Australia’s population is ageing. The number of people over 65 has more than doubled in 20 years from 1.6 million in 1995 to 3.6 million in 2015, and is forecast to reach 5.6 million by 2030. The seniors living industry is also undergoing significant change due to this ageing population, industry consolidation, changing expectations, and a shortage of quality accommodation.

The seniors living industry has three key accommodation components:

- manufactured housing estates (MHEs) – operate under a ground lease agreement in which the resident owns the relocatable home and leases the right to occupy the site from the village owner or operator

- retirement living communities and villages – facilities comprising apartments or villas in which the residents do not own the unit but live in it subject to a lease or licence to occupy. Retirement villages typically operate under a deferred management fee (DMF) structure

- aged care – a special-purpose facility that provides accommodation and other support ranging from assistance with day-to-day living to intensive nursing care to frail and aged residents.

Increasing degrees of care

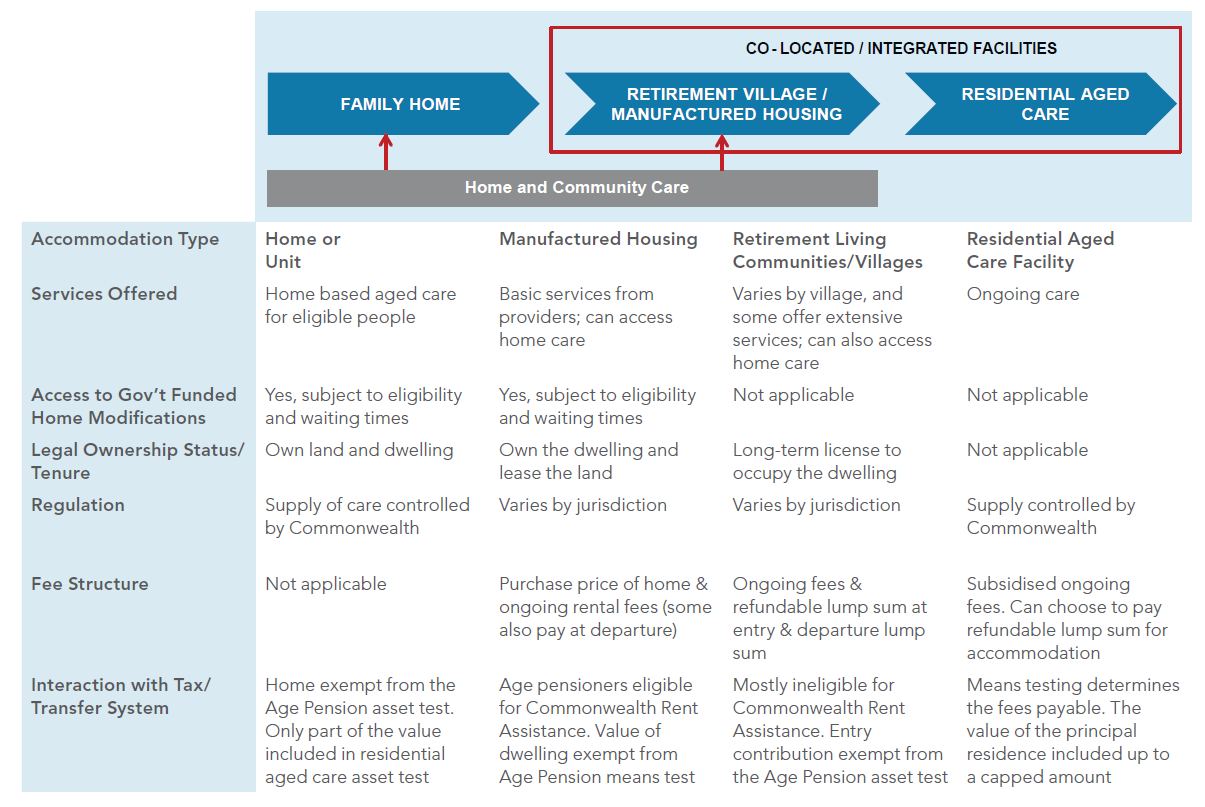

Older Australians are moving along the spectrum of seniors housing, from independent living at home, to accessing low-level support services in a retirement living community or manufactured housing estate, to ongoing nursing care in a residential aged care facility (as shown in Figure 1). There is also a growing move toward integrated facilities, offering a ‘continuum of care’, through the integration of an aged care facility and/or provision of home care services within, or adjacent to, an MHE or retirement living community.

