The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two additional articles.

Don't believe what Treasury and others say about a 30% superannuation tax. It is not a 30% tax on large balances, represented by the sum of the existing 15% tax on accumulation funds plus another 15% on balances above $3 million. It is a completely new tax with a different calculation method. If anyone disagrees with this, answer the question: '30% of what?' There is no answer. It's also not a 'doubling of the tax rate', as many journalists are now writing. The new tax is not 2x, it is x plus y.

The implications of taxing unrealised gains are slowly dawning on people, but it's doubtful Treasurer Jim Chalmers and Treasury understood the consequences of their new measurement method when it was proposed. Their first press announcement was incorrect:

"From 2025-26, the concessional tax rate applied to future earnings for balances above $3 million will be 30%."

Consider a simple example. An SMSF holds one asset, an investment property, which delivers taxable income, net of deductions, of $10,000 in a financial year. In an accumulation fund, tax at 15% is $1,500. Assume the property increases in value by $100,000. The new tax is calculated at 15% of $110,000 (income plus unrealised capital gain) with adjustments according to Treasury's formula. That's not another $1,500. These are two different 15% taxes, not a 30% tax.

Chalmers now needs to defend the new tax, including the unrealised gains. In a press doorstop on the weekend, within the space of a few sentences, he said the word 'modest' five times and 'simple' four times. It might be simple for large super funds who do not need to administer it, but it is not simple for the individuals affected. They could receive a large tax liability notice without the cash to pay it, and revaluing unlisted assets will become a major headache.

It's a Shakespearean reminder of Hamlet, where his mother, Gertrude, is asked about the queen in a play who repeatedly states she would not remarry if her husband dies. The famous reply, "The lady doth protest too much, methinks" means a point is made so much that the opposite is probably true.

Chalmers has taken comfort from the support given to the new tax by the Managing Director of National Australia Bank, Ross McEwan. However, when interviewed by Patricia Karvellas on ABC’s Radio National on 3 March 2023, McEwan was not asked about the unrealised gains. Did he know the implications or was he still on the 30% bandwagon?

“Actually, I think $3 million is a lot of money to have a super fund. I'm sure I'll put myself out there and people say, “You should never have said that” but I think $3 million is a lot of money. And a 4% return on that, I'm pretty sure after tax somebody could live on $120,000. It's not a bad sum of money. It's a move that probably needed to be made ... So that's just a reality of where we are. If we're all going to have to play our part to get this economy back into shape, get the debt down to the country. There's lots of decisions we don't like. We get a chance every three-odd years to make a decision.”

How much will support waver as people realise there is far more to this policy than a simple tax on amounts over $3 million?

Following McEwan, Samantha Maiden from News was asked why the Government made such a hasty decision:

"Look, it was a very peculiar thing, right? Because they started this conversation and conversations can be very dangerous. And then, you know, two seconds before they announced it, Anthony Albanese was telling people that they hadn't made a decision then all of a sudden, they had. One of the most extraordinary elements of it is that the Government just doesn't seem to have been very consistently effective about selling it. It's actually other actors in this debate who are far more effective. So for example, that interview that you've just done with the NAB CEO is the best birthday present Jim Chalmers didn't get yesterday.

And you know, this morning, Richard Marles has been on the Today Show with Karl Stefanovic, where he was completely unable to answer questions about how they were going to deal with this profit. So he was asked three times by Karl Stefanovic, it was a GST birthday cake moment if I've ever seen one ... Even though they do have the broken promise thing and I'm not minimising that but it should be something that's not so difficult to sell."

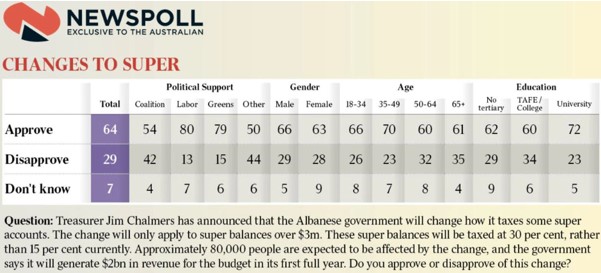

The first major survey question by Newspoll, detailed below, only mentions the $3 million and not the tax on unrealised gains or lack of indexation. The surprise in this result is that one-third either disapprove of the policy or don’t know, which is strong support for no change given only 0.5% of people will be adversely affected.

Then speaking on ABC Radio on 6 March 2023, political commentator Michelle Grattan was asked about the Newspoll survey supporting the Government’s super changes and what it demonstrates. She replied:

“Certainly, it will be a great relief for the Government because the whole issue has blown up into a huge argument, but it does show that the bottom line has cut through and people are accepting this is a fair change, and one that's necessary to make the system sustainable. Having said that, I think that the Government still has a big argument in front of it over the detail of the change and whether that high level of support holds. We'll see as that argument unfolds.”

