Financial markets are full of warnings about past performance not being an indicator of future performance. But past precedent can be invaluable in helping prepare for the future.

Most people currently investing in stock markets, or advising clients on how to manage their finances, have never experienced more than one interest-rate tightening cycle, and perhaps not lived through the global financial crisis (GFC). As a result, few people today can draw on their personal experiences to help them navigate the latest rate tightening cycle and its aftermath, so learning about the past might be the only way to appreciate what is happening now and could arise in the future.

Indeed, history is especially important in markets today with such elevated valuations for stocks. For investment managers, the brutal truth is that we are playing a game, albeit a very serious one. We are making decisions on behalf of investors in an environment of uncertainty, considering the probabilities of certain events such as recessions or debt defaults happening.

At the moment, the ‘higher for longer’ interest rate scenario and the expectation of recession have largely been priced out of markets. US stock markets are pricing in cuts in interest rates this year alongside a double-digit reacceleration in corporate profits. Falling bond yields have allowed multiples to expand and stocks to rise. But this situation is against the odds.

We believe that many investors and commentators are being excessively optimistic and not giving enough credence to a less rosy outcome. The potential end of the rate tightening cycle has prompted relief rallies in stocks before, but that does not change our assessment that the probability this rally could well end in tears are not insignificant.

US equities now yield less than sovereign bonds, investment grade bonds and cash. This is confusing for anyone used to the idea of an equity risk premium. There are ways to rationalise this inversion of the usual position including a tech-related new paradigm encompassing AI. But the simplest explanation is that US stocks are now very expensive, and those valuations can’t be sustained. They have been driven up by tailwinds such as low wage costs, rates of taxation and interest rates. These tailwinds are now reversing, and stock prices are vulnerable to a correction.

What does history tell us about the present? Focusing on the largest and most important economy, the US, one can draw on a few useful indicators that suggest stock markets could turn.

Earnings likely to fall

First and foremost, history suggests that US earnings and GDP recessions are more likely than not following an interest rate tightening cycle. In all the 13 tightening cycles since 1954, the ISM manufacturing index (which is a leading indicator of where the economy is going) fell below 50, which is where it currently sits. In 12 out of 13 cases there was an earnings-per-share (EPS) recession and in 10 out of 13 cases this was followed by a GDP recession.

The year that bucked the EPS trend was 1994, but that was a time when real earnings were well below the historical average, and unemployment was high (pent up demand) which is not the case now. Instead, we believe that EPS and the S&P 500 are most likely unable to durably sustain today’s levels, and that income, value and low beta stocks should outperform.

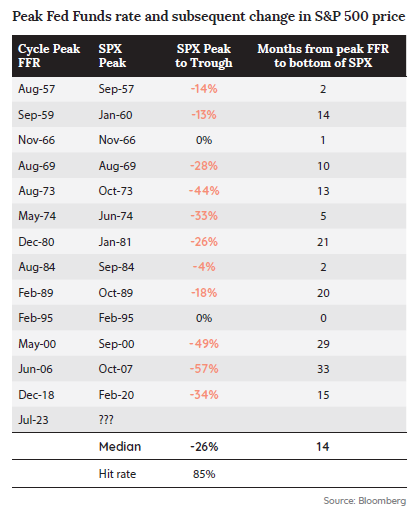

The chart shows that following a cyclical peak in the US Fed Funds Rate, the median decline in the S&P 500 has been 26% over the following 14 months. Typically, there is a gap between the peak in interest rates and the peak in the market, but then comes the fall in stock prices as corporate profits decline.

While the US Q4 earnings season has overall been good, looking beneath the surface suggests that all the growth has been due to the mega-cap technology companies, the so-called ‘Magnificent Seven.

These stocks grew earnings 50% year on year in the 4th quarter while so far, the remaining 493 companies in aggregate have delivered negative 10%. In addition, more companies in the S&P have lowered earnings estimates for 2024 than increased them. There is a big question mark over how much longer the magnificent seven can continue to carry the rest of the market.

A bigger concern is forward guidance. The S&P 500 is anticipating around 25% EPS growth over next two years. Given we are seeing signs of late cycle weakness and a lowering of inflation (as expected due to the lagged impact of monetary policy), these expectations appear overly optimistic, which then creates the risk of investor disappointment.

Toppy prices too

This is further compounded by high valuations against these expected earnings. It’s notable that the Shiller PE, the inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio, in the US is 33.6 compared to 26.5 since 1990 and merely 15 over the long term. This is not a market priced for disappointing earnings delivery.

Looking ahead we suspect that growth is a factor to avoid. This is because in anticipating slowing GDP growth, investors have bid up the stocks of companies they perceive to have structural or resilient growth. From here the path to outperformance for these equities in a post-peak rate world is narrow. This is especially the case because growth after all is cyclical too.

We also believe that the strong equity market performance at the end of 2023 and so far in 2024 has misled investors and analysts, who are now embracing what has been called an ‘immaculate slowdown’, where interest rates decline but corporate profitability grows. History tells us that a downturn in earnings is inevitable, and this will puncture the latest rally.

On the plus side, the strength in stock markets offers an opportunity to rebalance into our recommended factors of value, short duration, high income as a component of return, low leverage and low beta assets. All broad equity classes are more expensive than they were five years ago, but the return profiles have changed significantly.

Chad Padowitz is Co-Chief Investment Officer of Talaria Capital. Talaria’s listed funds are Global Equity (TLRA) and Global Equity Currency Hedged (TLRH). This article is general information and does not consider the circumstances of any investor.