The article on why $1 million is always superior to $500,000 despite the potential loss of franking credits and age pension attracted many worthy comments. A reader, John Hyslop, asked about self-funding a retirement and staying off the age pension. John asked:

“This is a powerful analysis with great supporting graphics. Could you please run some numbers on two other couples?

Let’s use the same basic assumptions as in your article but with a different mindset. The couples have always been self-reliant. They realise that they have been fortunate to save well, with generous taxpayer help in tax concessions, and essentially tax-free retirement. They are concerned that coming generations are being asked to fund a great lifestyle.

They aim to refrain from being on the age pension for as long as possible can. They realise that they can live a good life on $50k p.a. They will avoid major house extensions or ‘unnecessary’ spending simply to qualify for the age pension. Although being forced to make annual withdrawals from their SMSF, they could build up another investment reserve fund outside super using any surpluses.

Could you re-run the numbers to assess when they ‘have to’ go on the pension and with the possibility of being able to leave some inheritance for the kids? I believe the system is unsustainable and is likely to produce inter-generational conflict.”

Hi John

Under age pension rules, a couple can have a home of unlimited value and receive a full age pension if their other assets are worth less than $380,500. The pension cuts out when assets exceed $837,000.

The couple with $500,000 will be eligible for a part-pension from the start which will make up half their annual income. The couple with $1,000,000 will start to receive a part-pension when they reach age 72 after drawing down some of their capital. Using the minimum drawdown rule would not impact the period until they become eligible for age pension because from age 65 to 75, the minimum drawdown rate is 5%, the same as the investment return.

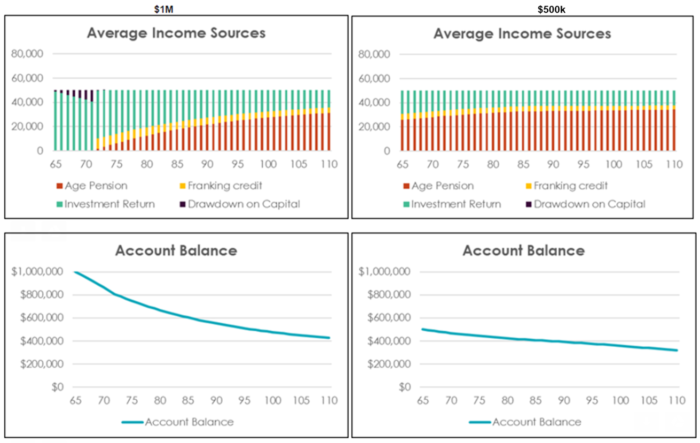

The charts below show:

- Both couples will go on the age pension, unless they feel strongly that they should not be a ‘burden’ on the budget. This is typical of most retirees as even with compulsory superannuation since 1992, it is expected that 70% of Australians of eligibility age will still be drawing a part-pension by 2055 (see 2015 Intergenerational Report).

- When the Smiths become eligible for the age pension, they also receive their franking refunds (assuming not in an SMSF), and no longer need to drawdown capital to spend $50,000 a year.

- Due to the more modest lifestyle, neither couple runs out of other capital, so there will always be something in reserve for unexpected costs or a bequest.

It’s especially interesting to contrast the consequences of living on $50,000 versus $80,000 (in the previous article), with both couples trading off greater financial security for a lesser lifestyle, assuming money delivers lifestyle benefits.

Smiths ($1 million) versus Joneses ($500,000) based on $50,000 annual expenditure

Graham Hand is Managing Editor of Cuffelinks. My thanks to quantitative analyst Estelle Liu for assisting with the calculations.