The rise in global equity prices in recent years has led to concerns over valuation levels. One indicator that appears to cause endless nervousness is the so-called 'Shiller' PE ratio. While the Shiller PE ratio is a poor short-run market timing tool, it has proven to be a reasonable guide for likely longer-run returns in the past. However, allowance today needs to be made for the large structural decline in interest rates.

The Shiller PE ratio is high

Made famous by Nobel-prize winning economics professor Robert Shiller, the Shiller or 'cyclically adjusted' PE ratio (SPER) compares the level of US share prices to the 10-year moving average level of earnings. The indicator became popular after Shiller used the analysis during the dotcom bubble to suggest the market was overvalued and lower returns could be expected over coming years, and he was eventually proven right!

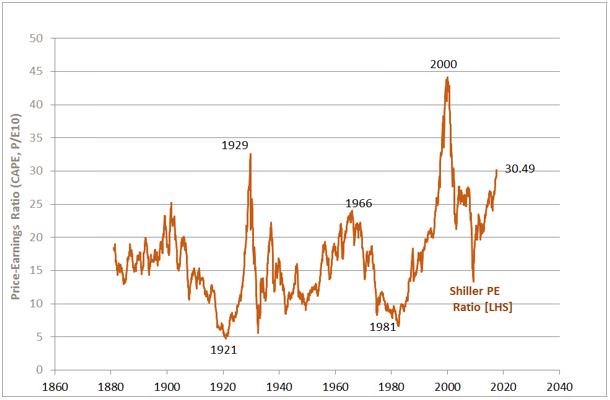

As seen in the chart below, the current level of the SPER is around 30, which is above its average since the 1880s of 16.7. The SPER is higher than during the peak of the late-1960s bull market, and close to the level in 1929 (32.5), but still well below the peak of 44.2 in 1999.

Shiller PE Ratio: 1880 to 2017

Source: Prof. Shiller, Yale University

It’s not a great market timing tool

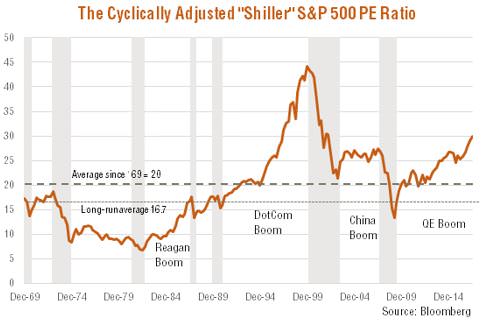

Does this mean the market is about to crash? As seen in the chart below, the SPER has tended to be above average for the much of the past two decades. Indeed, it continued to rise for an extended period through the late 1990s bull market, and hovered above 25 for most of the commodity-driven bull market prior to the financial crisis. As a short-run market timing tool, the SPER has not been much help!

The longer-run outlook for stocks is potentially more sobering

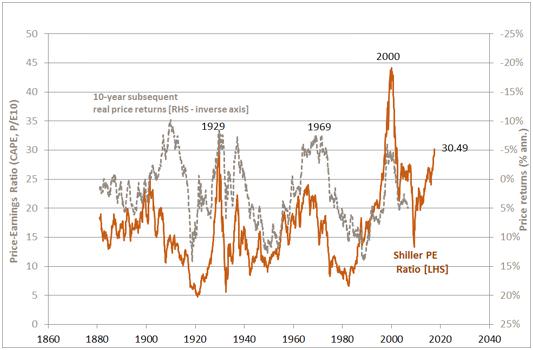

The SPER has had better success as an indicator of longer-run likely returns. As seen in the chart below, relatively high levels of the SPER have tended to be associated with relatively low real share price returns over the following 10-year period. Indeed, the last three times the SPER hit 30 (back in the late 1920s and again twice during the dotcom bust), subsequent 10-year real share prices returns were negative. That does not bode well for likely US share price returns over the coming decade!

Shiller PE Ratio and subsequent 10-year real share price returns

Source: Prof. Shiller, Yale University

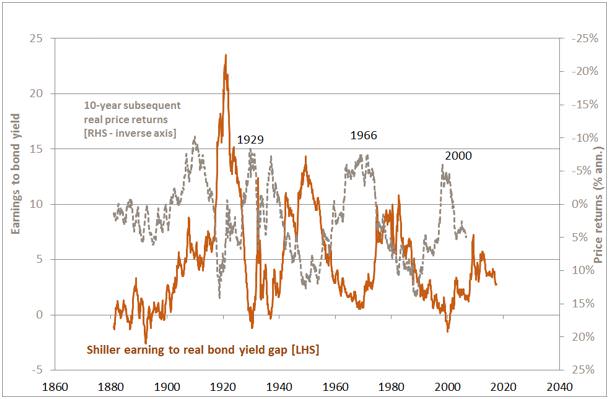

A complicating factor in extrapolating historical patterns is the huge cycle of rising then falling interest rates over the past 50 years. Equity markets faced the headwind of rising rates from the 1960s to the early 1980s, then enjoyed the tailwind of falling rates for the past 35 years.

As seen in the chart below, if we invert the SPER to generate a ‘Shiller earnings yield’ and compare this to real bond yields, current equity market valuations appear less troublesome. The Shiller earnings-to-bond yield gap is currently around 2.7% compared with a long-run average of 4.7%, but past periods of weak 10-year real share returns (in 1929, 1966 and 2000) were associated with earnings to bond yield gaps closer to zero.

Shiller Earnings to Real-Bond-Yield Gap and Subsequent 10-year Real Share Price Returns

Source: Prof. Shiller, Yale University

Compared with 1929, 1966 and 2000, this method of stock market valuation is not flashing red.

David Bassanese is Chief Economist at BetaShares, which offers Exchange-Traded Funds listed on the ASX. BetaShares is a sponsor of Cuffelinks. This article contains general information only and does not consider the investment circumstances of any individual.