The past few weeks have been a turbulent time for the global oil market, with oil futures prices falling below zero for the first time ever. In this article we discuss the alternatives for investors who are looking for exposure to oil.

Unless you own a storage tanker to physically hold oil, it is virtually impossible to invest in oil at the spot price. The most common way of gaining exposure is through oil futures contracts, but investing in futures directly can be complex and tedious. Most investors prefer to gain access to the oil market via exchange traded funds (ETFs), leaving the fund to manage the futures exposure for them.

Oil futures and contango

A key component of the performance of oil futures and any ETF that aims to track oil futures prices is ‘roll return’, which in turn depends on the shape of the oil futures curve.

Futures expire according to a predetermined schedule. On the futures settlement date, anyone holding a contract must take physical delivery of the oil. In order to avoid this, investors (including in oil ETFs), must ‘roll’ from one contract to the next prior to the settlement date. Rolling involves either a cost, or a credit, depending on the shape of the futures curve.

When the futures price of a commodity is higher than the spot price, this is known as ‘contango’. A market is in ‘backwardation’ when the futures price is below the spot price.

It is crucial that anyone considering investing in an oil ETF understand the impact this can have.

I’ll use the time around the roll period in early April 2020 of the BetaShares OOO fund (Crude Oil Index ETF - Currency Hedged (synthetic)) in the example below, but the concept of contango and its impact on performance applies to any futures-based oil ETF, or to anyone rolling futures themselves.

OOO aims to track an index that normally provides exposure to front-month West Texas Intermediate (WTI) Crude oil futures. WTI futures contracts settle on the third business day prior to the 25th of the month and therefore need to be rolled to maintain exposure. OOO’s Index gradually rolls the current contract over a five-day period commencing on the fifth business day of each month.

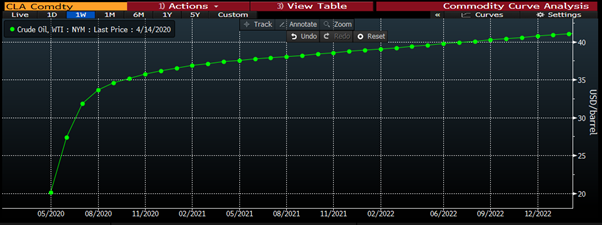

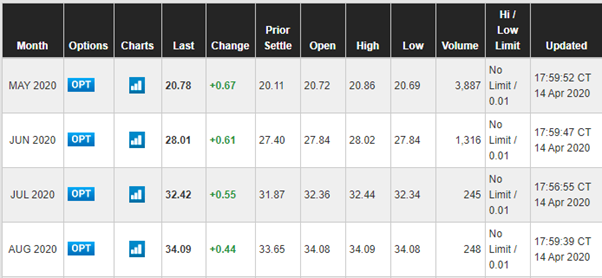

We have been witnessing extreme conditions with both demand and supply-side shocks. As you can see in the chart and table below, the futures curve has been very steep at the front end (steep contango). The curve has shifted dramatically over the last few months—it was still in backwardation in January. Following the S&P GSCI Crude Oil Index rebalance ending 13 April, however, the roll cost was as high as 27% per month.

Source: Bloomberg. Data as at 14th April 2020.

Source: CME. Data as at 15 April 2020.

The premium of the subsequent month’s futures contract will decay towards the oil spot price as the expiry date approaches. This is an unavoidable component of commodity futures.

At the time of the screenshot above, the June contract was trading at US$28.01, while spot WTI oil was US$20.78. If the spot price had stayed stable at that price, the June futures contract would have to erode 26% from then until expiry on 19 May 2020. This erosion would be reflected in a fall in Net Asset Value (NAV) of any oil ETFs, which aim to track these contracts.

Negative oil futures prices

On 21 April 2020, US oil futures prices were negative for the first time in history, following the largest one-day sell-off ever. This was based off the May WTI Crude futures contract, which settled on 21 April in the US.

Due to the supply glut and lack of demand for oil resulting from the global pandemic shutdown, the cost of storing oil has risen astronomically. Traders were desperately trying to offload contracts before settlement to avoid taking physical delivery. Given the cost of shutting a well, many producers were willing to pay someone to dispose of their oil.

What does this mean for funds that aim to track an index which provides exposure to oil futures?

The index the BetaShares OOO fund aims to track finished rolling into the June contract on 13 April, so was not holding May contracts when they traded negatively. On 21 April, when the May contract fell below zero, the June contract was trading at ~US$20. Of course, the performance of the ETF over that time was affected by the prevailing price of the June contract (it had been trading at highs closer to ~US$24 the day before).

Whilse oil futures prices are now back in positive territory, the risk of turning negative again remains. In the current environment, as the settlement date of the June contract approaches that risk may increase.