Figure 1: Continuum of care for seniors living

Continuum of care for seniors living

Source: Folkestone and the Productivity Commission. Click to enlarge.

Industry consolidation

Ownership across all three components of the seniors living industry is highly fragmented and the quality of facilities varies widely.

In the retirement living sector, the top six operators represent only 29% of the number of operators in the sector, according to Colliers International. However, approximately 60% of the facilities are currently accounted for by the for-profit operators such as Lend Lease, AVEO, Stockland, Retire Australia, Living Choice, and Australian Unity and 40% by the not-for-profit operators.

The aged care sector is a similar story. As at June 2014, approximately 63% of operators operated a single facility, accounting for 24% of all operational aged care places, while 29% operated between two and six facilities. Conversely, large providers with more than 20 homes comprised only 2% of all providers but 22% of operational places.

Increased participation from the private sector and institutional investors is leading the move from a boutique cottage industry to one of growing sophistication and scale. A flurry of ASX listings in recent years by both specialist aged care operators such as Japara, Regis and Estia, and listed A-REITs such as Gateway Lifestyles, Ingenia, and Lifestyle Communities, have shone the spotlight on the sector. AVEO (the former FKP) is transforming into a specialist retirement and aged care operator. We expect more opportunities for investors to access the sector through the unlisted space via both private equity and unlisted real estate funds.

Changing consumer expectations

Large numbers of affluent baby boomers are expected to bolster the sector’s numbers over the next 10-20 years. These customers will pay more for facilities and services but they will also expect high standards. There will be a greater emphasis on quality service, brand recognition and the reputation of service providers.

The Federal Government wants more people to age in their own home, with a commitment to increase funding for home care packages. MHEs and retirement villages will offer additional services including home care packages within their communities as a way to enhance their overall profitability.

Shortage of quality accommodation

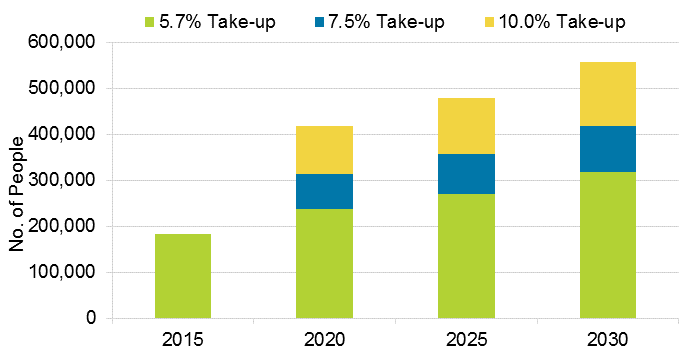

There are approximately 2,300 retirement living communities and villages in Australia, comprising more than 140,000 dwellings and housing approximately 184,000 people, according to the PwC/Property Council Retirement Census for 2015. The average age of a retirement living facility is 23 years, with many of the earlier ones heading towards obsolescence. Folkestone estimates that if the penetration rate of retirement living communities and villages was to increase from just under 6% to 7.5% of the over 65s population, the population of retirement living facilities would more than double to 419,000 by 2030 (see Figure 2). If penetration rates were to increase to 10% (in the US it’s currently around 12%), approximately 560,000 people would be living in retirement living communities by 2030.

Figure 2: Implied demand, retirement living community residents: 2015 – 2030

Source: Folkestone/ABS. Click to enlarge.

