An Australian paper on safe withdrawal rates from capital at retirement concludes that over 30 years, a 50/50 portfolio with a withdrawal rate of 4% a year would run out of money about 18% of the time. This is despite the excellent returns from Australian equities over the sample period. The study has important implications for financial planning over long retirement periods.

In contrast to academic work on the accumulation phase of investing, a trifling amount of research has been done on the decumulation phase of investing, where accumulated wealth must be managed to fund retirement needs for potentially 30 years or longer.

Twenty years ago, William Bengen, a practising financial planner with an aeronautical engineering degree, set about calculating the rate at which capital could be drawn for a US retiree with a high probability of the portfolio lasting 30 years. Bengen used US investment return data from 1926 to compute a safe maximum withdrawal rate (which he called SAFEMAX) of 4.15% per annum for a 50/50 portfolio of US shares and bonds. He thus suggested that if a US retiree commenced a systematic withdrawal plan drawing 4% of the initial portfolio value, and thereafter that same dollar amount (adjusted for inflation each year), a 50/50 ‘balanced’ portfolio would last for at least 30 years. Subsequent studies confirmed Bengen’s findings, and thus the ‘4% Rule’ was born.

Finsia safe withdrawal rate report

The 4% Rule has come to be the default safe withdrawal rate in retirement planning assumed by planning professionals. It relies on historical data for the US. How safe is it for other countries? A recently released Finsia report seeks to shed light on the matter.

Finsia’s report is the latest contribution in its Retirement Risk Zone initiative, focussing on the risks in the last two decades of work and the first fifteen years of retirement. The report was authored by Professor Michael Drew and Dr Adam Walk of Griffith University.

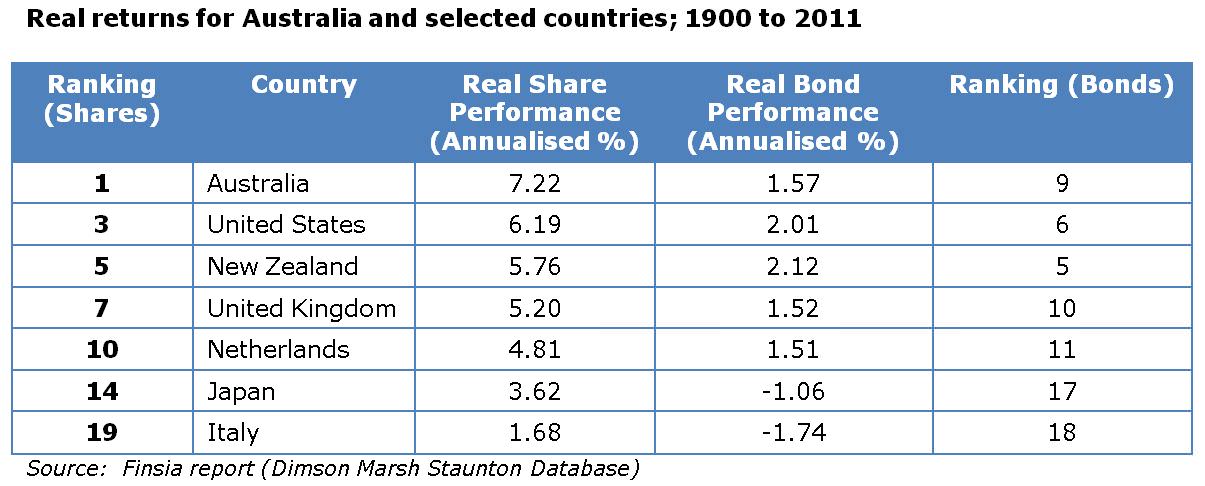

In an important departure from previous US-centric studies the authors used a global database of real (after inflation) investment returns for 19 countries spanning a period of 112 years. They focussed their analysis on Australia and a selection of other countries representing the quartile performers (Japan 25th, Netherlands 50th and New Zealand 75th) as well as the worst performer, Italy. The table below provides details of these nations (with the US and UK added for comparison):

