The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Legendary US basketball star, Wilt Chamberlain, died in 1999 but he is remembered for scoring 100 points in a single game and other individual records which still stand today. His intimidating physical stature at over seven feet tall and weighing 250 pounds and his aggressive approach to playing and living meant he was generally disliked across the NBA league, but he came up with the famous quote:

"Everybody pulls for David, nobody roots for Goliath."

There's a strange 'nobody roots for Goliath' in Australian funds management, as these numbers show:

- In the March 2023 quarter, the total managed funds industry in Australia rose $137 billion to $4,545 billion (ABS release 1 June 2023)

- On 31 May 2023, the total in Exchange Traded Funds (ETFs) was $143 billion (ASX and Cboe releases).

That's right. Goliath, or managed funds, rose almost as much in three months as the entire size of David, the ETF market. At $143 billion versus $4,545 billion, David is 3.1% of Goliath. Yet everybody pulls for David, and the greater coverage of ETFs gives the impression that it is the dominant structure capturing market flows. Put it down to the greater marketing commitment by ETF providers who not only promote their own funds but ETFs (or ETPs) in general, and their listed status gives them more exposure. The ease of investment in ETFs augurs well for their future growth.

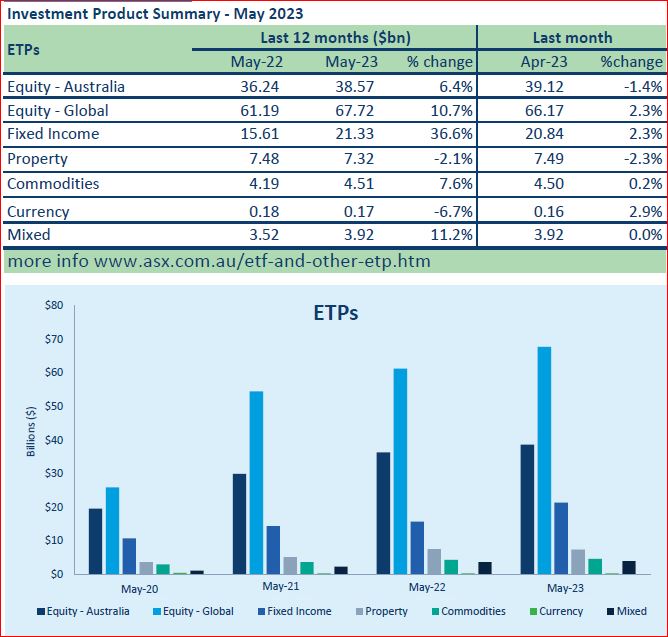

Look at the chart below from the ASX, and there's the story at the moment.

Global equites and fixed interest both up about $6 billion in a year, which while good for ETFs, is small for managed funds. The skilled ETF marketers give enthusiastic reporters (including from Firstlinks) the numbers and the story angles, while Goliath sleeps in the background with nobody cheering him on.

For example, in last week's Weekend AFR, in its Smart Investor section, the lead story was 'The Income Option'. It started:

"Some exchange-traded funds are bringing the 'covered call' strategy normally used by institutional investors to everyday portfolios ..."

ETFs are credited with an innovation which the managed fund industry has offered to retail investors for 15 to 20 years. I wrote about it a couple of weeks ago, yet every example in the AFR article is an ETF.

Then two pages further on, the heading - which was also on the front page - was '11 ETF strategies for income investors', advising the many types of ETFs with an income focus "if you know where to look". It included a table of 20 high-yielding ETFs.

It would be easy for investors to read these articles and think the investment choices are covered, but there are far more in the managed fund space. Many of Australia's best fund managers have chosen not to operate in the listed space. And while ETFs quickly introduce thematic and trend funds and generate much excited commentary (here comes robotics! invest in crypto! launch of cloud computing!), the money attracted to these special sectors is tiny and often flames out after an initial flurry.

