The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Your usual editor James Gruber is taking a well-earned break, so I’ve been tasked with bringing you the 581st Firstlinks. Thanks for having me back.

***

Among other things, finding stories for Firstlinks each week involves attending industry events and discussions.

Quite often the conversation at these events revolves around macro topics that, while interesting, are more pertinent to investment managers (and their short-term performance) than the long-term goals of our audience.

Here is a sampler of what you can expect people to talk about:

- What the economy at home or in the US will do in the next six months

- What the next interest rate decision might be

- What positioning might help an investor outperform with all of those things in mind.

As a result, it can be quite hard to glean insights that are truly valuable to the individual investors, who are generally more focused on achieving their financial goals rather than having a good quarter or year.

For that reason, I have got into a habit of asking speakers to share an investment or theme they are enthusiastic about regardless of what happens at the macro level. The most interesting answer I’ve had yet came from Janus Henderson’s Josh Cummings, who gladly offered up two themes.

The first theme was companies that deliver the “impossible to replicate” product that are elite live sport events. The fund he co-manages has had exposure to this through several shares including Formula 1, Manchester United, and the Atlanta Braves baseball team.

The rest of this note relates to the second theme he mentioned. Mostly because I thought this theme would be more “played out” by now than it seems to be. And also because it could have some interesting effects in Australia.

Still early days for e-commerce?

If I were to ask you what percentage of retail revenue in Australia was generated online, what would your guess be? If you guessed somewhere around 50%, you’d be way off. Even if you said 20%, you’d be miles away.

According to NAB’s study of retail data for the year to July 30th, the answer is something closer to 13.5%.

That was a smaller number than I expected, and it is mostly due to how people buy their groceries. Grocery shopping makes up 40% of Australia’s retail spend, and over 93% of these purchases are still made in store.

Reasons for groceries being e-commerce’s Achilles heal for so long aren’t hard to grasp. For one, selling groceries online is a harder and more costly business to run than selling groceries in a store. The seller has to pack and sometimes deliver each customer’s shopping rather than the customer taking it home themselves.

Selling and shipping food is also harder than selling other goods online - food deliveries are a lot bulkier than your average Amazon package, and they are more likely to decompose in storage or be damaged in transit. As Cummings put it, there’s a reason Amazon started with books and not eggs.

