When I interviewed the father of Modern Portfolio Theory, Nobel Laureate Harry Markowitz, in 2013, he told me, "Nobody seems to be very good at picking the market."

Elsewhere, Warren Buffett also said (referring to his colleague, Charlie Munger):

"Charlie and I spend no time thinking or talking about what the stock market is going to do, because we don’t know. We are not operating on the basis of any kind of macro forecast about stocks. There’s always a list of reasons why the country will have problems tomorrow.”

And Ray Dalio, Founder of Bridgewater Associates, advised:

“You should have a strategic asset allocation mix that assumes that you don’t know what the future is going to hold.”

If it's good enough for Harry, Warren and Ray, it's good enough for me ...

And yet most of us try some version of tactical asset allocation, especially in a year when major stockmarkets delivered 20% plus returns and cash paid zero. For portfolio returns, asset allocation was never more important, and gains like this will be difficult to repeat in the low-return markets of the future.

APRA turning up the heat on our super funds

There is now an extra factor in play on asset allocation at large super funds, with APRA releasing the first results under the Your Future, Your Super Performance Test regime. It has started with 76 MySuper funds and 13 products failed to meet their benchmark. It’s a fearsome ‘name and shame’ exercise that is causing agony among suffering funds and their trustees. The so-called ‘failing products’ include funds from Asgard, Christian Super, Colonial First State, Commonwealth Bank, Energy Industries, Maritime Super and BT Super.

APRA does not downplay the severity of the consequences:

“Trustees of the 13 products that failed the test now face an important choice: they can urgently make the improvements needed to ensure they pass next year’s test or start planning to transfer their members to a fund that can deliver better outcomes for them ... Trustees of failed products are required to write to members by 27 September 2021 advising them of their Performance Test outcome and providing the details of the ATO’s YourSuper comparison tool.”

Many trustees claim the process is unfair, because it benchmarks their funds against the wrong asset mix. It is especially cruel when equity markets have performed strongly and a fund is compared with a more growth-oriented benchmark. For example, Maritime Super CEO Peter Robertson argues it was benchmarked against a risker exposure:

“The benchmark we are being measured against was 66% growth assets. At times we had as low as 21% growth assets, so we are being measured against a benchmark which is going to be hard to achieve.”

Maritime Super says it employed a dynamic asset allocation process to reduce its exposure to equity markets, which was appropriate at the height of COVID, but it missed some of the 2020/21 bounce. Like it or not, the future viability of ‘failed funds’ depends on performance relative to the benchmark chosen by APRA, even if the action of the fund’s trustees and the asset allocation was appropriately determined and right for their own members. We cover this debate in more detail here.

How important is asset allocation for returns?

It’s obvious that deciding between cash, bonds, equities and the rich range of asset types has considerable impact on returns, although the often-stated claim that 90% of investment returns can be attributed to asset allocation is disputed. This number comes from famous research called The Determinants of Portfolio Performance by Brinson, Hood and Beebower in 1986 and updated in 1991. In this context, selecting stocks is barely worth the effort.

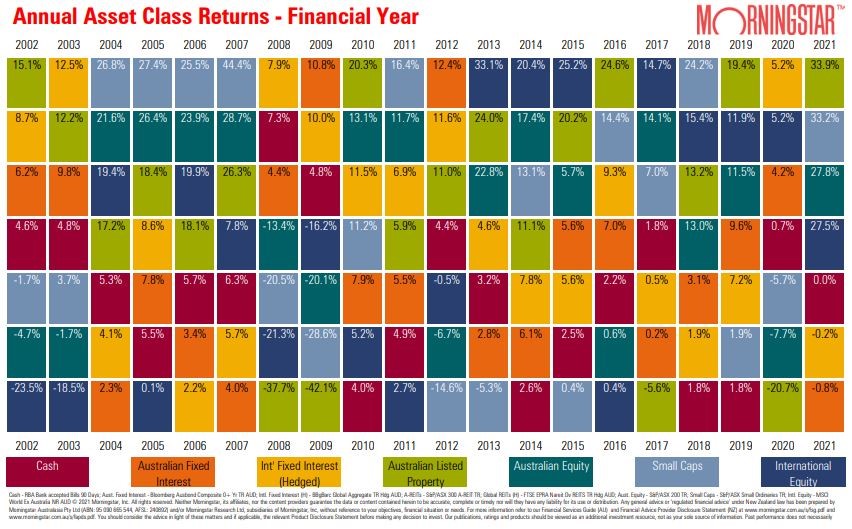

But even if 90% is correct, it is not overly helpful, because as Harry, Warren and Ray said, it is difficult to make the best asset allocations in advance. Returns from each asset class fluctuate so much that nobody can time the portfolio changes accurately. We all wish we had invested 100% in equities a year ago but the only investment decisions that matter now must be made today and in the future. One look at the Morningstar Gameboard below shows the winners and losers change every year.

