The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

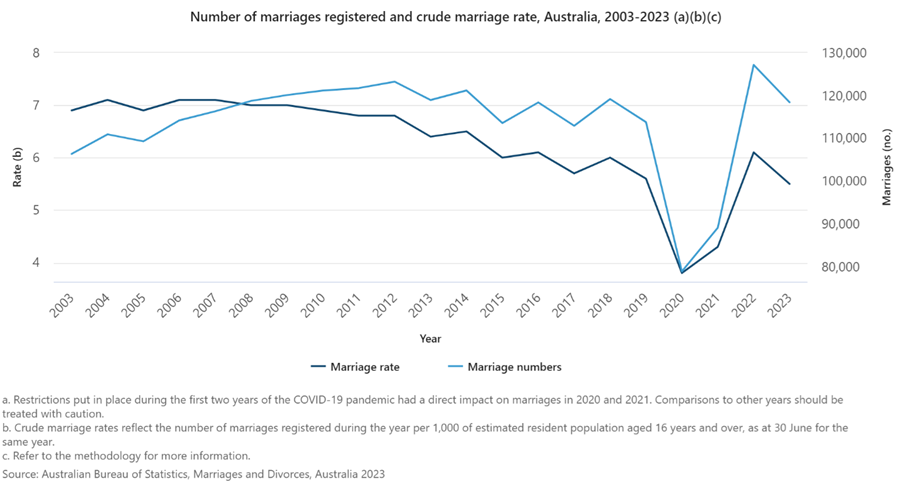

New data from the Australian Bureau of Statistics (ABS) shows that there were 118,439 marriages last year, a 6.9% fall from the record high reached in the previous year. The fall was expected given the post-Covid bump in marriages in 2022.

The long-term trends are revealing. While the total number of marriages has increased by around 4,600 since before the pandemic, the marriage rate – the number of marriages divided by the population aged 16 and over – has marginally fallen from 5.6 per 1,000 people in 2019 to 5.5 now.

Zooming out further, and the figures reveal that total marriages across Australia are around the same level as 2008. And the marriage rate has fallen significantly, from 6.9 per 1,000 people in 2003 to 5.5 in 2023.

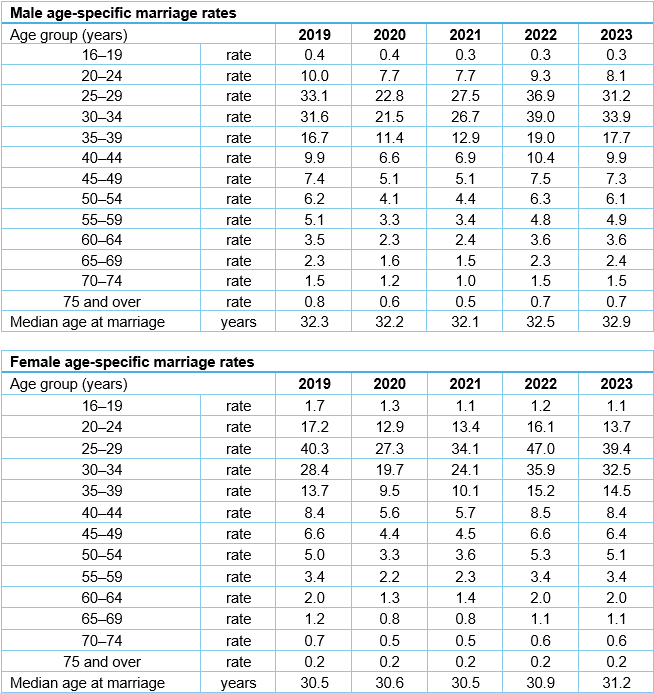

The median age that people get married increased last year compared to 2022. For men, it jumped from 32.5 years to 32.9 years, while for women, it lifted from 30.9 years to 31.2 years.

Much of it can be attributed to people postponing marriages during Covid, and them being naturally older when they got married over the past year. However, it does a continue a broader trend. A decade ago, men tied the knot at a median age of 31.5 years and women at 29.5 years.

Breaking down the ages for marriage, 20–30-year-olds are marrying less than before Covid, and 30–40-year-olds are marrying more. What’s behind this? Arguably, higher housing prices and the cost of living are playing a part.