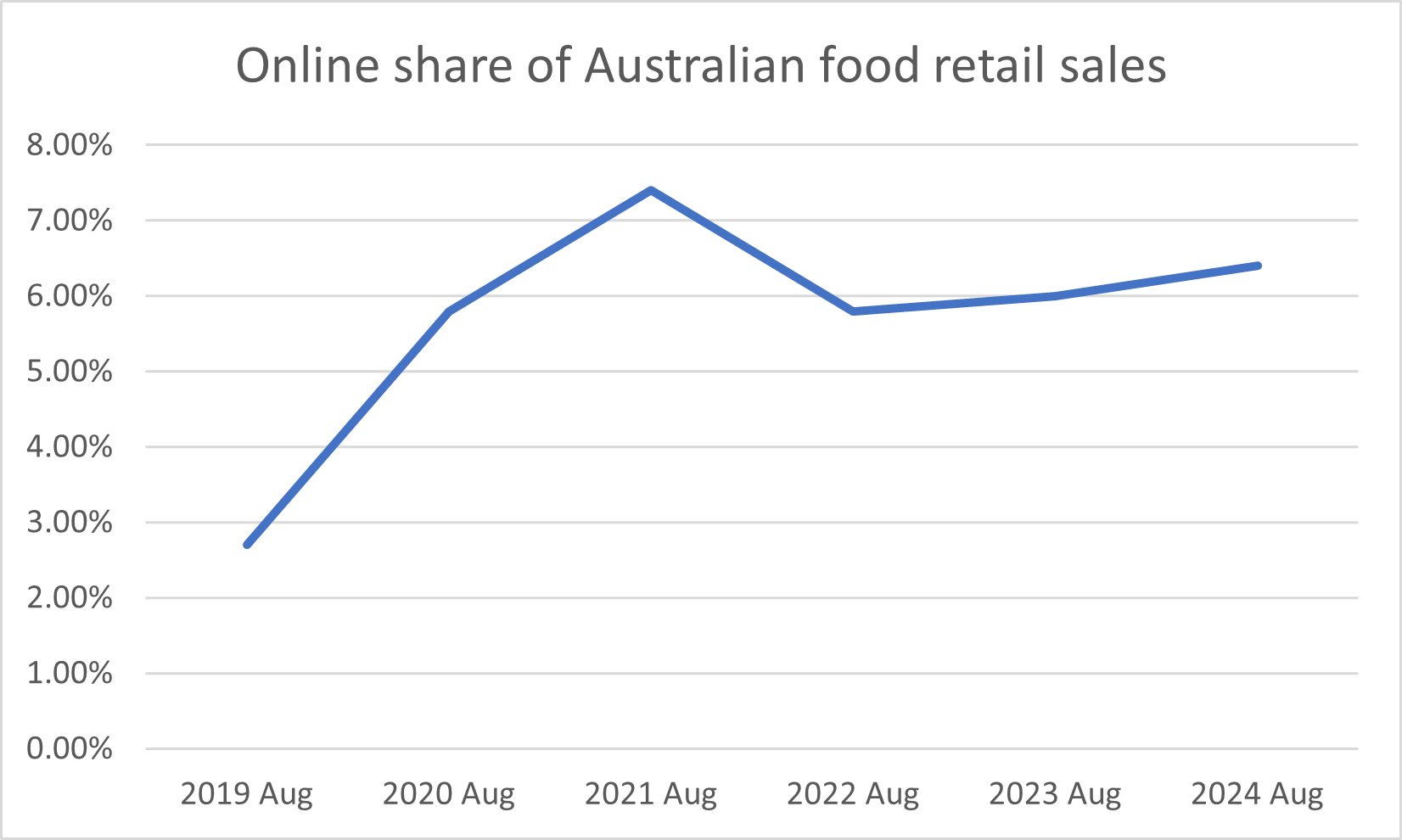

Yet the tide continues to grind slowly in favour of eGroceries - even in Australia, which has always been a long way behind countries like the UK when it came to ditching the shopping trolly for the digital cart. The 6.4% of Aussie food sales made online in August 2024 compares to 6% a year earlier and is easily more than double the 2.7% from 2019.

Covid pulled a lot of growth forward, with online sales peaking at 7.4% of total food sales in October 2021. But the long-term direction of travel is clear.

Figure 1: Online share of Australian food sales

Source: ABS Retail Trade Data

How far could this go?

Finding reliable and easily comparable data from other countries is hard. And it’s not like you can just copy and paste the adoption rate of one country across to another – especially when you are talking about a country like Australia.

But just for some context:

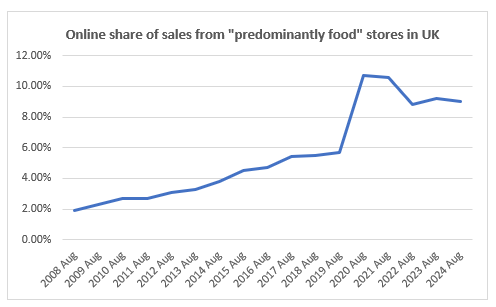

- Data from the UK's national statistics office suggests that 9% of sales from 'predominantly food' stores were made online in August 2024.

- A report by Agriculture and Agri-Food Canada estimated that e-commerce’s share of US grocery sales in 2023 was 11.8%, up almost 2x from 2019.

Both countries obviously saw big bumps from Covid. But it’s not as if eGroceries weren’t taking share from in-store sales before the pandemic.

