The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two additional articles.

It was 10 years ago this week, on 8 February 2013, that we published Edition 1 of Firstlinks (then Cuffelinks). Firstlinks aspires to offer timeless insights and education to its readers, with less of the daily noise of other newsletters. It is pleasing to look back on Edition 1 and see most of the articles remain relevant today, including a piece by former PM, Paul Keating. To mark the milestone, we are republishing a simple explanation of franking credits by Chris Cuffe which remains as accurate as when it was written. Did you know a super fund only needs to hold 32% of its assets in fully franked Australian shares to pay no tax?

***

On the subject of financial education, let's take a quick look at the role of the industry regulator.

Regardless of how much any person believes in capitalism and the free market economy - and Treasurer Jim Chalmers has had plenty to say about these in the last week - everyone agrees there is a role for financial markets regulators. Like it or not, the finance industry includes rogues and charlatans who need regulation and in some cases punishment. Many of our most respected businesses step out of line in their pursuit of profit and must face aggressive enforcement of laws to protect investors and the public.

As well as its role in regulating the conduct of Australian companies and financial markets, the Australian Securities and Investments Commission (ASIC) offers a wide range of educational resources. Firstlinks provides a section in our Education Centre highlighting the useful material on the Moneysmart website. There is a great selection of financial calculators including:

- Superannuation contributions optimiser

- Super versus mortgage calculator

- Retirement planner

- Super and pension age calculator

- Compound interest calculator

- Budget planner

- Income tax calculator

Links to all these resources and many more are in our Education Centre.

While ASIC performs essential services, it is not beyond criticism, such as when the Hayne Financial Services Royal Commission found its enforcement activities around financial advice and wealth management were poor.

The equivalent government agency in the US is the Securities and Exchange Commission (SEC), and it has also faced severe criticism for failing to enforce securities laws and sanction major financial institutions. Despite market manipulation and favouring inhouse books over clients, leading US investment banks were bailed out of the GFC and nobody went to jail.

The SEC also provides education services but they have limited relevance to Australians because our system of tax and superannuation is manifestly different. Nevertheless, it's revealing to look around its website for unusual activity and lessons for Australian law enforcement. How about this:

"The Securities and Exchange Commission today announced an award of more than $28 million to joint whistleblowers who provided critical information and assistance in an SEC enforcement action ... Whistleblowers may be eligible for an award when they voluntarily provide the SEC with original, timely, and credible information that leads to a successful enforcement action."

No doubt there was considerable angst involved in earning the US$28 million but it's a lot of money and whistleblower identity is not revealed. ASIC has rules around whistleblower protection but one reason we do not hear many stories about Australian whistleblowers is, according to ASIC,

"Unlike some foreign countries, whistleblowers in Australia are not eligible to receive a financial reward for making a whistleblower report; the Corporations Act does not provide for it."

While every publication needs to decide the right level to pitch its material on its education pages, some of the SEC content is low brow, such as this comparison of (American) football with investing:

"It’s a good time to talk about how investing is a lot like football. Both need a strong playbook to be successful. To invest wisely, you should put together a special team of professionals so there is safety for your holdings and you can hand off assets to your family without stressing whether your investment is a coin toss. It’s important to huddle with those involved in your future financial plans to identify goals. Every investment plan should have a strong offense ... As you kick off your financial plan, it is vital you keep in mind your level of risk tolerance."

And on it goes attempting to put a football term into every sentence. Nevertheless, it started me thinking and it misses the most important point when comparing football with investing in retirement.

I play soccer each week with a bunch of guys who are all over 60. Some of them once played at a high level and despite slowing down over the years, they still show some silky skills. But we welcome anybody, and some of the blokes are former rugby players who want to stay fit in a competitive game without the physical brutality of rugby. The problem is, when a rugby player turns to soccer at the age of 50 or later, trouble is not far away. They can't stop. They don't realise they are not supposed to simply barge into a tackle, or run over the top of the player with the ball. At times when it's not comical, it's dangerous.

They think they can play soccer because they played rugby. Like, how hard can it be?