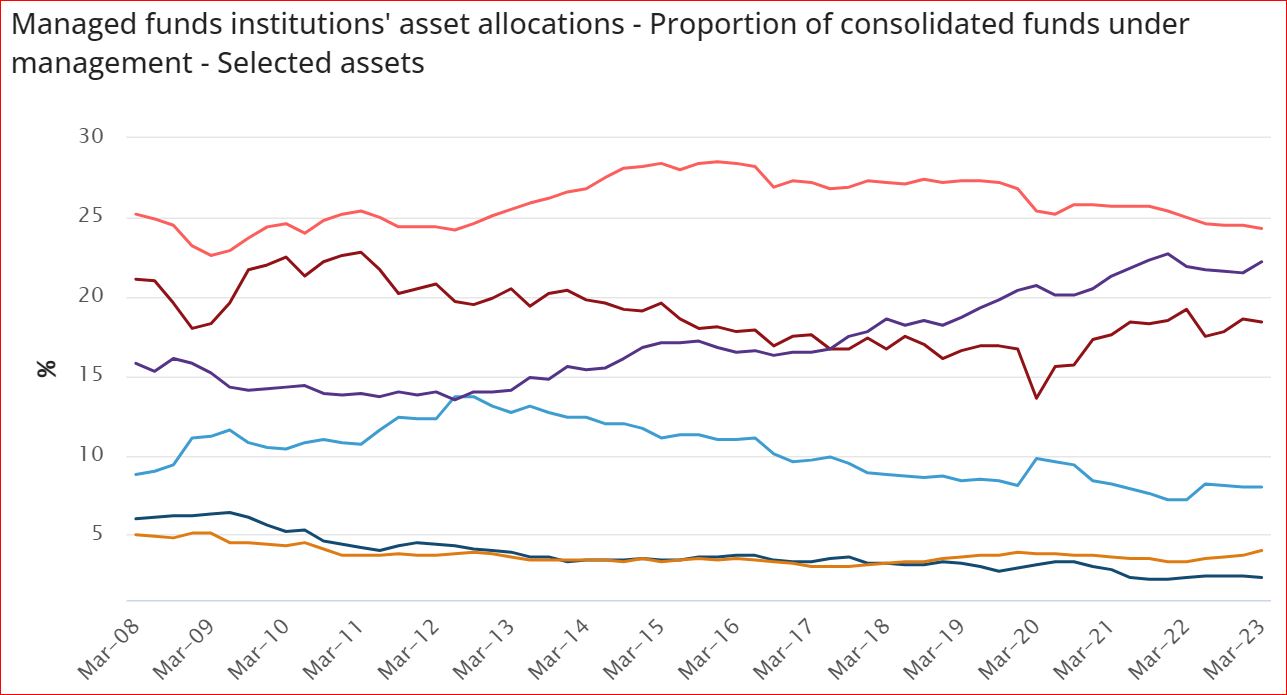

So what's happening with Goliath? The ABS data shows these movements in asset allocations:

Most of the big flows are into large superannuation funds. Deposits and (domestic) directly-held shares have fallen over the last 15 years while the winners are overseas assets and unit trusts. The ABS reports:

"Total unconsolidated assets of superannuation funds rose $120.9b (3.5%) to $3,546.6b during the March quarter. Key movements were as follows:

- assets overseas rose $44.3b (6.7%)

- units in trusts rose $35.9b (3.0%)

- bonds, etc. rose $13.5b (15.6%)

- shares rose $13.4b (2.3%)

- deposits rose $10.9b (4.2%)."

(The ABS defines managed funds as institutions - superannuation funds, unit trusts, etc - which buy assets on their own account, plus fund managers which provide professional investment services, less any cross investment between fund managers).