Source: ABS

Declining divorce rates

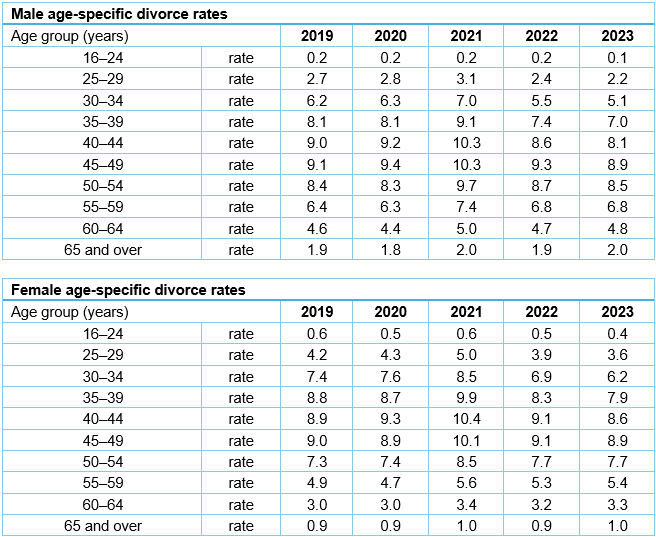

Like marriage rates, divorce rates are also falling. Last year, there were 48,700 divorces, down 1.1% from the year prior. The divorce rate also decreased 2.3 per 1,000 people from 2.4 in 2022.

There was a spike in divorces during the pandemic, which has since reverted to trends seen up to 2019.

Marriages are lasting longer. The median age of marriages to divorce was 13 years in 2023, up from 12.8 in 2022, and 12.3 in 2019. The median age of marriages to separation was 9 years last year, up from 8.9 the year prior, and from 8.6 years in 2019.

Over the past 20 years, the number of divorces per year has dropped by about 10%. But the divorce rates paint a truer picture, as they’ve decline from 3.4 per 1000 people in 2003 to 2.3 now.

What’s behind the fall in divorce rates? The figures on marriage breakdowns by age group may provide a clue.

The median age for divorce was higher in 2023 than 2019, up by 1.2 years to 47.1 for men and up by 1 year to 44.1 for women. The numbers show that for both men and women, there have been substantial declines in divorces for those aged less than 44. Conversely, there have been more divorces for aged 50 and above.

According to the Australian Institute of Family Studies, couples who had been married for 20 years or more accounted for more than one quarter of divorces. In the 1980s and 1990s, they made up about one in five divorces.

Source: ABS

Why are the young getting divorced less? There are a few possible explanations:

- People are getting married later, with many couples live together for years before marrying.

- Younger people are more educated than any previous generation, and studies show better education is linked to more successful marriages i.e. if a couple is university educated, the chance of divorce is much less.

- Economic uncertainty may also be keeping people together that would otherwise want to divorce.

Conversely, why are divorce rates up for older people? It’s likely that divorce is more socially acceptable now than it used to be. ‘Empty nest syndrome’ – the unhappiness and upheaval that can happen when children leave home – may also be a factor.

Retirement researcher, Dr. Michael Finke, has another possible explanation. In a Firstlinks article last year, he detailed how the happiest people in retirement were women who get divorced between the ages of 60 and 65:

“I think that relates to a problem that very often happens in a relationship when people retire. And that is that men tend to have a more limited social network and oftentimes that social network revolves around their work. And women tend to do a better job of investing in relationships that they can then draw from in retirement outside of the workplace. And so, what that means is that women oftentimes want to be able to maintain those relationships in retirement. Men all of a sudden become far more – in an opposite sex couple, they become far more reliant on their relationship with their wife. And the wife is often struggling to be able to manage her existing relationships and this perceived obligation that she has to her husband. And oftentimes they may not have developed the capabilities to spend all day with each other. They get married, and they see each other for breakfast and dinner, but not necessarily for lunch.”

Ramifications of rising ‘grey divorce’

Nevertheless, Australian Institute of Family Studies researchers have found divorced people aged between 55 and 74 years have less household disposable income and fewer assets than married couples the same age. And they observed that while household income levels can recover relatively quickly, it takes a longer period for assets such as housing to appreciate.

It may be why a greater number of older people are renting, and several studies show that financial stress and homelessness are increasing among retirees.

One issue that doesn’t get enough attention is the ability, or inability, of elderly divorcees to borrow money. I’ve heard anecdotally that even for retired couples, it’s becoming more difficult to borrow from banks. I expect that for those older and divorced, it would be even more so.

Of course, divorce also have implications for super, wills and estates, enduring powers of attorney, and possibly decisions around health care.

For the broader economy, the effects of rising divorce among the old are difficult to forecast. The trend is relatively recent and whether it continues is a matter of debate. Could it lead to more renting? Could it result in greater downsizing? Could it increase the reliance on government assistance in retirement? Time will tell.

----

It surprises me how often individual investors and even seasoned financial professionals don’t know the basics of building an investment portfolio. In my article this week, I run through how to go about constructing a simple portfolio, as well as the challenges involved.

