total capital waiting to be deployed in unlisted infrastructure funds is US$300 billion, up nearly 300% on a decade ago, and that doesn’t include major institutional investors, such as pension funds and sovereign wealth funds, who also invest in these assets.

Gerald Stack is Head of Investments, Head of Infrastructure and a Portfolio Manager, and Ofer Karliner is a Portfolio Manager at Magellan Asset Management, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

For more articles and papers from Magellan, please click here.