The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Here’s a brief experiment for you. Don’t worry, it will only take a minute. Stop reading here (but please come back) and just sit in silence for one minute. Go on, it won’t hurt.

Done? If you’re like most people, you won’t have experienced much silence. Within 10 seconds, you may have noticed thoughts running through your head. And these thoughts may have kept going. Some of them may have been quite random too. You might have thought of one subject, and then it branched off into an unrelated topic.

Don’t worry, that’s all normal. Nonetheless, it can be disturbing to realise how little control you have over your thoughts and how you react to them.

I’ve been an on-and-off meditator for a while, and meditation is a great tool for thought awareness and accepting thoughts as they come and go. Oddly enough, I’ve also found hypnosis is a powerful method for changing thought patterns. It delves into your subconscious, makes some tweaks, and alters thoughts and habits. Though in my experience, habits are hard to change and require ongoing work.

Cognitive biases and investing

While psychological tools for dealing with day-to-day life are advanced, those for becoming a better investor are just in their infancy.

The field of behavioural finance - studying how psychology affects financial decision making - only appeared about 20 years ago. Unsurprisingly, it found the mind impacts investing quite a lot, and that investors often don’t think and act rationally. That’s because biases and emotions cause errors in judgment.

The good thing about behavioural finance is that it’s come up with dozens of cognitive biases that investors need to be aware of. The problem is that it’s always been generic rather than personal: it’s never been able to specify which biases that you have, and how you can deal with them.

How personality influences outcomes

More recent research has shed further light on the personal. In fact, it’s found that your personality has a large influence on life outcomes, including financial success.

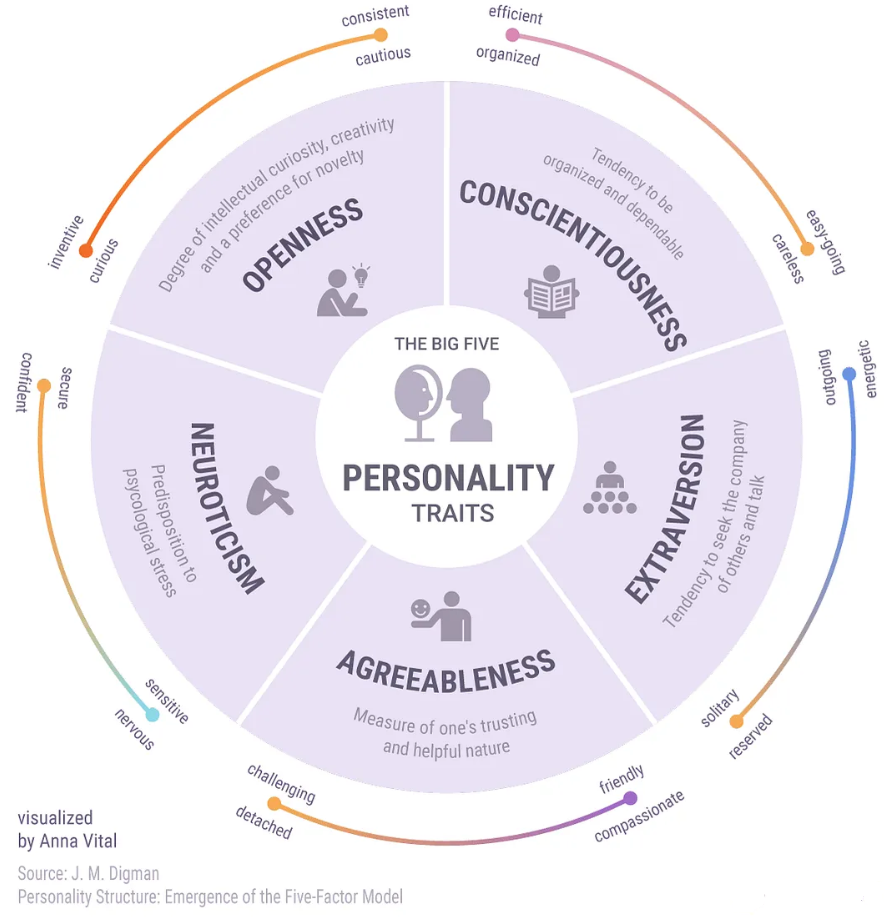

To understand why, let’s go through what psychologists define as the five broad personality types, known by the acronym, OCEAN:

- Openness to experience. Those open to new experiences are willing to try new things and use their imagination to embrace new ideas. Those at the other end of the spectrum are usually predictable, uncomfortable with change, and not very imaginative.

- Conscientiousness. The conscientious are organized and self-disciplined. Less conscientious people can be careless, impulsive, and procrastinators.

- Extraversion. The extraverted are social, outgoing, and happy to be the centre of attention. The less extraverted are usually reserved, reflective, and happy in solitude.

- Agreeableness. This measures how people tend to treat relationships with others. The highly agreeable are empathetic, trusting, and compliant. Unagreeable people are less caring and can be demanding and even insulting to others.

