The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

It’s nice to be back after a month-long bout of pneumonia. The infection landed me in hospital for a week, hooked up to a ventilation machine 24/7. It was humbling to go from being a fit and healthy person to one struggling to breathe after walking up a set of stairs.

It’s great to see that I didn’t miss much - only the assassination attempt on Donald Trump, Biden rolling over and Harris seemingly set to take on the Democratic nomination for President, and in markets, the Magnificent Seven entering correction territory …

A big thank you to Joseph Taylor, Mark LaMonica, Shani Jayamanne and Leisa Bell for their tremendous work with Firstlinks in my absence.

Being in hospital can give perspective beyond the day-to-day noise of the news. And it seems to me that there are some obvious market trends right now:

- US tech stocks are incredibly over-owned, overhyped and overvalued. If you add Alphabet, Meta, Amazon, Tesla and Netflix back into the tech sector of the S&P 500 index, tech equals 45% of the index. That means every passive investor, including many Australians, owns a major chunk of US tech – much more than they realise. And the hype around tech stocks is predicated on AI where returns from the enormous investments being made now are years away, as Alphabet admitted in a recent earnings conference call.

- US stocks more generally are significantly overvalued. On every major valuation metrics, US shares are trading 1-2 standard deviations above their historical averages.

- It’s true that part of the reason for money flowing into US stocks has been earnings growth, especially among the Magnificent Seven. It’s evident that overseas governments have invested their foreign exchange reserves not in US bonds as they once did, but in US stocks. That’s not only propelled these stocks higher but also put a bid under the US dollar, which has concurrently had a long bull market.

- Passive ETFs have poured fuel on the fire. They’ve filtered money into the biggest momentum stocks, namely US tech.

- The recent correction has led to a small unwinding of these trends. US small caps have benefited at the expense of US large caps. Depressed currencies such as the Yen have bounced hard against the US dollar.

- Is this the start of a larger correction? No one knows. However, the investor push into US stocks, especially tech, has reached such extreme levels that a more significant rotation out of them would seem inevitable at some point. A matter of when, not if.

- Who could be the winners? Non-US equities, value stocks, and to a lesser extent, small caps stand to benefit. They’re all under-owned and undervalued.

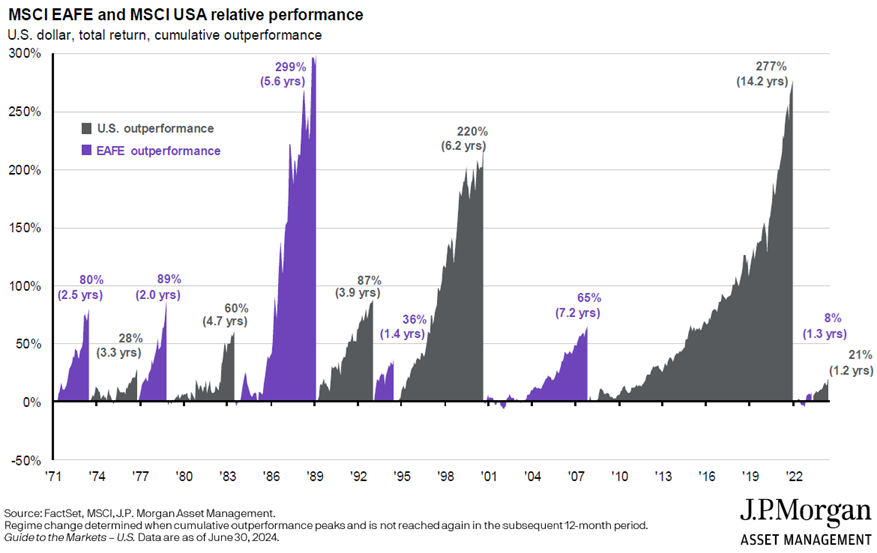

One chart that tells the story

For me, this chart sums up much of the story:

The MSCI EAFE index includes large and mid-cap stocks from 21 developed markets in Europe, Australasia, and the Far East. The chart shows the performance of this index compared to the MSCI USA index over the past 50 years or so.

As you can see, the relative performance of the two indices ebbs and flows, with one ascendant from anywhere from one to 14 years.

The thing that stands out is the recent outperformance of the US. From 2007-2021, American shares trounced the rest of the world. And after a minor reversal in 2022, US outperformance has returned.