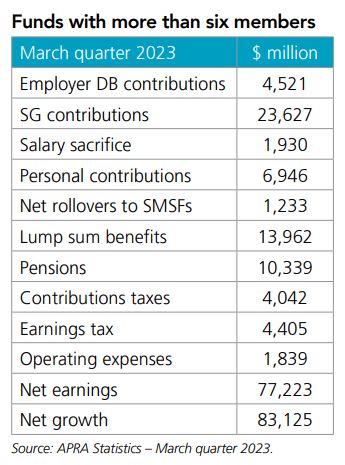

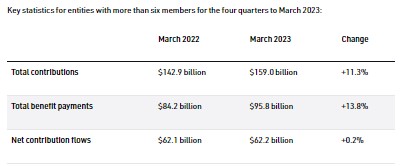

The largest industry fund, AustralianSuper, alone holds twice the assets of the entire ETF industry and it's heading for half a trillion, according to its CIO, Mark Delaney. The net growth into large super funds in the March 2023 quarter was $83 billion from many types of flows.

The annual contributions to large super funds are over $150 billion, as shown in the APRA data below.

And yes, to mangle history, the slings (and rocks) of outrageous fortune helped David to slay Goliath, according to the bible, and the Philistines fled the battleground. It may be a case of the winners writing the history books, but it will be a long time before David's ETFs reach anywhere near Goliath's managed funds.

While on this numbers game, it's sobering to realise the largest fund manager in the world, BlackRock, holds $13 trillion (yes, thousand billion) and Vanguard is at $10 trillion. That's where the real power over companies and markets lies.

So this week, we have articles on managed funds, platforms and SMSFs. From the recent Morningstar Investor Conference, Peter Labrie from Colonial First State and Jason Entwistle from HUB24 describe recent developments with platforms. They continue to grow strongly, especially supported by financial advisers, but do not receive much media attention.

It was also notable that Westpac has decided to retain its BT Platforms business after trying for years to sell it, repositioning to assist financial advisers to run their practices. It holds $131 billion in funds under management.

Then we check the latest SMSF data, despite esteemed publications such as the The Australian Financial Review predicting their demise talking about the "improved offerings from professionally managed funds and market volatility combine to take the shine off DIY super" and "... there was probably a little while where we all drank the SMSF Kool-Aid”. We check whether this prediction of the fall of SMSFs carries much weight, and why people use them and the role of financial advisers.

***

Does it feel like your portfolio is going nowhere while the news talks of a bull market, regaining 20% from its October 2022 low? Here's how CNN Business started this week:

"The stock market has made incredible strides since its downturn last year, so much so, it's difficult to believe the economy could be on the verge of recession. At the market's close on June 16, 2022, the S&P 500 index was at about 3,666.77, beaten down by persistent inflation, the Federal Reserve's interest rate hikes and geopolitical tensions. The broad-based index is at 4,409.59 as of the close on June 16, 2023, marking a roughly 20% gain from a year earlier despite collapses of regional banks, an only narrowly avoided debt default and the Fed's continued battle against inflation.

Mega-cap tech stocks that were battered by rising interest rates in 2022 have also seen a huge boost this year. Shares of Apple notched an all-time high close of $186.01 last Thursday, compared to $135.43 a year before. For the year, the S&P 500 is up roughly 15%, the Dow has gained 3.5% and the Nasdaq Composite has risen 30.8%."

There's a good reason you feel you are missing out, as both the All Ords and S&P/ASX200 price indexes are down over the last 12 months without the tech stock dominance of the US markets where the bull headines originate.

The local outlook is not great when Roy Morgan Research reports:

"Notably, confidence about ‘current financial conditions’ fell to a new low, after declining 10.6pts in the past four weeks. This is the third consecutive week with ‘future financial conditions’ below 90, the longest it has been this low on record. ‘Future economic conditions’ is at its lowest since early April 2020, as is confidence among outright homeowners, which fell for a fifth straight week. Confidence declined among renters to its recent all-time low from mid-May, while it rose for those paying off their homes."