- Neuroticism. This describes the emotional stability of a person. The highly neurotic are anxious, often hostile, and experience significant shifts in mood. Those less neurotic are calm, resilient, and rarely sad or depressed.

You’re not just one personality type; you’re a blend of them.

Studies show your personality type can remain relatively stable through your life. And that it’s influenced by both genes and the environment. Roughly 50% is thought to be inherited.

There are lots of websites where you can take a relatively quick quiz and get scored on the five personality traits, including OpenPsychometrics, FiveThirtyEight, and Truity.

Personality types and finances

The science suggests that your personality type is a good predictor of important life outcomes, including financial net worth.

Those open to experiences have higher salaries. They’re not as organized as the conscientious, but they tackle projects and investing with energy and imagination. However, they’re also inclined to spend more and enjoy the finer things in life.

Of all the types, conscientious people are most associated with career and financial success. They plan ahead, have shorter periods of unemployment, and are less indebted. Yet the tradeoff is that the conscientious are not as happy as some other personality types such as extraverts.

Extraverts earn higher salaries and have greater happiness. However, they don’t tend to be great with money as they spend too much and save too little. They’re also inclined to take greater risks with their cash.

Agreeableness is associated with lower salaries and net worth. Agreeable people might be nice, but that may also be their downfall. And like extraverts, they like to spend a lot, and not save enough.

Lastly, neurotics are also linked to less financial and career success. Unfortunately, they end up less happy due to higher levels of anxiety and stress.

Understanding personality types can help with investing

Unlike many psychologists, I don’t see personality types as deterministic. Just because you have ‘x’ personality doesn’t mean that you’ll have ‘y’ outcome. Instead, they indicate tendencies.

I think they’re a useful tool for becoming more self-aware. For instance, the personality tests show that I score reasonably high for conscientiousness, and reasonably high for openness. Though I also test moderate for neuroticism and very low for extraversion.

What this tells me is that I need to guard against a number of things. My mild neuroticism means I have some anxiety and don’t react calmly in all situations. My introversion suggests that I need push myself to meet more people, be more social, and be bold enough to ask for that pay raise if I deserve it! Also, my risk aversion means that I should try to take on more risk where it’s prudent. And I possibly need to seek out fund managers and financial advisers who embrace risk more than I do.

Doing all of the above could improve my chances of being financially successful.

Self-awareness as a superpower

If I’ve learned anything through the decades, it’s this: know thyself. Self-awareness is a superpower in life and investing. And tools to increase self-awareness can provide an infinite return on investment.

* Various studies on how personality influences finances can be found here, here, here, and here.

----

In my article this week, I look at how the odds favour ASX miners handily beating the Big Four banks over the next decade.

James Gruber

Also in this week's edition...

Jon Kalkman says that while encouraging people to draw down on their accumulated wealth in retirement might be good public policy, several million retirees disagree because they are deliberately and purposefully conserving that capital. Changing that mindset is difficult, so maybe it’s time for a different approach.

Chinese AI creator, DeepSeek, has been this week's big story. Robert Almeida from MFS outlines the implications for the Magnificent Seven tech companies, while Professor Anton van den Hengel makes the case for Australian-made AI.

Despite increased competition, Netflix has managed to become the dominant player in TV streaming. Magellan's Ryan Joyce reveals the secrets behind its success, and why the good times are expected to continue.

Markets aren't driven by numbers alone, says Leigh Grant. Examples from Tesla shares to Sydney houses show that investors must evaluate not just tangible assets or financials, but also the intangible story that magnifies their value.

A big market sell-off can force pensioners to 'sell cheap' in order to meet their minimum withdrawal requirements. Roger Montgomery believes that investing in less volatile assets that also deliver regular income could provide an alternative.

Two extra articles from Morningstar this weekend. Simonelle Mody highlights ASX names that can benefit from the clean energy transition, while Joseph Taylor makes a case for listed property investors looking beyond Goodman.

Lastly, in this week's whitepaper, MFS examines the disappearance of diversification in global markets and what investors should do about it.

****

Weekend market update

News that the Trump administration plans to implement tariffs on Mexico and Canada beginning tomorrow helped erase solid gains on the S&P 500, leaving the broad average lower by half a percent to shave the week’s gains to 1.2%. Treasurys also came under pressure, with 2- and 30-year yields settling at 4.22% and 4.83%, respectively, up four and seven basis points on the session, while WTI crude reversed early losses at US$73.5 a barrel and gold pushed above US$2,800 per ounce for the first time. Bitcoin slipped below US$102,000 and the VIX settled at 16.5 after testing 15 mid-day.