It's the same when they start investing in retirement by picking their own stocks. The guys know I work in investing and often discuss markets and even their own portfolios with me. Many enjoyed good careers, earned a lot of money as doctors or architects or engineers, and when they retire, their minds turn to investing. Like, how hard can it be? Just open an account with a stockbroker, and like playing rugby, barge in and do it themselves. Anyone can.

This is not investing of the type where they place their money in a cheap, diversified index fund and lie in a hammock reading a book. This is investing by buying and selling stocks. One player told me he owns about 200 stocks worth $2 million. If he sees a stock he likes, he puts $10,000 in it, and this occupies him for several hours a day, checking his portfolio.

He asked me what I thought about his strategy. How could I put it gently to a friend? I told him the only reason to follow this technique is if he enjoys doing it, and it occupies him in retirement. It's highly unlikely that he is doing better than a cheap (almost free) index fund, or a person who has spent 40 years as a portfolio manager. He'll have winners and losers and he'll jump at shadows and he'll tell himself he's good at it. If he's happy, go for it. It's more like entertainment than investing. Just like the beefy rugby player who laughs when the skinny soccer player gets hit by a truck.

What would the 92-year-old Warren Buffett say about this instant expertise? Here are four quick gems.

"Among the various propositions offered to you, if you invested in a very low cost index fund - where you don't put the money in at one time, but average in over 10 years - you'll do better than 90% of people who start investing at the same time."

"Risk comes from not knowing what you're doing ... There is nothing wrong with a 'know nothing' investor who realises it. The problem is when you are a 'know nothing' investor but you think you know something."

"We've long felt that the only value of stock forecasters is to make fortune tellers look good. Even now, Charlie and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children."

"If you like spending six to eight hours per week working on investments, do it. If you don't, then dollar-cost average into index funds. Just pick a broad index like the S&P 500. Don't put your money in all at once; do it over a period of time."

When I told author Peter Thornhill that I was writing about LICs, and asked him why he does not harvest discounts but sticks to the large LICs that trade around NTA, he replied:

“In the recent past I have begun to unwind my direct shareholdings where possible and moving the cash into a small handful of LIC's, about six. As I started with the LIC's some time ago the bulk are the old ones and I have been adding to them steadily so the holdings are substantial. I'm too lazy to go digging for a few bits here and there. As I tell audiences, I have better things to do with my life than spending time on the computer. I have a beautiful wife and family and we love to travel. We live a life we could never have imagined and, the most important lesson I have learnt over the last 40 odd years and after 1000's of presentations, happiness is to envy no one!”

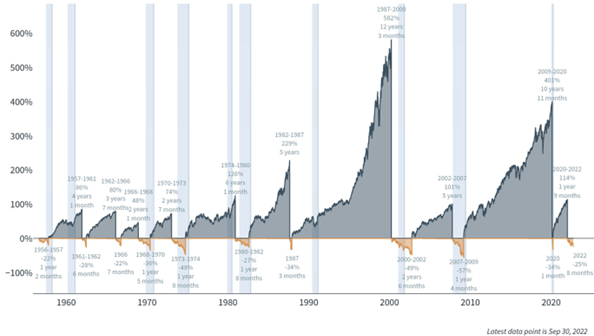

Once invested, it's essential not to panic and sell in a down market. It's not easy with all the talk of a recession and higher rates and investment banks such as Morgan Stanley arguing the market is expensive and earnings are falling. But for those who have the temperament to hang on, the data on the S&P500 below shows over the last 70 years, up markets have lasted far longer than down markets, about six times longer. Since World War II, the US has faced 13 economic recessions but the increases eventually overwhelm the falls.

Source: Clearnomics and Seeking Alpha

And so to the Reserve Bank, which shocked the market with the severity of the wording in Tuesday's release. Here is Gareth Aird from CBA.

"To be clear, we do not share those same concerns. We believe that the RBA’s 300bp of rate hikes between the May and December 2022 Board meetings had very little impact on price changes in the economy over 2022.

Indeed high inflation last year largely reflected the massive fiscal splurge over 2020 and 2021, coupled with ultra-loose monetary policy, to support the economy through the pandemic. The war in Ukraine also played a role in boosting prices through supply side disruptions. And the pandemic itself disrupted supply chains more generally. Finally, some idiosyncratic factors domestically, like floods on the East Coast of Australia, also boosted prices for some food items.