***

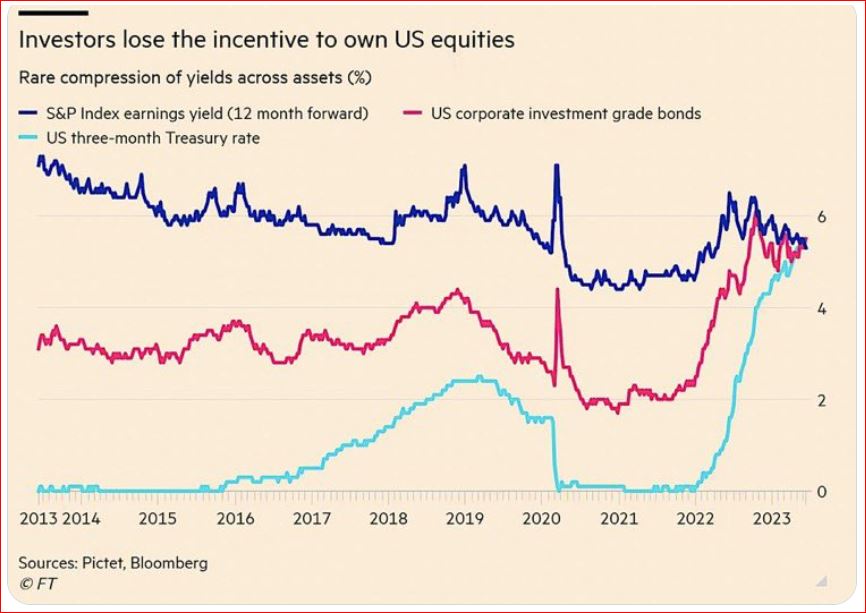

Before we leave overseas markets, check this chart of yields across the big asset classes of US cash, S&P earnings and corporate bonds. For the first time ever, they are all the same. While cash rates have risen, equity yields have fallen, removing some of the incentive to own equities with implications for portfolio balancing. Cash is now a legitimate investment in its own right, adding protection and optionality to a portfolio.

***

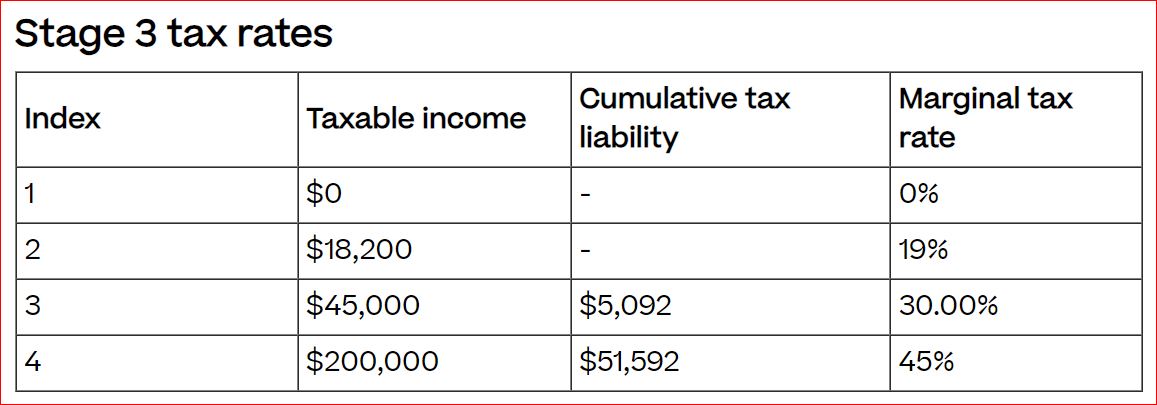

Former financial adviser, author and retirement expert Noel Whittaker rang me last week after reading a couple of my articles on discount capital gains and the $3 million super tax (also the subject of last week's podcast where I spend a few minutes explaining part of the calculation many are missing). Noel wanted to make the point that with the Stage 3 tax cuts, the 30% bracket will extend all the way to personal incomes of $200,000, with implications for the new $3 million tax super tax.