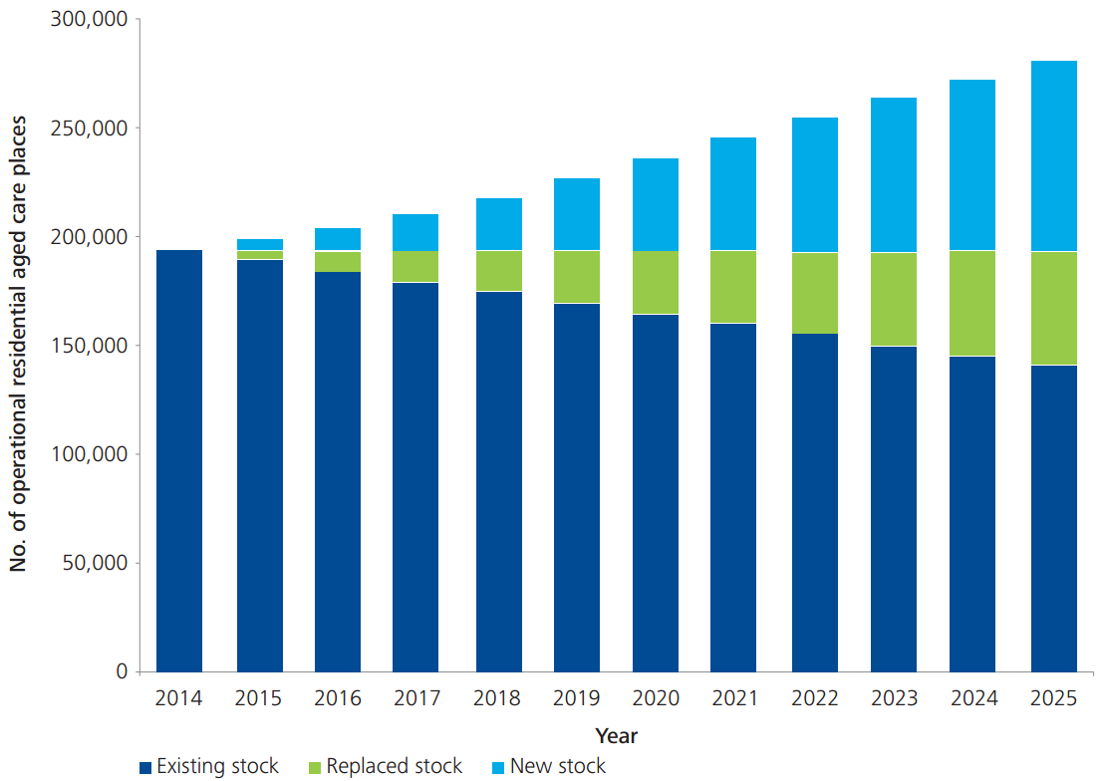

The Aged Care Financing Authority estimated in 2015 that the residential aged care sector will need to build approximately 82,000 additional places over the next decade compared with 36,778 new places created in the decade leading up to June 2014. At the same time, the sector will need to rebuild a substantial number of current facilities which are old, inefficient and don’t meet the standards of the government and the community. Assuming that the cost of construction continues to grow at the current rate, and that a quarter of the current stock of buildings is rebuilt at an even rate over the next decade, the Federal Government estimates the sector will require about $33 billion of investment over the next decade.

Figure 3: Number of operational residential aged care places required, 2014 - 2025

Source: Aged Care Financing Authority. Click to enlarge.

An attractive asset class

We believe all three components of the seniors living sector – manufactured housing estates, retirement villages and aged care – will continue to professionalise, consolidate and become more attractive as an investment asset class.

This will require a substantial amount of capital, and we see significant opportunities for investors taking a long term investment view to participate in the evolution and growth of this important sector either through investing in the operations or the underlying real estate via both the ASX and unlisted funds.

Adrian Harrington is Head of Funds Management at Folkestone Limited (ASX:FLK). This article is general information and does not consider the investment needs of any individual. Future articles by Adrian will explain the fees and funding of various retirement sector facilities.