In view of these unprecedented market developments, and to reduce the risk of exposure to negative prices (which potentially could reduce an ETF’s value to zero), many oil ETFs have considered it prudent and in investors’ interests to temporarily replace exposure with longer-dated contracts. In our case, exposure has been temporarily replaced with the less volatile three-month forward contract until further notice. This was done with the aim of reducing the risk of permanent loss of capital, and should also reduce the cost of rolling futures.

These types of de-risking changes have not been limited to ETF providers. Index providers have also made changes to benchmarks linked to short-term oil futures prices.

What lies ahead for oil?

Oil is a physical spot asset, the price of which is determined by supply and demand, unlike equities whose prices are based primarily on expectations of future earnings. In order to behave functionally, markets must square off all supply and demand. Until the global lockdown ends or unless there are monumental supply cuts, the dynamics look likely to remain extremely out of balance.

The US WTI Crude has been hardest hit, primarily due to geographic location. The landlocked city of Cushing, Oklahoma, is the major trading hub and delivery point for WTI crude contracts. While the shortage of off-land oil tankers is less severe, the global shutdown has caused US storage facilities, pipelines and refineries to approach physical constraints.

Oil markets are currently hitting transportation bottlenecks, without having filled storage capacity. If we do test global storage capacity in the coming weeks (beyond US onshore), there will likely be significant volatility, and oil futures prices could decline further until supply meets demand.

Looking beyond and to the eventual recovery, there is the chance that if we see sweeping refinery shutdowns and pipelines get clogged, we could see a supply-led inflationary shock when demand returns to pre-crisis levels. However, for those looking to capitalise, the strength of this rebound will depend on both a sharp increase in demand and how much excess inventory is built.

Energy companies

The current oil rout could see the energy industry finally undertake the critical restructuring it needs. Shale producers were already seeing sharply higher costs of capital, and the COVID-19 crisis could see that capital dry up entirely. The potential for widespread bankruptcies could see global energy markets once again be the domain of energy’s ‘supermajors’.

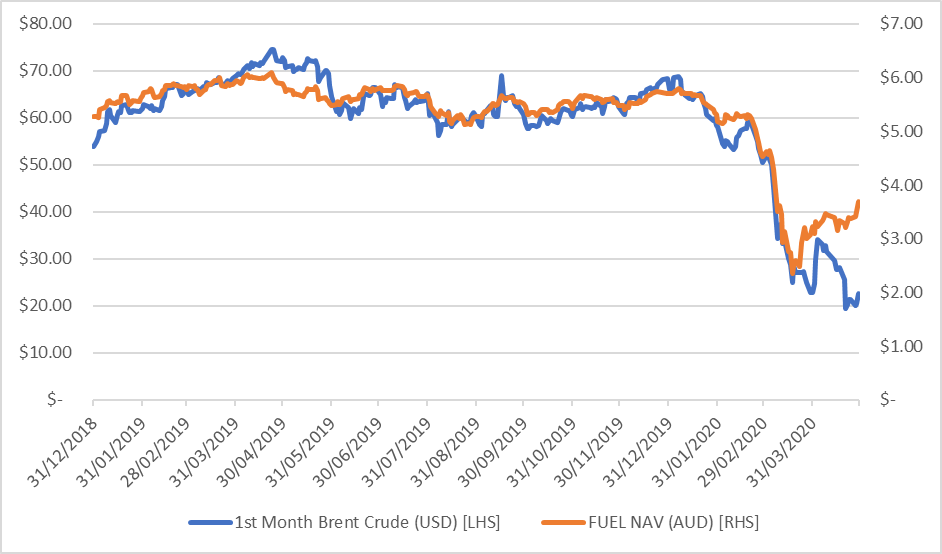

Energy remains a sector that’s crucial to any eventual recovery in global growth. One option for investors looking at a cyclical recovery by major energy companies is an ETF such as the BetaShares Global Energy Companies ETF – Currency Hedged (ASX:FUEL), which provides exposure to the 50 largest energy companies globally ex-Australia. These companies historically have shown a high correlation to the price of oil futures as can be seen in the chart below.

Source: Bloomberg, BetaShares. Data as at 29 April 2020. Past performance is not indicative of future returns

Note: As discussed above, the price of oil futures contracts is not the same as the ‘spot price’ of oil. As such, the performance of oil futures, or an ETF that is linked to oil futures, may be materially different to the performance of the spot price of oil itself.

Alistair Mills is Associate Director, Portfolio Analytics & Adviser Business at BetaShares, a sponsor of Firstlinks.This article is for general information purposes only and does not address the needs of any individual.

For more articles and papers from BetaShares, please click here.