It’s 2014 at the end of Super Bowl XLIX with 26 seconds left. The Seattle Seahawks were down by four points against the New England Patriots. The Seahawks were on the Patriot’s one-yard line just outside the end zone and it was only the second down1. It was a golden opportunity for the Seahawks to snatch a victory.

Seahawks coach Pete Carroll called a timeout and told his quarterback to pass the ball instead of making a running play. The quarterback passed. But the Patriots intercepted the ball, and the Seahawks lost a game that they looked like they were about to win.

Coach Carroll was crucified by fans for the passing decision. Many see it as the worst call in Super Bowl history, perhaps all of NFL history!

But was it a bad decision?

Former World Series of Poker Champion and cognitive behaviour expert, Annie Duke, thinks not. In her book ‘Thinking in Bets: Making Smarter Decisions When You Don’t Have All the Facts’, Duke highlights that, based on 15 years of NFL data, the probability of a short pass interception is below 2%.

The Seahawks were much more likely to score a touchdown or make an incomplete pass that would have barely used any clock time (and doesn’t count as a down).

If a touchdown results, you’re a genius who won the game doing what the opposition didn’t expect you to do. While an unsuccessful running play loses precious time off the clock and only allows time for one more play.

Just because the low probability event happened (an interception), it doesn’t make it a bad decision by the coach. Duke sums it up nicely:

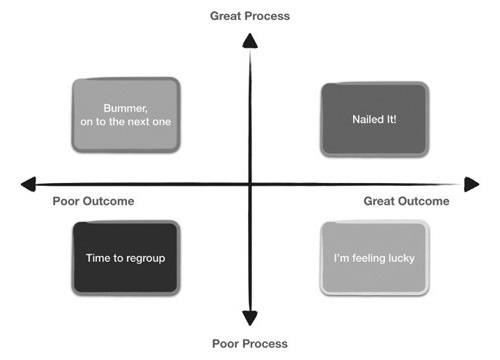

“What makes a decision great is not that it has a great outcome. A great decision is the result of a good process, and that process must include an attempt to accurately represent our own state of knowledge.”

The takeaway: in games where there is chance, and the probabilities aren’t certain (i.e. 100%), you can’t judge a decision by a result.

So-called ‘resulting’ is what poker players call the tendency to judge a decision based on its outcome rather than its quality. Investors need to avoid ‘resulting’ at all costs.

Two decades of trusting our process

At Ophir, we are highly focused on the ‘process’ principle at the portfolio level.

As long-time readers will know, we (Andrew Mitchell and Steven Ng) started out as Australian small-cap investors around 15-20 years ago. Then, as our most successful ‘Aussie’ investments increasingly became global as they expanded overseas, we launched into global small caps some six years ago.

Through that time, the ideal company in which we invest has not changed. It is typically A$500 million to $10 billion in market cap, growing revenue and profits above the market (so generally 10%+ per annum), taking market share, and growing into a big end market wherever that is in the world.

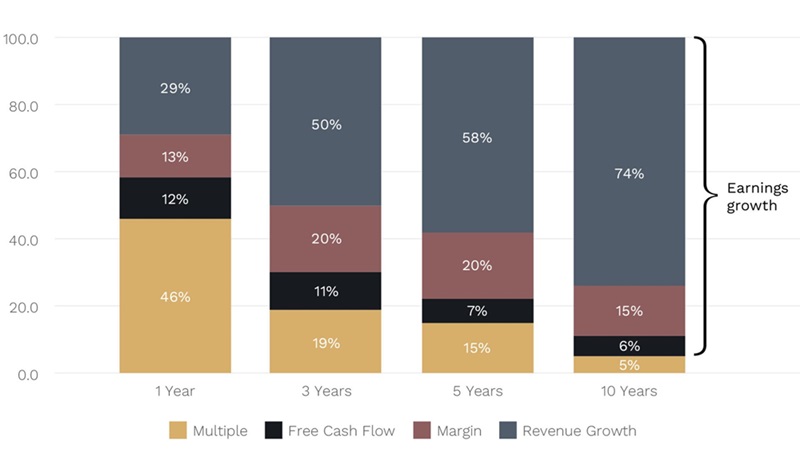

We strongly believe, and the evidence backs it up, that earnings drive company share prices in the long term. You can see this in the chart below where revenue growth, changes in margins and free cash flow all add up to earnings growth, which dominates as the driver of share market returns over time. And providing you don’t overpay for that above-average earnings growth, you give yourself a great chance of generating attractive investment returns and beating the market averages.

Key drivers stock performance – S&P 500 (1990-2009)

Source: Morgan Stanley Research

We also believe that one of the best indicators of above-average earnings growth over the longer term is strong earnings growth today that is beating market expectations.

If you were a fly on the wall in our investment team meetings, you would hear us focussed on how confident we are that our portfolio companies are likely to beat the market’s expectations for revenue and profit growth at their next result.

This, however, doesn’t guarantee you good investment returns in your portfolio in the short term. Changes in valuation multiples (yellow bar above), both at a stock and portfolio level, can swamp the fundamentals of revenue and earnings growth.

This was particularly the case in late 2021 to mid-2022 in our funds, and in particular our Global Funds, where despite still overwhelmingly getting the earnings right, valuation multiples decreased to a degree not seen since the GFC for the entire cohort of small-cap growth-orientated businesses globally, which is of course the pond that we fish in.

Why we’re happy with this process … despite

But we are also focussed on the ‘process’ principle for individual holdings, as the example of Altium shows.

Altium (ASX:ALU) is an Australian stock we held last year in the Ophir High Conviction Fund (ASX:OPH). It makes the most widely used software for the design and manufacturing of printed circuit boards.

But towards the end of 2023, one of our analysts warned us there was going to be an earnings hole at the first half 2024 result due in February 2024.

If we are highly confident an earnings miss is looming at an upcoming result, we will either down-weight the position or sell to zero. In this case the instruction was clear: get out entirely!

Just weeks later, in mid-February, Japanese chipmaker Renesas Electronics lobbed a takeover bid for Altium at $68.50 – a circa 34% premium to the closing price of the company’s shares the day before, valuing the business at A$9.1 billion in an all-cash deal.

Our analyst was livid and there was definitely a few swear words in the office! We had lost the chance at significant outperformance by selling the stock early.

Were we (Andrew and Steven) upset at the lost performance opportunity? No!

The reason is simple: The analyst did all the correct work, as part of our process and made the right call with the information they had at the time.

We will never hold onto a company because a takeover offer might be lobbed – the probability is usually just far too small and uncertain.

Low and behold, in late February when Altium came out with its result, it reported a big miss to earnings, that, but for the takeover offer, would normally have seen the stock fall upwards of -30%.

Altium (ALU) share price and earnings

Source: Bloomberg

Our analyst made the right call based on the percentages – a recommendation to sell Altium based on a likely upcoming earnings miss – and this isn’t invalidated due to a small-probability left-field takeover offer effectively rendering the earnings miss meaningless.

1 For non-NFL fans, in American Football you get four attempts to move the ball at least 10 yards up the field. The first of these tries is “first down”, the next “second down” and so on. Once they make it 10 yards or further the downs reset and it’s back to first down.

Andrew Mitchell and Steven Ng are co-founders and Senior Portfolio Managers at Ophir Asset Management, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

Read more articles and papers from Ophir here.