The Brinson study also looked at only equities versus cash and bonds and there are far more choices available now offering greater opportunities and mixtures of factors that determine returns.

With continuous switching of asset allocations a fraught process bound to fail, and it’s better to understand long-term goals and risk tolerances and look decades ahead rather than selecting short-term swings.

Asset allocations of major players

Let’s consider how some major asset allocations are set up, starting with the most powerful person in the financial world, the head of the US Federal Reserve, Jerome Powell.

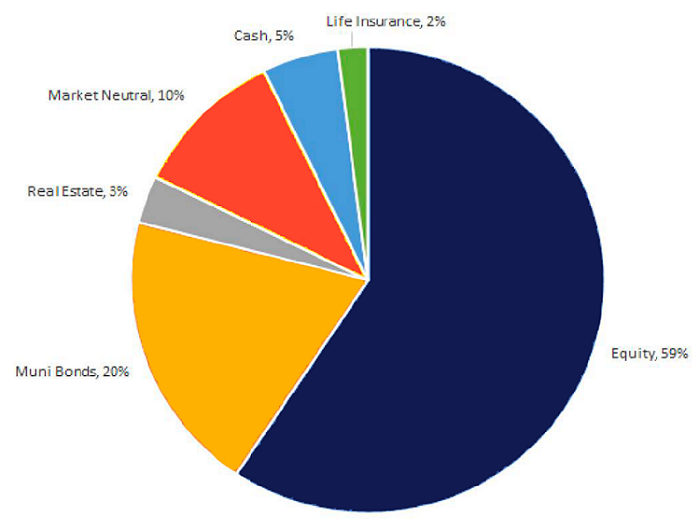

Powell is obviously investing for his own personal circumstances, but as someone who controls the destiny of markets in every announcement he makes, perhaps there is some comfort for growth investors in his high allocation to equities. It’s not fair to think his US policy decisions are influenced by the composition of his own portfolio, and he also manages to keep fixed interest and market neutral supporters happy with a decent allocation to those assets.

For a point of comparison, Powell is 68-years-old, his annual salary as Chair of the Fed is US$203,500 and his net worth is estimated at US$55 million. The assets below are based on his 278e filings to the US Office of Government Ethics disclosing the source of all income and assets in broad ranges.

Jerome Powell’s Estimated Asset Allocation, 2019

Source: Calderwood Capital Research

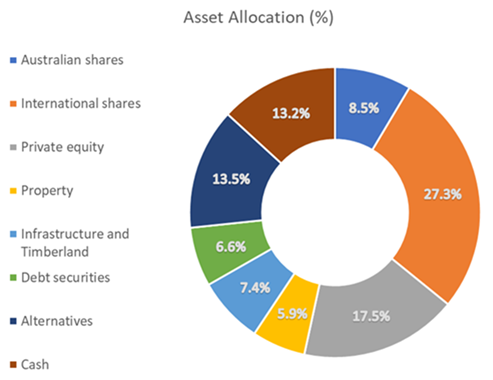

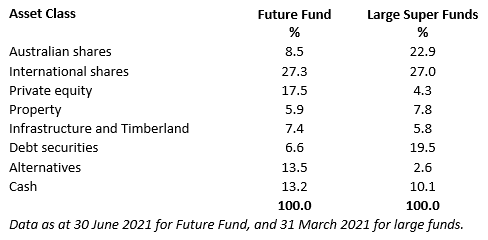

What about the biggest asset allocators in Australia, the Future Fund and the sum of our large superannuation funds? Although they are all long-term investors, there are significant differences.

We have explained the way the Future Fund works previously such as here and here, so we will not repeat these points, other than to note that its allocations to private equity at 17.5%, infrastructure and timberland at 7.4% and alternatives at 13.5% are much higher than by typical superannuation investors. It also splits its international shares evenly between global and emerging markets.