There are two ways to read the chart. If you believe in mean reversion and cycles as I do, then recent US outperformance looks primed to reverse, potentially a lot, and for a length of time.

An alternative view would be that recent American outperformance has only just restarted and may go for longer.

US stocks: overhyped, over-owned, and overvalued

Here’s why I don’t think the alternative view will play out.

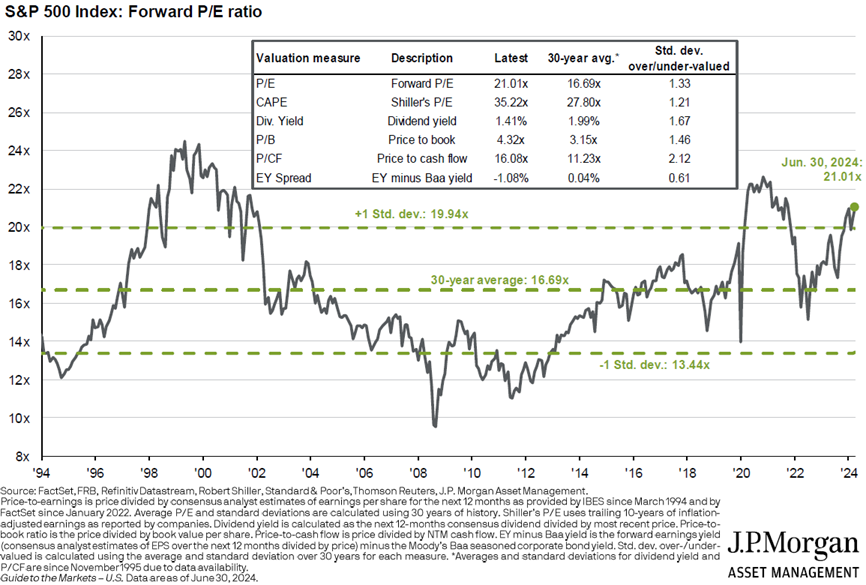

First, US stocks look overvalued on every important valuation metric.

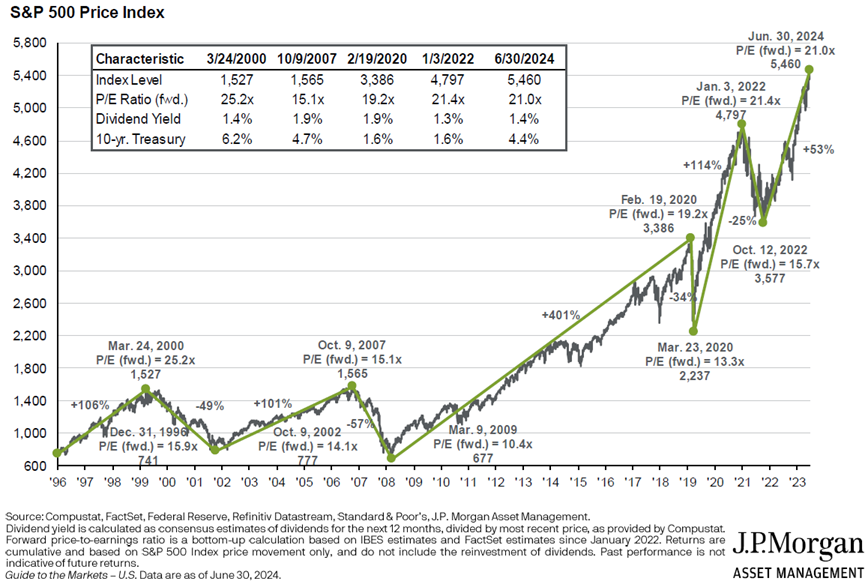

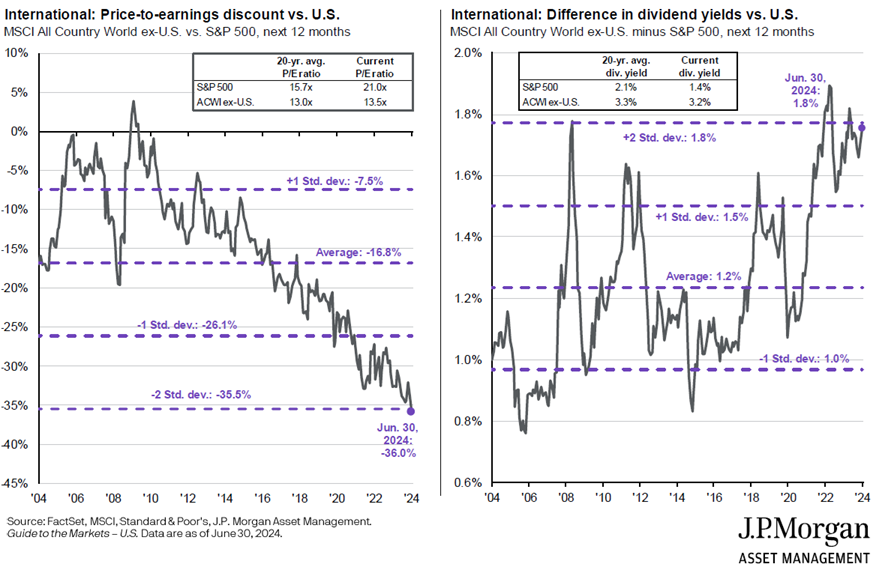

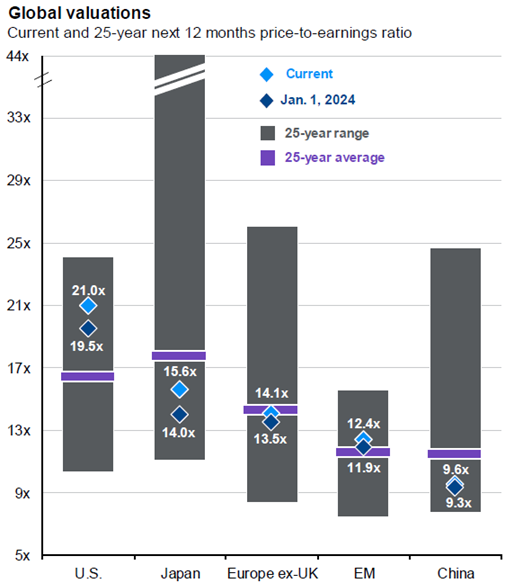

The above chart reveals that at 21x forward price-to-earnings ratio, the S&P 500 is close to its peak valuation reached in 2022. The big difference between now and then, though, is that interest rates are much higher currently, as are 10-year Treasury yields. Traditionally, higher rates and bond yields equate to lower equity valuations, but that hasn’t happened this time around.

Turning to the next chart, and on almost every valuation measure, the S&P 500 is 1-2 standard deviations above historical norms.

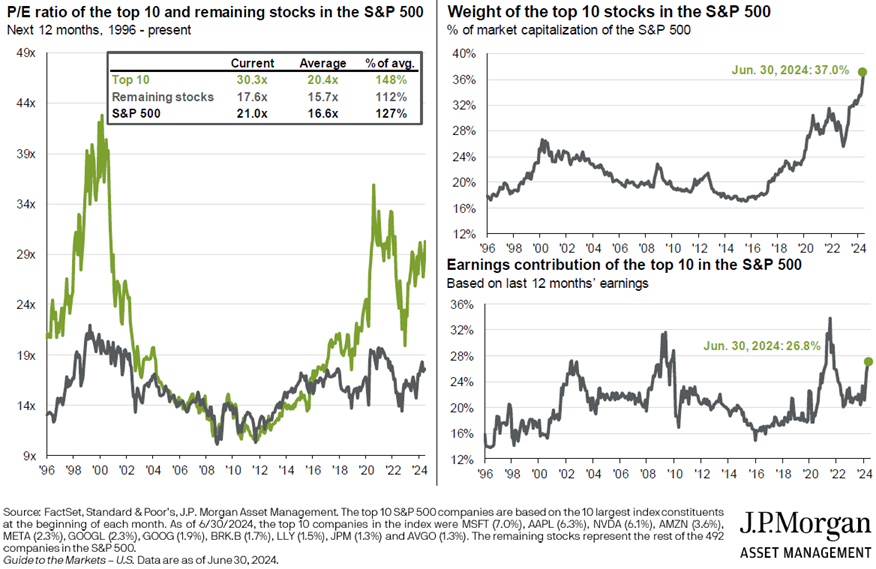

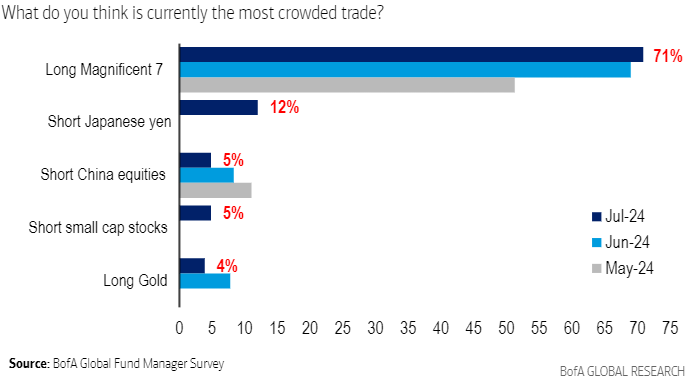

Second, the crowding into US large cap stocks, especially the Magnificent Seven, has reached extreme levels. The weighting of the top 10 stocks in the S&P 500 is 37%, more than double just a decade ago.

As mentioned previously, tech stocks now account for around 45% of the index. To put that into perspective, energy stocks after their roaring bull market of the 1970s accounted for just under 30% of the S&P 500 index at their peak.

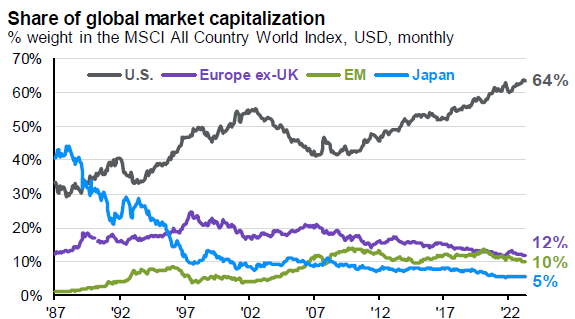

Third, the US share of global market capitalization has reached unprecedented levels. 15 years ago, the US weighting in the World index was close to 40%. Today, it’s 64%. Anyone buying a passive global stock ETF is essentially buying America.

Source: JPM

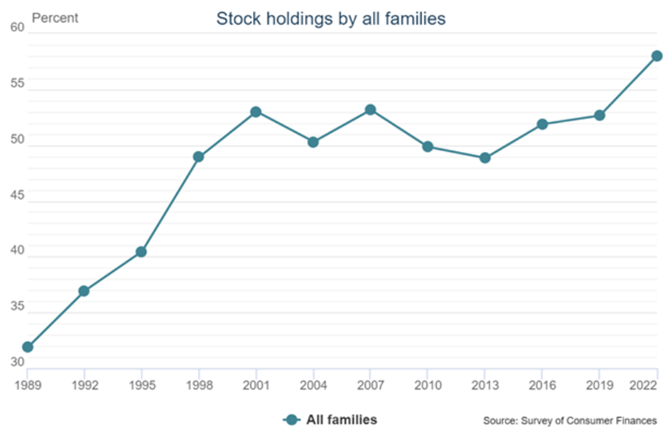

Fourth, US and international investors have never owned as many American stocks as they do today, which makes them over-owned in my view. US household ownership of stocks has grown from 15.6% in 1982 of Federal Reserve Board Z-1 Household Assets to 47% today. And 58% of all American families own stocks, up from 32% in 1989.

As for global institutional investors, they’re all in – and then some - on the Magnificent Seven.

Trades for the next decade

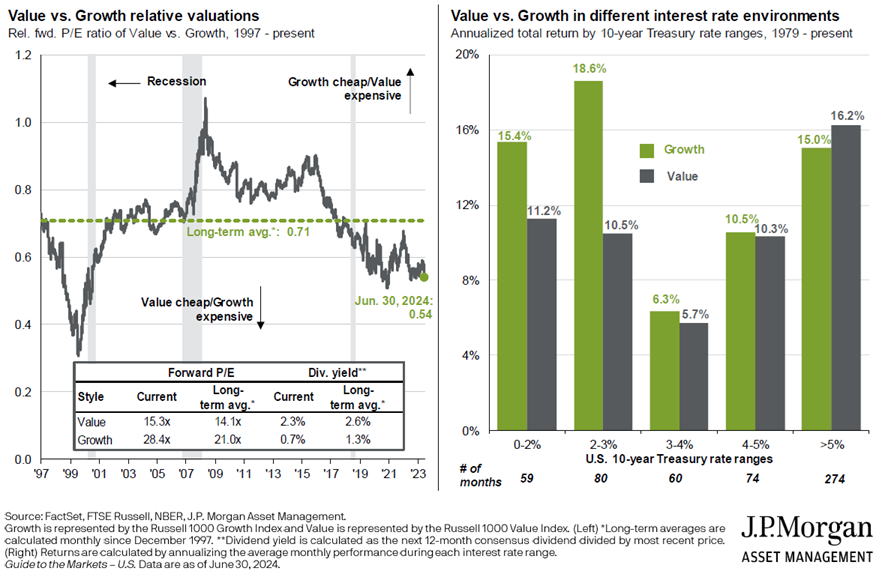

If a long-term rotation out of US stocks, particularly tech, is near, then which assets stand to benefit? Value stocks, for one. The charts below show value versus growth stocks in the US.

