The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

I love books and have done so from a young age. I own 600-700 books spread across my home and my parents’ garage. Recently, a real estate agent walked into my home and said, “Oh my god, who’s the book hoarder?” My wife, of course, pointed the finger straight to me.

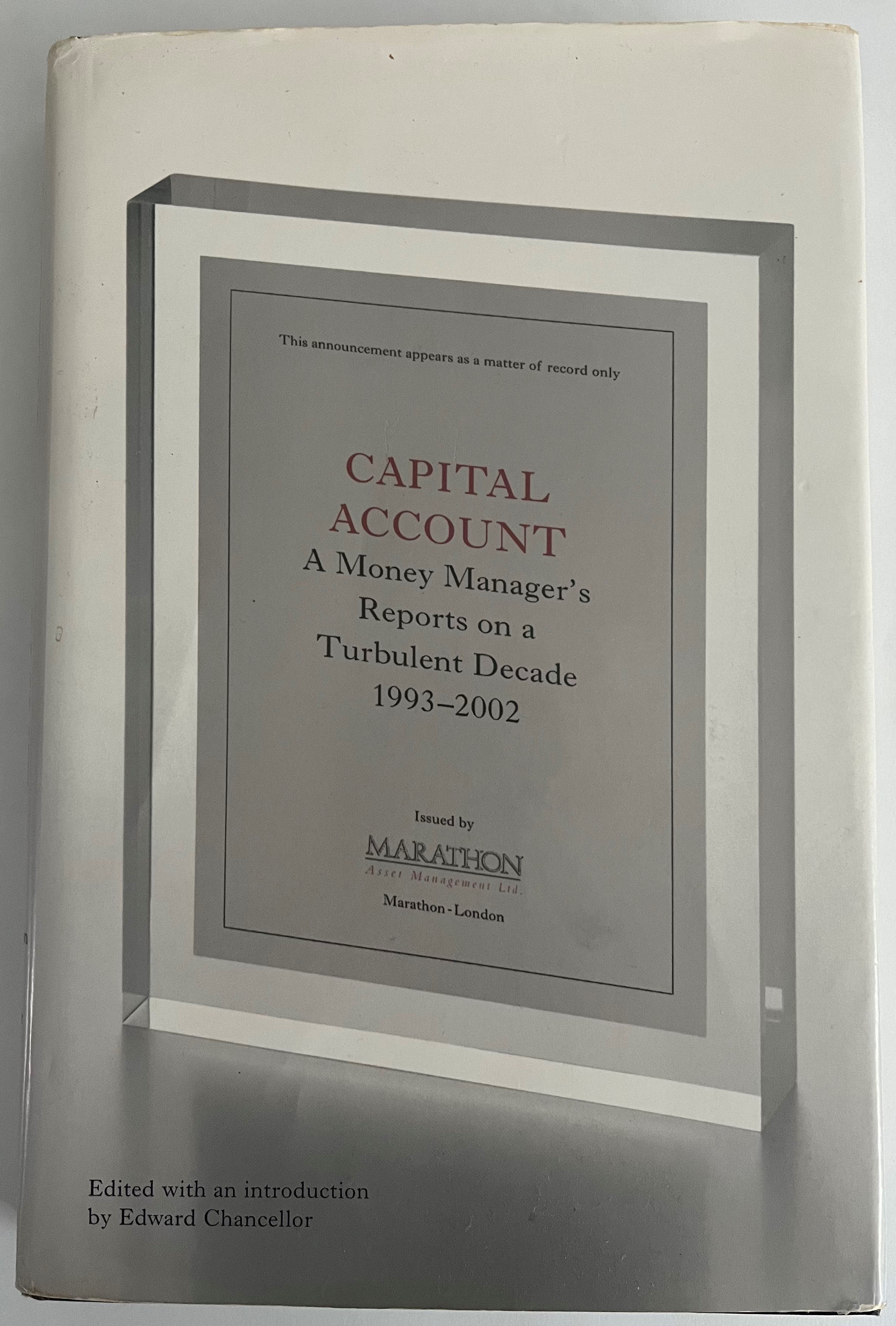

This week, I was chatting with a colleague, Joseph Taylor – who has just joined and will be helping with Firstlinks – and we got onto the topic of Edward Chancellor’s book, Capital Account, and he mentioned that it’s a hard book to get and is worth quite a bit of money.

I happen to own the book and, naturally, got curious. Joseph was right – the book can be bought on AbeBooks for $832 and on Amazon for $1,355. I quickly calculated that taking a potential $832 sale price from my initial 2010 purchase of $32 means the book has delivered me a compound annual growth rate of 26.2%. Not bad at all.