While it is incorrect to call the new tax a '30% tax' because the extra 15% is calculated in a different way to the usual 15% tax, the imposition of the tax on unrealised gains means many more people will prefer to invest in their own name. The dual impact of lower personal tax and higher super tax will have profound implications for large balances in super.

Graham Hand

Also in this week's edition ...

Given the hype around ETFs as mentioned above, everyone has heard of indexing, but what is direct indexing? It is growing swiftly, especially among those working with an adviser in a separately managed account. Morningstar's Karen Wallace explains what direct indexing is, and explores its benefits and drawbacks.

With some markets near their highs, fund managers are expressing caution. Platinum Asset's Clay Smolinski says interest rates are now in restrictive territory and a number of economic indicators suggest that there may be trouble ahead. Despite this, he thinks there are areas of opportunity for contrarian investors, including in China and select European stocks.

Ophir's Andrew Mitchell isn't as bearish yet he believes it is a good time to 'wargame' a possible US recession. He gives us seven lessons about what investors can expect from a recession, including the prospects of timing the bottom and how Ophir is positioning its portfolio for a possible US downturn.

Meanwhile, Duncan Burns of Vanguard acknowledges that the rapid market dip of last year and the subsequent rip this year has scared off many investors. He offers five reasons for investors to hold their nerve and stay invested, including that while market losses can sting, recoveries normally follow, and balanced portfolios have proven resilient through time.

And, Ned Bell of Bell Asset Management suggests that while growth stocks have reigned supreme since the GFC, now is the time for quality stocks to shine. He goes through the reasons why he thinks quality stocks will outperform both growth and value over the short and medium term.

Two extra articles from Morningstar for the weekend. Joshua Peach looks at Morningstar's most undervalued ASX stock, while Dan Romanoff explores the best wide-moat growth stock that you've never heard of.

Finally, in this week's White Paper, steel is one of the largest contributors to global carbon emissions and Franklin Templeton looks at the prospects of green steel from zero-emission hydrogen to help with the problem.

***

Weekend market update

On Friday in the US, stocks remained under some pressure with the S&P 500 slipping 0.8% to wrap up the holiday-shortened week lower by 1.4%, while Treasurys were well bid across the board with two-year yields declining six basis points to 4.71%. The long bond settling at 3.82%, testing the low end of its June trading range. WTI crude remained stuck below US$70 a barrel, gold managed only a weak bounce to US$1,929 per ounce and the VIX edged back above 13.

From AAP Netdesk:

The local share market on Friday extended its losses after the central banks of England and Norway hiked interest rates higher than expected in a bid to combat sticky inflation.

The benchmark S&P/ASX200 index on finished down 96.3 points, or 1.34%, to 7,099.2, while the broader All Ordinaries retreated 95.4 points, or 1.29%, to 7,285.6.

Nine of the ASX's 11 sectors finished in the red, with energy dropping nearly 4% after Brent crude prices fell on concerns about global growth.

Woodside dropped 4.6% to $33.74, Santos finished 4.3% lower at $7.30, and Beach Energy fell 3.3% to $1.325.

All of the Big Four banks finished lower, with ANZ retreating 2.1% to $22.82, CBA down 1.6% to $98.51, and NAB and Westpac both falling 1.4%, to $25.78 and $20.75.

In the heavyweight mining sector, BHP finished down 1.2% to $44.60, Rio Tinto was 1.1% lower to $113.13 and Fortescue dropped 0.6% to $21.41.

Delta Lithium soared 30.1% to an all-time high of 95c after the junior explorer announced what it called "stunning" drilling results from its Yinnetharra lithium project in WA's Gascoyne region.

Alcohol retailer Endeavour Group was another rare winner, finishing up 2% to $6.27.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

In your Interest: listed bonds and hybrids from Bell Potter

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website