Note how value stocks are being priced at half of growth stocks on a current price-to-earnings ratio basis. And value has historically outperformed growth in higher interest rate environments.

Value stocks are even cheaper outside of the US, too.

The other potentially more prospective area is in markets outside of the US. Many look cheap, especially those in emerging markets.

Source: JPM

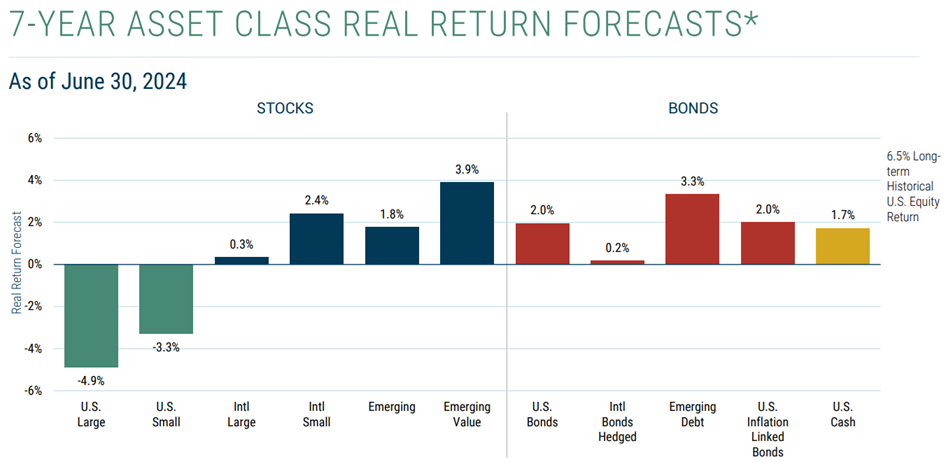

Legendary forecasters, GMO, tend to agree, as they expect attractive real returns from markets excluding the US over the next seven years.

Source: GMO

As the GMO chart indicates, small caps, specifically outside the US, also appear attractive. That follows the rush into larger caps in recent years, aided by passive ETFs.

Triggers

So, what would be the catalyst for a long-term rotation out of US equities? If I knew that I’d be a billionaire living in the Bahamas.

More seriously, there are numerous potential triggers. However, sometimes it can be as simple as price action. Famous perma-bear Albert Edwards says bubbles often deflate purely because prices start to go down. What he means by that is when prices go down, that can trigger technical selling and impact investor psychology, and that can feed onto itself and lead to a larger downturn. It’s a view of markets that closely aligns with George Soros’ reflexivity theory – where positive and negative feedback loops between expectations and economic fundamentals can cause price trends that substantially and persistently deviate from equilibrium prices.

Opposing points of view

Where could my view go wrong? There’s little doubt that the US has a lot going for it: a strong economy, significant private investment, cheap energy sources, a relatively young population compared to the rest of the world, and it attracts the best and brightest. That’s not to mention this little thing called AI which could revolutionise business and propel economic productivity. That’s the bull case for US equities to march higher.

The big question is whether any chinks may develop in this positive narrative. It could be AI being less than revolutionary or not rolling out as soon as investors expect.

And the other question is how much of the optimism is already priced in. As you might be able to tell, my view is: it’s priced in a whole lot.

Key takeouts

The premise of this editorial isn’t that people should rush to exit US stocks and tech. It’s more that it might be prudent to lean into non-US equities and other neglected areas such as value. It may feel lonely to do so given the way investors are currently positioned. Yet it may pay dividends in the long-term.

----

In my article this week, I highlight recent research which suggests that less volatile, older companies have historically outperformed more speculative, newer companies. It runs counter to the current hype around tech companies and startups. It turns out the tortoise really does win in investing.

James Gruber

Also in this week's edition...