This week, we take a deep dive into 10 aspects of the new superannuation tax which are receiving less attention, but which show the implementation will be far from straightforward, despite Jim Chalmers' Hamlet-like protestations. Many in his party are wondering whether the angst is worth it for only $2 billion in tax revenue a year.

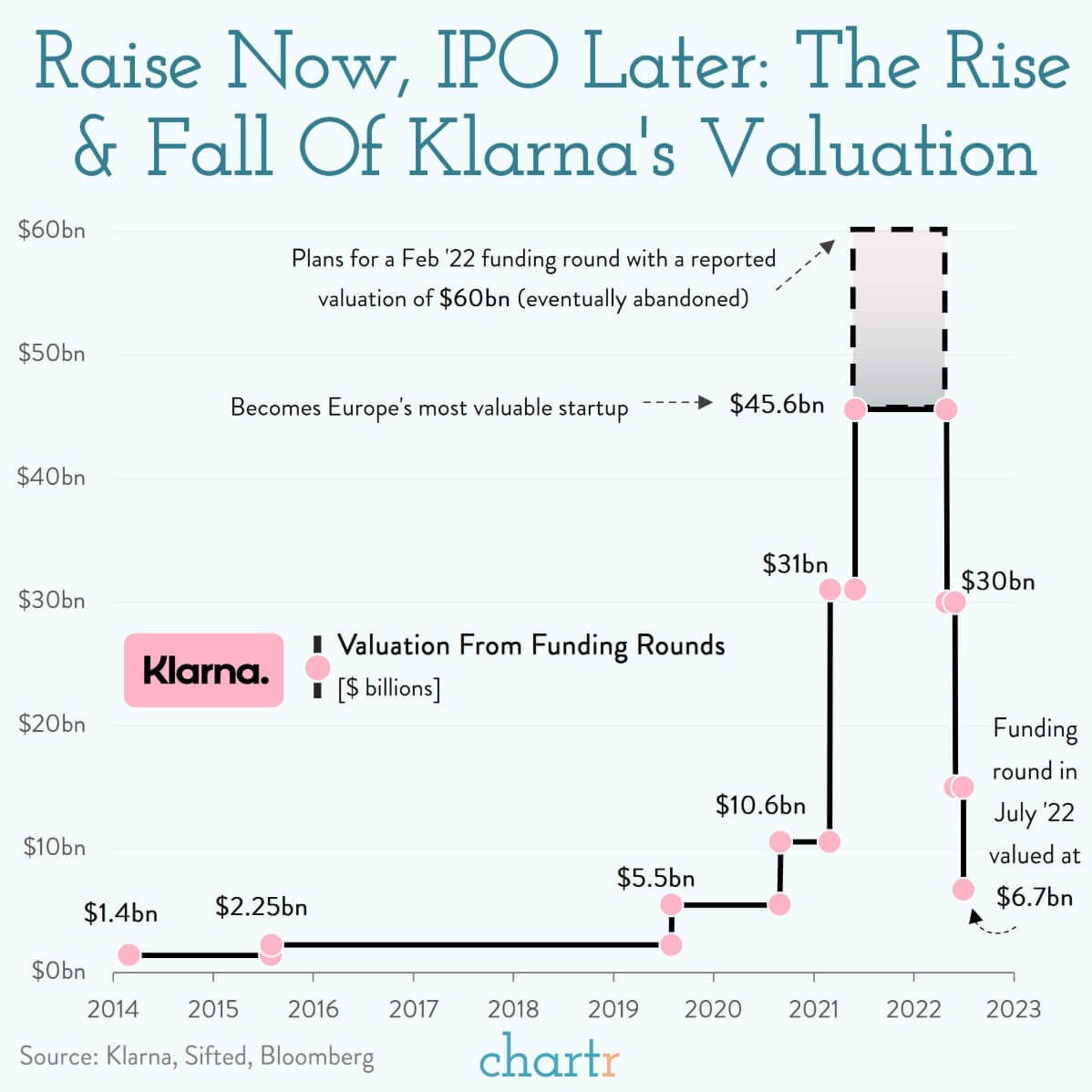

The splendid chart on the valuation of Klarna, the Buy-Now-Pay-Later business part-owned by the CBA, shows how the unrealised gains tax can hit hard (and we use some local BNPL examples in the related article). As recently as 2019, Klarna raised funds at a $5.5 billion valuation but reached a $60 billion valuation at the start of 2022. Struggling with losses and cash burning, it recently raised $800 million at a valuation of $6.7 billion. Many people choose their SMSFs to hold such assets, potentially creating massive tax liabilities when the value has not really changed over four years.

