Every Federal Budget is a balance of politics and economics. On Tuesday, Treasurer Josh Frydenberg handed out some short-term goodies in the form of a reduction in fuel excise, a temporary tax cut of $420 for 10 million workers and a payment of $250 to 6 million welfare recipients. The sting in the tail is that the excise is scheduled to return in six months and the entire $1,500 Low and Middle Income Tax Offset (LMITO) will end next financial year, and any new government is facing these two potential grenades.

Both problems are the other side of the election, so it can be sorted out later. There was little in the Budget on superannuation, which seems to have lost its proclivity as a fiscal punching bag. Apparently, deficits don't matter as much as they used to and the retiree vote is too powerful. Here's the Budget Paper comment on the main item relating to super.

The SMSF and super industry loved it because it gives flexibility and retains funds in accounts. SMSF Association CEO John Maroney said:

“The temporary reduction in the minimum drawdown rates will help retirees manage the impact of volatility in financial markets. The reduction is designed to reduce instances where retirees may have to sell some superannuation investments in a volatile or depressed investment market simply to satisfy the Government’s minimum pension drawdown requirements, so, in the current geopolitical and Covid climates, extending the cut in drawdown rates is an important initiative that will help many retirees.”

Even the Treasurer now loves retirees, somewhat ironic given it was Scott Morrison as Treasurer who introduced the caps on the amount allowed in super pensions. Said Frydenberg:

“We recognise the valuable contribution self-funded retirees make to the Australian economy and the sacrifices they made to provide for their retirement. This will provide retirees with greater flexibility and certainty over their savings.”

Let's remember these words if Frydenberg becomes Prime Minister and looks again to target overly-generous retirement benefits.

In reality, the 50% drawdown reduction is no less an election ploy than the other handouts. It allows people to retain more money in tax-advantaged super when policy directs it should be drawn out. Markets have recovered strongly from the pandemic and most retirees are far wealthier than when this measure was introduced for a year in 2020, especially with the skyrocketing value of their homes. Anyone managing a superannuation pension who does not have the minimum legislated amount available in cash is not planning retirement properly. Nobody should need to 'sell in depressed markets' - and markets are not depressed anyway. It's another election sop with the Treasurer knowing around 1.8 million accounts are subject to the minimum drawdowns.

Looking longer term beyond the next election, the government's dilemma is to move to some semblance of fiscal responsibility while meeting expanding costs of health, education, NDIS and other welfare. A potential saviour is higher commodity prices, which are delivering a massive bonus and making Treasury's predictions of only a few months ago look conservative. Treasury also overestimated the damage caused by the pandemic on health and the economy, with low unemployment and a reduction in welfare costs kicking in.

Here's a snapshot of where all the money goes (the second item, 'Other purposes', is mainly payments to states and territories):

Financing a trillion dollars of debt becomes more expensive with higher interest rates, especially as the Reserve Bank scrapped its $350 billion bond buying program in February. This means real investors need to be found at higher yields. Hard to believe we were worried about having no bonds on issue only a decade ago.

Bonds are seeing the type of volatility usually expected in equity markets, with the Bloomberg Aggregate Bond Index (US investment-grade bonds) falling in price over 6% this year, the worst quarter since 1980. Losses on global bonds are even higher.

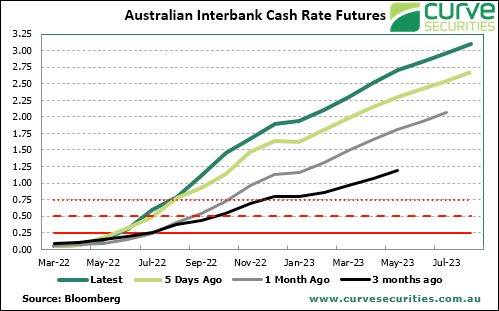

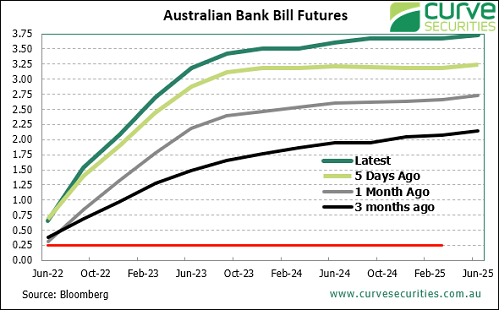

This week, we look at inflation and interest rates with a few fresh perspectives and consider what the Reserve Bank will do over 2022 and 2023, knowing the central bank is itself guessing. Let's hope they guess right because if the futures markets are correct, as shown below, many borrowers will be handing over the keys and losing their dream. A bank bill rate of 3.5% would see variable mortgage rates near 6%. Surely not.

