Every month, the Challenger technical team receives hundreds of calls from financial advisers. Most recently, questions about how new and upcoming changes to social security means testing may affect their clients have dominated the calls.

These are the top three topic areas from adviser queries regarding legislative change:

1. Assets Test changes

What’s changing and how does it impact my clients?

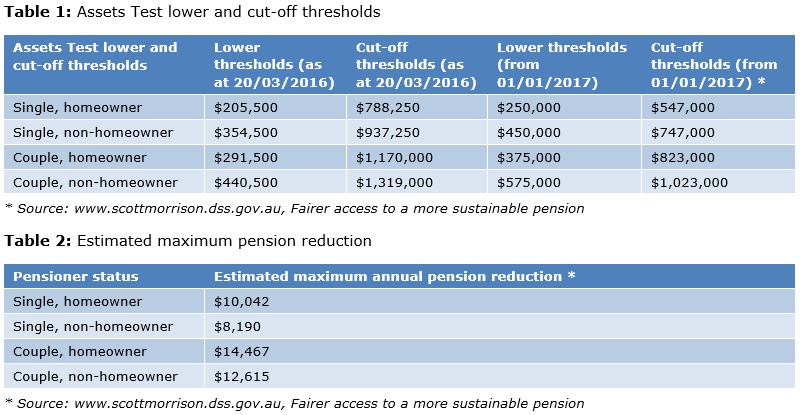

From 1 January 2017 the Assets Test lower thresholds increase (Table 1) and the taper rate will double from $1.50 to $3 per $1,000 of assets per fortnight. The higher thresholds allow clients to hold more assets before their pension starts to reduce under the Assets Test, which can lead to higher pension entitlements.

However, the increased taper rate reduces pensions at a faster rate once assessable assets are above the new Assets Test thresholds, with the largest reduction in pension entitlements (estimated in Table 2) occurring at the new lower asset cut-off thresholds (Table 1).

What about other considerations that I should be mindful of?

- Pensioners who lose their entitlement (and their pensioner concession card) will be provided with the Commonwealth Seniors Health Card (CSHC) without the need to satisfy the CSHC’s Income Test.

- A reduced pension bonus (for those who are registered) as the amount of the pension bonus is based on the retiree’s means tested Age Pension entitlement at the time of claim.

- A grandfathered account-based pension (ABP) becoming deemed where the client’s pension entitlement reduces to nil. When combined with the capping of deductible amounts for defined benefit pensions from 1 January 2016, the additional deemed income from the ABPs can lead to higher levels of assessable income.

What strategies can help?

To help enhance outcomes for their clients, advisers have been considering a combination of Assets Test friendly investment strategies. One strategy is the use of a lifetime annuity to support ongoing cash flow requirements and to help improve pension entitlements over the retiree’s lifetime. Other strategies include gifting within allowable limits; appropriate valuation of personal assets; funeral bonds up to $12,250; prepaying funeral expenses; and contributing funds to a spouse’s super fund who is under pension age.

2. Removal of the rental income exemption

What’s changing and how does it impact aged care residents?

New residents entering residential aged care from 1 January 2016 no longer have rental income from renting their former home excluded from their aged care income assessment.

Prior to 1 January 2016 where the former home was retained, rented out and the resident was liable for a periodic accommodation payment, the rental income was not assessable when working out their means tested care fee (MTCF).

While this strategy is still available to aged care residents from 1 January 2016 and continues to be beneficial from an Age Pension perspective, the rental income will no longer be exempt for aged care. This will generally lead to an increase in assessable income and the resident’s aged care fees.

What can people do in response?

Where this leads to the sale of the home, clients may seek advice on investments that specifically address their aged care needs. Some recent product innovations are now available which can help provide residents with regular cash flow and estate planning certainty.

Where the home is retained (e.g. occupied by a family member or previous carer), additional strategies might become critical. These can include deducting daily accommodation payments from lump sum accommodation payments, accessing equity in the home or seeking assistance from family members.

3. Estate planning for income streams

My client has died, what happens next?

The death of one spouse can have implications on the surviving spouse’s social security pension as they will be assessed using the single rate of pension and Income and Assets Test thresholds. As income stream products are fundamental to retirement income planning, the Centrelink and estate planning implications of these income streams on death are also critical.

Where an income stream reverts to a reversionary beneficiary, the assessable asset value of the income stream for Centrelink purposes will also pass to the beneficiary. For ABPs, this is the account balance, while for non-account based income streams such as annuities, it is the reduced asset value, worked out as:

Purchase price less (deduction amount x term elapsed)

The Centrelink/Department of Veterans’ Affairs assessment of these income streams will generally not change on reversion. That is, the income stream’s deduction amount remains unchanged and only the amount that exceeds the deduction amount is assessed as income. ABPs which commenced after 1 January 2015 or where grandfathered status has been lost, will have their income assessed using the deeming provisions.

In cases where the income stream pays a lump sum death benefit and is paid to a person other than the spouse, it will not form part of the surviving spouse’s assessable assets.

Minh Ly is a Senior Technical Services Analyst at Challenger. This general information is general and does not consider the needs of any individual.