From AAP netdesk:

On Friday, the local share market finished at its highest-ever level, eclipsing its previous record set eight weeks ago. The benchmark S&P/ASX200 index on Friday rose 38.6 points, or 0.45%, to 8,532.3, breaking its previous record of 8,495.2 from December 3. The broader All Ordinaries climbed 43.8 points, or 0.5%, to 8,789.7. The ASX200 rose 1.5% for the week, its fourth straight week of gains.

Nine of the ASX's 11 sectors finished higher on Friday, with telecommunications and utilities lower.

The property and materials/mining sectors were the biggest gainers, both rising 1.1%.

Goldminers shone as the safe haven asset amid the geopolitical uncertainty flowing out of Washington. Northern Star rose 2.6%, Newmont rose 3.8% and Vault Minerals climbed 6.9%.

Elsewhere in the mining sector, BHP rose 1.2% to $39.95 and Rio Tinto added 0.3% to $117.40. Fortescue was basically flat at $19.13.

In the financial sector, NAB rose 0.6% to $40.14 - its first $40-plus close in 17 years - while CBA was basically flat at $160.56. ANZ and Westpac both dipped 0.2%, to $30.62 and $33.73.

A couple of companies fell as they reported earnings results.

Origin Energy fell 6.7% to a six-week low of $10.45 after reporting its December quarter gas production was slightly lower than the prior quarter.

Pointsbet retreated 12.8% to an almost three-month low of 85.5 cents after reporting it made $65 million in gross profit in the first half of 2024/25, up 11% from a year ago.

ResMed dipped 0.8% to $40.18 despite beating expectations by announcing $US1.3 billion in revenue in the December quarter, up 10% from a year ago. Investors might have been spooked by gross margins coming in slightly lower than market expectations.

Competitor Fisher & Paykel Healthcare dropped 1% to $34.35.

From Shane Oliver, AMP:

Global shares were mixed over the last week. US shares fell 1% as tech shares fell on the back of the rise of DeepSeek’s AI app and a less dovish Fed and Trump’s tariff vows also weighed. Japanese shares fell 0.9%, but Eurozone shares rose 1.3% to a record high helped by a dovish rate cut from the ECB. Australian shares also surged to a record high on the back of expectations for a February rate cut after lower-than-expected inflation data helped by the market’s low exposure to AI related tech stocks. For the week the Australian share market rose 1.5%, although some of this will be reversed on Monday with ASX 200 futures down 1.2% on Trump’s tariff vows. Bond yields fell as did oil and metal prices, not helped by tariff talk, with iron ore flat. Bitcoin also fell but the gold price rose to a new record high. Trump’s ongoing talk of tariffs saw the US dollar rise and this along with increased expectations for RBA rate cuts saw the $A fall.

“As goes January so goes the year”…the so-called January barometer has a mixed record when it comes to falls in January, but for gains it provides a reasonably consistent but not perfect guide to the year. Since 1980 85% of positive Januarys have gone on to a positive year in the US and in Australia its 76%. So, with US shares up 2.7% in January and Australian shares up 4.6% it’s a positive sign for the year ahead.

A positive signal from the January barometer does not mean there won’t be corrections though and we continue to see a rougher more constrained ride than last year for Australian and global shares. Key risk factors are stretched valuations particularly for tech stocks with DeepSeek highlighting a key risk for them, Trump’s tariffs and other policies potentially adding to US inflation and impacting the Fed and various geopolitical risks. So, we continue to see a high likelihood of a 15% plus correction at some point this year. But ultimately, we see shares doing okay this year as Trump’s more negative policies are constrained by a desire to see shares rise at the same time that some of his policies reinvigorate the US, and with central banks continuing to cut rates, with the RBA joining in, boosting growth and profits.

Tariff man Trump continues to indicate that tariffs are on the way, starting with Canada and Mexico and China this weekend. The on then off 25% tariff on Columbia highlighted Trump’s use of them for negotiation purposes and Trump’s vow of 25% tariffs on Canada and Mexico and 10% on China from 1 February may be the same, but some sort of formal announcement looks imminent. This looks like it will take the form of an announcement that the tariffs will start immediately, or it could be by a certain date leaving room for negotiation as occurred with Columbia, although the White House has denied this and Trump has said there is nothing Canada, Mexico and China can do to forestall the tariffs. And Trump continues to talk of a general tariff, with debate about whether it ramps up gradually, and is vowing to impose tariffs on the EU, semiconductors, steel, metals, oil and gas and pharmaceutical products. Often Trump sounds like tariffs are the end point rather just for negotiating, but then again, he has to sound that way to make any negotiations work. This is all very unsettling for investment markets, with some of this showing up on Friday, and central banks. In 2018, Trump’s tariff announcements drove dips in US shares and along with Fed rate hikes contributed to a near 20% fall. One estimate suggests a 25% tariff on Canada and Mexico could add around 1 percentage point to US core inflation this year which would be bad for US consumers and the Fed. Ultimately, we see Trump toning it down to avoid a long-lasting consumer and market backlash, but it could be a rough ride in investment markets until we get more certainty that this will be the case.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website