The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

My favourite Michael Lewis book is Moneyball. The main character is Billy Beane, the General Manager of the Oakland Athletics baseball team from 1997 to 2015. The book first details Beane’s life before becoming a GM. Beane was an incredibly gifted young athlete who was drafted out of high school into the baseball major leagues. Then, things went downhill:

“If there was one thing Billy was not equipped for, it was failure … He didn’t know how to think of himself if he couldn’t think of himself as a success … The moment Billy failed, he went looking for something to break.”

Despite his physical gifts, Beane’s inability to deal with failure separated him from players who became successful, such as teammate, Lenny Dykstra:

“Physically, Lenny didn’t belong in the same league with him. He was half Billy’s size and had a fraction of Billy’s promise – which is why the Mets hadn’t drafted him until the 13th round. Mentally, Lenny was superior, which was odd, considering Lenny wasn’t what you’d call a student of the game. Billy remembers sitting with Lenny in a Mets dugout watching the opposing pitcher warm up. ‘Lenny says, “So who’s that big dumb ass out there on the hill?” And I say, “Lenny, you’re kidding me, right? That’s Steve Carlton. He’s maybe the greatest left-hander in the history of the game.” Lenny says, “Oh, yeah! I knew that!” He sits there for a minute and says, “So, what’s he got?” And I say, “Lenny, come on. Steve Carlton. He’s got heat and also maybe the nastiest slider ever.” And Lenny sits there for a while longer as if he’s taking that in. Finally he just says, “Shit, I’ll stick him.” I’m sitting there thinking, that’s a magazine cover out there on the hill and all Lenny can think is that he’ll stick him.’”

The point about Lenny, at least to Billy, was clear: Lenny didn’t let his mind screw him up. The physical gifts required to play pro ball were, in some ways, less extraordinary than the mental ones. Only a psychological freak could approach a 100-mph fastball aimed not all that far from his head with total confidence. “Lenny was so perfectly designed, emotionally, to play the game of baseball,” said Billy. “He was able to instantly forget any failure and draw strength from every success. He had no concept of failure. And he had no idea where he was. And I was the opposite.”

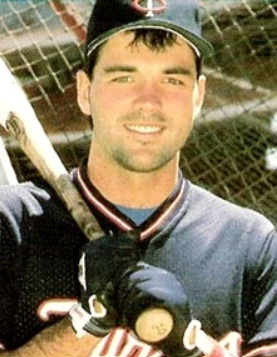

Billy Beane

Source: Baseball Wiki

Source: Baseball Wiki

Beane later went on to become one of the greatest managers in baseball. The irony is his success as a manager was from drafting young players who weren’t physically gifted like him, yet they played a team role and were undervalued compared to other players.

The simple takeaway from Billy Beane’s story is that people need to overcome failure to mature and become successful. But that’s a little too neat. It doesn’t address why people such as Beane can’t handle failure.

Like many mental demons, it’s fear that’s central to people being unable to deal with failure. It’s likely that Beane’s fear of disappointing people close to him or disappointing the idealized version of himself led to his hatred of failure.

Having once been an elite athlete, I can tell you that these fears are commonplace among professional sportspeople. And the ability to tame them often distinguishes those who become great versus merely good.

What’s true for sport is also true for investing. Conquering fears, such as failing, are critical to success.

To help with this, we’re going to explore what fear is, what types of fear there are, and the best ways to overcome it.

All of us are driven by fear

Dr Pippa Grange is one of the world’s most sought-after psychologists, having worked with the Australian Olympic team and several AFL clubs. In her book, Fear Less, she outlines what her work has taught her:

“What if I told you that your life is run by fear?

That might chime with you, or it might seem unlikely.

Either way, if you don’t feel fulfilled or truly successful, I can promise you that fear is ultimately what’s holding you back. If you are quick to judge others or harsh on yourself, fear is speaking. If your life never feels enough, fear is the culprit.

I have spent 20 years working as a performance psychologist, helping people find better, happier ways to work and play. And the conclusion I have reached is that all of us are driven by fear. All of us.

Yet, strangely, that’s not a depressing revelation or a permanent life sentence. In fact, once you acknowledge the role of fear, it quickly leads to a truly radical conclusion: if you can shrink the effects of fear, your life will be transformed.”

Dr Grange says there are two types of fear. There’s in-the-moment fear, which happens in a crisis or high stress situation, and one that you can’t help but recognize. Then there’s not-good-enough fear. This is the kind of fear that’s running your life and making your choices, almost on autopilot. It’s the fear about what happened in the past or what might happen in future. It’s the fear of disappointing people and failing, like Billy Beane had as a baseball player.

She says these fears can become distorted and lead to behaviour such as jealousy, perfectionism, staying isolated from others, and staying smaller than we really are.

Facing fears

Dr Grange says facing your ‘not-good enough’ fears is a kind of growing up:

“It’s about shedding your parents’ fears, your generational and social fears. It will leave you free to explore your true ambitions and rediscover what winning in life means to you.”