The key point is that rapid interest rate hikes in 2022 will impact demand for goods and services in the economy and by extension price changes in 2023 and 2024. Monetary policy tightening did not impact price outcomes in 2022.

But our job is to call what we think the RBA will do and not what we think they should do. As such, we now expect the RBA Board to raise the cash rate by a further 25bp at both the March and April Board meetings. This would take the cash rate to 3.85%."

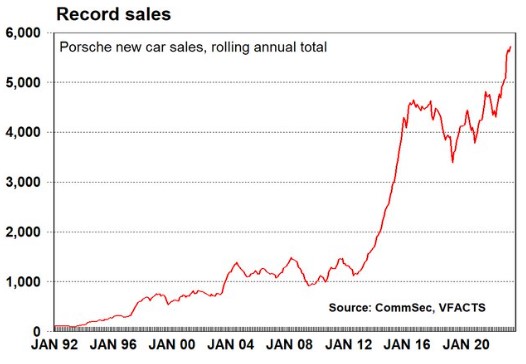

Look no further than new car sales in Australia, as the following shows for Porsche, to see how slowly higher rates are impacting buyers. In 2022, new car sales in Australia totalled 1,081,429 units, the highest since 2018. December 2022 alone achieved sales of 87,920, well up on 2021. The top two models were Ford Ranger and Toyota HiLux, suggesting a few tradies have done well.

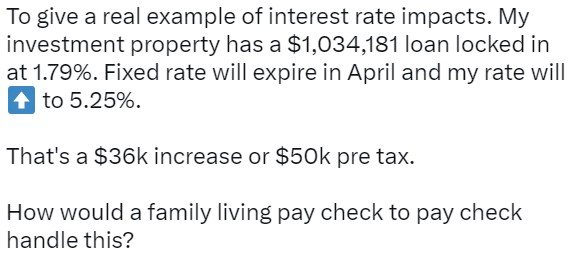

The Reserve Bank's forecast of more rate rises in the "months ahead" was especially surprising given the nine consecutive cash rate increases already delivered. With 800,000 borrowers coming off fixed rates over the rest of 2023, frugality must gather some steam soon. Why is the Governor again looking far ahead by warning of rate rises regardless of what the future data says when his forecasting track record is far from impressive. This borrower will pay far more than 5.25% in April.

Graham Hand

Also in this week's edition ...

The 2022 calendar year was challenging for most investors, yet it was especially difficult for ethical investors like Mike Murray of Australian Ethical who don't touch the energy sector - by far the best performing sector on the ASX. Nonetheless, Mike is sticking to his principles and sees opportunities in several areas of the market, including lithium, insurance and software.

Looking more broadly across major asset classes in Australia - cash, bonds, property, and stocks - James Gruber drills down to compare how the valuations of each stacks up. And he reveals what's cheap and what's not.

Passive investment's rise seems to know no bounds, though Daniel Taylor of Man Numeric believes a top may be nearing. He admits that as a investment manager, his views are self-serving but he gives evidence that active investing may soon come back in vogue.

Industrial property has been in favour for some time now, given the ascent of online retailing and limited supply of land to build new warehouses. That's resulted in record rental growth and vacancy rates of less than 1%. Steve Bennett and Sasanka Liyanage of Charter Hall don't see the momentum shifting any time soon, with supply imbalances driving continued rental growth.

Did anyone tell the Treasurer that if he had replaced the $5 note with a $5 coin, he could have saved $1 billion? Owen Covick and Kevin Davis argue the merits for a $5 coin, and even delve into the thorny issue of whether a monarch should appear on it.

In the weekend update by Morningstar, Mark LaMonica explores two investment opportunities in the A-REIT sector, while Neil Macker looks at Disney's earnings and its decision to axe 7,000 jobs.

Lastly in this week's whitepaper, Perpetual and the Australian Securitisation Forum look at the reasons for the growth of non-banks in Australia and New Zealand, as well as the sector’s opportunities and challenges for future growth.