Graham Hand

Weekend market update

From AAP Netdesk: Investors relaxed from pushing Australian shares higher as interest builds for the Reserve Bank's first meeting since the US raised rates. The ASX posted its second consecutive marginal loss on Friday after a run of seven consecutive days of gains ended mid-week. The main talking point for Australian investors next week will be the Reserve Bank's rate decision and commentary on Tuesday. Higher inflation pushed the US Federal Reserve in March to hike for the first time since 2018.

The ASX200 index has struggled to stay higher than 7500 points in the past week. The current level of 7493.8 points is a little more than 100 points from its record of August. The All Ordinaries index closed lower by 3.7 points, or 0.05 per cent, to 7785.9. The market had its third consecutive week of gains and improved 1.18 per cent.

In company news, a NSW planning panel has approved extending the life of Whitehaven Coal's mine at Narrabri. The decision extends the life of the mine from 2031 to 2044, as long as Whitehaven limits carbon emissions. Whitehaven was up about half a per cent to $4.17.

Domain will buy Realbase for the same value and may pay $50 million more if targets are achieved. The company will sell new shares for $3.80 each. Domain shares were paused from trading but last sold for $4.01.

Star Entertainment chairman John O'Neill will run the company while it searches for a permanent boss. Matt Bekier resigned as chief executive this week after an inquiry found Star workers failed in their responsibilities to prevent criminals using casinos. Star was little changed at $3.24.

From Shane Oliver and Diana Mousina, AMP Capital: There were plenty of movements in bond markets. US 10-year yields fell to 2.3% (after getting above 2.5% last week) and 2-year yields lifted to 2.45% this week (from just 1.3% at the beginning of March!). This means that on the 2-10 year yield measure, the US yield curve finally went negative (or inverted). As we have written previously, other measures of the yield curve (like the 10-year less fed funds rate) are still upward sloping (see chart below).

While many commentators and central banks are dismissing the yield curve inversion, I think there is still some relevance in its signal such as the risk of an economic downturn (or recession) in the next 12-24 months, a future bear market or a policy mistake by the central banks which means future interest rate cuts. These are all valid concerns to keep in mind for 2023.

***

Also in this week's edition ...

Remember how in 2020, Treasurer Josh Frydenberg banned conflicted remuneration called stamping fees, particularly targetting Listed Investment Companies and Listed Investment Trusts (LICs and LITs). Treasury had found many advisers and stockbrokers were not acting in the best interests of their clients. Now, with a rapid expansion of investors qualifying as 'wholesale', LICs and LITs are back and the issuers are lining up again.

Shane Oliver and Diana Mousina give their highlights of the 2022 Budget, noting that 'fiscal repair' in the medium term is in the form of restrained spending rather than austerity. Pre-election, the Budget aims to create far more winners than losers but with some stings in the tail.

The conventional logic is that bigger is better when it comes to population and innovation. More people means more researchers and innovators and more consumers to buy products services. However, Emma Davidson sees many benefits in the inevitable decline in global population.

Cameron McCormack explores how investors can navigate changing economic conditions by incorporating factors into their investing approach. He explores how quality, momentum, growth and enhanced value perform throughout the economic cycle.

The Covid-19 pandemic, and the range of policies aimed at mitigating its impact, has triggered a return to levels of inflation unseen for 40 years. Ashok Bhatia believes that there is a strong case for thinking about inflation in the asset allocation process, but also how it fits into the broader objective of portfolio diversification and income generation.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Australian income investors will be partly insulated from the rising interest rate environment with dividend stalwarts in banking and mining set to benefit from or shrug off changes cash rate increases, writes Lewis Jackson. And with all the talk of 'yield curve inversion', Sandy Ward goes back to basics.

And finally, supply chain pressures highlight the important role and economic value created by companies working to make our infrastructure more efficient. Francyne Mu reviews two logistics companies that are well positioned to perform.

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

IAM Capital Markets' Weekly Market Insight

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website