A good way to judge how companies are performing in Australia is to compare stockbroker price targets before and after the release of financial results. It's a straightforward measure and cuts out noise about one-offs and taxes, currency fluctuations, management ability and strategy execution.

Notable movements in share price targets

After cloud accountancy software provider Xero released its FY18 financial report in May 2018, price targets went up. When property listings platform REA Group provided an update on the March 2018 quarter, price targets went up. The same happened for News Corp, though that was largely REA-inspired. After Macquarie Group released their financial report last month, price targets jumped.

And the banks? Every one has recently seen price targets decline on the back of financial results, or, in the case of CBA, a quarterly trading update. Most commentators point at ‘cheap’ valuations for the banks (except Bendigo and Adelaide) given most are trading below consensus (and declining) price targets.

Banks are finding it difficult to participate in the broad-based market recovery, regardless of all the value calls, the fact that cheap-looking laggards have been regaining investor interest, and despite most banks paying above-market half-yearly dividends.

The IBISWorld view on banks

Clearly, something else is going on and it's not just about ongoing despicable embarrassments at the Royal Commission. Sector analysts at IBISWorld are widely known for their specialised sector research reports such as on retail spending and new trends in consumer electronics. They have weighed in on what lies ahead for the sector once thought of as the closest thing to ‘indestructible’ by Australian investors (but no longer).

On their assessment, Australian banks will be hamstrung with higher capital requirements, tighter regulation, and higher costs as a result of the public outrage over their misconduct in years past, and the regulatory and political scrutiny that follows as a result. While IBISWorld suggests higher costs will be partially passed on to clients, the analysts now forecast declining revenues for the next five years.

Another consequence of the Royal Commission should be tightened standards for lending to investors, consumers, and businesses, suggest the analysts. While this opens up a drive for increased market share by smaller competitors, including non-bank lenders, this will also have consequences for credit growth in general, which closely intertwines with economic momentum and house prices in Australia.

The UBS analysis of the sector

UBS's negative view on banks has consequences for the broader domestic economy with the house view fearful that tighter credit is likely to lead to weaker house prices. There will be a flow-on impact on household sentiment through a fading of the so-called wealth effect that stems from positive momentum for property prices.

No surprise then, that UBS thinks GDP growth forecasts by economists elsewhere are likely to prove too optimistic, including the 3% forecast maintained by the RBA for 2018. UBS suggests 2.75% is more likely, and this will keep interest rates on hold until the second half of 2019.

In a separate analysis, UBS economists suggest that tighter public scrutiny in Australia has the potential to spread to New Zealand. This could translate into yet more pressure for Australian banks who also dominate across the Tasman.

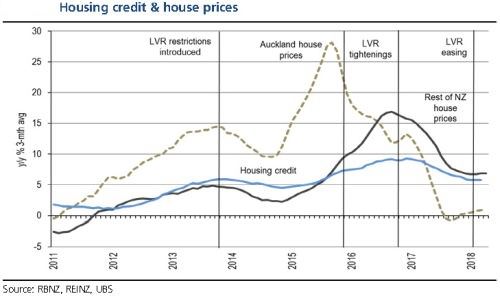

While further tightening of credit in New Zealand would add more downside risks for house prices and consumer spending there, and potential for bad debts to rise, an equally-intriguing observation can be made from the graph below, taken from that same UBS report on Australian banks in New Zealand.

The graph shows the tightening by banks had an almost immediate impact on house prices where there was elevated momentum (Auckland), and that a softening in lending standards once house prices were falling takes a lot longer to then stabilise the market.

The JP Morgan perspective on banks

JP Morgan recently wrote that Australian banks had let their standards slip, as was also revealed at the Royal Commission. APRA had already instructed banks to set limits on new loans in high debt- and high loans-to-income categories, in industry parlance known as DTI and LTI loans. With aggregate household debt in Australia rising to 189% of disposable income, JP Morgan believes that banks are being forced into more conservative lending practices.

A big chunk of the positive momentum in house prices in recent years stemmed from investor-borrowers, and there appears to be a direct link to higher LTI loans with both sellers and buyers in this particular bracket enjoying high LTI mortgages.

JP Morgan is predicting credit growth slowing from 6% annualised to 4% over three years. This seems like a gradual, relatively small contraction, but the impact could be significant. Consider the following maths: High LTI loans represent around 10% of total volume in new loans, but because of their above-average size, JP Morgan believes these loans represent maybe 31% of all new lending in dollar terms. JP Morgan is not predicting a crash in house prices in Australia, but a noticeable slowdown in overall activity, which translates into lesser demand for credit. A crash requires forced sellers.

Related effects of a credit slowdown

The outlook for banks has not looked as clouded since the global financial system froze in 2008, and this is understandably turning the sector into one of the major laggards in the local share market. Investors holding shares in discretionary retailers should also better prepare for tougher times ahead. This is a slow going, long drawn out process and with little in the way of a sizeable increase in average wages, I'd be inclined to think the overall landscape for consumer spending will remain subdued for a lot longer than the optimists expect.

Rudi Filapek-Vandyck is an Editor at FNArena. FNArena’s service can be trialled for two weeks at www.fnarena.com. This article has been prepared for educational purposes and is not meant to be a substitute for tailored financial advice.