Why is the book so expensive?

Edward Chancellor, the book’s author, is a well-known financial writer. His most recent book, The Price of Time, is a critique of modern-day central banking and has received widespread media coverage. And he’s probably best known for his book, Devil Take the Hindmost, which is one of the best books on history’s most outlandish episodes of financial speculation.

Capital Account, written in 2004, is more niche than these books and features the shareholder letters of London-based hedge fund, Marathon Asset Management, from 1993-2002. Marathon is a highly successful value-based manager that’s developed a unique framework for picking stocks called the capital cycle approach.

It’s a sophisticated method that takes Professor Michael Porter’s famous ‘five forces’ competitive strategy and applies it to markets. It does a great job of explaining the causes of booms and downturns in industries and markets. In January this year, I wrote in more detail on the approach and how it pinpointed the reasons behind the battery metals bust.

As an aside, I met the man who developed Marathon’s capital cycle approach back in 2008. His name is Jeremy Hosking, and he came to an investor conference in Singapore hosted by the stockbroker I was working for at the time. I remember that he got up during a presentation from the CEO of a Malaysian gaming company that I was covering as an analyst and went on a blistering tirade against the capital allocation practices of the company. For those that are familiar with Asia, that outspokenness in public never happens, and it made quite a scene.

Back to Capital Account, and further research into why it’s become so expensive suggests that there aren’t many copies of the book around because the bookseller went bankrupt while it was going to print! I’m not sure exactly how many copies of the book there are, but plan to write to Mr. Chancellor to find out.

Entering the world of collectibles

When thinking of collectibles, art, classic cars, coins, stamps, and jewelry usually come to mind. Books, not so much.

Murray Stahl, a portfolio manager at the US-based Horizon Kinetics has long been intrigued by collectibles as assets that are durable and can retain, or even increase, their value during times of crisis or upheaval.

In a 2019 article, he tells the story of Calouste Gulbenkian, an Armenian merchant and engineer, born in the Ottoman Empire in 1869 and educated in France and London:

“He [Gulbenkian] became one of the founding shareholders of Royal Dutch Shell by obtaining the Ottoman oil concession for that company in the territory then known as Mesopotamia, now known as Iraq.

At one point, Gulbenkian owned the entire oil concession of the territory that would become modern day Iraq. Prior to the First World War, he swapped the concession interest for a 5% interest in Turkish Petroleum that eventually became interests in such firms at Total, Royal Dutch Shell, British Petroleum, and Exxon. In 1938 (note the timing), these interests were moved to a Panamanian company known as Participations and interests or simply Partex Oil and Gas (Holdings) Corporation. The company still exists and is owned by the Calouste Gulbenkian Foundation in Lisbon…

Shortly before the outbreak of the Second World War, Gulbenkian acquired diplomatic immunity as the economic advisor to the Persian diplomatic legation in Paris – yet another example of exquisite timing. Prior to the German occupation of Vichy in 1942, this diplomatic immunity enabled him to leave France unmolested and move to Lisbon, where he resided for the rest of his life.”

Stahl details how much of Gulbenkian’s wealth was invested in collectibles, and these retained their value through periods of enormous upheaval, including the Great Depression, war, inflation and deflation.

At one stage, Gulbenkian had one of the largest art collections in the world. Many of the thousands of pieces are still housed in Lisbon.

In one deal, Gulbenkian bought paintings from the Soviet Government and paid for it with oil. It was 1930 when the Soviets needed hard assets such as oil.

Gulbenkian was also a big book collector. Many of these books ended up in the library of the Armenian Patriarchate of Jerusalem, and the library is said to keep the largest collection of Armenian books, periodicals, and newspapers in the world.

From Gulbenkian’s story and others who’ve endured tumultuous times, Stahl says:

“Books are a very intriguing asset class with regard to upheaval or crisis investing. Very few people understand the value of rare books. Moreover, rare books have the property of hiding in plain sight, so to speak. A rare book held on shelves containing pedestrian books is not likely to be noticed by anyone. Government, tax, and even customs officials routinely ignore books unless they are in a large shipment. Even in such instances, many officials presume by the size of the shipment that it contains nothing other than paper destined for recycling.

Unlike gold, books are not durable collectibles. In reality, many are routinely damaged or lost by people who have no idea of their value. Great sums of money can be invested in a handful of books. Books can be loaned to libraries for safekeeping and insured by those libraries.”

What kind of returns can books achieve?