Figure 2: Growing well before COVID: Online share of food store sales in UK

Source: UK ONS

Whatever way you cut it, Australia still potentially has a long way to go when it comes to online grocery sales.

Who stands to benefit?

As investors, we aren’t just interested in the trends themselves but in which companies might stand to benefit from them.

On headline numbers from August’s reporting season alone, you might think that the most obvious beneficiaries from the shift will be Woolies and Coles. Woolies championed a more than 20% uptick in e-commerce sales in Australian food business and Coles bettered it with a 30% lift.

I’m not so sure and see three potential issues here.

- Our retail analyst at Morningstar, Johannes Faul, sees a potential problem if (as is most likely the case) these are not incremental sales. If revenue simply shuffles from a more profitable channel (in-store) to a less profitable one, this trend could actually hurt supermarket earnings – unless scale and investments in technology improve the economics of online.

- Could online customers be less loyal? My choice of supermarket is usually dictated by two things: 1) the store’s proximity to where I live and 2) to what extent I can be bothered driving. This means a lot less if I shop online and get it delivered. I’m sure supermarkets will invest heavily in loyalty programs to combat this. But that’s even more cash out of the door.

- Longer term, what if Amazon really manages to crack groceries in the US and brings a “your profit margin is my opportunity” approach to Australia? Coles and Woolies would then be competing with a low price juggernaut and one of the world’s best loyalty programs in Amazon Prime.

A better way to play it?

When you consider that Australia spends $170 billion every year on food, every 0.5% of share taken by online represents $850 million more in spending. Do those sums for bigger markets like the US and you get even sillier numbers.

My thinking? Platform businesses able to skim a few basis points in commission from those amounts could do quite well. Amazon’s marketplace obviously counts here. As do other platforms that lend their logistics networks and customers to retailers. Whenever I’ve ordered a Coles delivery, for example, I have used Uber to order it. Uber own the customer relationship with me and presumably charge Coles to generate sales on their platform.

Another interesting one could be the UK-listed Ocado. Ocado found a way to make online food retailing work and now sells its logistics and warehousing expertise to supermarkets worldwide (it is Coles’ major partner in their online push).