She suggests several methods to overcome fear, including:

- Replace fear with a different story. Think of yourself as a failure? Drop the label and rewrite your story into something else.

- Replace fear with purpose. Purpose can direct your attention, influence decisions, and create meaning for you.

- Replace fear with surrender. This comes from Eastern philosophy; that the best way to conquer fear is to accept it and let it go. Easier said than done!

- Replace fear with dreams and desires. Like purpose, dreams can direct attention, so you don’t get flustered by fear.

Applying this to markets

What’s this got to do with investing? If you think about the common mistakes that people make with their money, many relate to fear. For example:

Leaving money in a saving account for years instead of investing in markets. This common mistake can come from many different fears: of market dips, uncertain outcomes, lack of market expertise, or repeating past investment failures.

Selling stocks after the market falls. This can be driven of fear of further losses and failure, sometimes being spooked by scary media market stories, or hearing the horror stories of other investors.

Buying a trendy growth stock before it crashes. This happened to many investors in 2020-21 during the meme stock craze: it’s the fear of missing out. Greed is a close cousin to fear. It can also relate to wanting to connect with like-minded people.

Listening to a hot tip that goes awry. Again, this is likely the fear of missing out.

Buying complex funds/stocks/products that investors don’t fully understand. This can come from ignorance, fear of missing out, or wanting to prove yourself to others.

Giving into fear can mean making irrational decisions that lose money.

How can investors overcome these fears? There are many different methods though the best way may be to take the advice of Dr Grange and have a larger investment goal or purpose. That is, to have a financial plan and the discipline to stick with it. A plan that’s suited to you can act like a lighthouse does to a ship, providing a navigational aid even when things can get stormy, or distractions can easily take you off course. It’s likely to reduce fear-related unforced errors.

Funnily enough, Billy Beane came up with his own plan later in life as General Manager. It was a radical plan that encountered immense resistance even from those within his baseball club. It didn’t work at first as his team hit rock-bottom. Yet, despite the initial failures, Beane stuck with the plan, and eventually found success. In the process, he revolutionized baseball.

James Gruber

Also in this week's edition ...

In a talk with MBA students, famed investor Howard Marks doesn't hold back, delivering a scathing assessment of the value of much investment analysis. In particular, Marks is no fan of economic forecasting:

“I've been talking about the uselessness of forecasting for a long time ... And the belief that you know is dangerous if the truth is that you don't know. And that's how you get into big trouble.

Instead, Marks prefers to invest in things that are knowable. He believes investor psychology drives market prices and that it's better to buy underpriced companies than to purchase the best companies ... as Graham Hand reports.

The US dollar is diving against many currencies and Capital Group Australia's Matt Reynolds thinks that it could spell the end of an 11-year USD bull market. Already markets in Europe and Japan are benefitting from the dollar's decline, and Reynolds thinks it opens up many opportunities in these markets and others outside America.

In less than five years, all Baby Boomers will be eligible for retirement and the Baby Boomer bubble will be all but over. AUSIEX's Patrick Salis examines what the generational change will mean for Australia, with an emphasis on the implications for the wealth management industry.

The RBA have been saying for some time that higher interest rates will eventually weigh on consumers and house prices. It hasn't happened yet, so is the RBA early or is it wrong? Challenger's Pete Robinson suggests the odds are that it's early and outlines his case for why that is.

The response to inflation in advanced economies has seen rapid interest rate rises, but the money supply has remained elevated, particularly in Australia. Tony Dillion says a gradual reduction in the RBA's balance sheet should help with inflation, and if that doesn't work, there are other tools that could be employed.

In the late 1980s, KKR made the largest buyout in history paying the then ungodly sum of US$25 billion ($64 billion in today’s money) for RJR Nabisco. Today, the barbarians of buyouts have become the angels of alternatives: KKR is now one of the world's dominant alternate asset managers. And Montaka's Amit Nath believes many investors are underestimating the vast opportunities in KKR’s addressable markets.

A new Wealth of Experience podcast is out and our special guest is well-known investor author and speaker, Peter Thornhill. He talks about the best way to build an income for life. We also have Graham Hand discussing why ETFs grab all of the headlines when they're small fry compared to managed investment funds, and Peter Warnes on his outlook for the Australian economy and markets.

Two extra articles from Morningstar for the weekend. Mark LaMonica looks at how to build a dividend portfolio with ETFs, while Josh Peach says the share price plunge in an ASX bluechip may present a timely opportunity.

Finally, in this week's whitepaper, Firetrail thinks investors need to think differently to understand which companies are really helping to decarbonise the world.

***

Weekend market update

In the US on Friday, stocks reversed early gains to settle just south of unchanged on the S&P 500. Yet the broad wrapped up a nice week with a 2.5% advance. Meanwhile Treasurys sold off in bear-flattening fashion with the two-year yield jumping 15 basis points to 4.74% and the long bond rising to 3.93% from 3.9% the day prior. WTI crude pulled back to US$75 a barrel, gold went marginally lower to US$1,960 an ounce, and the VIX remained a bit north of 13.