***

Weekend market update

On Friday in the US, stocks shook off some intraday losses to settle just north of unchanged on the S&P 500, though Treasurys broadly weakened with two- and 30-year yields settling at 4.5% and 3.83%, respectively, up two and eight basis points on the day. Energy caught a strong bid with WTI crude settling near $80 after Russia announced a 500,000 barrel per day production cut (equivalent to 5% of its output), while gold edged lower to $1,874 per ounce.

From AAP Netdesk: On Friday in Australia, shares finished lower for the fourth session of the past five, and this time their losses were the week's worst. The benchmark S&P/ASX200 index finished Friday down 56.6 points, or 0.76%, to a three-week low of 7,433.7, while the broader All Ordinaries dropped 64.7 points, or 0.84%, to 7,631.1.

Every ASX sector except consumer staples was in the red on Friday with tech stocks the worst performers, falling 2%. Wisetech Global dropped 5.1% and Afterpay owner Block declined 6.2%.

Coalminers were hammered as the price of thermal coal plunged further.

Newcastle coal futures have dropped from around $US360 a tonne in late January to around $US225, their lowest level since the start of the war in Ukraine more than a year ago.

Bloomberg reported on Thursday that embattled Indian conglomerate Adani Group has been selling the commodity at a discount as it faces liquidity issues.

Whitehaven fell 3.7% to a five-month low of $7.74, New Hope sank 8.6% to a near three-month low of $5.31 and Yancoal dropped 5.9% to a two-month low of $5.45.

The big banks were all lower, with NAB down by 0.9% to $31.68, ANZ dropping 0.8% to $25.71, Westpac declining 0.3% to $23.84 and CBA down 0.2% to $109.95.

But insurers gained, with IAG up the most, by 1.3%.

Consumer staples also defied the sell-off, with alcohol retailer Endeavour Group up 2.4% to $6.82 after adding digital transformation expert Rod van Onselen to its board.

In the heavyweight mining sector, BHP dropped 0.3% to $48, Fortescue declined 2.3% to $22, and Rio Tinto retreated 1.1% to $122.55.

REA Group fell 2.7% to $121.11 after the realestate.com.au owner said its half-year profit after tax had fallen 9% to $205 million amid a drop in listings following rapidly rising interest rates.

From Shane Oliver, AMP:

- Global share markets mostly fell over the last week on hawkish comments from the Fed, higher bond yields and recession concerns. For the week US shares fell 1.1%, Eurozone shares fell 1.3% and Chinese shares fell 0.9% but Japanese shares gained 0.6%. Australian shares also fell 1.6% not helped by more hawkish than expected interest rate guidance from the RBA with falls led by property, health, utility and IT stocks. Bond yields mostly rose on increased interest rate expectations. The $A was little changed despite a rise in the $US.

- We remain reasonably upbeat on the outlook for investment markets this year as inflation falls and central banks get off the brake, but it won’t be smooth sailing. And after a very strong start to the year, shares are vulnerable to a pullback. Till their highs last week global shares were up 8.6% year to date and Australian shares were up 7.4%. This was above or roughly in line with our expected gains for the whole year. But we still expect that it will be a volatile year given that: the process of getting inflation back down won’t be smooth; the topping process in central bank rates will take time with setbacks along the way as we have seen for both the Fed and the RBA over the last week; recession risks are high; raising the US debt ceiling around the September quarter won’t be smooth; and geopolitical risks around Ukraine, China (as highlighted by the balloon over the US) and Iran are significant. With shares getting overbought after the new year rally and seasonality turning less positive (February can often be a bit messy after a December/January bounce), shares both globally and in Australia are vulnerable to more of a pull back in the short term.

- Fed pushing back against the market getting too dovish and expecting rate cuts later this year. Following the prior week’s stronger than expected jobs data, Fed officials struck a somewhat more hawkish tone over the last week. Fed Chair Powell emphasised the Fed’s expectation for two more rate hikes but arguably wasn’t as hawkish as feared. However, other Fed officials were more hawkish stressing the need for rates to be higher for longer. We continue to expect another 0.25% hike in March and since we expect inflation to fall faster than the Fed does – as suggested by our Pipeline Inflation Indicator which is continuing to fall – we expect this to be the peak for the Fed ahead of rate cuts later this year. The stronger than expected January payroll report in the US added a bit of upside risk to this, although jobs are always a lagging indicator.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website