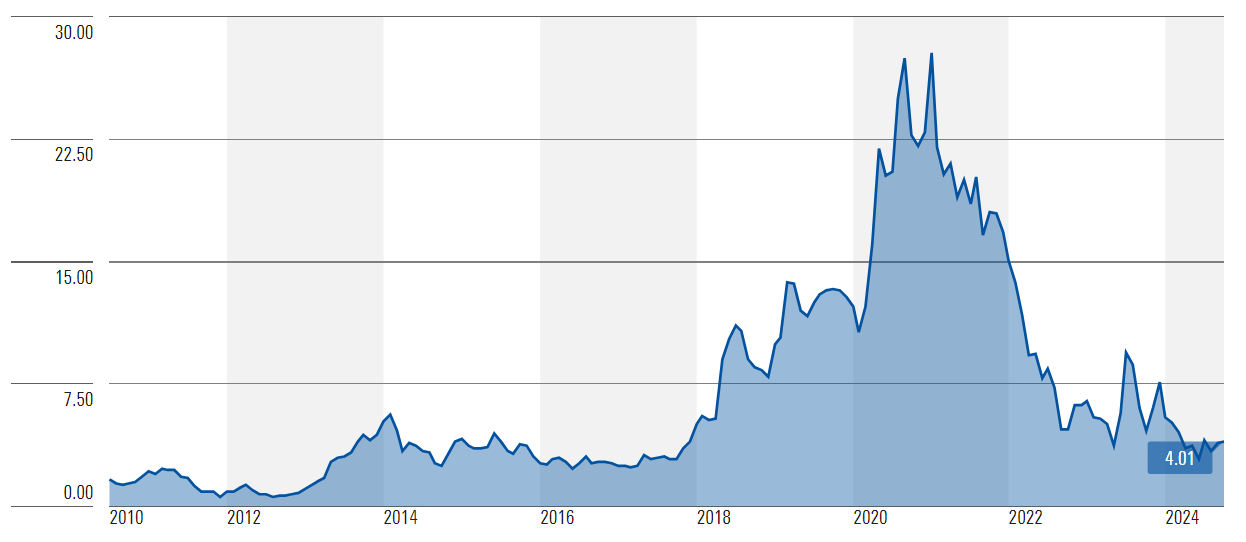

Figure 3: Ocado share price chart

Source: Morningstar

As you can see from the chart above, Ocado has ridden this wave before only to be dumped hard. I have also found the way Ocado describes its business and cash flow potential rather confusing in the past. But if the eGroceries trend is bigger and earlier than many people realise, maybe I should try again.

Joseph Taylor

In this week's Firstlinks...

Couples with a big age gap face unique challenges when it comes to retirement planning. Glen James fleshes out some of the big financial and non-financial things to consider, and explains why having a frank conversation – and having it as early as possible – is essential. Read more here.

Many market participants today have been swept away by the need for quick returns and validation of their opinion. Chris Mackay from MFF makes a case for ignoring the noise and instead practicing old-fashioned patience and focused analysis of companies and industries. Investors who can do this while making the most of the unprecedented technology at our fingertips can add plenty of value.

Building your own home usually sees your dream outcome collide with reality at some point. And in many ways, building an investment portfolio ready for the ups and downs of financial markets isn’t too different. Jamie Wickham provides a framework for real world portfolio construction.

Rob Arnott once said that “in investing, what is comfortable is rarely profitable”. Yet buying assets at or near the ‘point of maximum pessimism’ can be extremely hard. In an extract from his new book, John Addis reveals how to fight your evolutionary instincts, feel the fear and buy anyway.

Investors today are faced with highly concentrated markets and a lot of noise about elections, AI, interest rates and other factors with the potential to affect markets. Ted Maloney, Chief Investment Officer and CEO-elect of MFS sat down with me to discuss what really matters for investors seeking long-term success.

Prolonged periods of geopolitical tension don’t usually set the scene for stellar equity market returns. With this in mind, investors may benefit from considering assets that have fared better in such environments in the past. Ray Jia makes the case for gold’s role in a portfolio at times of high geopolitical tension.

Sydney Swans flunked the AFL grand final again and Tony Dillon thinks a well-meaning rule change in 2016 might have played a small part. In this article, he uses data to show the changing face of AFL finals and explains why AFL bosses are unlikely to be sad about the outcome.

Two extra articles from Morningstar this weekend. Simonelle Mody highlights two cheap Australian tech stocks, while Shani Jayamanne reveals what Morningstar analysts think of the ASX’s most shorted companies.

Lastly, in this week's whitepaper, Neuberger Berman compare returns from Evergreen and Traditional funds.

****

Weekend market update

Stocks continued their heady jaunt in the US on Friday as the S&P 500 rose two thirds of a percent to reach fresh highs, up nearly 23% in the year-to-date, while Treasurys managed a mixed showing with two-year yields dipping three basis points to 3.95% while the long bond settled at 4.39%, up from 4.26% one week ago. WTI crude consolidated its recent gains north of US$75 a barrel, gold pushed higher by nearly 1% to US$2,665 per ounce, bitcoin finished little changed at US$63,100 and the VIX retreated below 21.

From AAP Netdesk:

The local share market on Friday finished slightly lower but its weekly performance was enough to make up for last week's losses and leave it within striking distance of an all-time high. The benchmark S&P/ASX200 index on Friday closed down 8.5 points, or 0.1%, at 8,214.5, while the broader All Ordinaries dipped 7.2 points, or 0.08%, to 8,491.5. For the week, the ASX200 gained 64.5 points, or 0.79%, after dropping 62.2 points the prior week.

Five of the ASX's 11 sectors finished lower on Friday and five closed higher, with financials basically flat.