This begs the question of what type of returns can books deliver? Stahl cites one example of the American classic, To Kill a Mockingbird. A hardcover of the first edition was published in 1960 and sold for US$3.95. Recently, a first edition was auctioned for US$27,000. That makes for a compound annual rate of return of 16.14%. That doesn’t tell the full story, though.

The book quickly became a best seller, and millions of book club editions were printed in 1960 at a price of US$3.95. These book club editions now sell for about US$65. The compound annual rate of return for these book club editions is just 4.86%.

However, these book club editions were available everywhere post 1960, including at garage sales, and selling for as little as 10 cents. If you’d bought the book for 10 cents and sold it now, the compound annual rate of return would be 12.03%.

Books can fetch much higher prices too. Hedge fund billionaire Ken Griffin made headlines in late 2021 by purchasing a first edition of the US constitution for US$43.2 million. The document is one of 13 copies from 1787.

The most valuable book is likely to be the notebook of Leonardo Da Vinci from the 1500s which was purchased by Bill Gates for US$30.80 million in 1994 (or US$63.3 million in inflation-adjusted terms).

In investing, books don’t command those kinds of prices. Seth Klarman’s Margin of Safety is one of the most expensive, fetching a price tag of more than $5,400. Klarman is a deep-value oriented fund manager who wrote the book in 1991 when he was relatively unknown. Given his outstanding track record since that time, the book has become highly sought after.

How do books become so valuable?

A book’s value is determined by supply, demand, and its condition.

On supply, the number of first editions of books are generally in decline. With demand, it depends on whether the enduring popularity of a title, author, or subject. Like art, the death of an author can heighten demand.

Keeping a book in prime condition isn’t easy. Moving, handling, and storage can often take their toll. There can also be damage from sunlight, moisture, and insects.

Some of the books that I own have developed brown spots, and my research for this article has unearthed a name for this process: foxing! (no, I’m not making this up) The causes of foxing aren’t fully known, though humidity and chemical oxidation are the suspected culprits.

Should I sell Capital Account?

The rise in the value of Capital Account has got me thinking about whether it’s time to sell. It’s unlikely that demand for the book will increase over time given the ideas are likely to remain niche. The question is how demand will fare against the limited supply of the book, and that’s difficult to forecast. I suspect Capital Account won’t reach the cult status of Margin of Safety and that today’s selling price is a good one.

Yet, there’s a personal element to the decision-making process too. I like the book and find its contents valuable. I’m sure I will refer to it when writing future articles. And I wouldn’t want to lose access to it.

But the biggest reason why I’ve decided not to sell Capital Account is because of what books represent to me. I consider books as the ultimate school for life. They fulfill my endless curiosity and thirst for learning. It’s a passion that I don’t want to turn into a business of buying and selling.

However, if Ken Griffin comes calling with an offer, you never know…

***

If you’re like me, you may have put money into term deposits over the past year and it’s time to decide whether to roll them over or look elsewhere. In my article this week, I look at the pros and cons of investing in cash versus other assets right now.

James Gruber

Also in this week's edition...

There's a lot of research on the average spend of people in retirement, yet little on how spending changes as individuals progress through different stages of retirement. Ruvinda Nanayakkara has gathered data on how spending plummets as we go from 60 through to the age of 75. He says it's critical information that can impact the level of savings required at the point of retirement.

Noel Whittaker is back, this time with a new book called Wills, death & taxes made simple. Noel says that every year, millions of dollars are spent on legal fees, and thousands of hours are wasted on family disputes - all because of poor estate planning. The book is an attempt to rectify that, and in this week's article, Noel offers tips on how to make an effective will.

Robert Almeida from MFS has a harsh message: we've become soft, and throughout history, soft people ultimately produce tough times, until the cycle reverses. Almeida says the policy response to the GFC and Covid purposely created a soft business operating environment that produced high returns for owners of capital. He says things are now going to get tougher for businesses and markets.

Erik Knutzen and Hakan Kaya of Neuberger Berman think this year will be another year of reflation and geopolitical uncertainty — with the latter significantly raising the tail risk of a return to problematic inflation. And that provides a good backdrop for commodities to outperform.

Australian commercial property has had a horror stretch but is the worst over? Charter Hall's Sasanka Liyanage and Patrick Barrett see encouraging signs that it could be, and that industry returns may improve over the medium term.

Allan Gray's Simon Mawhinney has made a name as a value investor who isn't afraid of a stoush to extract the best returns from a stock. In an exclusive interview with Firstlinks, he tackles proxy advisers head on, and offers a guide on how company boards can improve their transparency and how they deal with shareholders.

Two extra articles from Morningstar for the weekend. Nathan Zaia gives his take on ANZ's results, while Joseph Taylor explores three ASX companies that share something powerful with Uber.