From AAP Netdesk:

The local share market has enjoyed its best week since November after cooling US inflation increased expectations of an end to domestic interest rate hikes. The benchmark S&P/ASX200 index finished Friday up 56.2 points, or 0.78%, to 7,303.1 - a gain of 3.7% for the week. The broader All Ordinaries rose 61.7 points, or 0.8%, to 7,517.1.

IT stocks led the gains on the ASX, up 1.7%, with logistics software provider Wisetech rising 2.4% and semiconductor developer Weebit Nano up 9.5%.

Miners helped lift the index into positive territory, up 1.4%, while seven of the remaining nine industrial sectors also climbed.

The heavyweight miners rose alongside the iron ore price. BHP gained 1.8%, Fortescue Metals rose 1.4%, and Rio Tinto firmed 1.6%.

Of the Big Four banks, NAB, CBA and ANZ were up 1.4%, 0.7%, and 0.3% respectively, while Westpac traded sideways.

Afterpay parent Block hit its highest price since March, leaping 5.2% to $111.29.

Health care stocks were the day's biggest losers, falling 0.6%. Big cap biotech company CSL dropped 1.3% while sleep apnoea mask producer Resmed slipped 1.2%.

Biotech developer Neuren Pharmaceuticals soared 16.8% after striking a deal with US distributor Acadia to market its Rett syndrome treatment Daybue worldwide.

Neuren will receive US$100 million (A$145m) up-front as part of the deal, with additional potential milestone payments of up to US$427m, plus royalties.

From Shane Oliver, AMP:

- Global share markets rebounded strongly over the last week as US inflation fell sharply adding to expectations that the Fed and other central banks are at or near the top on rates. For the week US shares rose 2.4%, Eurozone shares gained 3.5%, Japanese shares were flat and Chinese shares rose 1.9%. Consistent with the risk on tone bond yields fell sharply, oil, metal and iron ore prices rose and the $A rose as the $US fell sharply.

- Shares are still at risk of a short-term correction given the high recession risk, worries about Chinese growth, the risk of more rate hikes with central banks still remaining wary (as evident by Fed speakers after the US CPI release) and the seasonally rougher patch often seen out to September/October but the ongoing fall in global inflation consistent with our positive 12-month view on shares appears to be dominating for now. So, any pull back may be shallow.

- US inflation falling as fast as it went up will take pressure off the Fed. US inflation surprised on the downside again in June falling to 3%yoy, which is down from 9.1% a year ago. Core inflation fell to 4.8%yoy. This was helped by base effects as high monthly increases a year ago drop out but the monthly pace of inflation has also slowed with 3 month annualised core inflation slowing to 4.1%. Just as goods price inflation led services inflation on the way up its also leading on the way down with services inflation now slowing.

- In fact, the core services inflation excluding shelter which the Fed has been focussing on has slowed to 2.4% annualised in the last 3 months and shelter inflation is now also rolling over consistent with falling inflation in asking rents. Technical measures of underlying inflation such as the median and trimmed mean inflation are also rolling over and the breadth of price rises is now collapsing with only 45% of CPI categories now seeing monthly annualised inflation greater than 3%.

- RBA Deputy Governor Michele Bullock to replace Governor Lowe once his term expires in mid-September. While there was a strong case to reappoint Lowe for another 3 years or so in order to finish the job of taming inflation, the appointment of his Deputy, Michele Bullock is an excellent choice given her experience at the RBA and her monetary policy credibility. Because she is well known and highly experienced in communicating RBA views it means less risk of the initial uncertainty that can come with new central bank governors and hence less need for her to prove herself by, for example, coming out even more hawkish on interest rates. Michele Bullock has been on the Board since April last year and has presumably agreed with the rate hikes and her public comments have been consistent with Governor Lowe’s strategy. As such and given that Michele Bullock still has to return inflation to the RBA’s 2-3% inflation target I doubt the change in governor will result in any significant change in the outlook for interest rates. The good news is that all the heavy lifting on interest rates has already been done and with inflation falling globally and in Australia we are likely at or close to the top on interest rates. In fact, the new Governor’s first big decision will likely be to cut interest rates starting next year, although she will have to deal with the fallout from the rate hikes including the high risk of recession.

- Governor Lowe’s legacy. While Governor Lowe made a few mistakes in the aftermath of the pandemic so did many other policy makers through what were extraordinary times and his mistakes were greatly overshadowed by his massive contribution to helping the Australian economy weather and recover from the pandemic shock without major long term costs, his contribution to the achievement of a near 50 year low in unemployment and his decisive response to the inflation problem and clear explanation of why we need to bring inflation back under control in a reasonable timeframe. But he has also sought to bring inflation back under control in a far more balanced fashion than seen by many other global central banks.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website