The materials sector was the biggest mover, though that's not saying much. It dropped 0.45% as losses for the iron ore giants outweighed gains for goldminers. BHP fell 1.1% to $43.43, Fortescue dropped 1.3% to $19.47 and Rio Tinto dipped 0.2% to $119.58.

Northern Star gained 1.1%, Evolution grew 1.8% and Newmont rose 2.1% as the yellow metal changed hands at a two-day high of $US2,644 an ounce.

The big four banks also had a subdued day, with CBA dipping 0.4% to $135.64, Westpac edging 0.1% lower at $30.86, ANZ adding 0.2% to $30.39 and NAB basically flat at $37.28.

In small caps, IRIS metals soared 102.8% to 36.5c after the lithium explorer announced it had successfully converted spodumene concentrate to 99.5% battery-grade lithium at its Beecher Project in the US state of South Dakota.

From Shane Oliver, AMP:

Global share markets rose over the last week helped by the absence so far of an Israeli retaliation against Iran & hopes that it will avoid disrupting oil supplies along with optimism for a continuation of “Goldilocks” - not too hot not too cold - economic conditions. For the week US shares rose 1.1% also helped by solid bank results kicking off the September quarter earnings reporting season, Eurozone shares rose 0.7% and Japanese shares gained 2.5%. Chinese shares fell 3.3% on the absence of follow through so far in terms of fiscal stimulus announcements. Reflecting the global lead Australian shares rose 0.8% with gains in IT, financial and consumer stocks offsetting falls in property and resources shares. Oil prices rose slightly on ongoing supply disruption fears and are up about 11% since Iran’s missile attack but only back to levels seen in August. Metal prices fell with iron ore back down slightly on the back of a lack of a big fiscal announcement in China. The $A fell slightly and the $US rose.

So far oil prices are up around 11% from their pre-Iran attack levels and back to levels seen in August which is just in the realm of normal volatility and not enough to a significantly impact global growth or inflation. For Australian petrol prices it maybe adds 5 cents a litre at most but that will be lost in the regular discounting cycles each city sees.

While US September inflation came in slightly higher than expected, disinflation is continuing, and the Fed likely remains on track for another 0.25% cut next month. Still solid economic conditions with strong payroll data along with the minutes from the last Fed meeting indicating its not in a hurry argue against more 0.5% cuts but slowing leading jobs indicators (with rising continuing jobless claims in the last week) point to another 0.25% cut next month. This is also consistent with comments from Fed speakers most of whom don’t seem to have been fazed by the higher-than-expected September inflation data. In other words, we are likely to continue seeing “good cuts” (reflecting lower inflation) rather than a “bad cuts” (responding to plunging economic conditions). Horrific hurricane damage in Florida is likely to distort some upcoming US economic data but is unlikely to signficantly alter the outlook - with oil production/refining little impacted (unlike with Hurricane Katrina in 2005) and a short term hit to activity followed by a boost from rebuilding.

Falling inflation and rates globally are positive for Australia as we lagged on the way up and are just likely doing the same on the way down. The minutes from the last RBA meeting retained the RBA’s cautious relatively hawkish stance. Yes, it omitted the line that “it was unlikely that the cash rate…would be reduced in the near term” but Governor Bullock repeated the same line at the post meeting press conference. However, we remain of the view that the fall in inflation and interest globally is good news for Australia because just as Australia lagged on the way up in inflation and rates its doing the same on the way down and so is no cause for alarm. Its also worth noting that Australian monthly trimmed mean inflation at 3.4%yoy is only just above US core inflation at 3.3%yoy and running about three months behind. And the latest NAB business survey and Melbourne Institute Gauge point to an ongoing fall in underlying inflation in Australia. So our base case remains for the RBA to start cutting in February with a risk that it could come in December after September quarter and October monthly inflation data.

Curated by James Gruber, Leisa Bell and Joseph Taylor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website