Finally, in this week's whitepaper, the World Gold Council gives a Q1 2024 update on the supply and demand drivers that drove gold to new price highs.

***

Weekend market update

On Friday in the US, stocks settled just north of unchanged on the S&P 500 as the broad average wrapped up a relatively placid week with a 1.4% gain, while Treasurys came under some pressure with the two-year yield rising to seven basis points to 4.87% and the long bond climbing to 4.64% from 4.6%. WTI crude pulled back towards US$78 a barrel, gold kept its momentum with a push to US$2,364 per ounce, bitcoin retreated to one-week lows at $60,700 and the VIX finished at 12.6, testing fresh year-to-date lows.

From AAP Netdesk:

The local share market on Friday closed in the green to notch up its third-straight week of gains amid rising global confidence of interest rate cuts this year. The benchmark S&P/ASX200 index on Friday closed up 27.4 points, or 0.35%, to 7,749.0, while the broader All Ordinaries rose 28.5 points, or 0.36%, to 8,022.7. The ASX200 finished the week 1.6% higher, following last week's gain of 0.7%, as stocks across the 11 sectors rebounded from Thursday's sell-off.

The Australian energy sector recorded a 1.9% rise following the future gas strategy announced by the Federal Government on Thursday, which sets out to move the country towards net zero emissions by expanding the country's reliance on gas. Woodside gained 1.9% and Santos rose 2.1%, with Ampol and Viva Energy also in the green off the back of the controversial strategy, which has been derided by environmental critics as propping up the fossil fuel industry.

Uranium miner Deep Yellow, operating across Australia and Namibia, rose 3.7% to $1.67.

The big four banks recorded gains, with NAB up 0.9% to $33.81, ANZ rising 1% to $29.09, Westpac lifting 1.3% and Commonwealth Bank climbing 0.5% to $117.54. CBA's gains came after the Federal Court ruled in its favour in a long-running shareholder class action alleging the bank had breached its disclosure obligations.

Life360 dropped 2.5% to $15.11 after the family tracking tech company announced it had suffered a net loss of $9.8 million in the March quarter.

But chief executive Chris Hull said the results showed continued momentum, with paying subscribers nearly doubling to 96,000 and revenue growing 15% year-on-year.

REA Group finished up 1.4% to $187.32, a day after the realestate.com.au owner announced March quarter operating earnings of $177 million, up 30% from a year ago.

In the heavyweight mining sector, BHP dropped 0.35%, Fortescue fell 0.76% and Rio Tinto slipped 0.16%.

From Shane Oliver, AMP:

The RBA held at 4.35%, retained a formal neutral bias in “not ruling anything in or out” but with more hawkish language suggesting its more cautious on inflation. The bad news is that the RBA still considers the jobs market as too tight, inflation is falling more slowly than expected, it revised up its inflation forecasts for this year and it actually considered hiking again. In the event, the RBA decided to leave rates on hold on the grounds that rates are restrictive enough, higher rates have impacted households more than in other countries because of a high share of variable rate mortgages and it still sees inflation falling back to the high end of the target range by end next year and to the mid-point by mid-2026. In other words, it sees the hot March quarter CPI and near-term pressures from higher fuel prices as temporary and not warranting a further tightening and has chosen to simply go down a similar path to the Fed in effectively ratifying “high for longer rates” rather than seeing a need for “higher rates”.

However, its language is more hawkish than after its March meeting suggesting a low tolerance for anything that leads it to forecast that it will take “markedly longer” to get inflation back to target. The Governor’s use of the word “markedly” suggests the hurdle to hike again is high, but it’s likely that near term risks are still skewed up for rates. Key things to watch apart from inflation are whether the Budget adds extra net stimulus to the economy for the next year, the impact of the 1 July tax cuts on consumer spending and the size of the rise in minimum and award wages in the upcoming Fair Work Commission decision.

We continue to see the RBA leaving rates on hold ahead of rate cuts starting late this year. While near term risks are on the upside with the money market pricing in a 13% chance of a hike in August, we expect that inflation will slow again in the June quarter as weak demand continues to weigh. Our Pipeline Inflation Indicator is still pointing down, the Melbourne Institute’s Inflation Gauge for April points to a renewed fall in inflation and contrary to RBA assumptions energy rebates are expected to be extended in the Budget avoiding a rise in household energy prices. We are allowing for a 0.25% cut in the cash rate to 4.1% in November or December.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Clime Investor Briefing Event Series - 29 May- 27 Jun 2024 Brisbane, Adelaide, Perth, Melbourne, Sydney. Free entry, bookings essential.

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website