***

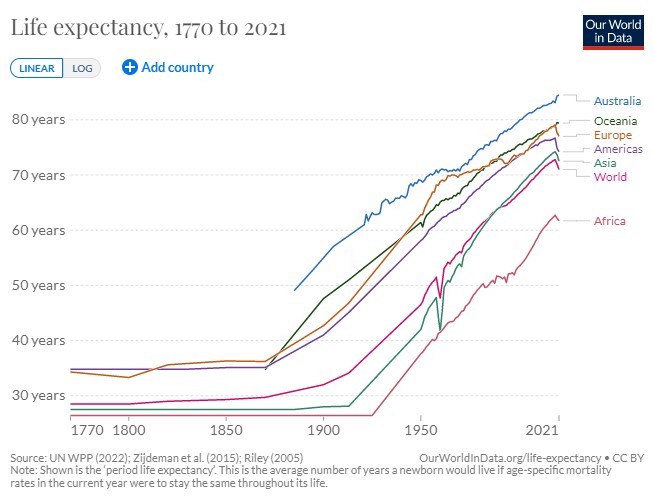

On the subject of living a long time (that is, superannuation), the latest life expectancy data has good and bad news for Australians. On the bad side, around the world, the pandemic has shortened life expectancy like no other single health issue for many decades, and this has continued into 2022/2023. On the good side, the data below shows Australians have the longest expectancy of any of the data sets in the comparison. Hanging on to decent superannuation balances is important for Aussies as we will live so long.

***

The Australian dollar fell to its lowest level since November 2022 after hawkish commentary from Federal Reserve Chairman Jerome Powell contrasted with RBA Governor Philip Lowe's dovish turn. Powell warned of interest rates rises including a possible return to 0.5% levels. He told the US Senate:

"The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated."

But Phil Lowe told the Australian Financial Review's Business Summit that the Reserve Bank Board had discussed a potential interest rate pause and that rates were already in "restrictive territory". Lowe stressed an important difference between the US and Australia:

“In the US, when the Federal Reserve raises their mortgage rates, if you’ve got an existing mortgage you don’t pay more. In Australia, you do.”

Graham Hand

Also in this week's edition ...

Ron Bird says the Albanese Government has lost sight of the real purpose of superannuation. Sure, it involves setting aside savings to fund retirement, but these funds come from somewhere. Contributions to superannuation involve sacrificing current consumption with the expectation of being able to consume more in the future. This trade-off should be the focus in making policy, and super is benefitting the wrong people.

The Government is determined to limit early access to super to help pay down a mortgage, much to Jon Kalkman's chagrin. He says younger people should have the option to draw on their super balance, within limits, to assist with their housing needs at the time in their lives when they need it most. Current policy is inequitable and hypocritical as it allows retirees to access their super early to pay off their mortgage.

ATO figures show about 20% of the $890 billion in SMSFs is allocated to cash and term deposits. Vanguard's Jean Bauler says while this is understandable to an extent, more of the money is likely to make its way into bonds given the now attractive yields on offer.

Warren Buffett's partner, Charlie Munger, is famous for applying disciplines outside of finance to give him an edge in markets. James Gruber follows suit by looking at how ecological niches can be applied to stock markets and may help you become a better investor.

Matt Reynolds of Capital Group says the pandemic has permanently changed global supply chains. Businesses are moving away from being too reliant on China or other countries, and that has vast implications for both companies and markets.

Brad Potter of Tyndall says the recently passed Inflation Reduction Act is poised to have a significant impact on the US economy, especially in the renewable energy sector. The Act includes provisions that incentivise the growth of the renewables sector, creating a 'supercycle' of investment and development, and Australia is well placed to benefit.

Earlier this week, to celebrate International Women’s Day, Morningstar's Annika Bradley led an empowering and thought-provoking panel discussion with industry leaders Katie Hudson, Elizabeth Kumaru, and Dr Laura Ryan. They shed light on how to #EmbraceEquity, discussed the importance of financial literacy for women and shared experiences and learnings on investing. If you missed out on the livestream, watch the recording here.

In the weekend update by Morningstar, Josh Peach looks at five overvalued ASX shares to avoid buying today while Susan Dziubinski highlights ten US growth stocks to own for the long term.

Lastly, in this week's white paper, Capital Group explores various scenarios for inflation and interest rates, and the analysis points to one clear conclusion: the importance of investing in fixed income.

***

Weekend market update

Friday was an eventful day on Wall Street with the second-biggest bank failiure ever in the US. Regulators closed Silicon Valley Bank, the 16th largest bank in America.

Unsurprisngly, there was another round of panic buying in short-dated Treasurys as the two-year yields plunged to 4.6%, a stunning 45 basis points below Wednesday’s close, while the long bond rallied to 3.7% from 3.88% the day prior. Stocks sank 1.4% on the S&P 500 to wrap up a brutal minus 4.2% showing for the week and narrow the 2023 advance to less than 2%, while WTI crude rose to near $77 a barrel and gold ripped 2% to $1,872 per ounce. The VIX rose two points to 24.7 for its most elevated close of the year.