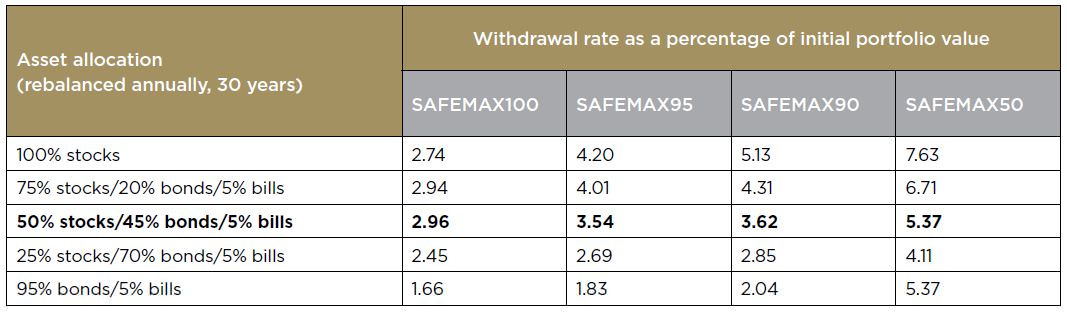

Drew and Walk used a simulation process to model the probability of portfolio ruin (retirement capital exhausting) for various retirement timeframes, and for various growth/defensive asset allocations. The results for a 30 year retirement for Australia appear below:

The highlighted row indicates that using a 50/50 asset allocation, the Australian safe withdrawal rate is 3.62% p.a. (real) at a 10% chance of portfolio ruin (SAFEMAX90) over a 30 year retirement.

Whilst Australia has enjoyed the highest equity returns of all 19 nations over the 112 years analysed, its 50/50 SAFEMAX90 real rate of 3.62% p.a. is not the highest. Both NZ (3.97% p.a) and the Netherlands (3.67% p.a.) had higher safe withdrawal rates, owing to superior risk-adjusted returns from their respective bond markets. The two laggards were Italy with a SAFEMAX90 rate of 1.23% p.a. and Japan with a rate of 0.29% p.a.

What conclusions can be drawn from the report?

The report’s authors conclude that there is no ‘silver bullet’ when it comes to retirement planning. They warn against using the 4% Rule in a deterministic way, instead suggesting that the underlying philosophy of the Rule can be a useful tool in framing retirement conversations and in forming expectations. They note that a retiree couple with a $1 million starting pension balance would need to draw in excess of 5.6% to generate the ASFA comfortable retiree budget.

Perhaps more importantly, the report suggests that asset-liability management needs to be considered more thoroughly in retirement planning. The authors note that, “The conversation is a difficult one in that, for many investors, their focus is on the asset side … of the equation, not the liability. We posit that the first challenge in tipping the scales in the retiree’s favour is to get the framing right, moving from a ‘pot of gold’ (asset) mindset to an ‘income replacement’ focus (liability).”

Scope for future research

Whilst the report is an important step, especially given its Australian context, much more needs to be done to further our understanding of the decumulation phase. The report does not consider, for example, the interaction between personal retirement assets (superannuation), other assets and the age pension. It ignores important personal planning issues such as mortality risk, taxes, franking credits or the bequest motive. Current government statistics indicate that less than 20% of retirees are fully self-funded, and that most Australians will be dependent on some level of government assistance in retirement. With those aged 65 plus estimated to grow in number from the current 3 million to some 4.2 million by 2020, and with pension assets expected to exceed $1.4 trillion (2011 dollars) by 2026, there is a lot at stake. This report shows that even if the future repeats the excellent past returns, the old 4% Rule is little more than a conversation starter.

Harry Chemay is a Certified Investment Management Analyst, a consultant across both retail and institutional superannuation and Fellow member of FINSIA. He has previously practised as a specialist SMSF advisor, and as an investment consultant to APRA-regulated superannuation funds.

The full study is, “How Safe are Safe Withdrawal Rates in Retirement? An Australian Perspective”, FINSIA Research Report, Professor Michael Drew and Dr Adam Walk. Available on the FINSIA website.