The COVID-19 crisis has delivered an historic challenge to health authorities and macroeconomic policymakers alike. For many company management teams, it has above all tested their recent decisions on how they allocate capital.

Adjectives used to describe the past 12 months are losing their meaning; unprecedented, tragic, volatile, worrisome and so on. Throw in some comments about the extraordinary levels of monetary and fiscal stimulus and there you have 99% of the commentary that will review this amazing period.

We do not know what the future looks like, but we are optimistic. Worst-case health and economic scenarios, forecast by some, have not eventuated in Australia. Let’s hope that continues.

Rather than making vague prognostications on what the future holds or predicting how stock markets will react, we share some insights from our investment experience and outline how this shapes our process and portfolios.

Management and capital allocation

It has been said that we can only judge the quality of management decisions made during the good times after the cycle turns and the ‘tide goes out’. Whether it be the need to:

- write down acquisitions purchased at the top of the cycle

- repair balance sheets with dilutive equity raisings and dividend cuts

- jettison assets that are now ‘non core’

... the recent market dislocations have shone the spotlight on management decisions made over the past cycle.

Ultimately, we look to invest the money of our clients in companies run by executives who we trust and view as highly competent. Management teams influence the creation of shareholder value through their decisions on capital allocation.

Here are two examples that illustrate the shareholder wealth that management teams can create when they allocate capital with skill and insight.

Example 1: the battle of the plumbing wholesalers

It’s not only products and business models that create wealth. Management teams make decisions on how to deploy capital and over time those decisions compound on each other leading to potentially vastly different outcomes.

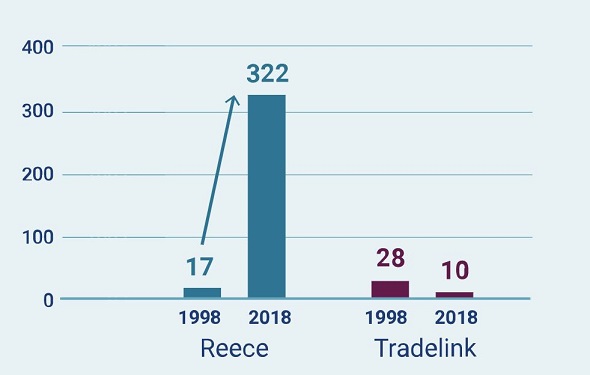

Take the example of two businesses that, on the surface, operate what would seem to be similar business models (wholesale distribution) selling similar products (plumbing supplies) to similar trade customers. If we rewind back to 1998, Reece and Tradelink were generating similar earnings of roughly $20 million a year.

Now let’s fast forward 20 years, a timeframe in which management decisions have compounded their effects on the outcomes for the businesses.

Figure 1: Reece and Tradelink operating earnings 1998 and 2019

Source: Airlie Funds Management

The difference is stark. Reece has produced an 18-fold largely-organic increase in earnings while Tradelink earnings have actually fallen over the last two decades.

What was the difference over those 20 years? We attribute it overwhelmingly to Reece management. The business has been run by members of the Wilson family for decades. They skilfully invested capital in high-returning projects to grow the business and stayed focused on core competencies with the long term in mind. We also believe the family’s significant shareholding (about 75%) of the business over that period further contributed to great decisions on capital. They had ‘skin in the game’.

This owner-managed structure is one we like. We have several such long-term holdings across our portfolios including Reece, Premier Investments, Mineral Resources and Nick Scali.

Example 2: Wesfarmers

If there was ever a good corporate structure in which to examine decisions on capital allocation it would have to be the conglomerate. While there has been much debate on the case for and against the conglomerate, proponents of the structure point to the ability of the corporate centre to make value-accretive capital decisions so that the whole is greater than the sum of the parts. Of course, if we invert this, the risk with the conglomerate is the company trades at a persistent discount to the sum of its parts.

We believed this was the case with Wesfarmers in mid-2016. As the share price chart in Figure 2 shows, Wesfarmers traded sideways for the best part of five years from 2013 to 2018 when return on equity was stuck around 10% (adjusting for write-downs). Few material changes had been made to the asset portfolio and the company was dealing with some poor capital-allocation decisions in relation to the expansion of Bunnings into the UK.

Our analysis indicated there was value trapped inside the collection of assets that could be unlocked and we engaged with management on these views. Around mid-2017, Rob Scott was appointed CEO of Wesfarmers and quickly made significant changes.

Rob and his team skilfully extracted Wesfarmers from the UK, demerged Coles and made other material divestments that amounted to almost $20 billion across 10 transactions. The company’s share price has rallied since this time.