The extent of this variation is best illustrated by comparing the Future Fund with large super institutions, which place far more in Australian equities and debt securities.

As a long-term investor, private equity may help maximise returns by capturing an illiquidity premium and giving exposure to themes not available in liquid markets. Investments in infrastructure and timberland provide inflation protection and portfolio diversification. The Future Fund has historically employed a ‘barbell’ strategy, meaning there is a considerable allocation to cash but also a sizeable exposure to riskier strategies. Holding cash allows the Fund to be opportunistic and buy cheaper assets in times of market corrections.

Can a retail investor replicate the Future Fund?

In the year to 30 June 2021, the Future Fund delivered a return of 22.2%, similar to the best-performing super funds but above the average fund with larger exposures to listed equities. Its ‘private’ assets are judged to be less volatile in price so the risk-adjusted returns are impressive (although simply because an airport is listed does not mean it is a more volatile asset than an unlisted airport, even if its value changes more often).

The biggest difficulty for retail investors replicating the portfolio like the Future Fund is the access to the world of private equity, debt and infrastructure, as the Fund's latest update reports:

“Listed equity markets performed strongly while our significant exposure to private equity has delivered excellent returns. During the year we committed to additional opportunities in Australian infrastructure, notably through a further investment into Powering Australian Renewables (PowAR), and a new partnership with Telstra InfraCo Towers."

Until recent years, it was more difficult for retail investors to access ‘alternative’ assets such as private equity, infrastructure, corporate bonds, securitisations and long/short funds. However, while not rivalling the Future Fund in range and access, the available assets have expanded including dozens of funds listed on the ASX and Chi-X, accessible in the same way as any listed share.

Another factor for a retail investor with a large SMSF that does not concern the Future Fund is the need to ensure enough liquidity to pay personal pensions.

As articles have appeared in the media this week saying it is not possible for a retail investor to replicate the Future Fund, here are some examples of what is possible, predominantly in the listed space to illustrate ease of access (these are not recommendations although the author owns investments in many of these funds).

- Pengana Private Equity (ASX:PE1)

- WAM Alternative Assets (ASX: WMA)

- Partners Group (unlisted private equity)

- Argo Global Listed Infrastructure (ASX:ALI)

- Magellan Core Infrastructure Fund (CHX:MCSI)

- Thorney Opportunities (ASX:TOP)

- Bailador Technology (ASX:BTI)

- Gryphon Capital Income Trust (ASX:GCI)

- Metrics Income Opportunities (ASX:MOT)

- Metrics Master Income Fund (ASX:MXT)

- Qualitas Real Estate Income Fund (ASX:QRI)

- NB Global Corporate Income Trust (ASX:NBI)

- Perpetual Credit Income Trust (ASX:PCI)

- Coolabah Active Composite Bond (CHX:FIXD)

- Janus Henderson Tactical Income (CHX:TACT)

- Absolute Equities Performance Fund (ASX:AEG)

And of course a vast range of thematic or sector specific ETFs and unlisted funds accessible via platforms or directly with managers.

This does not replicate the number of direct opportunities available to the $200 billion Future Fund or the large super funds, but moving beyond equities and bonds into non-traditional asset classes is easy for anyone.

What about expected returns?

The wonderful returns achieved in recent decades from a traditional 60/40 or 70/30 growth-defensive fund will not be replicated in coming decades. Those portfolios benefited from a 30-year interest rate rally and rerating of equity P/Es. For an analysis of the expected future returns from these balanced portfolios, see the White Paper from UBS in this week’s newsletter, linked here.

To quote the conclusion from UBS from that paper:

“The run-up of equities in the last few months continues to pull some future returns into the present. Our expected returns for equities - especially US equities - are the lowest in years. Pockets of equities outside the US offer more compelling expected returns.

When it comes to asset returns and inflation, we see that the market is little prepared for a sustained breakout of price pressures. A disruptive repricing of inflation risks will affect all markets - in the short-run there is no place to hide from negative real returns.

We expect alternatives to suffer the least as commodities, gold and real estate gain relative to other asset classes. Again, the nature of inflation will be important. Inflation tied to a more robust growth backdrop should benefit real estate, while a Stagflation would probably be very positive for gold. Commodities would probably be one of the drivers in inflation and clearly should do better in an inflationary growth environment.

In short, we believe that the market opportunities to truly profit from inflation are few.”

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor.