For many Australians, the primary goal of investing is to accumulate sufficient assets to fund a comfortable retirement. Whether it’s joining the grey nomads travelling the Australian countryside, seeing more of the world or spending quality time with the grandkids, everyone has plans for their retirement. The investment focus and risk appetite changes the closer the investor is to retirement.

For the early accumulators in the early stages of the superannuation savings journey, maximising returns should be the focus. Their savings pool is relatively small and the investor usually has time to ride out market volatility.

For investors either approaching or already in retirement, the focus generally shifts from maximising returns to minimising risk. However, the actions taken at this time are critically important with investors faced with significant longevity risk and sequencing risk.

What is longevity risk?

As life expectancy increases, the savings required to fund the average retirement likewise increases. Longevity risk broadly refers to the risk of an investor outliving their retirement savings. Retirees may be at risk of outliving their savings if they invest too conservatively, while on the other hand, a sharp downturn in markets could have a significant negative impact on their capital.

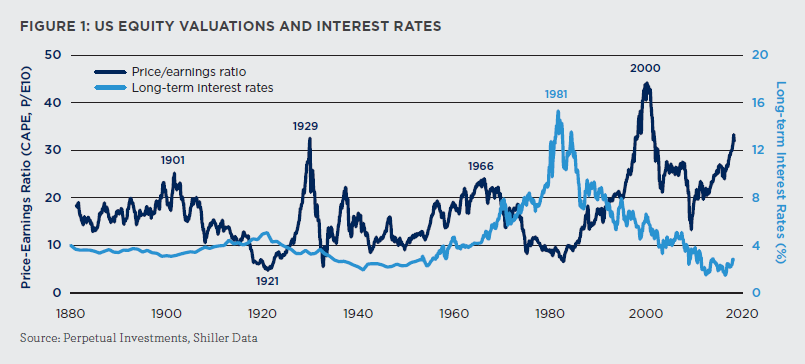

Figure 1 below highlights both long-term bond yields and equity valuations. Investors face difficult asset allocation decisions when balancing the need to minimise risk while ensuring their capital will last their lifetime.

Despite an uncertain investment outlook, retirees should maintain some exposure to growth assets to ensure their capital will last the distance. The temptation may be to flock to the relative ‘safety’ of cash. According to APRA, Australian investors have $89 billion in cash deposits, despite historically low interest rates. By the time the return is adjusted for inflation, a cash investment is unlikely to protect retirees against longevity risk.

What is sequencing risk?

Towards the end of the accumulation phase and in early retirement, an investor’s savings pool is generally at its largest, and is more exposed to market movements given the volume of capital at risk. Sequencing risk is the risk that the order and timing of investments and returns is unfavourable.

Sequencing risk is most significant during the last 10 years of an investor’s accumulation phase and the first 10 years in retirement. The sequence of returns during this period has a significant impact on the sustainability of the retirement income. A fall in market value of investments would leave the investor much less time for capital valuations to recover and increase the probability of a shortfall of funds in the late stage of retirement.

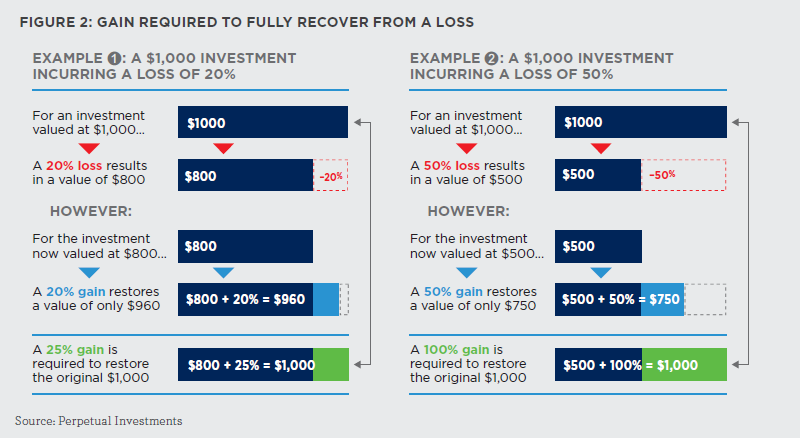

Figure 2 below shows that the larger the potential loss suffered, the more significant the gain required to recover the capital. A valuation fall of 20%, for example, requires a 25% return to get even, and a fall of 50% necessitates a 100% appreciation. A retiree drawing down on a diminishing capital base will only exacerbate the issue.