Figure 2: Wesfarmers share price since 2013 ($A adj. for Coles demerger)

Source: Airlie Funds Management

It doesn’t matter until it matters … and it has really mattered this year!

Not only did Wesfarmers management adeptly capitalise on the final stages of the bull market to sell assets at good prices, it built resiliency and optionality into the balance sheet heading into the downturn. This contrasts with how the Wesfarmers balance sheet was positioned during the GFC and should bode well for the company’s ability to make value-accretive transactions at attractive prices.

This focus on the balance sheet and a company’s financial strength is another central component of the Airlie investment process. It helps us identify opportunities such as Wesfarmers, and avoid 'value traps' whereby valuations may seem appealing but with the wrong level of debt for the business model, a company is unable to consistently generate adequate cash flow and returns for shareholders.

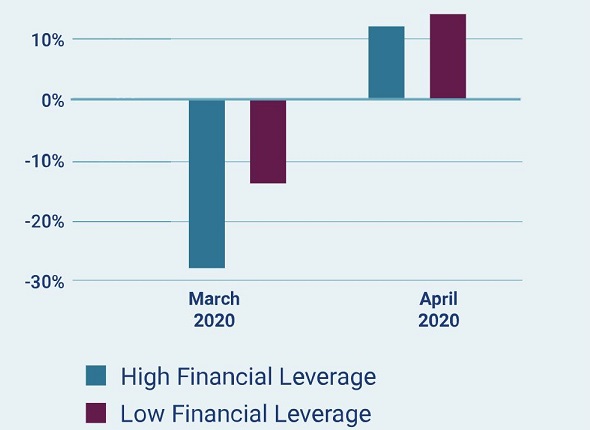

Corporate debt levels haven’t seemed to matter to the market over the last few years and some management teams have been lured by cheap debt to fund buy-backs or increase dividend payouts. The economic impacts of COVID-19 have quickly changed the market's view on the importance of financial strength.

Figure 3 shows the outperformance of those stocks in the ASX200 Industrials index with low financial leverage in March and April 2020.

Figure 3: Outperformance of stocks with low financial leverage in March and April 2020

ASX 200 Industrials Total Return by Net Debt to EBITDA

Source: MST Marquee, Airlie Funds Management

The strength of 'low equitisers'

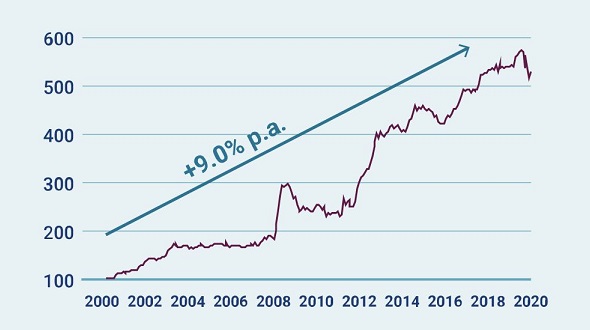

We have seen over $20 billion of equity capital raised on the ASX in the past four months to repair balance sheets. However, we believe that it is not only in the short term that financial strength matters. Over the long term, companies that are able to fund their operations, including growth, from internally generated cash flows tend to outperform those that repeatedly need to come to the market to raise equity.

This collection of companies that repeatedly require new equity capital, or 'equitisers', have underperformed by 9% p.a. relative to low equitisers on the ASX over the past 20 years. These decisions about how to fund the business tie back to management decisions on capital allocation.

Figure 4: Long-term outperformance of companies with low levels of 'equitisation'

Source: MST Marquee, Airlie Funds Management

Looking to the future

We are ultimately optimistic, even though we are unable to predict the future. The government and community response in Australia has kept us in relatively good shape. We are mindful that in the very short term, government policy responses will be key to both the health and economic outlook. Currently in Australia, the Job Keeper/Job Seeker fiscal programmes are due to be removed later this year (update - they have now been modified and extended into 2021). From our discussions with company executives, there is caution on the ramifications for employment and consumer spending from the removal of these programmes.

While the near-term outlook is uncertain, we have confidence in our investment process. It is robust and has been tested through multiple cycles over two decades. We continue to expect those companies with high-quality management teams and strong balance sheets to do well over the medium to long term.

Matt Williams is a Portfolio manager for Magellan-owned, Airlie Funds Management. Magellan Asset Management is a sponsor of Firstlinks. This article has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not consider your investment objectives, financial situation or particular needs.

For more articles and papers from Magellan, please click here.