James Gruber

Also in this week's edition...

John Abernethy is back, this time to highlight an issue that's often left unsaid in the debate about Australia's housing crisis - the explosion in mortgage debt. He says that debt and its cost is the sole cause of our great housing price bubble, but there is a lack of acknowledgement of their role. And the lack of regulatory intervention in the mortgage market exposes the failures of the RBA, APRA, and Treasury. He goes on to suggest some solutions to the crisis.

The Transition to Retirement Income Streams strategy has waned in popularity in recent years, but Lindzi Caputo says that could change if the proposed extra tax on super balances above $3 million goes ahead. 60-65 year olds who are still working could benefit most.

Separation of assets remains one of the most reported contraventions by SMSF auditors, and it raises the question about whether a declaration of trust can satisfy the requirements of SMSF regulations. Shelley Banton says it's a complex matter that demands examination from many different perspectives.

Improving our investment behaviour is difficult. Our choices have a messy confluence of influences. It is impossible to ever understand precisely why we made a particular decision – it is just too complex. This doesn’t mean, however, that we are helpless bystanders. In fact, Joe Wiggins says there are many seemingly innocuous areas that we can change to improve the chances that we might make sound judgements. Foremost of these is what we pay attention to.

Small caps have significantly lagged their larger counterparts of late, and none more so than those in Europe. Political turmoil and new regulations have left Europe-listed small caps unloved and under-covered. Alantra's Jacobo Llanza believes that taking a 'friendly activist' approach to investing in those with global growth opportunities can reap dividends.

The cyclically adjusted P/E ratio, or CAPE, has been a common and widely accepted gauge of market valuation in recent decades. But Brian Jacobs thinks it's reached its used-by-date, and explains why.

Two extra articles from Morningstar this weekend. Shani Jayamanne looks for opportunities in earnings season movers and Roy Van Keulen runs the ruler over REA Group’s big potential acquisition.

Lastly, in this week's whitepaper, VanEck analyses the current state of play in credit and fixed income in light of expected rate movements in Australia and the US.

***

Weekend market update

On Friday in the US, stocks sold off to the tune of 1.7% on the S&P 500 and 2.7% on the Nasdaq 100 to wrap up the worst week since March 2023. stocks. A mixed payrolls report was no help for the bulls. Treasurys steepened with two-year yields dropping another nine basis points to 3.66% while the long bond edged higher to 4.03% from 4.02%. WTI crude sank to a year-to-date low of US$68 a barrel, gold retreated to US$2,495 an ounce, bitcoin lost nearly 5% at US$53,400 and the VIX settled north of 22.

From AAP Netdesk:

The Australian share market on Friday reclaimed more of its midweek losses. The benchmark S&P/ASX200 index on Friday finished up 31 points, or 0.39%, to 8,013.4, while the broader All Ordinaries gained 27.1 points, or 0.33%, to 8,214.8. The ASX200 finished the week 1% lower, snapping its three-week winning streak, in a week that also highlighted a rotation out of the bourse's commodity sectors and into financials.

Eight of the ASX's 11 sectors finished higher on Friday, with energy, materials and tech lower.

Energy was the biggest mover, falling 3% for a 9.1% drop for the week - the sector's worst weekly performance since a 24.7% plunge in late March 2020, at the start of the COVID-19 pandemic. The sector's struggles have been driven mostly by falls in the price of oil. Brent crude was hovering near a 14-month low of $US73 a barrel on Friday, on speculation that members of the OPEC+ oil cartel would unwind voluntary production cuts.

Also, spot uranium prices were down to under $US80 a pound, an 11-month low.

Woodside on Friday dropped 3.9% to a two and a half year low of $24.02, Santos fell 1.4% to a 10-month low of $6.92, Whitehaven Coal retreated 5.6% to a 15-month low of $5.77 and yellowcake developer Deep Yellow dipped 5.5% to a one-year low of 94c.

On the flip side, all of the big four banks were hitting their highest levels in years. NAB climbed 1.4% to a 17-year high of $39.05, ANZ and Westpac both added 1.7%, to seven-year highs of $31.79 and $32.10, respectively, while CBA grew 1.5% to an all-time high of $143.47.

In the heavyweight mining sector, BHP dropped 1.2% to a nearly two-year low of $38.45, while Rio Tinto and Fortescue both dipped 0.1%, to $107.02 and $16.12, respectively.

Goldminers gained as the precious metal traded for US$2,519 an ounce, near its all-time high. Evolution was up 1%, Northern Star added 1.5%, and Newmont grew 0.5%.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website