The Retirement Income Covenant mandates super funds create retirement strategies, but David Bell and Geoff Warren think progress has been uneven, leaving retirees under-served. They advocate for a retirement licensing regime that could enforce standards and improve outcomes.

Australian banks have had a roaring 12 months even though their earnings haven't improved. Are the stocks headed for a tumble? While fund managers and sell-side analysts are falling over themselves to be negative, Hugh Dive reckons the outlook is more nuanced.

Stocks and bonds have moved up and down together a lot in the recent years. Does this high correlation between stocks and bonds make bonds less attractive as a portfolio diversifier? Benoit Anne from MFS thinks not, because that high correlation has lifted overall portfolio risks, and the best way to lower those risks is by increasing bond allocations.

As markets retreat from record highs, more bears are making headlines. Roger Montgomery isn't one of them as he sees positive economic growth combining with disinflation to provide a nice backdrop for equities going forwards.

There's been a big rotation from large caps into small caps in the last month. Can it continue, and if so, what's the best way to play it? VanEck's Arian Neiron has some answers.

Two articles from Morningstar this weekend. Joseph Taylor highlights three pricey ASX shares going into earnings and Johannes Faul digests Kogan’s better than expected results.

Finally, in this week's whitepaper, the World Gold Council gives an overview of recent supply and demand trends in gold.

***

Weekend market update

On Friday in the US, stocks settled lower by 1.9% and 2.4% on the S&P 500 and Nasdaq 100, respectively, as a softer than expected July payrolls print and uninspiring results from Amazon unsettled investors. Treasurys caught another frenzied bid to leave the two-year yield at 3.88%, down 86 basis points from a month ago, while WTI crude sank to US$74 a barrel, gold slipped to US$2,437 per ounce after testing US$2,475 this morning and bitcoin retreated below $63,000. The VIX settled at 23.5, down from almost 30 as of mid-morning but easily establishing a year-to-date closing high with a near seven point advance for the week.

From Shane Oliver, AMP:

- Risk off with shares down again, bond yields down, commodity prices down and the $A down. Shares got a boost mid-week from firming expectations for Fed rate cuts, but this gave way again to renewed concerns about weaker economic growth after weak US jobs data and concerns that we have seen the best for tech stocks as tech earnings results have been mixed. For the week, US shares fell 2.1%, Eurozone shares fell 4.2%, Japanese shares fell 4.7% not helped by a hawkish Bank of Japan and Chinese shares fell 0.7% on the back of uncertainty about the Chinese growth outlook and a lack of decisive policy stimulus. The ASX 200 surged above 8100 mid-week helped by lower than feared inflation and a boost from rising Fed easing prospects but the gains were reversed on Friday as global growth worries impacted leaving the market up just 0.3% for the week. Bond yields plunged on expectations for lower interest rates along with safe haven demand. Despite escalating tensions around Israel and Iran again, oil prices fell reflecting worries about oil demand as did metal and iron ore prices. And consistent with the risk off tone the $A fell.

- A correction is underway. Shares went sky-high into July on the back of better news on inflation, increasing optimism about lower interest rates ahead and optimism about IT and AI related earnings. Our view remains that lower interest rates will boost shares on a 6 to 12 month view, assuming recession is avoided. However, in the next few months global and Australian shares look vulnerable to further falls suggesting that it's too early to buy the dip as: valuations are stretched; investment sentiment looks too optimistic; recession risk is now very high in the US and Australia; and geopolitical risk is high particularly around the US election but also around the Middle East with increasing risks of escalation in the Israel war to include Hezbollah and Iran with risks to oil supplies. (While Iran and Israel likely want to avoid all out direct war the risks are now high again following the assassination of Hamas’ leader in Iran.) So, as we enter the seasonally weak period of August and September a further correction in share prices looks likely.

- Japan aside, the global monetary policy easing cycle continued to gather pace over the last week. It started in emerging countries and then slowly spread to developed countries with Switzerland and Sweden cutting rates, followed by Canada and the ECB cutting a few weeks ago. Its now gathering pace with the Bank of England cutting and the Fed set to start next month. And lower than feared inflation in Australia has now removed the case for another RBA hike here leaving us on track for a cut by February next year. While lower interest rates are normally good for shares, this is less so initially when a recession occurs and share markets appear to be getting increasingly concerned that central banks may have left it too late and that a recession may be on the way. Faling commodity prices and bond yields are likely reflecting the same concerns.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website