It can be incredibly disheartening when poor investment performance occurs close to retirement, or soon after, just when the investor’s nest egg is at its largest. It might force the investor to make some less-than-ideal decisions.

They may have to postpone retirement and work longer than anticipated, or re-join the workforce. Alternatively, the investor may have to reduce expenditure and make different lifestyle choices, forgoing travel or other post-retirement plans. In an attempt to rebuild the retirement nest egg, the investor may increase exposure to growth assets and potentially increase the investment risk of their remaining savings in an attempt to recoup losses.

An example of sequencing risk

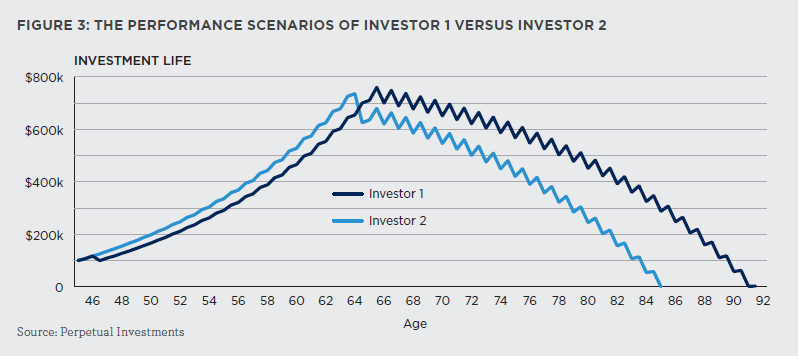

A simplified example of sequencing risk is illustrated by two investors in Figure 3 below, which charts the following scenarios which are similar in most respects:

- Each investor started with $100,000 savings at age 45 and then contributed an additional $10,000 per year.

- The average return for both investors is 7% per annum.

- Investor 1 incurs a loss of 15% at the age of 46.

- Investor 2 incurs a loss of 15% at the age of 64.

- Both retire at age 65 and draw a pension of $60,000 per annum.

Investor 2 exhausts their retirement savings six years earlier than Investor 1 due to the impact of sequencing risk when a negative return is experienced closer to retirement when the savings balance is high. The impact of a negative return experienced close to the commencement of the accumulation phase, when the amount of investment savings is lower, is much less profound.

Traditionally, as investors move towards retirement, exposure to defensive assets increases to reduce exposure to market risk and therefore sequencing risk. However, with low cash rates and bond yields, a lack of investment risk in portfolios introduces the certainty of low returns, which are likely to be insufficient to meet the needs of an ageing, longer-living population. In other words, lowering investment risk contributes to longevity risk.

The role of real return funds

Minimising exposure to volatility is the key to mitigating the effects of sequencing risk, as the magnitude of negative returns will be reduced, although it is not possible to completely avoid adverse market environments.

As an alternative to the traditional move to defensive assets, objective-based or ‘real return’ investing seeks to balance strong investment returns with an element of capital preservation.

Real return funds apply protection strategies and sources of portfolio diversification designed to provide investors with a higher certainty of achieving a particular return objective with a lower level of risk. Portfolios can be built to meet an investor’s risk profile, desired return and investment horizon. Through specialised asset management, dynamic asset allocation or by investing in a broader investment universe, real return funds often have greater flexibility to adjust the portfolio’s asset allocation in response to market conditions.

Investors should be able to choose the timing and style of their retirement. Rather than putting their assets and retirement at risk, real return funds should be considered by investors seeking a comfortable retirement, irrespective of their longevity.

Adam Curtis is Head of Investment Specialists at Perpetual Investments. This article is for educational purposes and is not intended to provide you with tailored financial advice.

Perpetual is a sponsor of Cuffelinks. For more articles and papers from Perpetual, please click here.