From AAP Netdesk:

On Friday, the local share market suffered its worst single-day loss in five months after news of Silicon Valley Bank's difficulties broke. The benchmark S&P/ASX200 index on Friday plunged 166.4 points, or 2.28%, to an eight-week low of 7,144.7. The All Ordinaries dropped 166.2 points, or 2.21%, to 7,348.2.

Every sector finished lower except for utilities. Energy was the hardest hit, falling 3.4% as Woodside dropped 3.5% to $34.05.

The heavyweight mining sector fell 3.1%, with BHP down 3.4% to $45.01, Fortescue retreating 2.7% to $21.51 and Rio Tinto losing 3.3% to $117.28.

Financials were down 2.8% with major losses for all the big banks. CBA dropped 3.3% to a near-five-month low of $95.51, NAB fell 3.0% to $29 and Westpac and ANZ both retreated 2.6%, to $21.79 and $23.85 respectively.

Macquarie fell 3.2% to $184.66 and Suncorp dropped 2.8% to $12.62.

In the mining sector, there were also sharp losses among lithium players as the price of the battery metal continued to drop. Liontown fell 8%, Allkem 8.6% and Pilbara 7%.

Piedmont Lithium fell 6.3% as it responded to a critical report by a short seller, Blue Orca Capital, and announced its Quebec lithium mine had produced an initial batch of spodumene concentrate.

Goldminers were a rare spot of green, with Northern Star adding 1.7% and Gold Road Resources climbing 1.4%.

Origin Energy climbed 2.5% to $8.35, bolstering the utility sector, following a report that Brookfield Asset Management and EIG Partners could submit a binding $18.2 billion takeover offer for Australia's largest energy retailer as early as next week.

Booktopia fell 4.2% to 23c after the Federal Court ordered the online bookseller be fined $6 million for breaching Australian consumer law over its returns policy.

From Shane Oliver, AMP:

- Global share markets mostly fell over the last week with more hawkish commentary from Fed Chair Powell and worries that problems at two regional US lenders may mean wider issues for banks. This saw US shares fall 4.6% for the week giving up most of their gains for the year to date and Eurozone shares fell 1.8%. Chinese shares also fell 4% but the Japanese share market rose 0.8%. While Australian shares were initially boosted by a less hawkish RBA they succumbed to the global weakness to be down around 1.8% for the week with falls in resources, health and financial shares leading the declines. Bond yields mostly fell helped partly by safe haven demand and in Australia by less hawkish RBA commentary. Oil and metal prices also fell, but the iron ore price rose. With a more hawkish Fed and less hawkish RBA the $A fell as the $US rose.

- Are we going to see broader systemic problems in US banks? The collapse or closure of two regional US lenders – Silicon Valley Bank which landed to tech start-ups and Silvergate Capital which was a crypto friendly lender have led to concerns that they may reflect the start of broader problems in the US banking system. This is quite possible as Fed rate hike cycles by tightening financial conditions invariably trigger financial stresses (think the tech wreck and GFC) and troubles in start up companies and crypto businesses and nervous depositors in banks who fund them are not that surprising in this environment and given what’s happened to crypto over the last year. At this stage its too early to tell if problems at these lenders reflect just isolated problems or are indicative of wider potential problems impacting the US banking system. Either way banks are likely to see a tougher environment ahead as growth slows and higher rates cause more financial stress for borrowers. And it is a sign that Fed tightening has got traction and the Fed may be close to the top on rates.

- Fed Chair Powell confirms the Fed has becomes more hawkish in the last month. This reflects the recent run of stronger than expected economic data with inflation falling more slowly than previously indicated. As a result, Powell indicated that the peak level of interest rates is likely to be higher than previously expected and if warranted the Fed is prepared to step up the pace of rate hikes again. At its December meeting the Fed dot plot of officials’ interest rate expectations indicated a peak of 5-5.25% but this now looks likely to move up to 5.25-5.5% at this month’s meeting.

- It was a different story at the RBA, which in contrast to the Fed has become less hawkish. As expected, the RBA increased the cash rate by another 0.25% taking it to 3.6%. But thanks to a run of softer economic data the RBA wound back its hawkishness from last month that followed the stronger than expected December quarter inflation data. While its still hawkish and repeated its message on the need to get inflation down, it acknowledged recent data that showed slowing growth, some easing in the jobs market, signs of a peak in inflation and reduced risk of a wages breakout. As such it toned back its guidance on the expected outlook for interest rates from several more rate hikes to maybe just one more and opened to door to a pause in rates with Governor Lowe noting that “with monetary policy now in restrictive territory, we are closer to the point where it will be appropriate to pause interest rate increases to allow more time to assess the state of the economy.”

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Plus updates and announcements on the Sponsor Noticeboard on our website