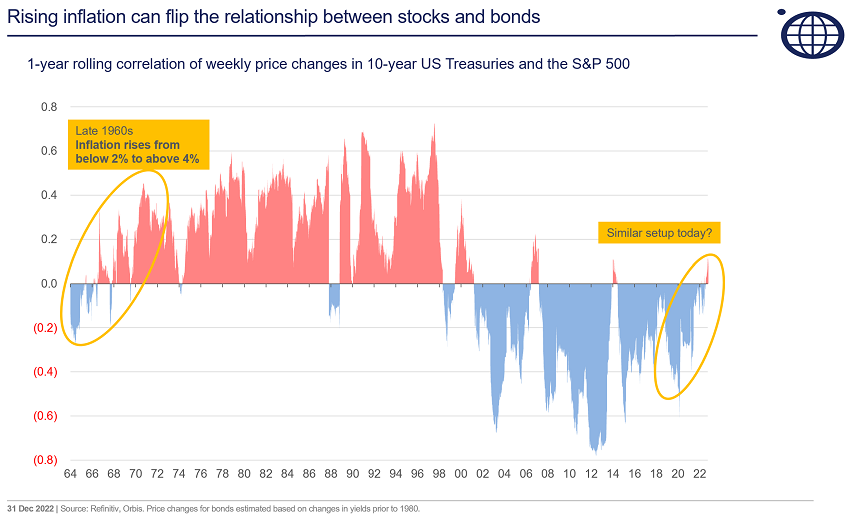

In 2022, investors were hit by a double whammy of both equities and bonds suffering similar levels of declines in prices. The perceived wisdom is that this is not supposed to happen. Bonds and equities are meant to be uncorrelated, so that when one struggles the other does well.

The reality is that bonds and equities fall at the same time more often than expected. In fact, a look over history shows the period where equities and bonds were completely uncorrelated is more of an anomaly, particularly in periods of rising inflation.

This means the traditional diversification strategy of 60:40, with 60% in equities and 40% in bonds, is not the silver bullet some may think it is.

Diversification matters in many ways

Now this doesn’t mean you should rip up your investment approach and do something completely different. But it would be foolhardy not to try and learn from recent experience and be more open-minded in your view of what diversification means. It’s not just about different asset classes, although that obviously helps, it’s also about broadening your horizons for different styles, different regions and even combining active and passive strategies.

For many, the active versus passive debate can be divisive: you’re either one or the other. But both approaches have their strengths and weaknesses, which suggests that perhaps the answer is to create a blended approach.

For example, 2018-2021 was a tough period for value-oriented managers but 2022 showed the ugly side of a purely passive portfolio. Everyone agrees that timing markets is a fools' errand, but what if you leave a passive ‘core’ in place and supplement it with a valuation-focused active manager? This can help offset the Achilles heel of a purely passive approach of being fully exposed to the whole market as it becomes over-priced.

Importantly you can add as many managers as you like to your portfolio, active or passive, value or growth or something more contrarian. But it’s no use ‘diversifying’ across 10, 20 or 30 managers if they are all doing the same thing, with the same focus and holding the same stocks in their portfolios.

The key is to choose managers that have a compass that they stick to, staying true to their investment philosophy and process no matter what the market cycle throws at them. It may be painful at times, but you’ll know what you’re getting over the long-term, and each one can act as a diversifier for your overall portfolio because they are each doing something different.

… and valuation matters, too

In the latest 'Everything Bubble', growth stocks were the darlings of the markets, helped along by the money being pumped into the system by central banks in the wake of the GFC and the Covid-19 pandemic.

But now it appears that bubble is bursting, and more people are beginning to recognise that valuations matter.

Focusing on the broad market cycle misses something crucial - the cycle in valuation gaps, which can have just as big an impact on investor returns. Not all assets go up by the same amount during a bubble, and the same is true when that bubble bursts. This can lead to different experiences depending on what type of investment you’re in, whether it's the market darlings, or the unloved, boring businesses.

From a diversification point of view, this means it can be beneficial to build a portfolio from the bottom-up, focusing on fundamentals, rather than starting from a high-level top-down macro viewpoint. At Orbis, asset classes such as equities, bonds, commodities, and hedged equity all compete equally for space in our portfolios. We aim to select investments across asset classes to find those that will combine to offer the most attractive balance of risk and reward. By doing this, we end up with a portfolio that can be very different to the benchmark both on the equity and the bond side.

As contrarian investors we recognise that not everyone has the courage to stand above the parapet and potentially look foolish in the short-term, even when they know the long-term thinking is sound. But as a diversification tool, it can be powerful to have alternate viewpoints in a portfolio.

While it is a cliché, the old adage 'don’t put all your eggs in one basket' still holds true for investing. When you’re constructing a portfolio, the different baskets of risk and return should be truly different and robust enough to deliver a good balance of investment approaches that can weather any environment.

Shane Woldendorp, Investment Specialist, Orbis Investments, a sponsor of Firstlinks. This article contains general information at a point in time and not personal financial or investment advice. It should not be used as a guide to invest or trade and does not take into account the specific investment objectives or financial situation of any particular person. The Orbis Funds may take a different view depending on facts and circumstances. For more articles and papers from Orbis, please click here.